New Hampshire LLC Operating Agreement for Husband and Wife

Description

How to fill out LLC Operating Agreement For Husband And Wife?

Are you currently in a circumstance where you will require documentation for either business or personal tasks nearly every workday.

There are numerous authentic document formats accessible online, but finding templates you can rely on isn't simple.

US Legal Forms provides a vast array of form templates, such as the New Hampshire LLC Operating Agreement for Husband and Wife, designed to meet state and federal requirements.

Select the payment plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

Choose a convenient document format and download your copy. Retrieve all the document templates you have purchased in the My documents section. You can acquire an additional copy of the New Hampshire LLC Operating Agreement for Husband and Wife at any time; just select the desired form to download or print the document template. Use US Legal Forms, the largest collection of legitimate forms, to save time and avoid mistakes. Their service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the New Hampshire LLC Operating Agreement for Husband and Wife template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

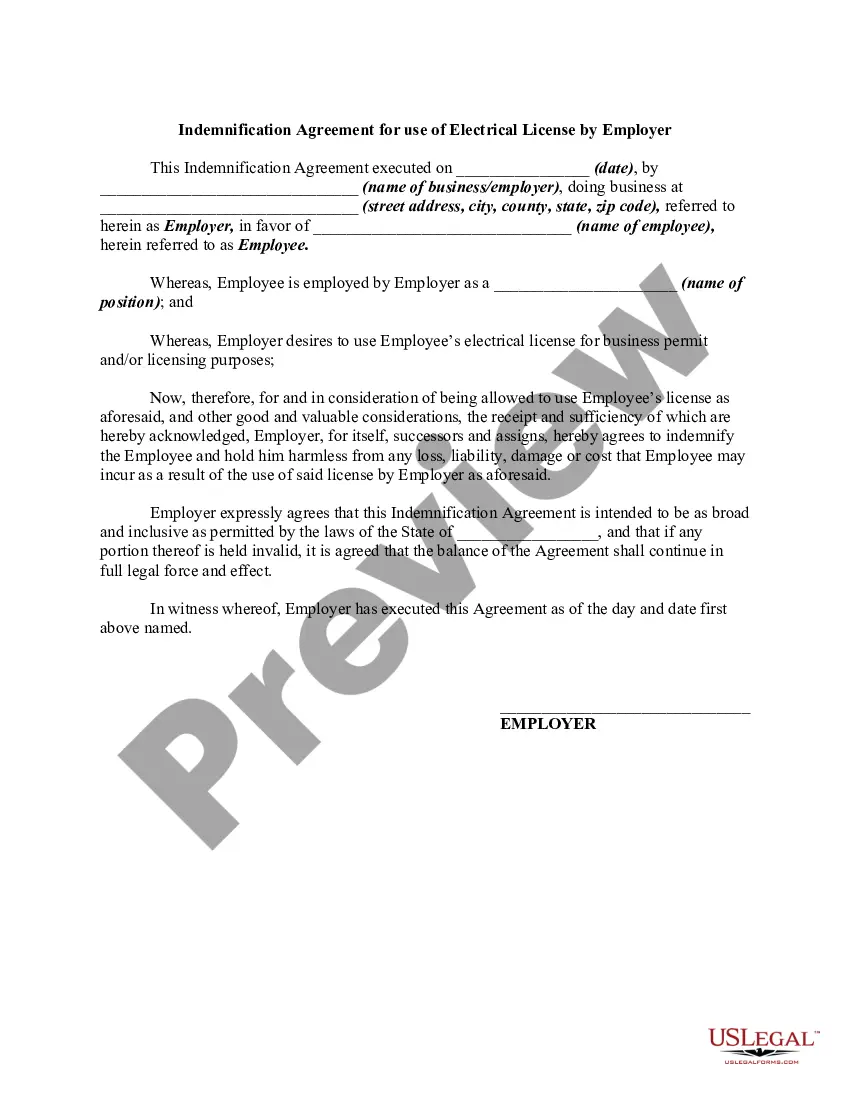

- Utilize the Preview button to review the document.

- Check the summary to confirm you have chosen the right form.

- If the form isn’t what you’re seeking, use the Lookup field to find the form that meets your needs.

- Once you obtain the correct form, click Get now.

Form popularity

FAQ

Setting up an LLC can be very quick, especially if you utilize online services. Many platforms can help you complete the process and submit your application within hours. After submission, you will typically receive your LLC approval in about a week. A clearly defined New Hampshire LLC Operating Agreement for Husband and Wife can help you start operating faster and more efficiently.

10 Must Haves in an LLC Operating Agreement Member Financial Interest. What percentage ownership does each member have? Corporate Governance. Corporate Officer's Power and Compensation. Non-Compete. Books and Records Audit. Arbitration/Forum Selection. Departure of Members. Fiduciary duties.More items...

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Every New Hampshire LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

What should an LLC operating agreement include?Basic company information.Member and manager information.Additional provisions.Protect your LLC status.Customize the division of business profits.Prevent conflicts among owners.Customize your governing rules.Clarify the business's future.

This agreement can be implied, written, or oral. If you're formingor have formedan LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

Banker suggests that answering "yes" to one or more question; it may be time to dissolve your partnership.Review your partnership agreement.Consult your state's statutes.Schedule a meeting with your business partner.File Articles of Dissolution.Divide the partnership assets equitably.

Every New Hampshire LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.