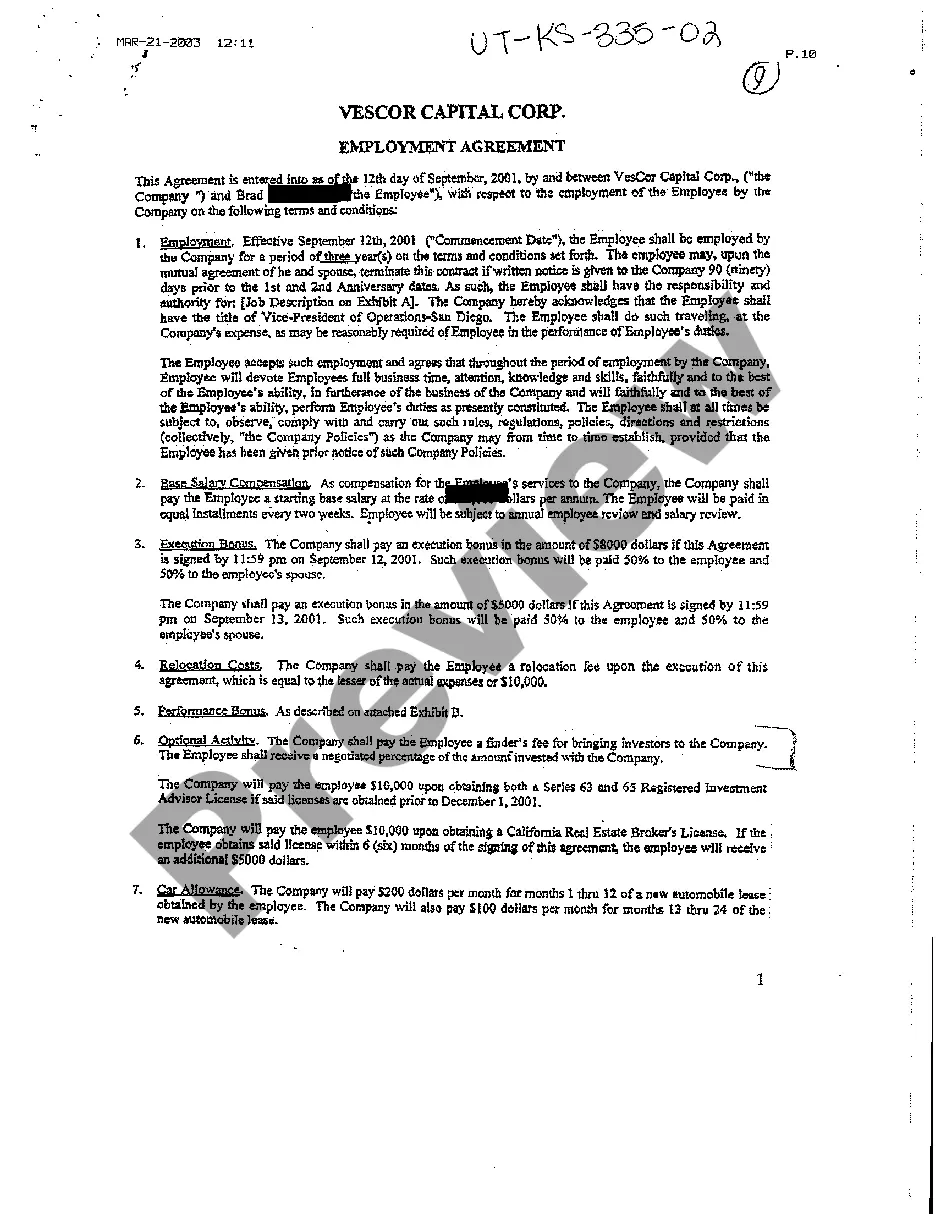

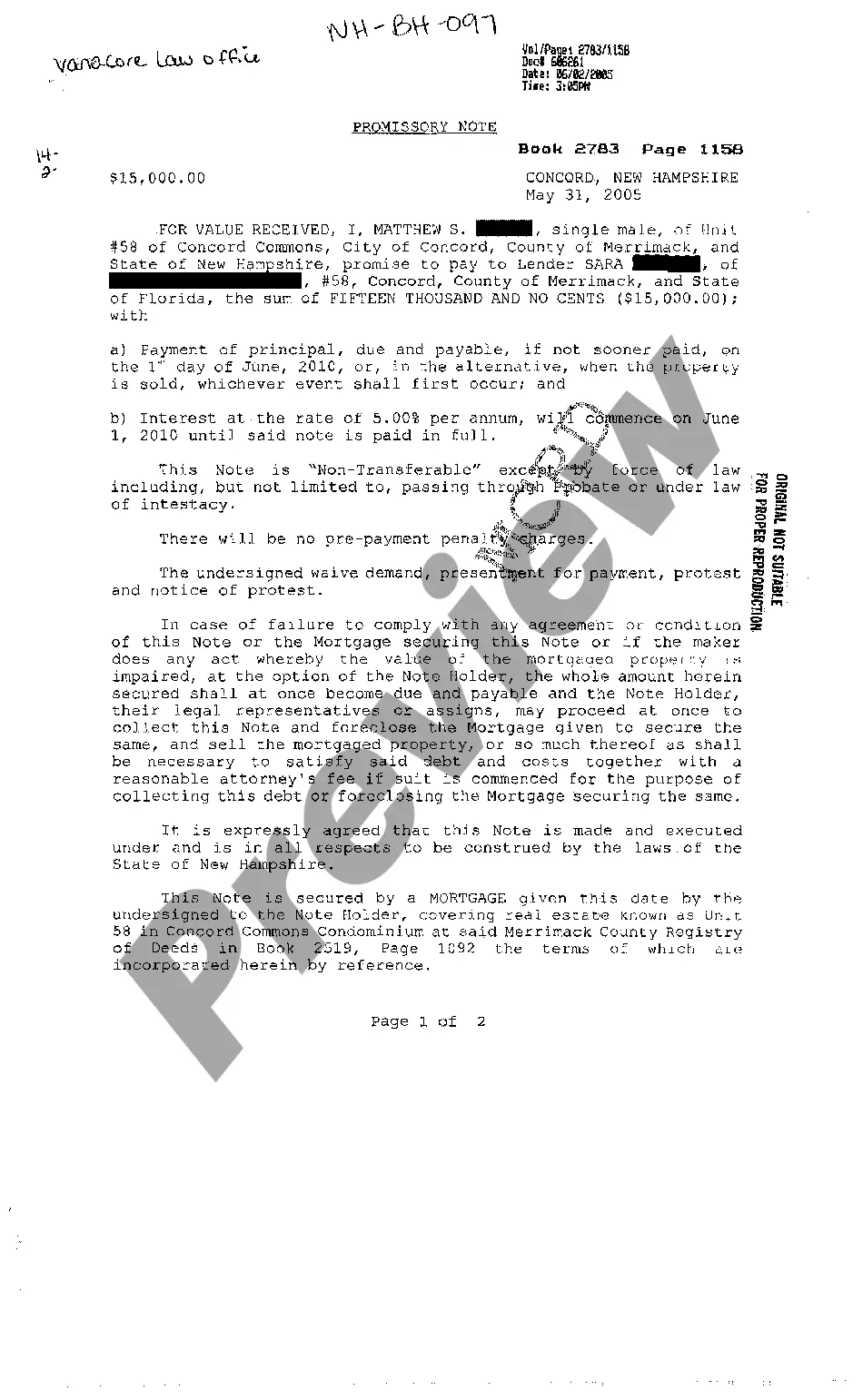

New Hampshire Bill of Costs (District Court)

Description

How to fill out Bill Of Costs (District Court)?

Have you been inside a place in which you require paperwork for sometimes business or person functions nearly every day? There are plenty of legal papers templates available online, but locating versions you can rely isn`t straightforward. US Legal Forms offers 1000s of type templates, much like the New Hampshire AO-133 Bill of Costs - Federal District Court Official Form, which are composed in order to meet federal and state needs.

In case you are currently familiar with US Legal Forms website and have a free account, just log in. Following that, it is possible to download the New Hampshire AO-133 Bill of Costs - Federal District Court Official Form design.

If you do not come with an account and want to begin to use US Legal Forms, follow these steps:

- Find the type you will need and make sure it is for the appropriate metropolis/region.

- Make use of the Preview key to check the shape.

- See the information to actually have selected the appropriate type.

- If the type isn`t what you are searching for, make use of the Research industry to discover the type that fits your needs and needs.

- When you get the appropriate type, simply click Acquire now.

- Opt for the costs prepare you would like, fill out the required details to make your account, and buy your order with your PayPal or credit card.

- Choose a practical document format and download your copy.

Find each of the papers templates you might have purchased in the My Forms menus. You can obtain a additional copy of New Hampshire AO-133 Bill of Costs - Federal District Court Official Form at any time, if necessary. Just click the necessary type to download or produce the papers design.

Use US Legal Forms, the most comprehensive selection of legal types, in order to save efforts and avoid faults. The service offers expertly created legal papers templates that you can use for a variety of functions. Make a free account on US Legal Forms and initiate generating your way of life easier.

Form popularity

FAQ

§ 1920, which applies in both civil and criminal cases. A judge or clerk of any court of the United States may tax costs in criminal cases. BILLS OF COSTS HANDBOOK Taxation of Costs by the Clerk District of Nebraska (.gov) ? info ? taxation... District of Nebraska (.gov) ? info ? taxation... PDF

For U.S. Court of Appeals decisions, you must indicate which circuit decided the case, followed by "Cir.", followed by the year the case was decided. You abbreviate the First Circuit as 1st Cir., the Second Circuit as 2d Cir., the Third Circuit as 3d Cir., the Fourth Circuit as 4th Cir., and so on.

Tax costs generally refers either to increased tax liabilities resulting from a corporate transaction or more frequently as a motion of a losing party to challenge paying certain costs of the winning party in litigation. tax costs | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? tax_costs cornell.edu ? wex ? tax_costs

The federal statute governing taxation of costs, 28 U.S.C. §1920, allows ?[f]ees of the court reporter for all or any part of the stenographic transcript necessarily obtained for use in the case.? The court ruled here that this language was not broad enough to reach remote deposition fees. Analyses of Section 1920 - Taxation of costs, 28 U.S.C. § 1920 Casetext ? part-v-procedure ? analysis Casetext ? part-v-procedure ? analysis

Taxation of costs is a ministerial function performed by a court upon the resolution of case. It involves entering the various costs and their amounts against the party (either the claimant or defendant) against whom those costs have been awarded by the court. Taxation of costs - Wikipedia wikipedia.org ? wiki ? Taxation_of_costs wikipedia.org ? wiki ? Taxation_of_costs

A cost bill can include fees of the clerk, fees for service of summons and subpoena, fees for printing, fees for witnesses, compensation of court-appointed experts, etc. Statutes typically limit what can be included in the cost bill and attorney fees are usually a cost not allowed to be included.

The federal statute governing taxation of costs, 28 U.S.C. §1920, allows ?[f]ees of the court reporter for all or any part of the stenographic transcript necessarily obtained for use in the case.? The court ruled here that this language was not broad enough to reach remote deposition fees.

The federal district courts are the trial courts in the federal court system. New Hampshire has one federal district court, which is known as the U.S. District Court for the District of New Hampshire.