New Hampshire Application for Employment or Work

Description

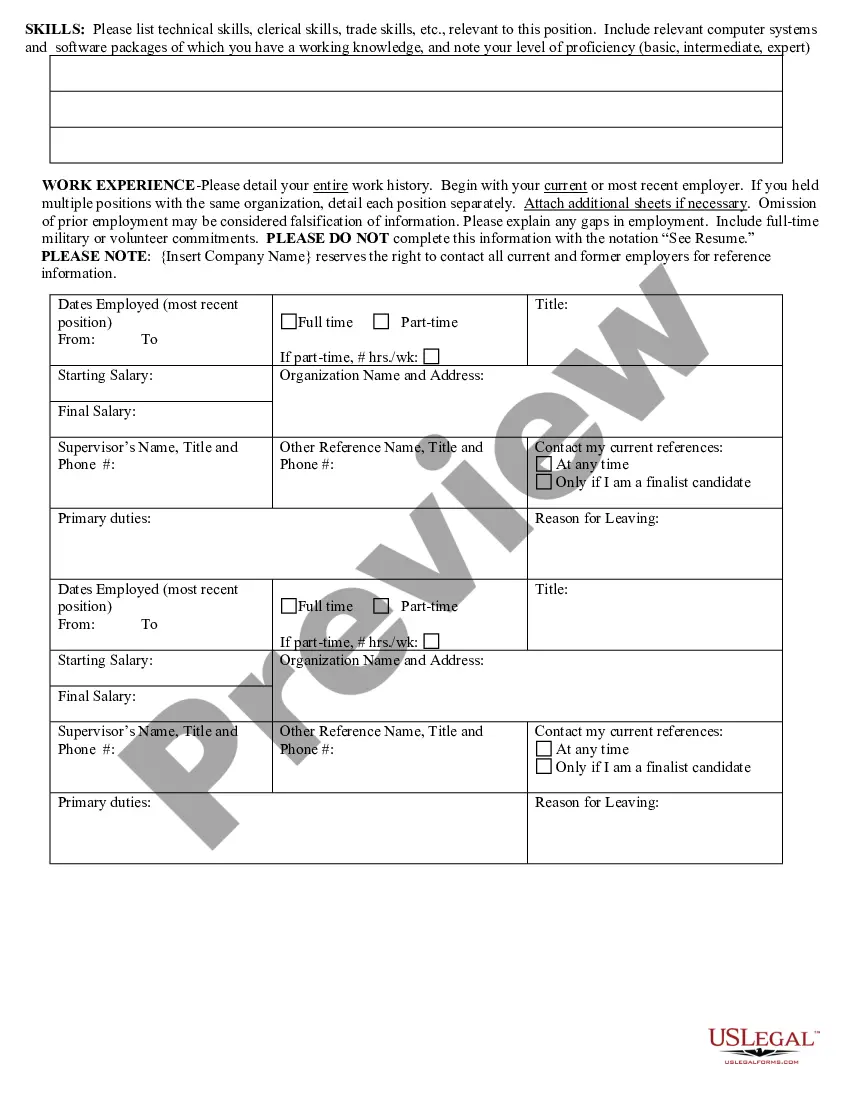

How to fill out Application For Employment Or Work?

If you require to download, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is your property for years. You will have access to every form you downloaded within your account. Visit the My documents section and select a form to print or download again.

Be proactive and download, then print the New Hampshire Application for Employment or Job using US Legal Forms. There are countless professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to acquire the New Hampshire Application for Employment or Job with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the New Hampshire Application for Employment or Job.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure that you have selected the form for the correct city/state.

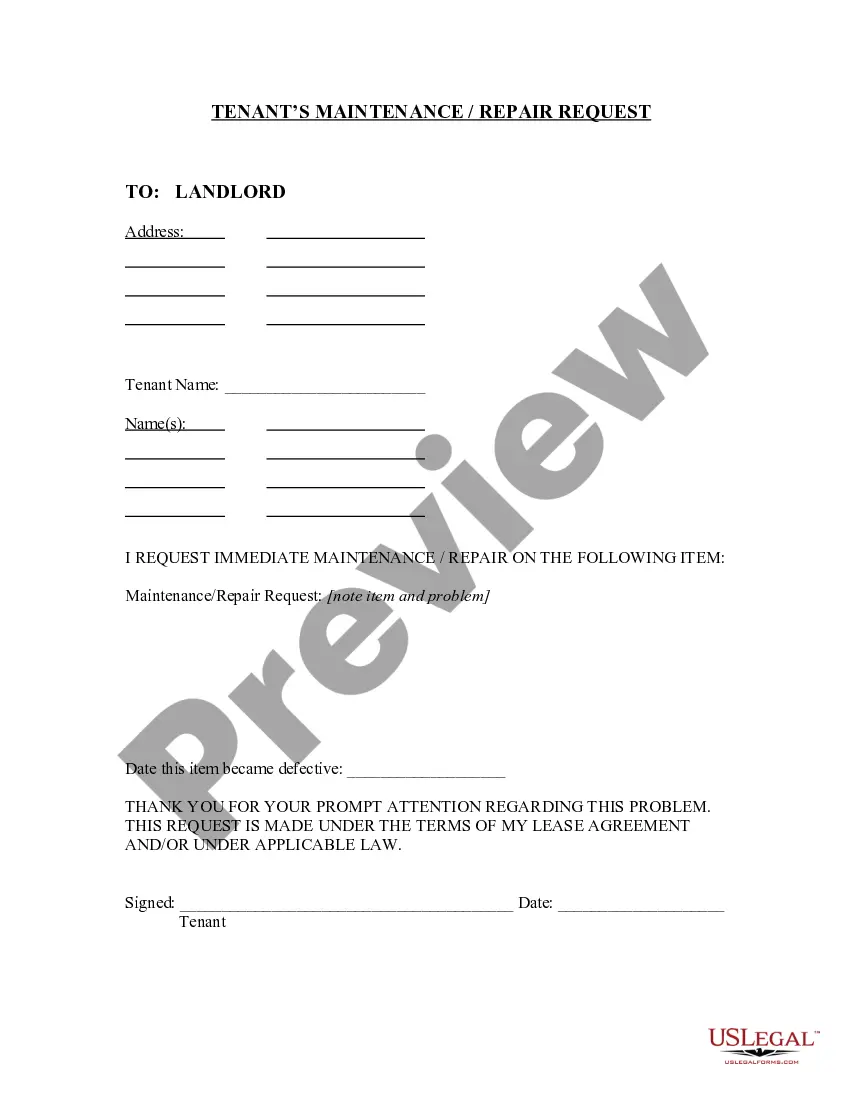

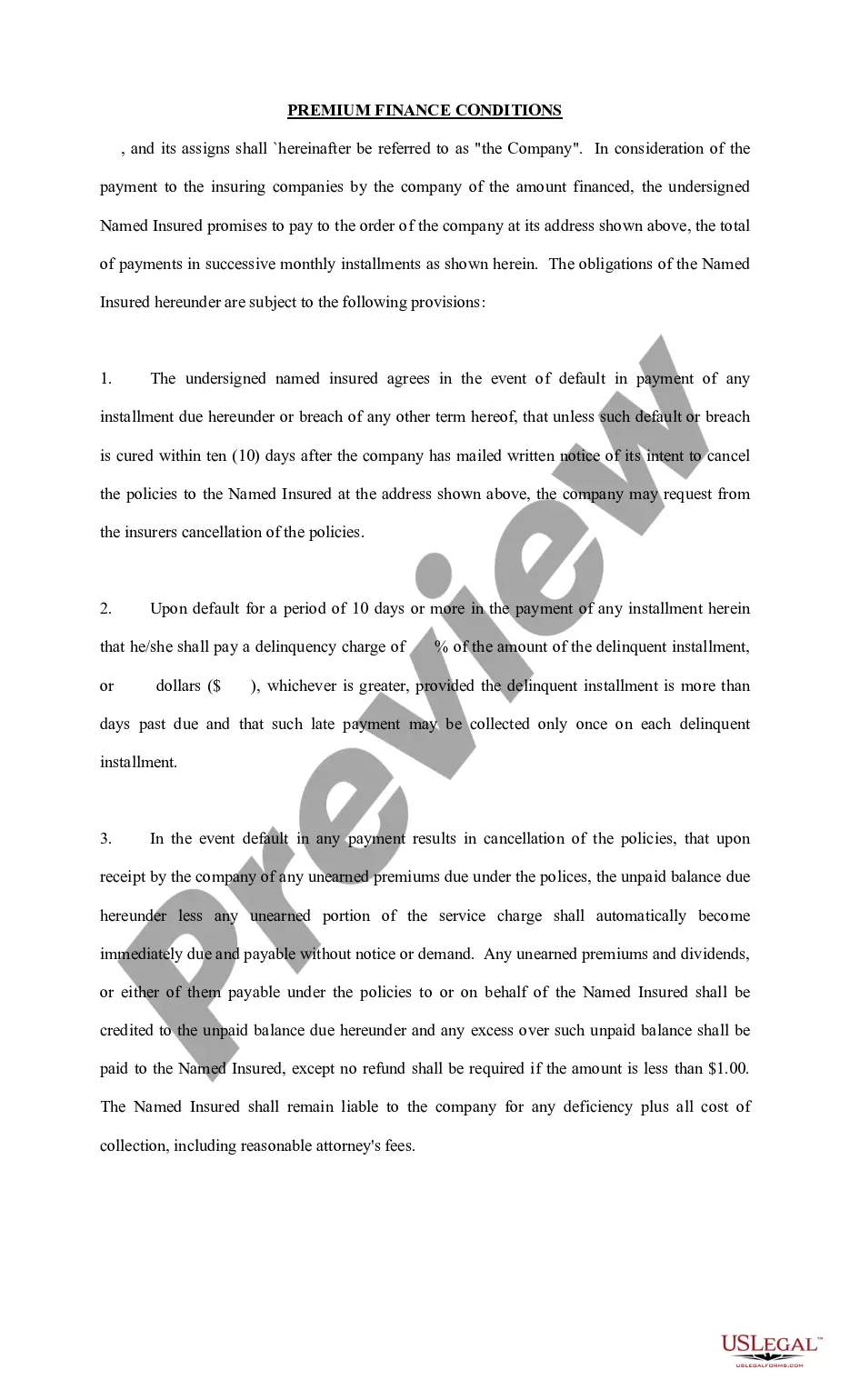

- Step 2. Use the Preview option to view the form’s details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now option. Select the pricing plan you prefer and enter your information to create an account.

- Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Hampshire Application for Employment or Job.

Form popularity

FAQ

Each state sets its own unemployment insurance benefits eligibility guidelines, but you usually qualify if you: Are unemployed through no fault of your own. In most states, this means you have to have separated from your last job due to a lack of available work. Meet work and wage requirements.

In order to be eligible for unemployment compensation, an individual: Must be totally or partially unemployed. Must register for work unless you have been specifically exempted. Must be available for full-time work on all shifts and during all the hours work claimant is qualified for is normally performed.

How to File your Weekly Continued ClaimStep 1: Login. From this welcome screen, you will need to click on Login at the bottom of the page.Step 2: Select File for Benefits on The Dashboard.Step 3: Select Your Location.Step 4: Click the link File for weekly benefits for week ending2026Step 5: Weekly Claim.

Yes, you are allowed to work part-time and still file for benefits but you may be earning too much to qualify for a benefit. Depending upon how much you earn will then determine whether you still receive a weekly benefit. You are allowed to earn up to 30% of your weekly benefit amount without any reduction.

You may still qualify for regular unemployment benefits, whether you are out of work for reasons related to COVID-19 or for any other reason. See how New Hampshire determines eligibility for benefits.

To be eligible for this benefit program, you must a resident of New Hampshire and meet all of the following: Unemployed, and. Worked in New Hampshire during the past 12 months (this period may be longer in some cases), and. Earned a minimum amount of wages determined by New Hampshire guidelines, and.

The minimum earnings required for eligibility are $2800 ($1400 each in 2 separate quarters), which would result in a $32 weekly benefit amount. The more earnings in your base period, the higher your weekly benefit amount, to a maximum of $427 for $41,500 or more in earnings.

If you have a firm start work date and can provide your NH Works Office with a letter or contact name and phone number that can confirm your start work date, your work search requirement may be waived for up to four (4) weeks.