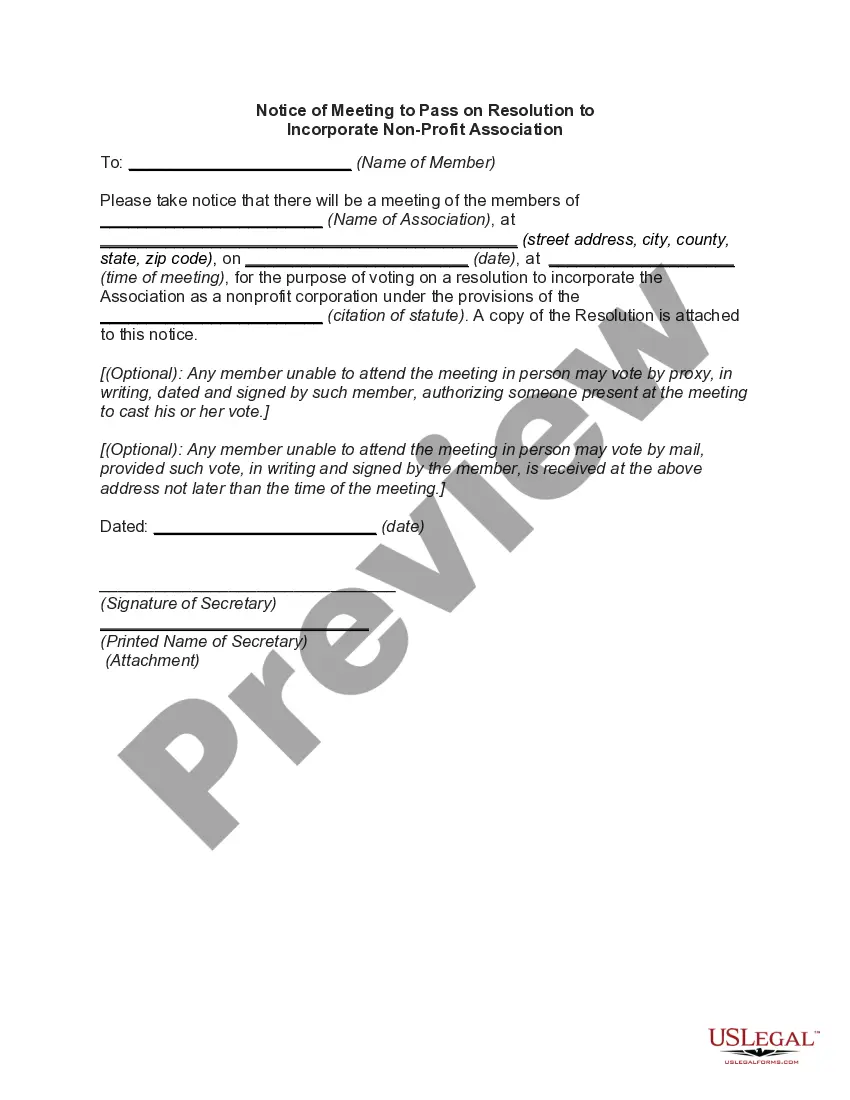

New Hampshire Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association

Description

How to fill out Notice Of Meeting To Pass On Resolution To Incorporate Non-Profit Association?

Locating the appropriate legitimate documents template can be challenging. It's clear there are numerous templates available online, but how do you find the authentic document you need? Utilize the US Legal Forms website. The service provides a wide array of templates, including the New Hampshire Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association, which can serve both business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already a member, Log In to your account and select the Acquire option to locate the New Hampshire Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association. Use your account to navigate through the legal forms you may have previously purchased. Visit the My documents section of your account to obtain another copy of the documents you need.

If you are a new user of US Legal Forms, here are some simple steps you can follow: First, ensure you have selected the correct form for your city/county. You can review the form using the Review option and read the form description to confirm it is suitable for you. If the document does not meet your requirements, use the Search feature to find the appropriate form. Once you are confident the form is suitable, click on the Acquire now button to obtain the document. Select the payment plan you prefer and provide the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Finally, fill out, edit, print, and sign the acquired New Hampshire Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association.

US Legal Forms is the largest collection of legal documents where you can find various paper templates. Use the service to obtain properly designed paperwork that complies with state regulations.

Form popularity

FAQ

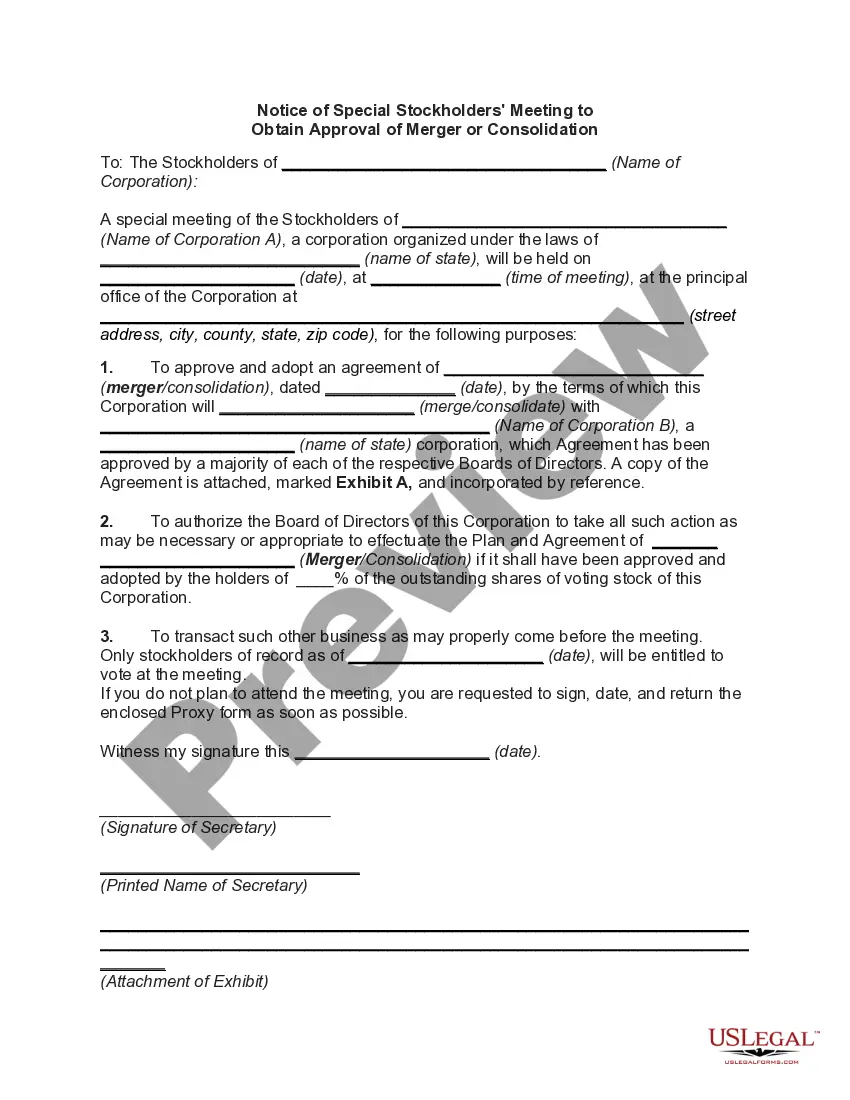

Request a meeting of the board of directors via postal mail or email (again, you will have to refer to your bylaws). The purpose of the meeting, date and time should be listed on the request. The notice must be sent to all directors/shareholders entitled to vote on the change.

Many governing documents provide that an officer may be removed by a majority vote of the board members, but that an elected board member may only be removed with a vote of the association membership.

If you want to increase the number of board members within the limit set by the bylaws, simply raise the prospect of filling vacant seats at a regular meeting of the board, recruit candidates, vet their credentials, vote on their candidacy and seat the one who gets the most votes of the existing directors.

When you incorporate your organization as a nonprofit corporation and are granted tax exempt status, gifts and donations that are given to your corporation can be deducted from the donors' federal and state income tax returns.

The owners of a corporation are its stockholders, and the owners, at least in theory, can do almost anything they want, including firing members of an incompetent board of directors. There are many obstacles, but it can be and has been done.

Call a special meeting when you want to change the board of directors before the term has ended. Give all shareholders notice of the meeting. The notice must include the place at which the meeting will be held, the time and date of the meeting, and the purpose for which you called the meeting.

The answer is yes - nonprofits can own a for-profit subsidiary or entity. A nonprofit can own a for-profit entity regardless of whether or not it is a corporation or limited liability company, but there are rules pertaining to any money invested by the nonprofit during the start-up process.

Unless otherwise specified in the bylaws, you will need at least a majority vote to remove the president. Record the decision. The board secretary will be responsible for making a record of the decision, including how many members voted in favor of removal. Vote to appoint a new president.

profit organization (NPO) has no legal requirement to incorporate; however, as an unincorporated entity, the organization would have no legal status. An unincorporated NPO is simply a group of people (members) who get together for a common purpose.

Your organizational by-laws should describe a process by which a board member can be removed by vote, if necessary. For example, in some organizations a board member can be removed by a two-thirds vote of the board at a regularly scheduled board meeting.