New Hampshire New Employee Survey

Description

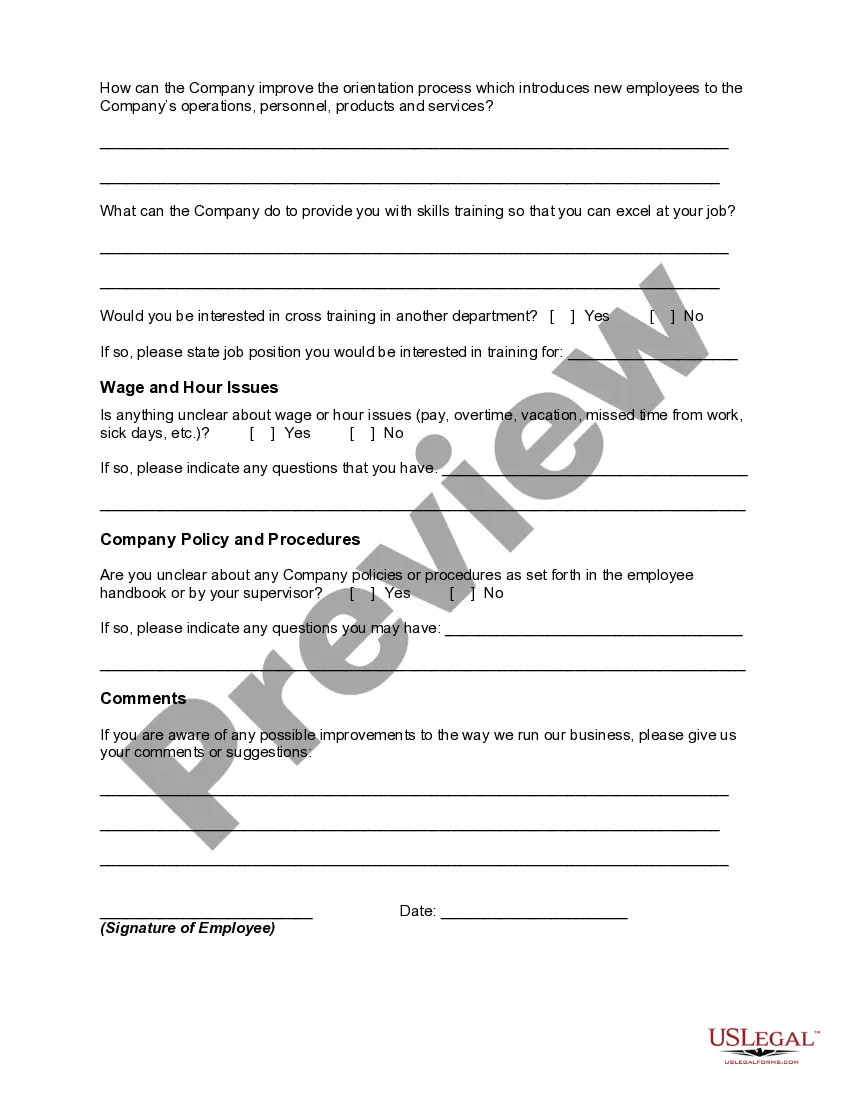

New employee surveys can be done for many purposes. One of them is the new employee orientation survey. This survey is generally done after a few days of orientation to determine any potential issues relating to productivity, turnover, attitudes and other aspects. It would also help the management to understand the productivity of the orientation or training program that the new employee went through in the initial days. The employee's experiences in the early days of employment are also important determinants, since they represent the company's image through the eyes of a new person.

Another kind of new employee survey can be undertaken to know whether the employee has completely understood all the aspects of the new job or not. This can include the job analysis and description, the basics of the job, the most enjoyable and least enjoyable parts of the job, and so on. New employee survey can include information relating to corporate culture, training, supervisor relations, work environment, pay and benefits, communications, feedback, leadership, corporate vision, and overall satisfaction.

How to fill out New Employee Survey?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, categorized by types, states, or keywords.

You can obtain the latest versions of forms such as the New Hampshire New Employee Questionnaire in moments.

If the form doesn’t meet your needs, use the Search box at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose the payment plan you prefer and provide your details to register for an account.

- If you already have a monthly subscription, Log In and download the New Hampshire New Employee Questionnaire from the US Legal Forms collection.

- The Download button will appear on each form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/state. Click on the Preview button to review the form's content.

- Check the form summary to confirm you have picked the right form.

Form popularity

FAQ

The State Unemployment Insurance or SUI tax is funded by employers and offers short-term benefits to employees who have lost or left a job for various reasons.

North Carolina reinstates pre-pandemic work-search requirements for unemployment benefits. A pre-pandemic era work search guideline is being reinstated in an effort to transition North Carolina's unemployed back into the workforce.

New Hampshire is one of four states (New Hampshire, New Jersey, Tennessee and Vermont) that assign SUI tax rates on a fiscal year, rather than a calendar year, basis.

The New Hampshire Department of Employment Security announced that as a result of the state's decreased unemployment insurance (UI) trust fund balance due to COVID-19 UI benefits, employers will see an increase in their state unemployment insurance (SUI) tax rates for second- and third-quarter 2020.

If you have a firm start work date and can provide your NH Works Office with a letter or contact name and phone number that can confirm your start work date, your work search requirement may be waived for up to four (4) weeks.

SUI, which stands for State Unemployment Insurance, is an employer-funded tax that offers short-term benefits to employees who lost their jobs through a layoff or a firing that is not misconduct related. As with many things payroll and taxes, SUI tax rates vary by state, and we have the most current rate ranges below.

As a general matter, you are likely to be eligible for PUA due to concerns about exposure to the coronavirus only if you have been advised by a healthcare provider to self-quarantine as a result of such concerns.

The Employer Status Report must be completed within 30 days of first furnishing employment and can be found on- line at . This is the initial registration form for a state unemployment account number.

New Hampshire's unemployment tax rates for the third quarter of 2021 are unchanged, the state Employment Security department said July 9. Effective from July 1, 2021, to Sept 30, 2021, tax rates for positive-rated employers range from 0.1% to 2.7% and rates for negative-rated employers range from 4.3% to 8.5%.

Steps to Hiring your First Employee in New HampshireStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?14-Apr-2021