New Hampshire Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

Description

How to fill out Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

If you need to finalize, acquire, or generate legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search feature to find the documents you require.

Various templates for business and personal use are categorized by type and state, or keywords. Use US Legal Forms to find the New Hampshire Sale of Assets of Corporation without needing to adhere to Bulk Sales Laws with just a few clicks.

Every legal document template you obtain is yours forever. You can access each form you downloaded in your account. Navigate to the My documents section and choose a form to print or download again.

Compete and obtain, and print the New Hampshire Sale of Assets of Corporation without needing to comply with Bulk Sales Laws with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to get the New Hampshire Sale of Assets of Corporation without needing to comply with Bulk Sales Laws.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for your specific city/state.

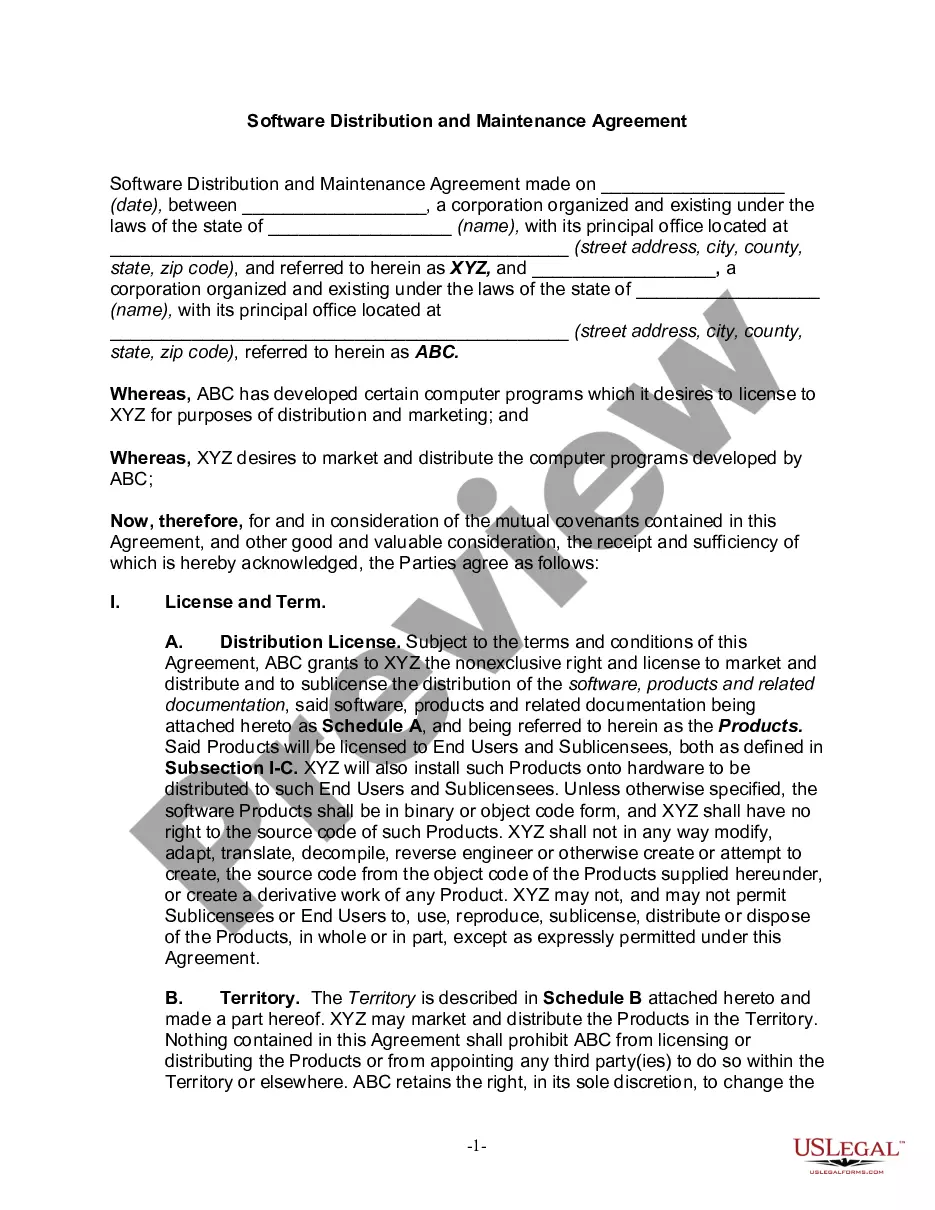

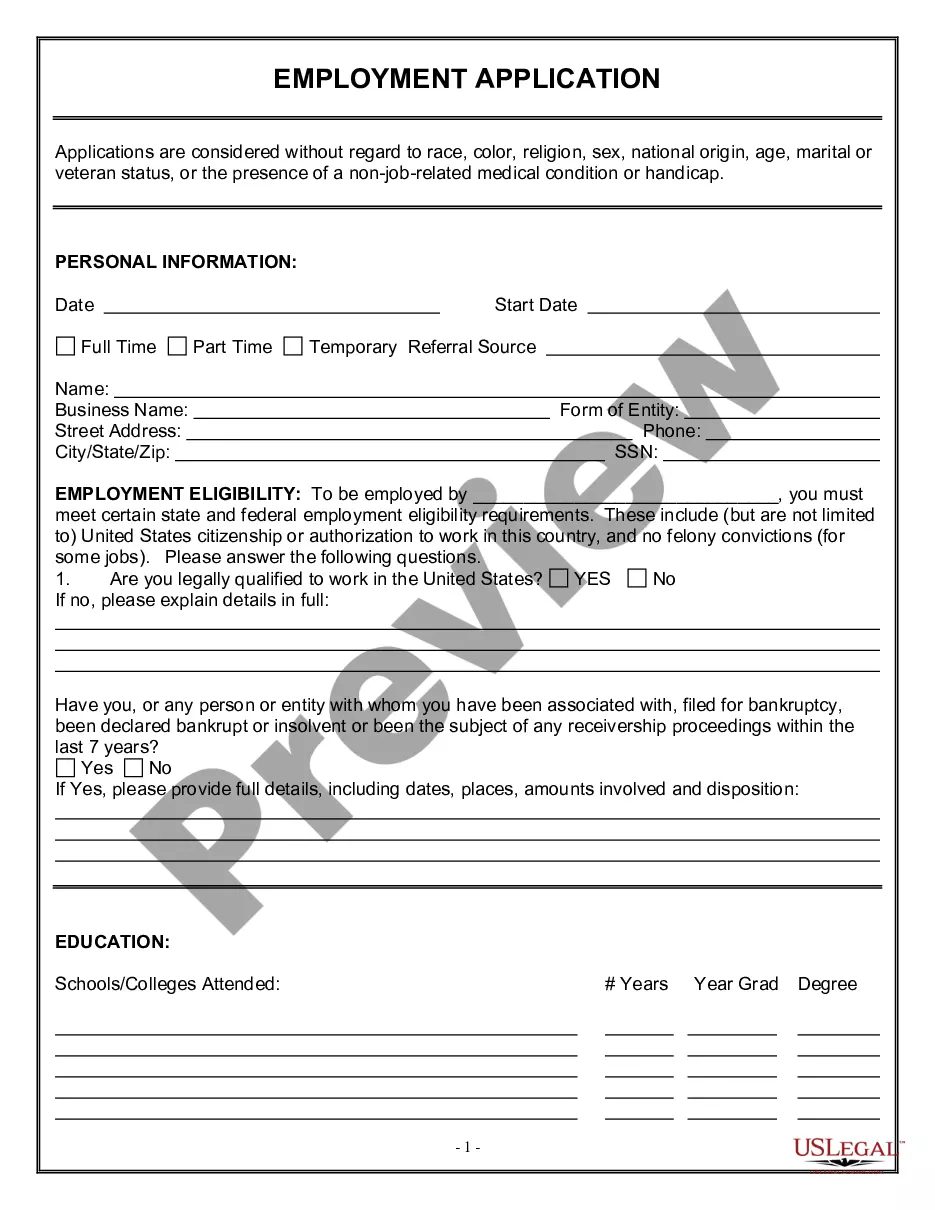

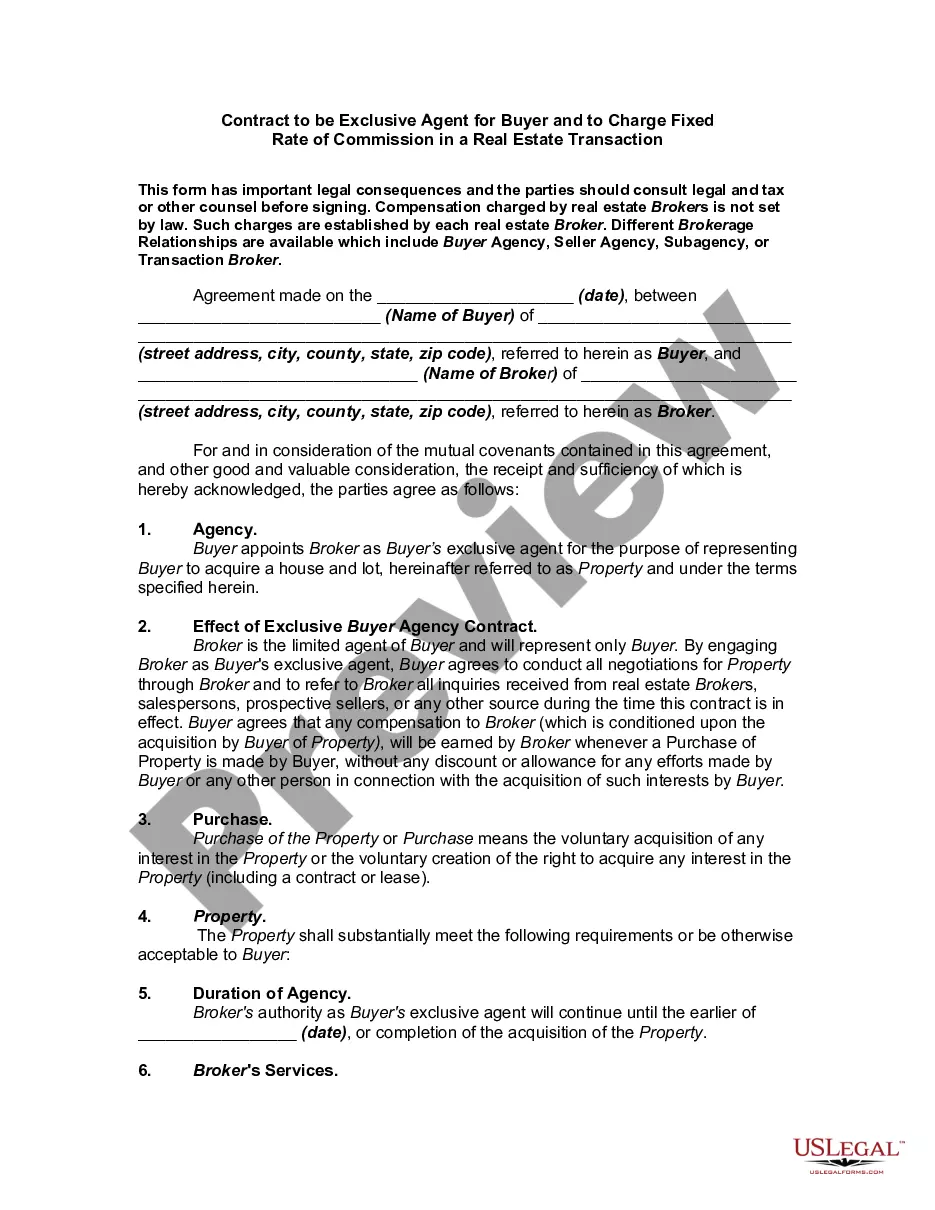

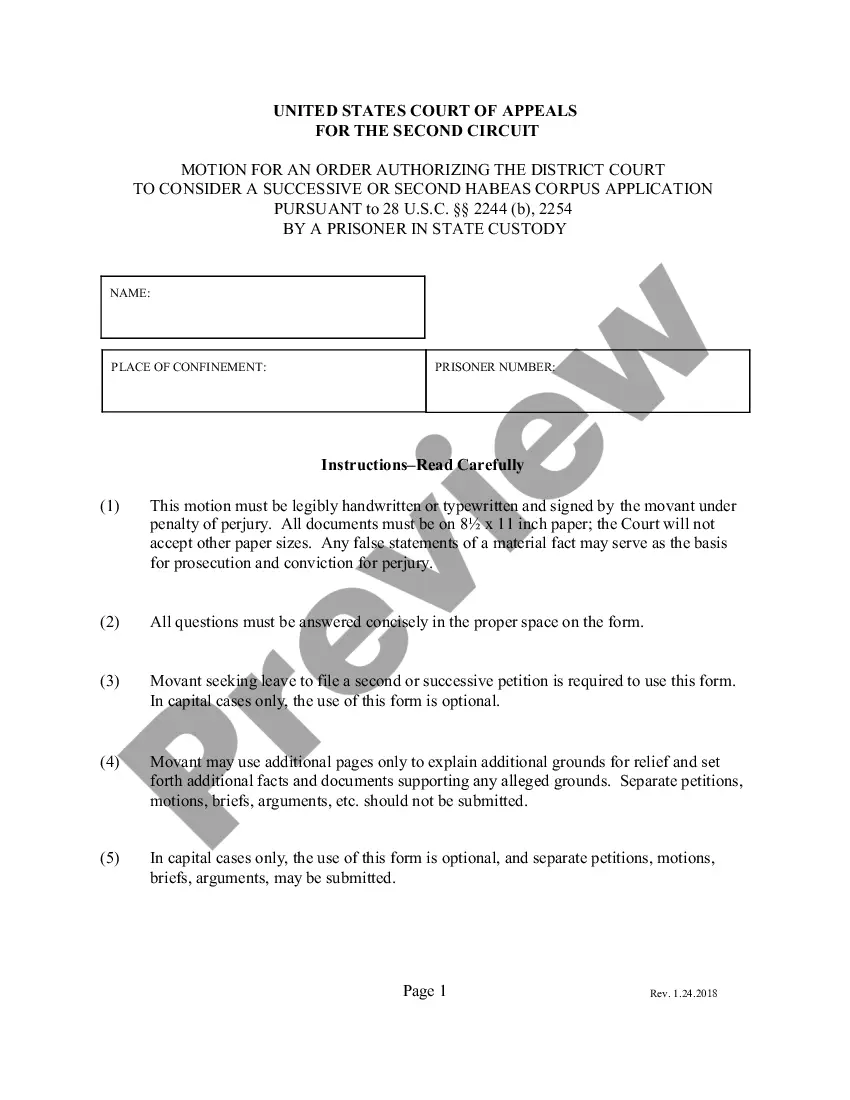

- Step 2. Use the Review option to examine the form's contents. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the payment option you prefer and enter your credentials to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the New Hampshire Sale of Assets of Corporation without needing to comply with Bulk Sales Laws.

Form popularity

FAQ

Yes, the seller must inform all of its creditors about the upcoming bulk transfer. This notification process helps avoid disputes and ensures that creditors can take appropriate actions to protect their interests. In the context of the New Hampshire Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, proper notification is a crucial step to ensure compliance and maintain good relations with creditors.

Yes, when a bulk transfer occurs, the Uniform Commercial Code (UCC) mandates that notice be provided to the buyer's creditors. This notice helps protect the interests of creditors who may be affected by the transaction. Ensuring compliance is essential, especially in a situation involving the New Hampshire Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws.

Typically, the board of directors must approve the sale of all the assets of a corporation. Depending on the total value and impact of the sale, shareholder approval may also be needed. Familiarity with the New Hampshire Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws can clarify these requirements. For assistance, you can leverage platforms like uslegalforms to navigate these legal waters easily and efficiently.

In the context of selling, 'bulk' refers to a large quantity of goods or assets transferred in a single transaction, typically as part of a business sale. When discussing the New Hampshire Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, this means that the significant assets of a corporation can be sold without adhering to bulk sales regulations. Thus, businesses can efficiently transfer ownership without the complex legal requirements imposed by these laws.

Where the statute requires the vendor, transferor, mortgagor or assignor to notify personally or by registered mail every creditor "at least ten days before transferring possession" of any stock of goods, wares, merchandise, provisions or materials, in bulk, it is sufficiently complied with by sending notice by

Related Content. Also known as bulk transfer laws. These are state laws which require, among other things, a buyer to give notice to the seller's creditors if it is acquiring a significant portion of the seller's business or assets.

The key elements of a Bulk Sale are: any sale outside the ordinary course of the Seller's business. of more than half the Seller's inventory and equipment. as measured by the fair market value on the date of the Bulk Sale Agreement (Agreement).

In general, a bulk sale is a sale to a buyer of all or most of the assets of the business outside the ordinary course of business.

Bulk sales legislation was enacted to protect creditors where a sale of assets has the effect of putting the debtor out of business.

A bulk sale, sometimes called a bulk transfer, is when a business sells all or nearly all of its inventory to a single buyer and such a sale is not part of the ordinary course of business.