New Hampshire Job Expense Record

Description

How to fill out Job Expense Record?

If you require to completely, retrieve, or print genuine document templates, utilize US Legal Forms, the largest assortment of legitimate forms, which can be accessed online.

Take advantage of the site’s straightforward and convenient search to locate the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan that suits you and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to discover the New Hampshire Job Expense Record with just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download button to obtain the New Hampshire Job Expense Record.

- You can also access forms you previously retrieved in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the steps below.

- Step 1. Make sure you have chosen the form for the correct city/state.

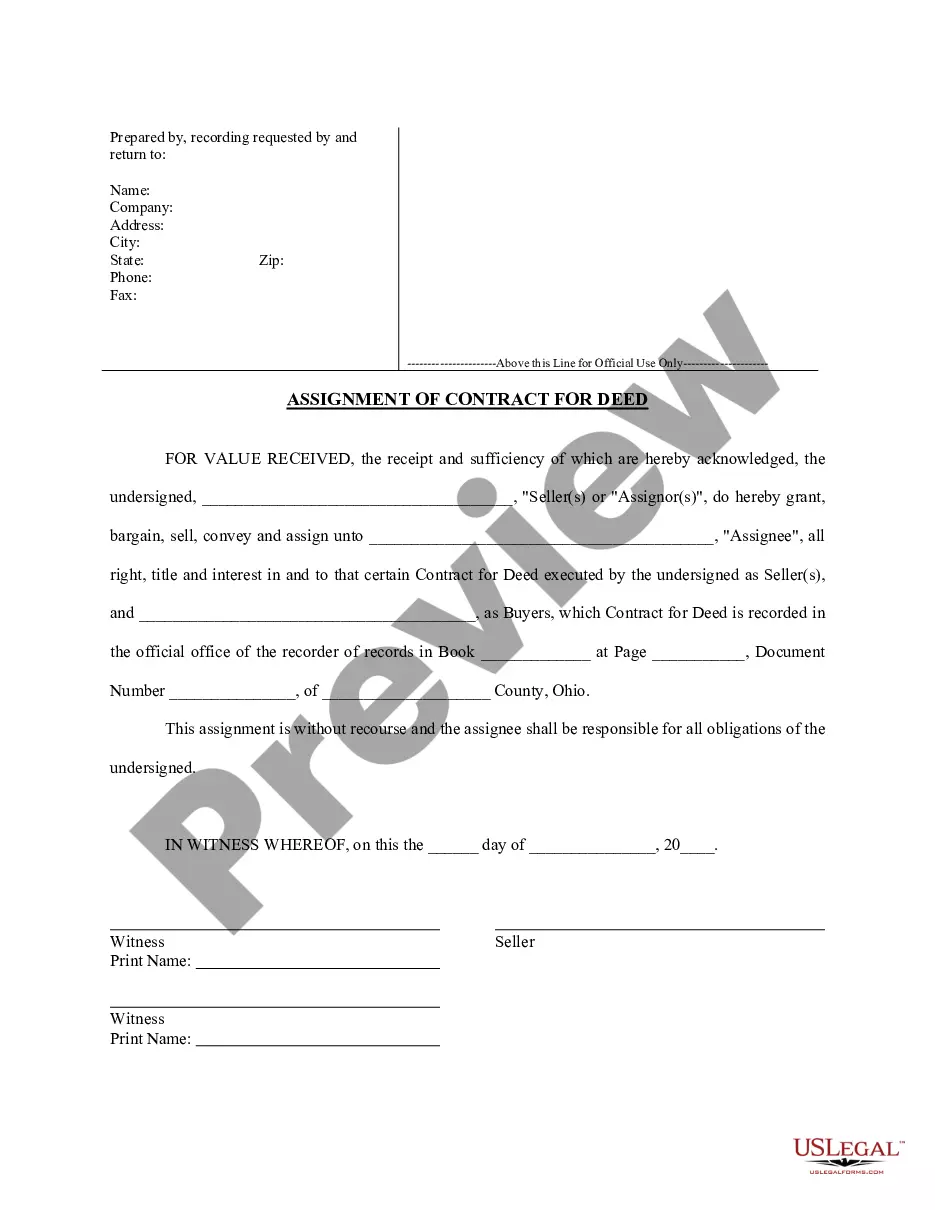

- Step 2. Use the Review option to assess the form’s content. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legitimate form format.

Form popularity

FAQ

However, most states allow employers to provide electronic pay stubs that can be printed (with access to a printer ensured by their employer). Some states require employees to give consent to receive pay stubs electronically.

Yes, employers must provide, in writing, an employee's rate of pay at the time of hire and upon any changes, as well as all policies pertaining to any fringe benefits.

Employers must give all their employees and workers payslips, by law (Employment Rights Act 1996). Workers can include people on zero-hours contracts and agency workers. Agency workers get their payslips from their agency.

In New Hampshire, state UI tax is one of the primary taxes that employers must pay. Unlike most other states, New Hampshire does not have state withholding taxes. However, other important employer taxes, not covered here, include federal UI and withholding taxes.

New Hampshire is an at-will state, which means employers can generally fire their employees at any time and for any reasonwith some important exceptions. Note that the state's at-will laws do not apply to union employees or those working on employment contracts.

The minimum earnings required for eligibility are $2800 ($1400 each in 2 separate quarters), which would result in a $32 weekly benefit amount. The more earnings in your base period, the higher your weekly benefit amount, to a maximum of $427 for $41,500 or more in earnings.

Employers must allow their employees to have at least 24 consecutive hours off from work in every seven-day period.

Form 1099Gs issued from 2009 through 2020 are available online by logging into the unemployment benefit system and going to your correspondence box.

Do You Need Help With SUI?Alabama. SUI Tax Rate: 0.65% - 6.8%Alaska. SUI Tax Rate: 1.00% - 5.4%Arizona. SUI Tax Rate: 0.05% - 12.76%Arkansas. SUI Tax Rate: 0.4% - 14.3%California. SUI Tax Rate: 1.5% - 6.2%Colorado. SUI Tax Rate: 0.62% - 8.15%Connecticut. SUI Tax Rate: 1.9% - 6.8%Delaware. SUI Tax Rate: 0.3% - 8.2%More items...

New Hampshire is one of four states (New Hampshire, New Jersey, Tennessee and Vermont) that assign SUI tax rates on a fiscal year, rather than a calendar year, basis.