New Hampshire Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005

Description

How to fill out Debtor's Certification Of Completion Of Instructional Course Concerning Personal Financial Management - Post 2005?

Choosing the right lawful record template can be quite a struggle. Naturally, there are a variety of layouts available online, but how would you get the lawful form you want? Use the US Legal Forms web site. The service delivers 1000s of layouts, such as the New Hampshire Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005, which you can use for enterprise and personal demands. All the forms are inspected by experts and satisfy federal and state demands.

Should you be currently signed up, log in to the profile and click on the Down load switch to obtain the New Hampshire Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005. Utilize your profile to check throughout the lawful forms you may have purchased formerly. Visit the My Forms tab of your respective profile and have an additional copy of the record you want.

Should you be a new customer of US Legal Forms, listed here are basic recommendations that you should stick to:

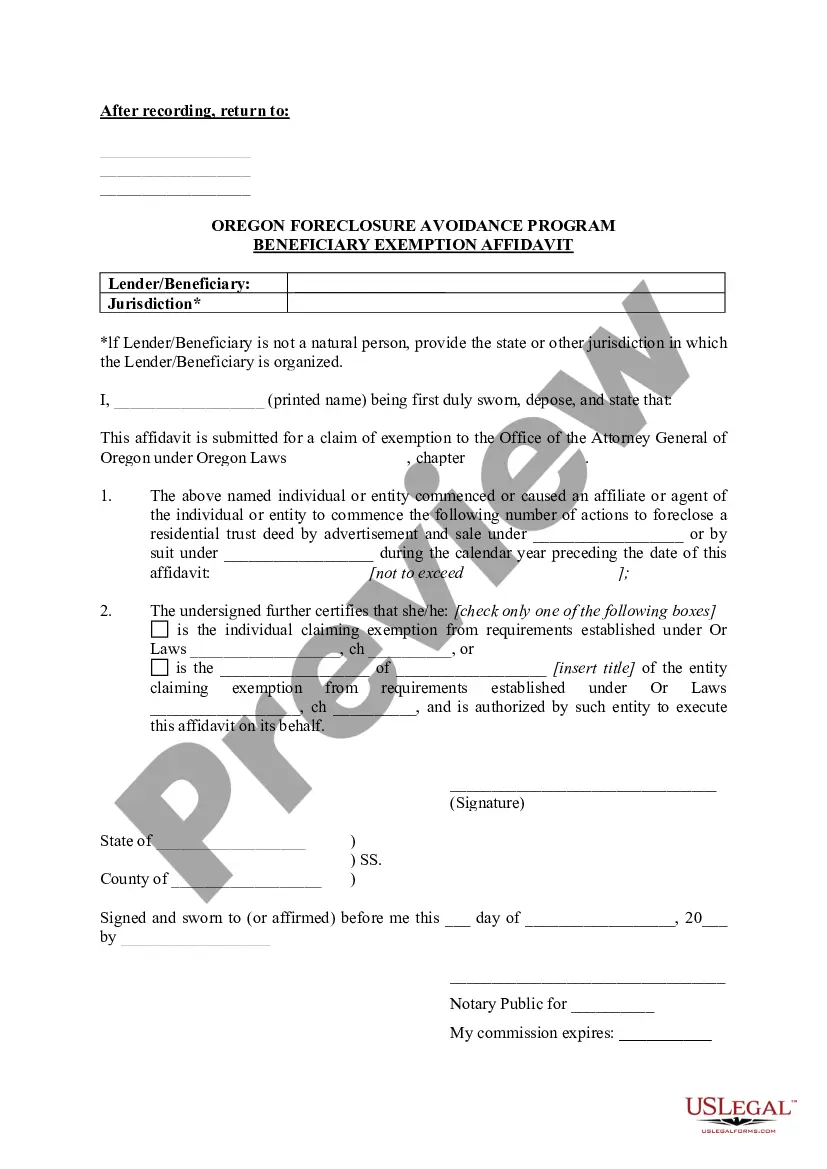

- Very first, ensure you have chosen the appropriate form to your city/region. It is possible to look through the shape utilizing the Review switch and look at the shape explanation to make certain this is basically the right one for you.

- When the form will not satisfy your needs, take advantage of the Seach area to find the appropriate form.

- Once you are sure that the shape is suitable, click on the Buy now switch to obtain the form.

- Select the pricing plan you want and type in the required details. Create your profile and buy an order using your PayPal profile or credit card.

- Choose the document file format and download the lawful record template to the gadget.

- Comprehensive, change and printing and signal the received New Hampshire Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005.

US Legal Forms is the largest catalogue of lawful forms where you can discover numerous record layouts. Use the company to download expertly-created documents that stick to state demands.

Form popularity

FAQ

The court may deny an individual debtor's discharge in a chapter 7 or 13 case if the debtor fails to complete "an instructional course concerning financial management." The Bankruptcy Code provides limited exceptions to the "financial management" requirement if the U.S. trustee or bankruptcy administrator determines ...

Funds received after the date of an Order of Dismissal or an Order of Conversion in a confirmed case and after the Trustee has closed the case will be disbursed directly to the debtor(s). These refunds will be generated once per month, near the end of the month, prior to the regular disbursement cycle.

Bankruptcy Courses If you are on the receiving end of Bankruptcy Official Form 423, then it is safe to say that you are in the middle of a bankruptcy. The law requires bankruptcy filers to complete two classes. First, a debtor must complete a pre-filing class. Second, a debtor must complete a post-filing class.

In summary, a Chapter 13 bankruptcy can fail for lots of reasons. These could be inadequate repayment plans, failure to make plan payments, changes in your financial circumstances, failure to do those required courses, filing too soon after previous bankruptcy, and filing without legal representation.

About 45 days after you've received your discharge, you will receive a document called a Final Decree. It's the document that officially closes your case. Once this document is received, you are no longer in bankruptcy.

Incomplete or Inaccurate Documentation: Filing for Chapter 13 bankruptcy requires comprehensive documentation, including income records, tax returns, and a complete list of debts and assets. Failure to provide accurate or complete information may result in disqualification or case dismissal.

A report from the American Bankruptcy Institute, shows that filing Chapter 13 bankruptcy with the help of an attorney has a more successful outcome than pursuing credit counseling. While results vary somewhat from state to state, between 40 percent to 70 percent of Chapter 13 cases complete repayment successfully.

A total of 226,777 chapter 13 consumer cases were closed by dismissal or plan completion in 2020. Table 6 illustrates that 116,145 of these cases were dismissed. In 49 percent of the cases closed (110,632 cases), the debtors received a discharge after completing repayment plans, up from 43 percent in 2019.