New Hampshire Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers

Description

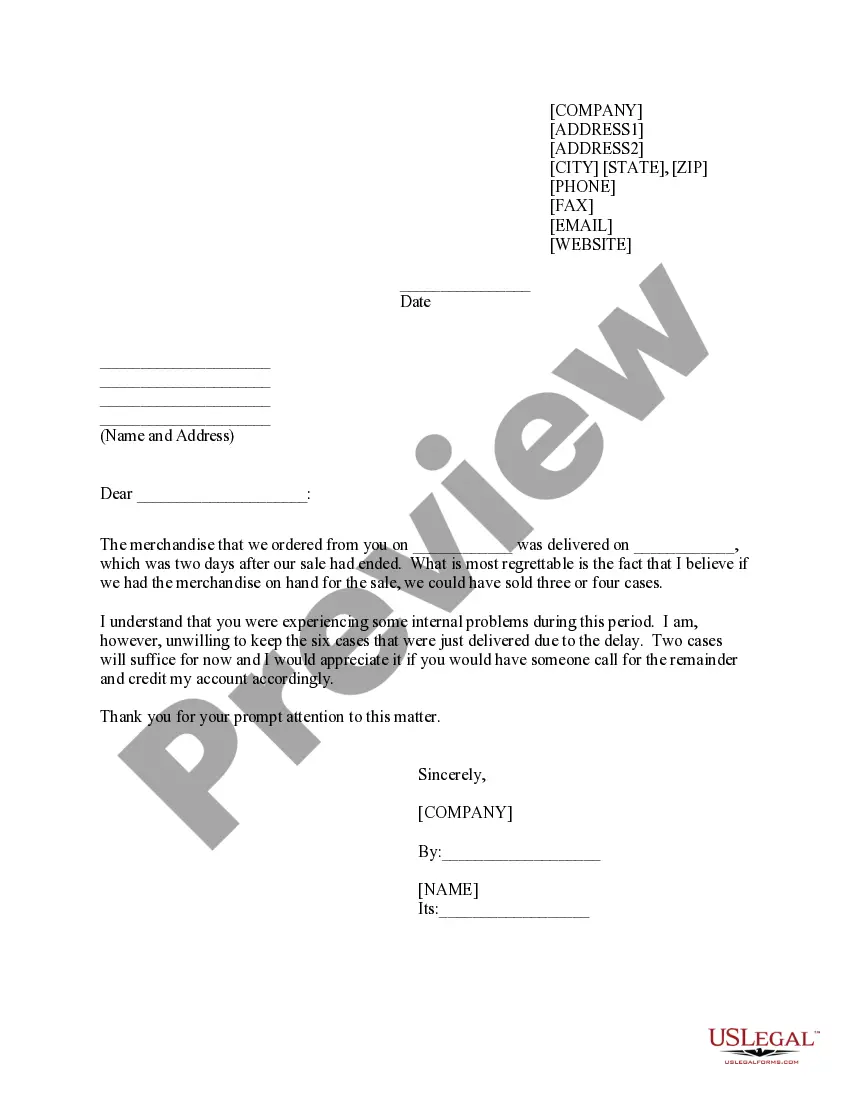

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options To Executive Officers?

If you have to comprehensive, obtain, or print legal papers web templates, use US Legal Forms, the most important collection of legal varieties, that can be found on-line. Make use of the site`s basic and practical search to obtain the documents you want. A variety of web templates for enterprise and individual functions are categorized by types and says, or search phrases. Use US Legal Forms to obtain the New Hampshire Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers in just a few mouse clicks.

In case you are already a US Legal Forms customer, log in in your bank account and click the Obtain key to get the New Hampshire Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers. You can also access varieties you in the past downloaded from the My Forms tab of the bank account.

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the shape to the correct area/land.

- Step 2. Utilize the Preview method to examine the form`s information. Never forget about to see the information.

- Step 3. In case you are not happy with all the type, utilize the Search discipline near the top of the screen to get other models from the legal type web template.

- Step 4. After you have located the shape you want, select the Purchase now key. Pick the pricing plan you choose and add your credentials to register for an bank account.

- Step 5. Process the transaction. You can use your bank card or PayPal bank account to accomplish the transaction.

- Step 6. Find the file format from the legal type and obtain it on your own system.

- Step 7. Full, revise and print or indicator the New Hampshire Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers.

Every legal papers web template you acquire is your own for a long time. You might have acces to each type you downloaded inside your acccount. Click the My Forms area and choose a type to print or obtain once again.

Remain competitive and obtain, and print the New Hampshire Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers with US Legal Forms. There are many professional and status-distinct varieties you may use to your enterprise or individual requirements.

Form popularity

FAQ

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

With this type of incentive, participants are granted a right or option to purchase stock from the company at a specific price?usually the fair market value of the stock when the option is granted. The option to purchase shares continues over an extended period that is measured in years.

Here's an example: You can purchase 1,000 shares of company stock at $20 a share with your vested ISO. Shares are trading for $40 in the market. If you already own 500 company shares, you can swap those shares (500 shares x $40 market price = $20,000) for the 1,000 new shares, rather than paying $20,000 in cash.

Incentive stock options (ISOs) are a form of equity compensation that allows you to buy company shares for a specific exercise price. ISOs are a type of stock option?they are not actual shares of stock; you must exercise (buy) your options to become a shareholder.