New Hampshire VETS-100 Report

Description

How to fill out VETS-100 Report?

If you need to aggregate, acquire, or reproduce legal document templates, use US Legal Forms, the largest assortment of legal forms available online.

Utilize the site's straightforward and efficient search function to locate the documents you require.

A range of templates for business and personal purposes are organized by categories and suggestions, or keywords.

Every legal document template you acquire is yours for life. You have access to every form you saved in your account. Navigate to the My documents section and select a form to print or download again.

Be proactive and download, and print the New Hampshire VETS-100 Report with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to quickly find the New Hampshire VETS-100 Report with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and then click the Download button to access the New Hampshire VETS-100 Report.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm that you have selected the form for the correct city/state.

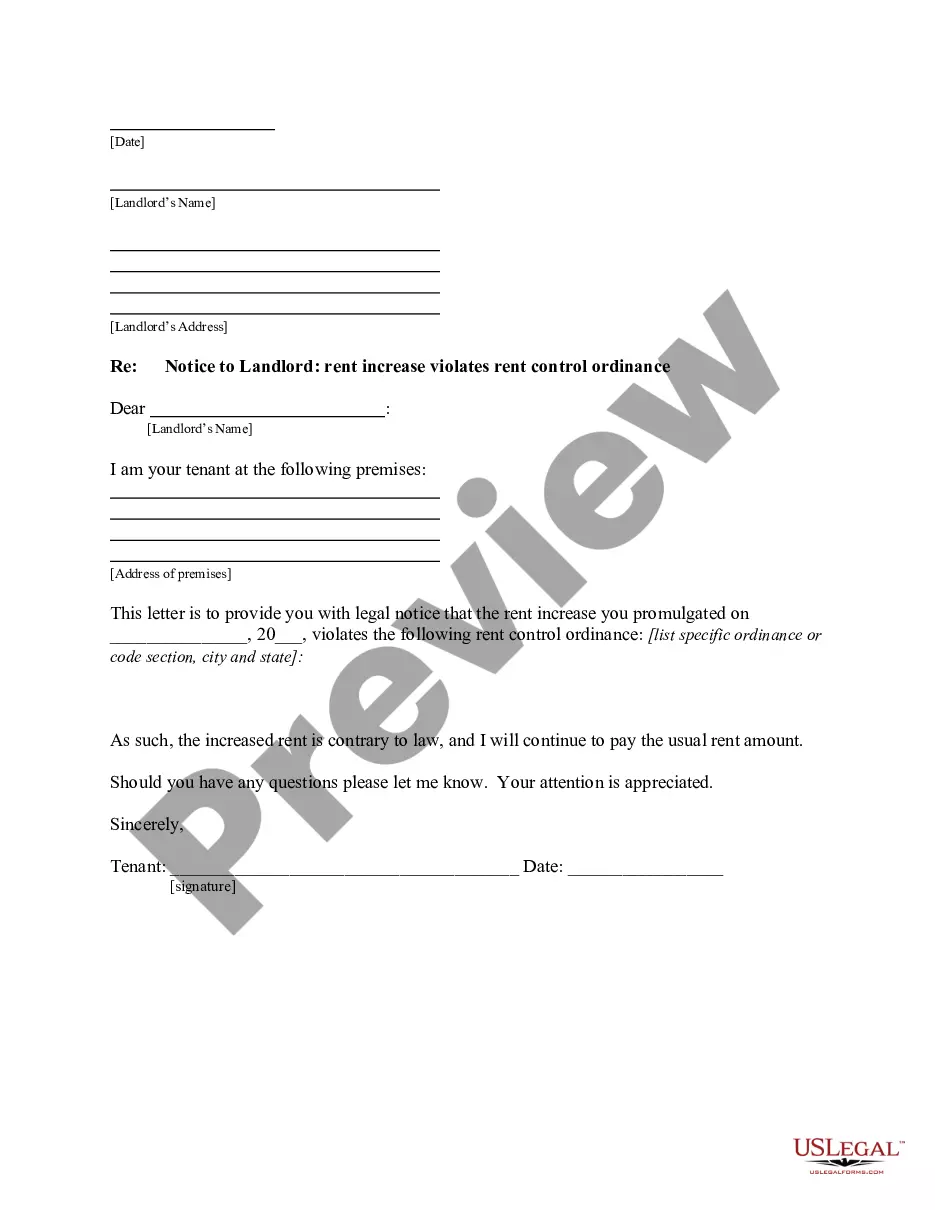

- Step 2. Use the Review option to examine the form's details. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal template.

- Step 4. Once you have identified the form you need, click the Purchase now button. Choose the pricing option you prefer and enter your credentials to create an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the New Hampshire VETS-100 Report.

Form popularity

FAQ

The VETS-100A Report is now named the VETS-4212 Report. The VETS-100 Report is rescinded, rendering obsolete the VETS reporting requirements applicable to Government contracts and subcontracts entered into before December 1, 2003. The term covered veteran is replaced with the term protected veteran.

The applicant must be 65 years of age on or before April 1st in the year they are applying for the exemption. The applicant must have been a New Hampshire resident for three consecutive years prior to April 1.

What NH Property Tax Exemptions Are Available?65 or over on April 1 of the year they are applying.NH resident for the last three consecutive years.Owner or co-owner of the property.Net annual income of less than $34,300 for single persons and $47,200 for couples.Separate assets of $95,000 or less.

You must file the VETS-4212 Report if you have a current federal government contract or subcontract worth $150,000 or more. This includes both prime contractors (businesses that are the direct contract recipients) and subcontractors (businesses contracted by businesses with a federal contract).

A disabled veteran in New Hampshire may receive a full property tax exemption on his/her primary residence if the veteran is 100% disabled, blind, paraplegic or a double amputee as a result of service and owns a specially adapted home acquired with assistance from the VA.

Federal contractors and subcontractors who are required to file form VETS-4212 can submit their forms electronically by using either the VETS-4212 Reporting Application or batch filing process, or by using the paper form by email or U.S. mail. We recommend that you file your form electronically.

There are several states that waive property taxes for 100% disabled veterans, including Florida, Texas, Virginia, New Mexico and Hawaii. These exemptions are available on principal residences only, not second or vacation homes. Often a surviving spouse who remains unremarried is also eligible for the benefits.

Tax Exemption for Certain Permanent and Total Disabled Veterans that are in receipt of Specially Adapted Housing from the VA: The home of an honorably discharged, disabled Veteran that was acquired with assistance from the VA is exempt from all property tax.

Tax Exemption for Certain Permanent and Total Disabled Veterans that are in receipt of Specially Adapted Housing from the VA: The home of an honorably discharged, disabled Veteran that was acquired with assistance from the VA is exempt from all property tax.

The Vietnam Era Veterans' Readjustment Act (VEVRAA) requires covered federal contractors and subcontractors to file the VETS-4212 Report. The VETS-4212 Report requires a company to indicate the type of contractual relationship that it has with the federal government.