New Hampshire Sample Letter for Response to Inquiry - Mortgage Company

Description

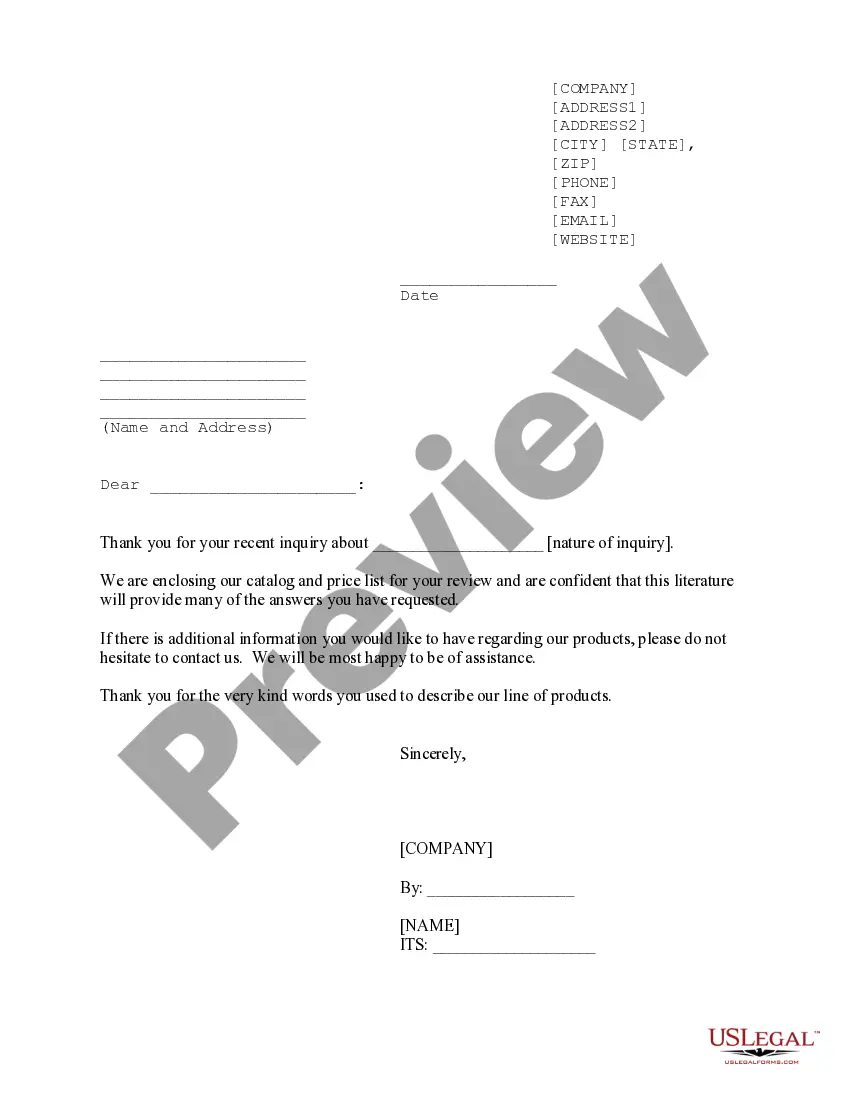

How to fill out Sample Letter For Response To Inquiry - Mortgage Company?

If you wish to complete, download, or print lawful file themes, use US Legal Forms, the largest collection of lawful forms, which can be found on-line. Use the site`s simple and handy lookup to find the documents you will need. Different themes for organization and individual purposes are sorted by groups and states, or keywords. Use US Legal Forms to find the New Hampshire Sample Letter for Response to Inquiry - Mortgage Company in just a handful of clicks.

If you are currently a US Legal Forms customer, log in in your bank account and click the Acquire button to find the New Hampshire Sample Letter for Response to Inquiry - Mortgage Company. You can also gain access to forms you earlier delivered electronically from the My Forms tab of your own bank account.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the form for that appropriate city/country.

- Step 2. Utilize the Review method to examine the form`s articles. Do not forget about to see the information.

- Step 3. If you are not satisfied using the type, make use of the Lookup discipline towards the top of the screen to locate other variations from the lawful type web template.

- Step 4. After you have found the form you will need, go through the Get now button. Select the costs plan you choose and add your credentials to sign up for an bank account.

- Step 5. Procedure the purchase. You may use your charge card or PayPal bank account to finish the purchase.

- Step 6. Pick the file format from the lawful type and download it on the gadget.

- Step 7. Total, edit and print or signal the New Hampshire Sample Letter for Response to Inquiry - Mortgage Company.

Each and every lawful file web template you buy is your own property forever. You may have acces to each and every type you delivered electronically with your acccount. Select the My Forms segment and select a type to print or download yet again.

Remain competitive and download, and print the New Hampshire Sample Letter for Response to Inquiry - Mortgage Company with US Legal Forms. There are thousands of expert and express-particular forms you can utilize for the organization or individual demands.

Form popularity

FAQ

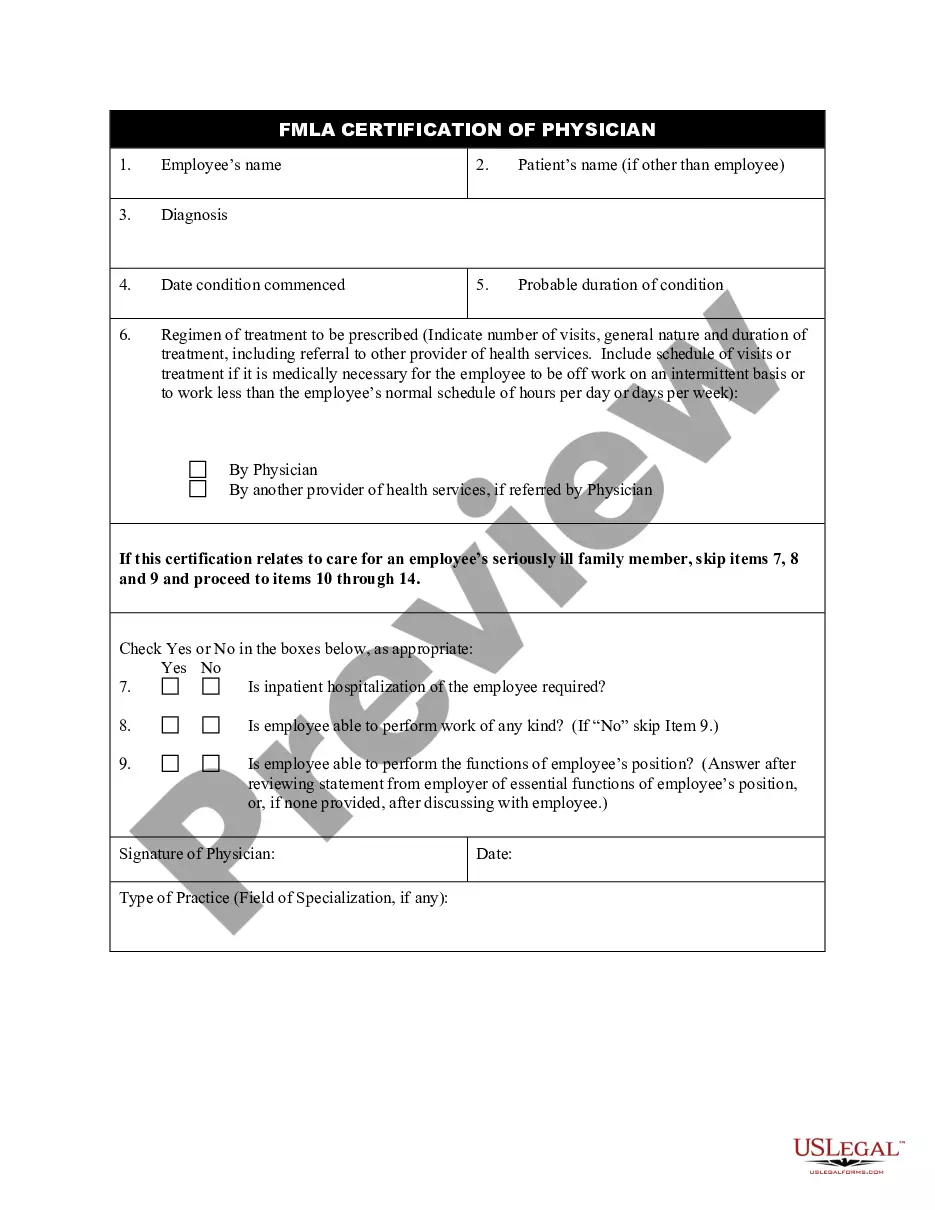

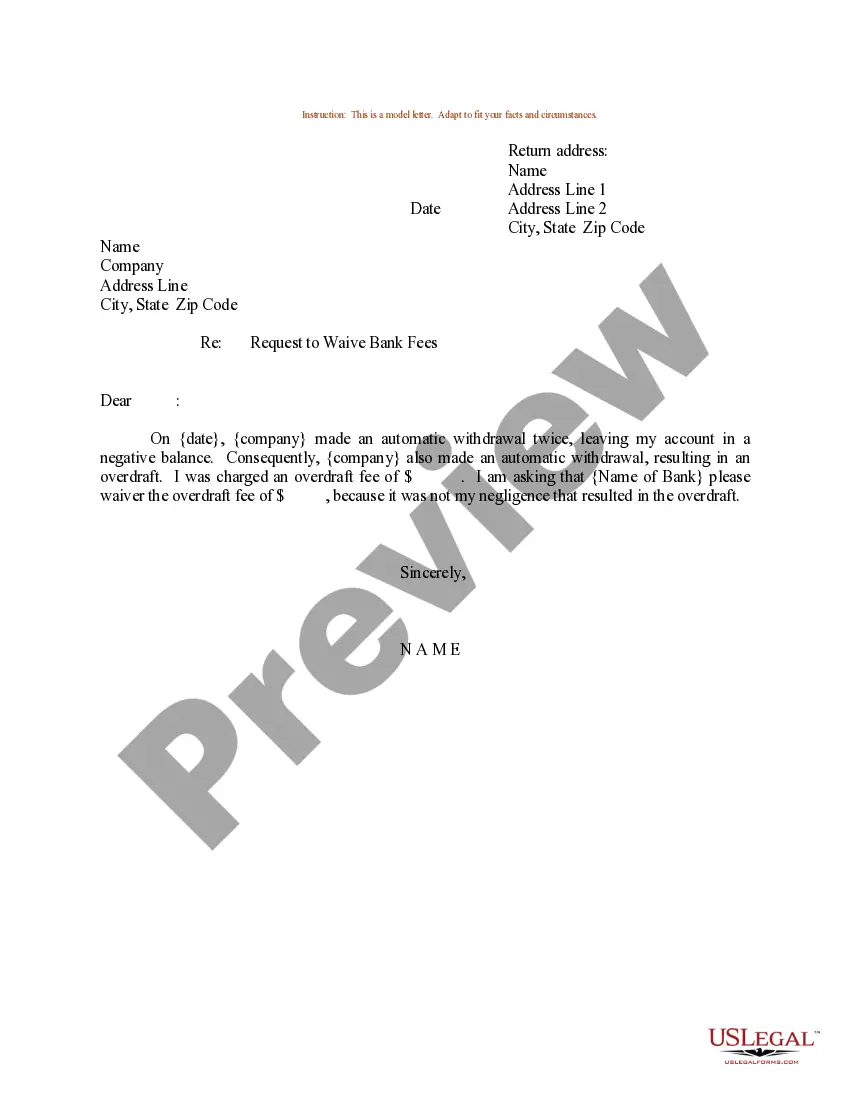

A letter of explanation may provide the extra documentation needed to: Clear up any discrepancies on your credit report, like late payments or cosigned loans. Verify the dates of major credit issues like bankruptcies or foreclosures. Help an underwriter understand how you earn money or why your income changed.

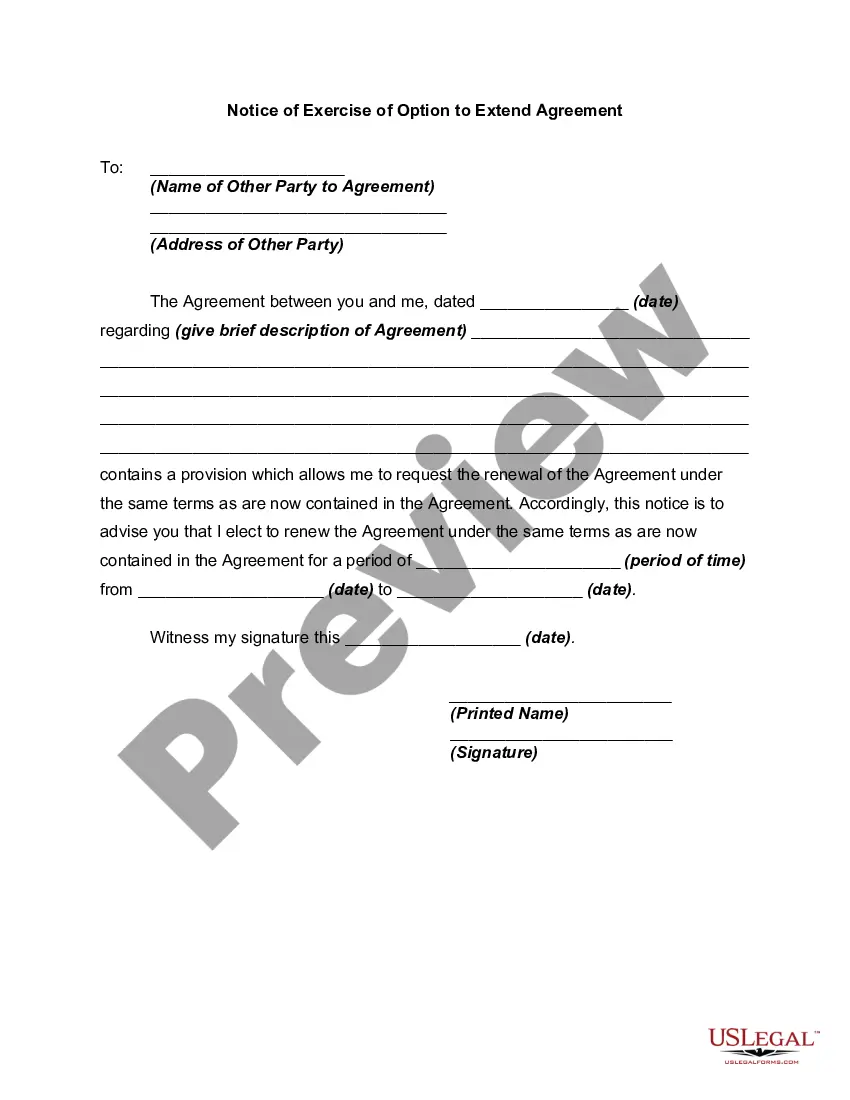

It's best when writing a letter of explanation to make it short and to the point. You'll want it to provide the recipient with the information they need, however. Be clear and offer as much relevant detail as possible since the person reading the letter will need to understand your situation.

The Inquiry letter is used to explain all credit inquiries in the last 120 days. When the lender pulls credit OR when credit is automatically pulled at borrower submission.

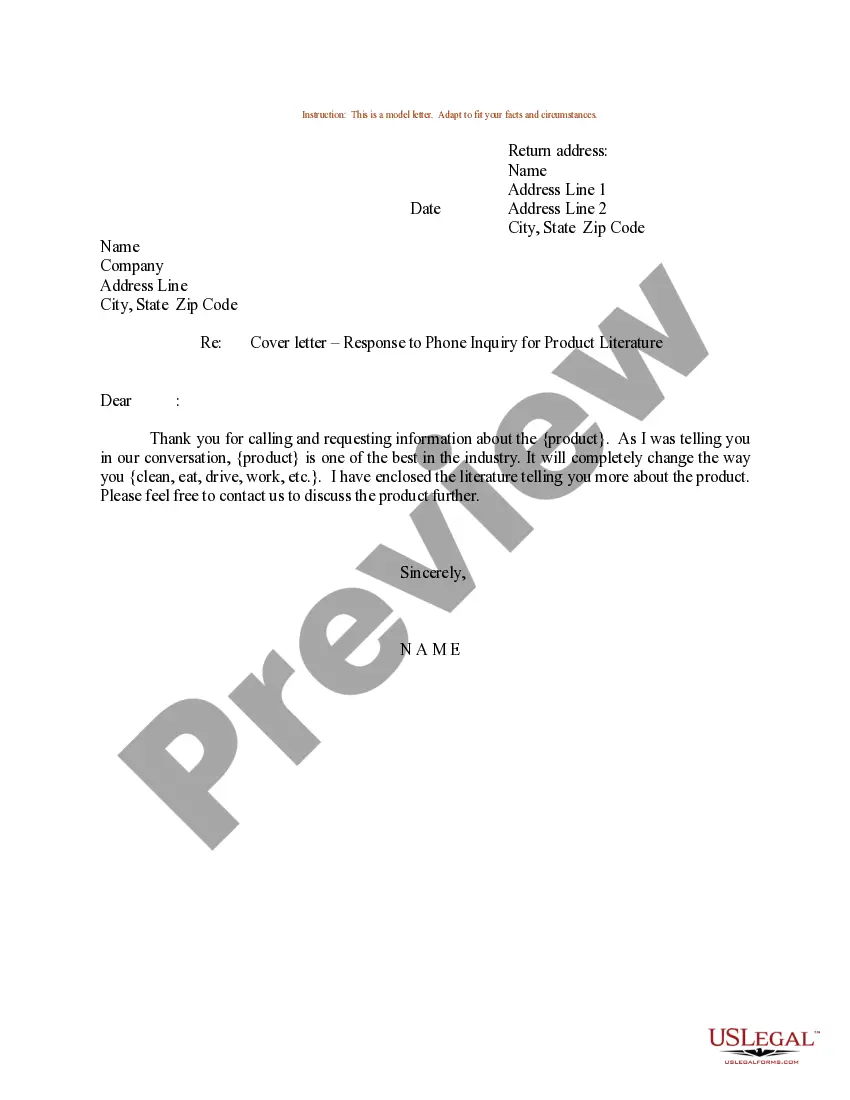

Content of replies: Acknowledging receipt of an enquiry/request. ... Explaining action taken as a consequence of the enquiry. ... Making suggestions / justifying recommendations / pointing out pros and cons / hedging. ... Apologising and rejecting proposals. ... Stipulating action requested or to be taken.

Be clear and offer as much relevant detail as possible since the person reading the letter will need to understand your situation. Still, avoid including unnecessary details or answering questions the underwriter never asked.

There is no specific format as such to the Letter of Explanation. The LoE is a single document which should be short, concise and factual (ideally 1 page, maximum 2 pages) and addresses any issues there may be in your application. LoE is only required to explain something that is not apparent and needs clarification.

How To Write A Hardship Letter: 7 Tips Include Accurate Contact Information. ... Be Personal, But Keep It Semi-Formal. ... Keep The Letter Short And Concise. ... State The Problem. ... Provide Enough Documentation. ... Include An Action Plan. ... Have Your Letter Reviewed Before Sending.

Here are some of the things mortgage experts recommend you include: The date you're writing the letter. The lender's name, mailing address, and phone number. Your full legal name and loan application number. Your explanation, with references to any supporting documents you're including. Your mailing address and phone number.