New Hampshire Sample Letter for Deed of Trust

Description

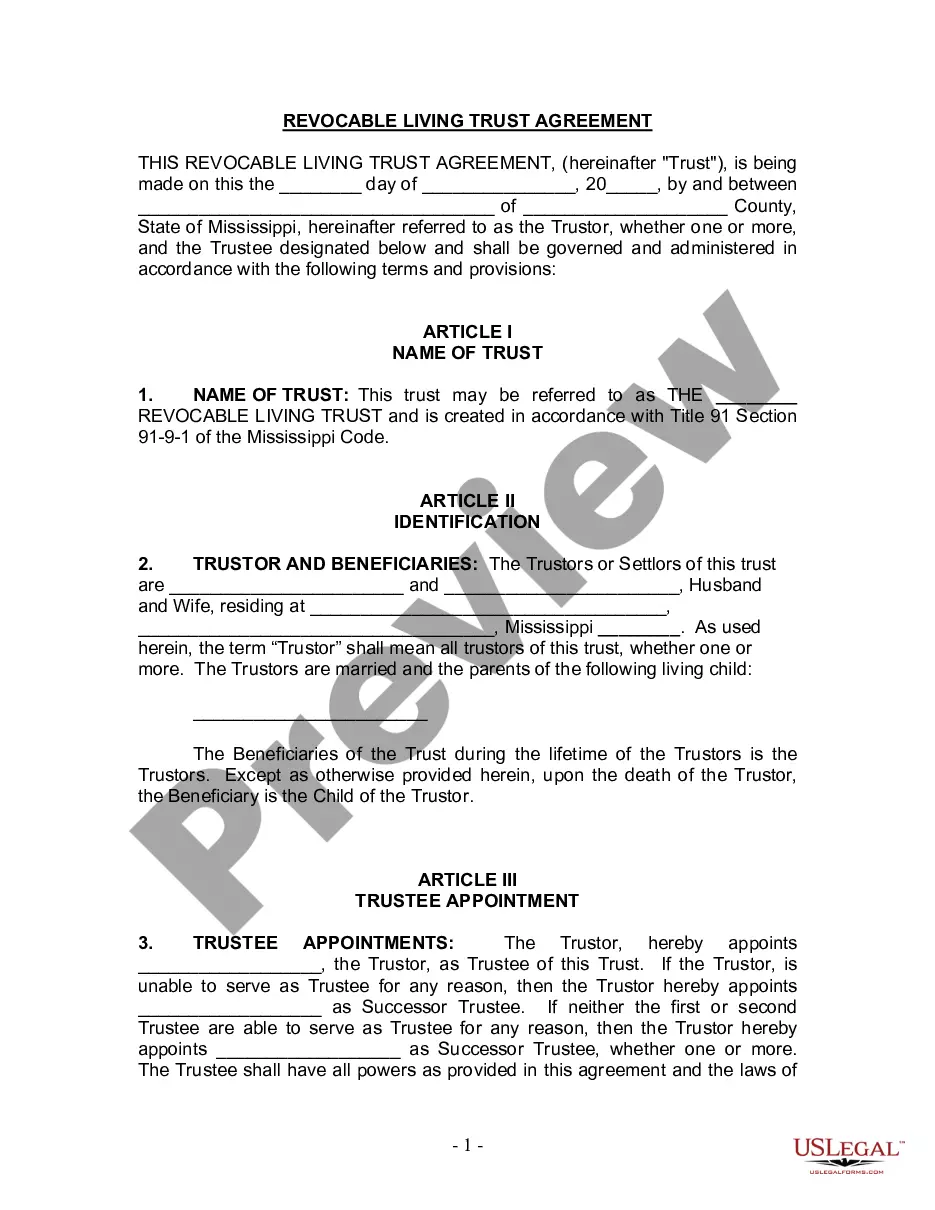

How to fill out Sample Letter For Deed Of Trust?

US Legal Forms - among the most significant libraries of lawful types in the United States - delivers an array of lawful record layouts you are able to obtain or printing. Utilizing the web site, you may get 1000s of types for enterprise and personal purposes, categorized by groups, suggests, or search phrases.You can get the most up-to-date versions of types such as the New Hampshire Sample Letter for Deed of Trust within minutes.

If you currently have a registration, log in and obtain New Hampshire Sample Letter for Deed of Trust from your US Legal Forms collection. The Obtain switch will appear on each and every form you see. You have access to all previously downloaded types in the My Forms tab of your accounts.

If you would like use US Legal Forms the very first time, listed here are straightforward recommendations to obtain started off:

- Make sure you have picked the right form for your metropolis/state. Click on the Preview switch to check the form`s information. See the form outline to actually have chosen the correct form.

- If the form does not match your needs, use the Research discipline near the top of the display screen to find the one that does.

- If you are content with the form, confirm your choice by clicking the Purchase now switch. Then, choose the costs program you want and supply your qualifications to register to have an accounts.

- Procedure the transaction. Make use of charge card or PayPal accounts to finish the transaction.

- Pick the format and obtain the form on your device.

- Make adjustments. Complete, change and printing and indicator the downloaded New Hampshire Sample Letter for Deed of Trust.

Each template you put into your money does not have an expiration day and it is your own eternally. So, if you wish to obtain or printing one more version, just proceed to the My Forms portion and then click around the form you need.

Obtain access to the New Hampshire Sample Letter for Deed of Trust with US Legal Forms, probably the most comprehensive collection of lawful record layouts. Use 1000s of specialist and status-distinct layouts that satisfy your organization or personal needs and needs.

Form popularity

FAQ

Unlike other states, a New Hampshire deed needn't specify the purchase price, but must include the names of the grantor and grantee, the grantee's mailing address, a description of the land or interest being conveyed, and the grantor's notarized signature.

The Deed is a recorded document memorializing the transfer of property from the Grantor to the Grantee. The Note is an unrecorded paper that binds an individual who has assumed debt through a promise-to-pay instrument.

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

If you would like a copy of your deed, you can obtain it yourself for nominal cost and time, or contact your county's Register of Deeds, who would be glad to assist you. ? website at .doj.nh.gov/consumer.

Deeds of Trust work in a simple manner: a lender gives money to a borrower for a home purchase. In exchange, the lender receives a promissory note that guarantees the borrower will repay the loan amount. A Trustee holds the title during the loan period.

The only way to change, add or remove a name on a deed is to have a new deed drawn up. Once a document is recorded, it can not be changed. To show any change in ownership of property, you need to have a new deed drawn up.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.