New Hampshire Accredited Investor Status Certificate

Description

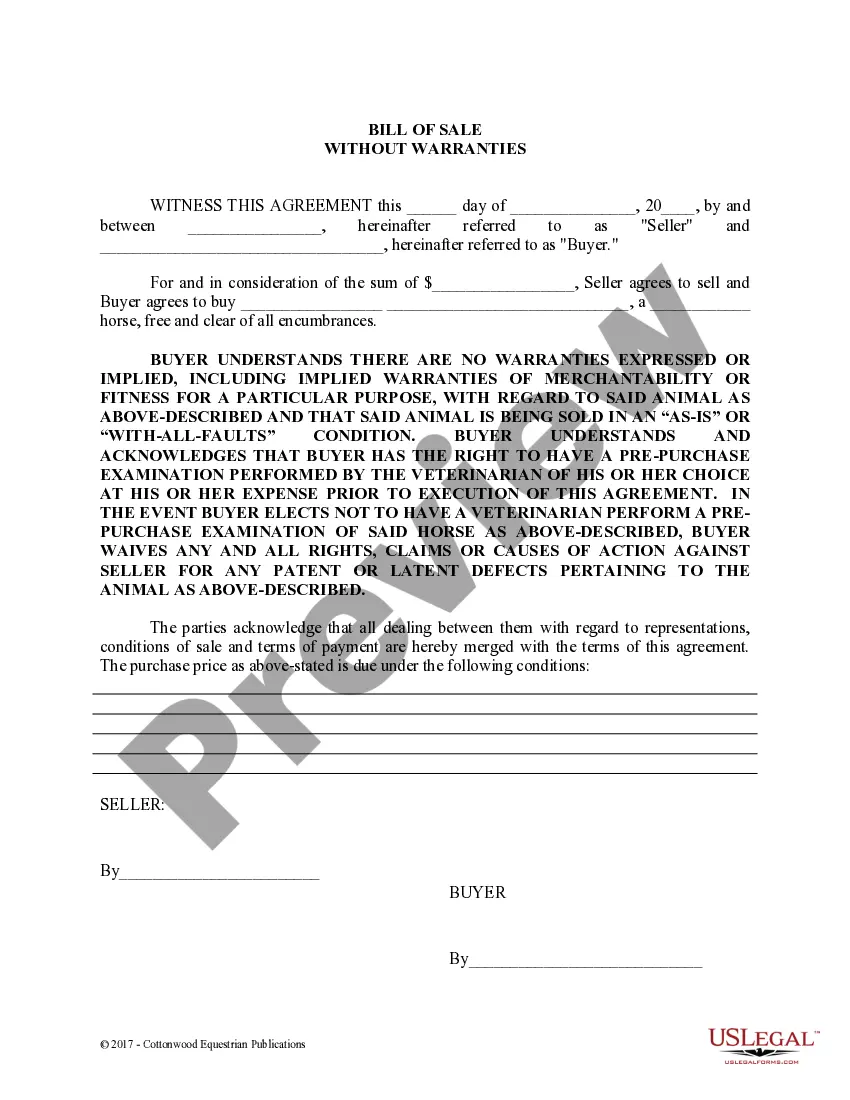

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Status Certificate?

Finding the right legal document design could be a battle. Of course, there are a variety of layouts accessible on the Internet, but how would you obtain the legal type you will need? Make use of the US Legal Forms web site. The support provides a large number of layouts, such as the New Hampshire Accredited Investor Status Certificate, which you can use for company and private demands. Each of the kinds are checked by experts and satisfy state and federal specifications.

In case you are currently signed up, log in for your bank account and click the Acquire option to obtain the New Hampshire Accredited Investor Status Certificate. Use your bank account to check through the legal kinds you possess bought previously. Go to the My Forms tab of your bank account and obtain another copy in the document you will need.

In case you are a fresh consumer of US Legal Forms, allow me to share simple instructions that you can follow:

- Initial, be sure you have chosen the proper type for your area/area. You are able to look over the form while using Preview option and study the form description to guarantee it will be the right one for you.

- In case the type does not satisfy your preferences, make use of the Seach industry to find the appropriate type.

- When you are certain that the form is acceptable, go through the Acquire now option to obtain the type.

- Pick the prices prepare you would like and enter in the essential info. Create your bank account and buy the order making use of your PayPal bank account or credit card.

- Opt for the data file format and acquire the legal document design for your product.

- Complete, change and print and indicator the obtained New Hampshire Accredited Investor Status Certificate.

US Legal Forms may be the largest local library of legal kinds in which you can discover different document layouts. Make use of the company to acquire professionally-manufactured papers that follow status specifications.

Form popularity

FAQ

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

In the case of a successful verification, you'll get an attorney's letter certifying that you have been verified as an accredited investor pursuant to standards required by federal laws.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant.

If that type of official documentation is not available, you may be able to provide evidence through earnings statements, pay stubs, a letter from your employer certifying your income, or perhaps bank statements that show that you receive that income.

VerifyInvestor.com is the leading resource for verification of accredited investors as required by federal laws.

Accredited Investor Definition The SEC defines an accredited investor as someone who meets one of following three requirements: Income. Has an annual income of at least $200,000, or $300,000 if combined with a spouse's income. This level of income should be sustained from year to year.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.