This form is a trust used to provide supplemental support for a disabled beneficiary without loss of government benefits. It may be revocable or irrevocable, as the funds are contributed by a third party, and not the beneficiary. The Omnibus Budget Reconciliation Act of 1993 established the supplemental needs trusts.

New Hampshire Supplemental Needs Trust for Third Party - Disabled Beneficiary

Description

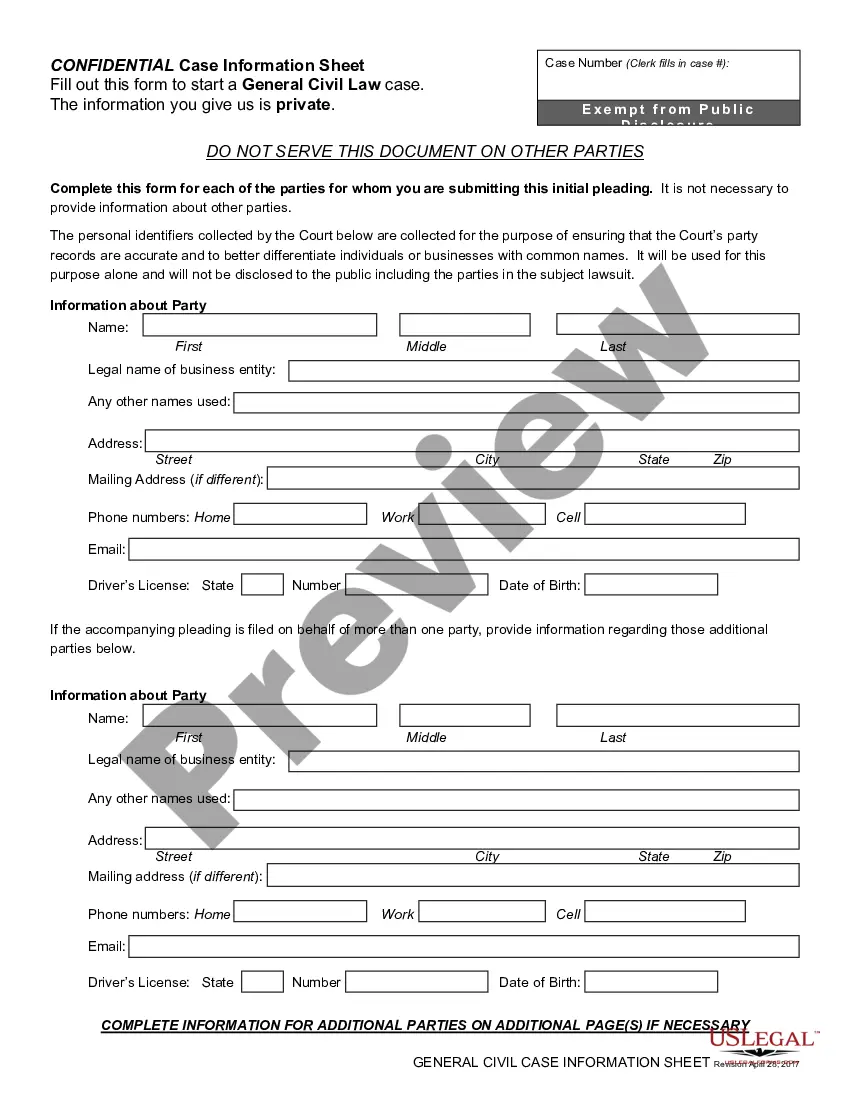

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

Are you currently in a situation where you require documents for either business or personal purposes every single day.

There are numerous legal document templates available online, but locating reliable versions can be challenging.

US Legal Forms provides a wide array of template forms, including the New Hampshire Supplemental Needs Trust for Third Party - Disabled Beneficiary, which can be generated to meet federal and state requirements.

Once you find the appropriate form, click Acquire now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you're already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the New Hampshire Supplemental Needs Trust for Third Party - Disabled Beneficiary template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is relevant to the correct city/state.

- Use the Preview button to review the form.

- Check the information to ensure you have selected the correct document.

- If the form does not meet your requirements, utilize the Lookup section to find the document that suits your needs.

Form popularity

FAQ

One notable disadvantage of a third-party special needs trust is the inflexibility in distributing funds. When establishing a New Hampshire Supplemental Needs Trust for Third Party - Disabled Beneficiary, the trust must follow specific guidelines regarding distributions to maintain the beneficiary's eligibility for government benefits. Additionally, if the trust is not properly structured, it might lead to unplanned tax implications or diminished funds for the beneficiary's needs. Always consider consulting with a professional to effectively manage these potential pitfalls.

party special needs trust operates by allowing family members or friends to provide financial support to a disabled individual without affecting their eligibility for government benefits. With the New Hampshire Supplemental Needs Trust for Third Party Disabled Beneficiary, the funds can be used for various purposes, such as medical expenses or qualityoflife enhancements. Proper establishment and management of the trust ensure that the beneficiary can enjoy additional resources while maintaining their benefits.

Typically, the grantor or third party who establishes the special needs trust is responsible for paying taxes on the income earned within the New Hampshire Supplemental Needs Trust for Third Party - Disabled Beneficiary. However, if the trust generates taxable income, the trust may also be required to file its tax return. Understanding these tax implications is essential for effective financial planning.

The beneficiary of a supplemental needs trust is usually the individual with disabilities who may benefit from additional financial resources without jeopardizing their government benefits. In the context of a New Hampshire Supplemental Needs Trust for Third Party - Disabled Beneficiary, this arrangement allows the funds to enhance the beneficiary’s quality of life. It is vital to clearly define the beneficiary's needs when creating the trust to ensure it serves its intended purpose.

Setting up a trust fund for a disabled person typically involves several essential steps. First, consult a qualified attorney who specializes in the New Hampshire Supplemental Needs Trust for Third Party - Disabled Beneficiary to ensure compliance with state laws. Next, identify the trust's purpose, select a trustee, and outline how funds will be managed. This tailored approach helps secure financial stability for the disabled individual.

While a special needs trust, like the New Hampshire Supplemental Needs Trust for Third Party - Disabled Beneficiary, offers significant benefits, it also has potential downsides. Managing the trust involves ongoing oversight and may incur legal fees. Additionally, beneficiaries must navigate restrictions regarding how funds can be used to avoid losing government benefits. It is crucial to understand these complications before establishing a trust.

The best place for a person on disability to live often depends on their specific needs and preferences. In New Hampshire, areas with access to healthcare, community services, and support networks are valuable. Many individuals find comfort in communities that prioritize accessibility and inclusivity. Exploring locations with a strong support system can enhance quality of life for those utilizing New Hampshire Supplemental Needs Trust for Third Party - Disabled Beneficiary.

A supplemental needs trust can qualify as a qualified disability trust, but not all trusts do. A New Hampshire Supplemental Needs Trust for Third Party - Disabled Beneficiary is designed to provide additional benefits without interfering with government assistance. To determine qualification, it's essential to understand the specific provisions and regulations surrounding these trusts, and platforms like USLegalForms provide valuable resources for this clarity.

Setting up a trust for a disabled person involves several steps, including deciding on the type of trust, drafting the trust documents, and appointing a trustee. A New Hampshire Supplemental Needs Trust for Third Party - Disabled Beneficiary should be meticulously structured to meet the specific needs of the individual. Utilizing a platform like USLegalForms can simplify this process, offering templates and guidance to ensure that the trust operates as intended.

There is no strict maximum amount that you can place in a New Hampshire Supplemental Needs Trust for Third Party - Disabled Beneficiary. However, contributions must be made with careful planning to ensure compliance with government regulations and to preserve the disabled beneficiary’s eligibility for means-tested benefits. Consulting with legal professionals or platforms like USLegalForms can help you navigate these complexities.