New Hampshire Split-Dollar Life Insurance

Description

How to fill out Split-Dollar Life Insurance?

It is possible to invest several hours on the web trying to find the legal record web template which fits the state and federal demands you want. US Legal Forms supplies a large number of legal forms that are evaluated by experts. You can actually acquire or produce the New Hampshire Split-Dollar Life Insurance from the service.

If you already possess a US Legal Forms account, you are able to log in and then click the Acquire switch. Following that, you are able to complete, edit, produce, or signal the New Hampshire Split-Dollar Life Insurance. Each and every legal record web template you purchase is the one you have permanently. To acquire one more backup for any bought develop, visit the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms internet site for the first time, adhere to the easy instructions under:

- Very first, make certain you have selected the best record web template for that state/town that you pick. Read the develop information to make sure you have chosen the correct develop. If readily available, utilize the Preview switch to check throughout the record web template as well.

- In order to find one more version in the develop, utilize the Research field to obtain the web template that fits your needs and demands.

- When you have identified the web template you desire, just click Acquire now to proceed.

- Pick the rates prepare you desire, type in your references, and register for your account on US Legal Forms.

- Complete the financial transaction. You can use your credit card or PayPal account to pay for the legal develop.

- Pick the format in the record and acquire it to your system.

- Make modifications to your record if needed. It is possible to complete, edit and signal and produce New Hampshire Split-Dollar Life Insurance.

Acquire and produce a large number of record templates utilizing the US Legal Forms site, which provides the greatest variety of legal forms. Use expert and state-distinct templates to deal with your company or individual needs.

Form popularity

FAQ

The best way is to contact the policy's issuer (the life insurance company). Their records are key: even if you see your name listed on an old policy document, the deceased may have changed their beneficiaries (or the allocation of benefits among those beneficiaries) after that document was printed.

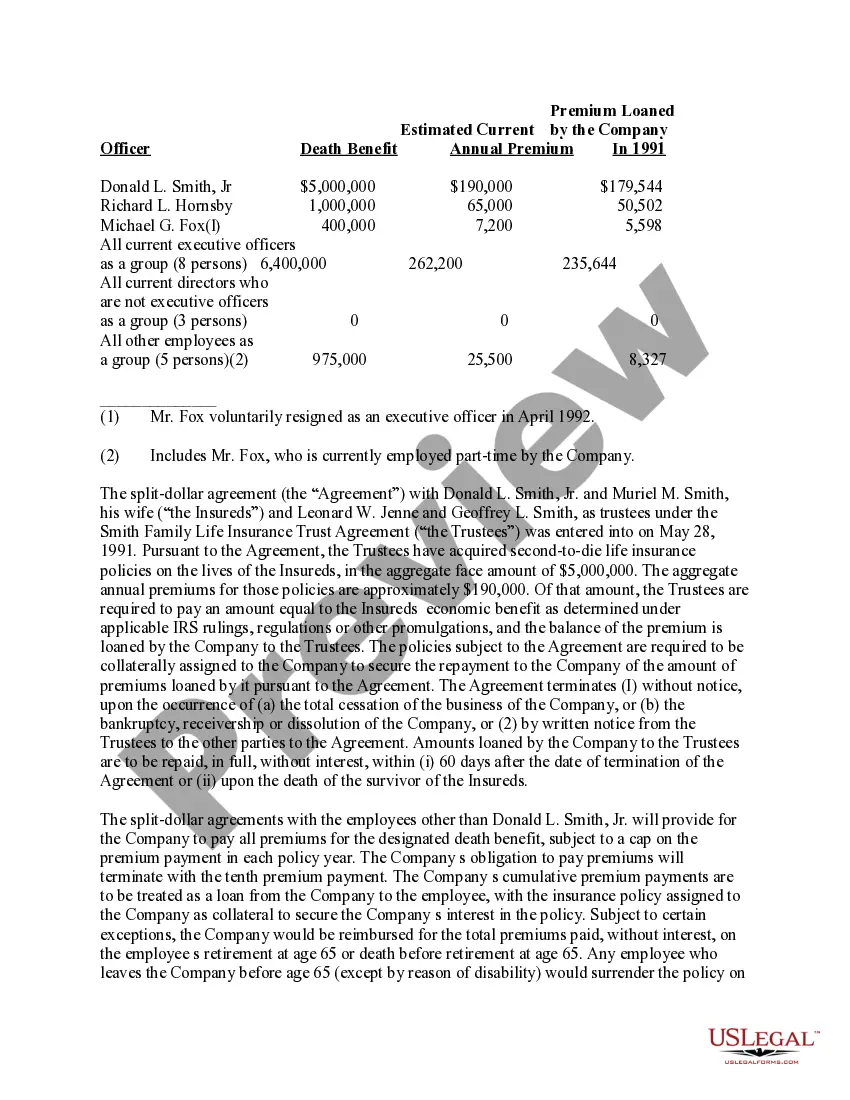

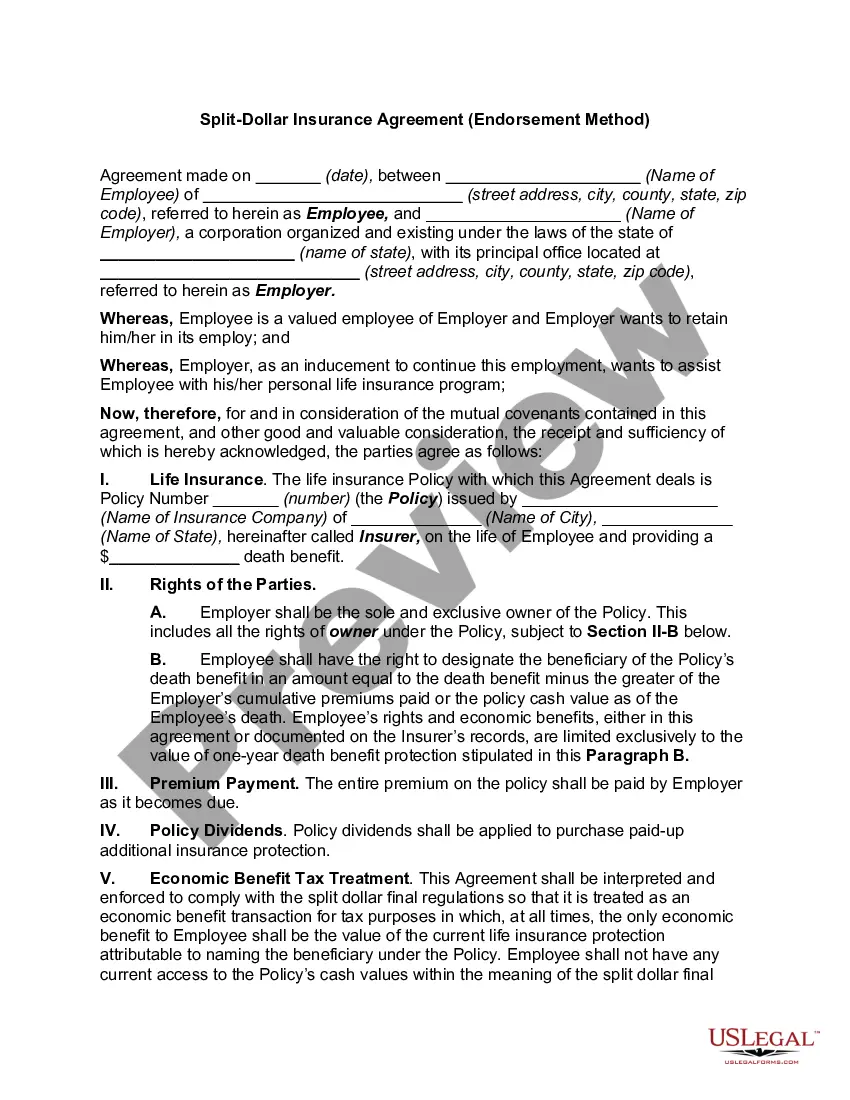

dollar life insurance agreement (or ?splitdollar plan?) is a strategy generally used as an employer benefit or for estate planning involving life insurance. It's an agreement between two or more parties to share the ownership, costs, and benefits of a permanent life insurance policy, like whole life.

Split Dollar Loan Regime Agreement & Contract Generally, at the employee's death, the employer receives a portion of the death benefit (usually equal to the total premiums plus interest from the loan) and the employee's beneficiary receives the balance.

While split-dollar life insurance arrangements offer numerous advantages, they also come with potential drawbacks, such as complexity, tax considerations, and limited availability. Both employers and employees must carefully weigh the benefits and disadvantages of this type of arrangement before deciding to pursue it.

With a classic split-dollar plan, the employer pays some of the premium (the part that is equal to cash value), while the employee pays the rest. If the employees dies, or the plan is terminated, the surrender cash value is paid to the company, and the death benefits are paid out to beneficiaries.

Employers are responsible for making split-dollar life insurance premiums, regardless of the plan's type. However, it is important to note that under loan arrangements, employees must repay the premiums via collateral assignments made to their employer.

Split-dollar payment arrangements generally take one of two forms: The employer pays the premiums and owns the contract. The employer receives reimbursement of the premiums upon the employee's death, and the employee's beneficiary then receives the balance of the insurance proceeds.

In a split-dollar plan, an employer and employee execute a written agreement that outlines how they will share the premium cost, cash value, and death benefit of a life insurance policy. Split-dollar plans are frequently used by employers to provide supplemental benefits for executives and to help retain key employees.