New Hampshire Depreciation Schedule

Description

How to fill out Depreciation Schedule?

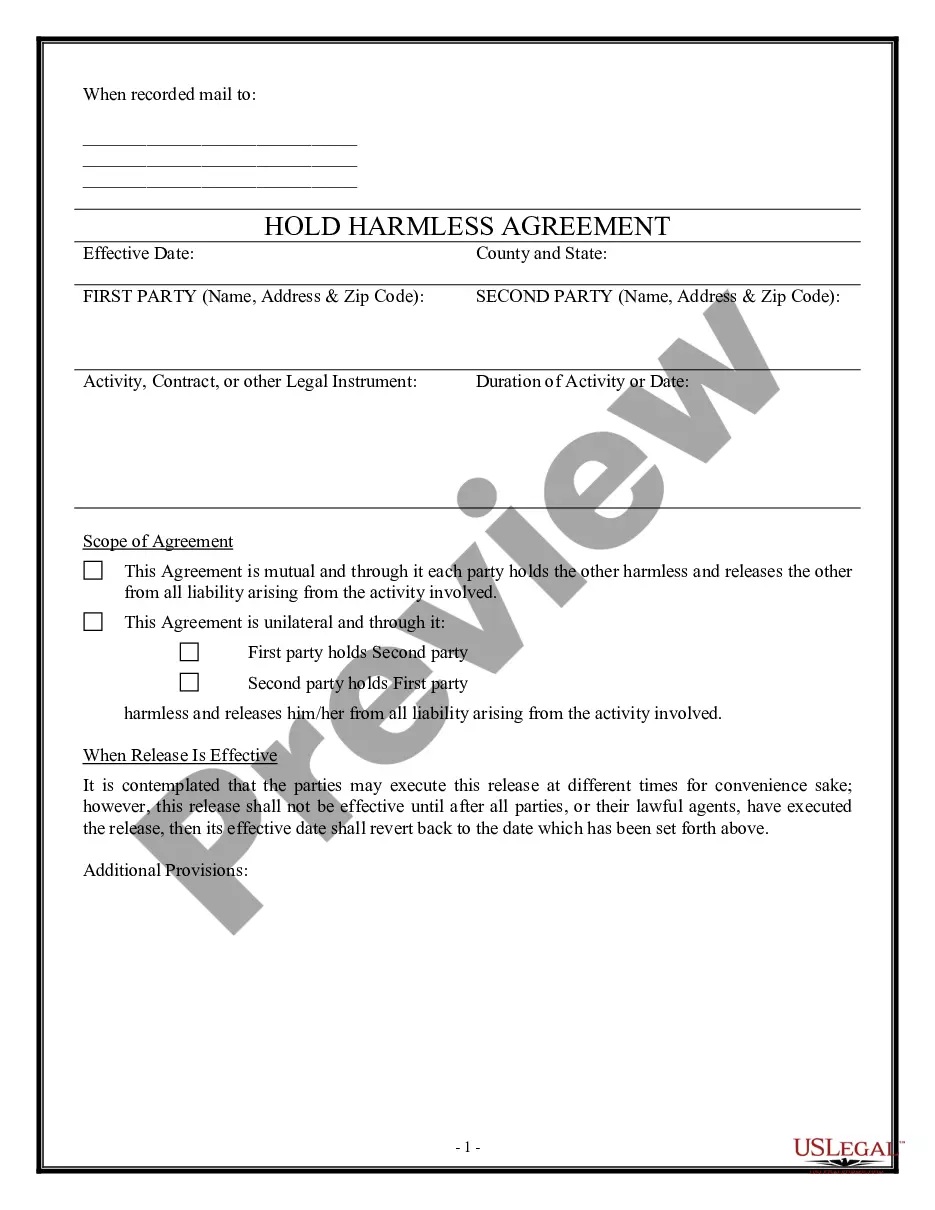

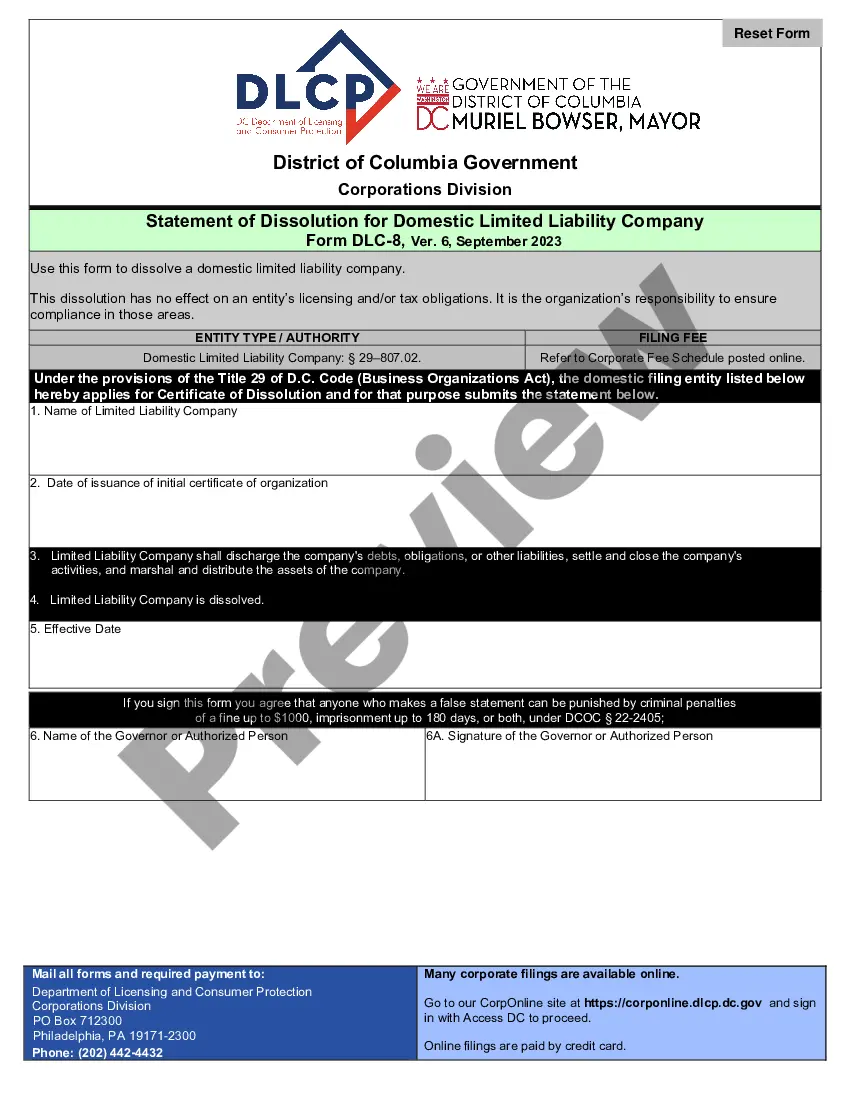

US Legal Forms - one of the largest collections of legal documents in the United States - provides a wide selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can find the latest versions of forms like the New Hampshire Depreciation Schedule in moments.

If you already possess a subscription, Log In and download the New Hampshire Depreciation Schedule from the US Legal Forms library. The Download button will appear on every document you view. You can also access all your previously downloaded forms in the My documents section of your account.

Process the payment. Use a credit card or PayPal account to complete the transaction.

Select the file format and download the form to your device. Edit it. Fill out, modify, print, and sign the downloaded New Hampshire Depreciation Schedule. Every template you’ve added to your account has no expiration date and belongs to you forever. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you desire. Access the New Hampshire Depreciation Schedule with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your area/county. Click the Preview button to review the form’s content.

- Read the form description to make certain you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the page to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Get now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

Filing a federal extension does not automatically extend your New Hampshire filing requirements." DP-10 Instructions, page 2. Form DP-59-A is available through the STEX screen. New Hampshire allows an extension of time to file its required return; it does not allow an extension of time to pay the tax due.

This proposed bill repeals the New Hampshire limitation of $100,000 for the Internal Revenue Code (IRC) Section 179 deduction. As a result, taxpayers would be permitted to use the current IRC Section 179 maximum deduction of $500,000 for property placed in service on or after July 1, 2017.

New Hampshire Business Profits Tax rate is 8.2% of the gross profit after reasonable compensation. The New Hampshire Business Enterprise Tax rate is . 75% of all wages, interest, and dividends, including the owner's reasonable compensation.

Bonus depreciation, allowed federally under IRC §168(k), is not allowed for New Hampshire BPT purposes pursuant to RSA 77-A:1, XX and RSA 77-A:3-b.

The states that do not conform simply do not allow bonus depreciation and no additional deduction for bonus depreciation is allowed....States that do not conform to the new rules:Arizona.Arkansas.California.Connecticut.District of Columbia.Florida.Georgia.Hawaii.More items...

It lets you deduct all or part of the cost of equipment purchased or financed and put into place before December 31, 2022. The only stipulation is that the equipment needs to qualify for the deduction.

The Section 179 deduction applies to tangible personal property such as machinery and equipment purchased for use in a trade or business, and if the taxpayer elects, qualified real property.

This proposed bill repeals the New Hampshire limitation of $100,000 for the Internal Revenue Code (IRC) Section 179 deduction. As a result, taxpayers would be permitted to use the current IRC Section 179 maximum deduction of $500,000 for property placed in service on or after July 1, 2017.

State Conformity with Federal Section 179Forty-six states allow Section 179 deductions. Of the remaining four, three do not levy corporate income taxes and the fourth (Ohio) does not make allowances for federal expense deductions against its gross receipts tax.