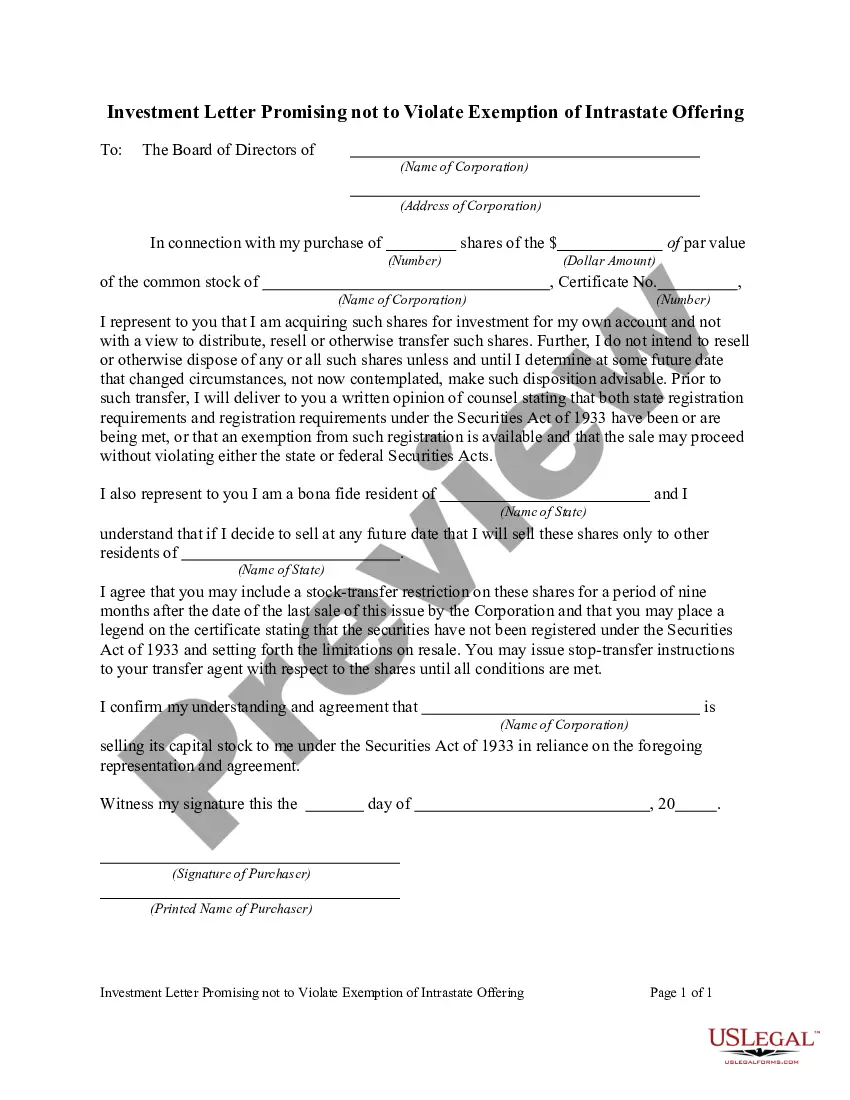

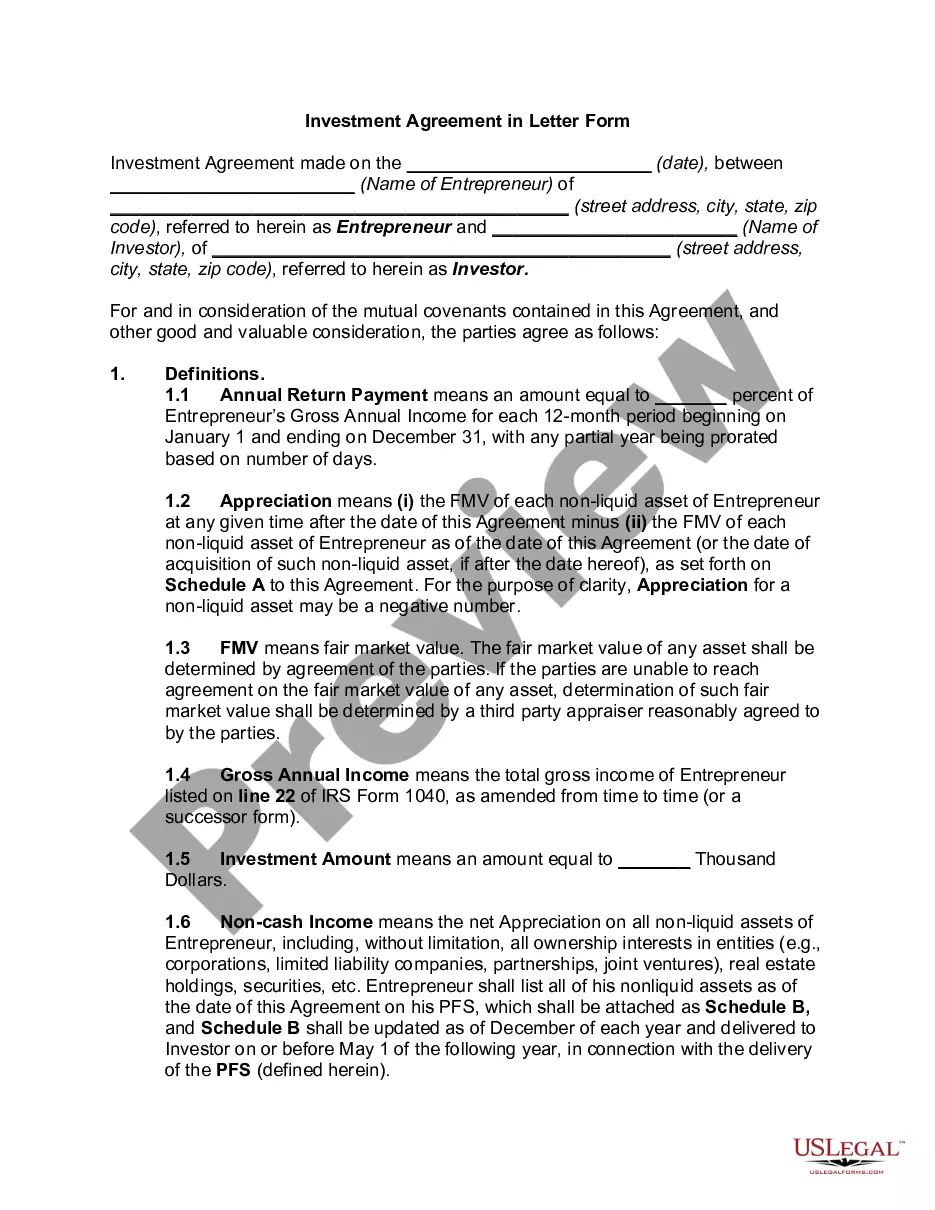

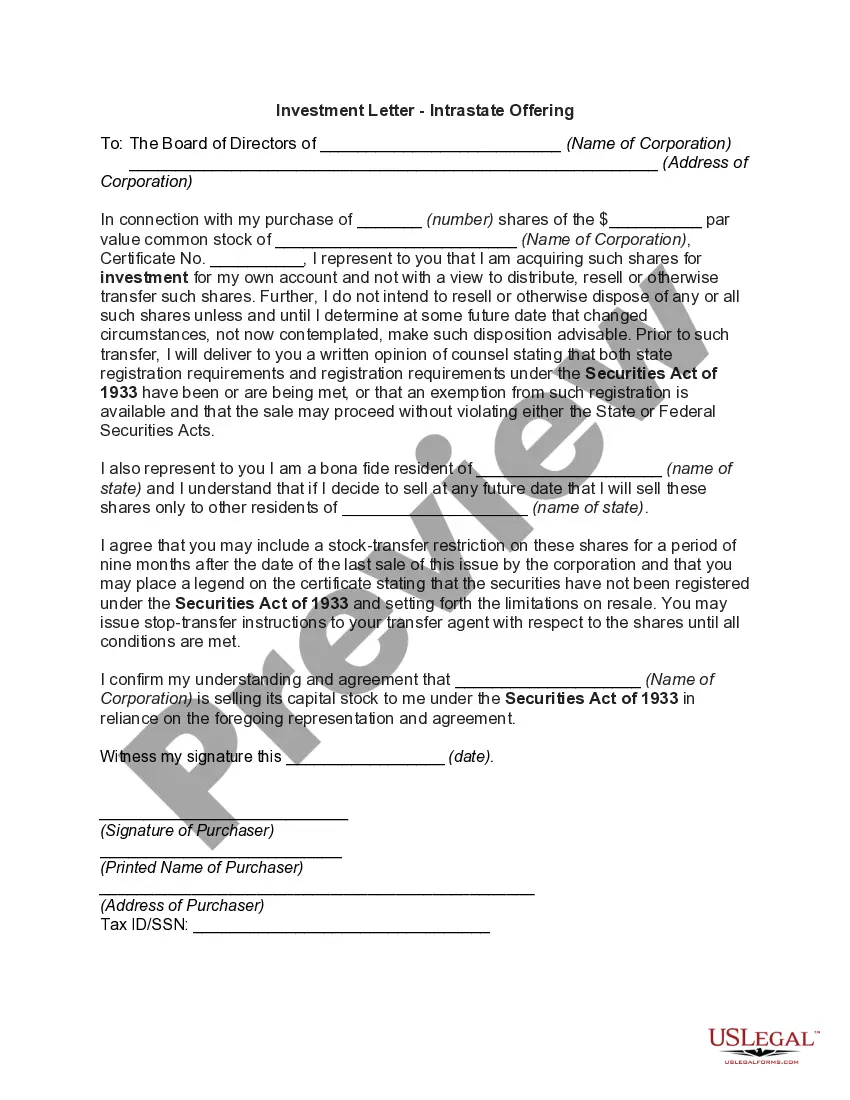

New Hampshire Investment Letter regarding Intrastate Offering

Description

How to fill out Investment Letter Regarding Intrastate Offering?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By utilizing the website, you will access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the New Hampshire Investment Letter for Intrastate Offering in just a few moments.

If you already have a subscription, Log In to download the New Hampshire Investment Letter for Intrastate Offering from the US Legal Forms library. The Acquire button will be visible on every form you review. You will also find all previously downloaded forms under the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded New Hampshire Investment Letter for Intrastate Offering. Every template you add to your account has no expiration date and belongs to you permanently. Therefore, if you want to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the New Hampshire Investment Letter for Intrastate Offering through US Legal Forms, which is one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/county.

- Click the Review button to check the form's contents.

- Examine the form information to ensure you have chosen the correct document.

- If the form does not meet your requirements, use the Search field at the top of the page to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Next, select the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

Establishing residency in New Hampshire involves living in the state and planning to make it your primary home. You should obtain a New Hampshire driver's license, register to vote, and file your taxes in the state. Residency is often a critical aspect for obtaining a New Hampshire Investment Letter regarding Intrastate Offering, as it may demonstrate your commitment to local business operations.

Your LLC may not be in good standing in New Hampshire due to various reasons, such as failing to file annual reports or not paying state fees. It's crucial to address these issues promptly, as they can impact your ability to obtain a New Hampshire Investment Letter regarding Intrastate Offering. Make sure to check your LLC status regularly and rectify any discrepancies to maintain compliance.

Yes, New Hampshire does tax rental income, categorizing it as part of your gross income. It's important to track any income generated from rental properties for accurate tax reporting. To better manage your investments and clarify potential tax impacts, a New Hampshire Investment Letter regarding Intrastate Offering can guide your decisions.

No, New Hampshire does not tax capital gains, allowing investors to benefit from profits generated during the sale of assets. This favorable approach can enhance your investment returns. For detailed investment considerations and assistance, obtaining a New Hampshire Investment Letter regarding Intrastate Offering can be invaluable.

In New Hampshire, taxable income includes wages, interest, dividends, and certain business profits. Income generated from capital gains is not subject to state income tax. Leveraging a comprehensive New Hampshire Investment Letter regarding Intrastate Offering can provide you with crucial insights into your tax obligations and investment potential.

Yes, New Hampshire taxes certain types of investment income, particularly interest and dividends. However, investment income from capital gains is not taxed in the state. Understanding these tax implications is essential, and a New Hampshire Investment Letter regarding Intrastate Offering can help you navigate your investment strategy effectively.

New Hampshire is not phasing out its interest and dividend tax at this time. The state still levies a tax on interest and dividend income, which can affect your overall investment earnings. For detailed guidance, consider obtaining a New Hampshire Investment Letter regarding Intrastate Offering from a trusted source, which can provide clarity on your investment obligations.

In New Hampshire, capital gains are not taxed at the state level, so residents do not need to worry about state capital gains tax. However, federal tax obligations may still apply. To maximize your investment returns while minimizing tax impacts, consider reviewing the New Hampshire Investment Letter regarding Intrastate Offering for insights and strategies.

While some officials have proposed plans to move towards a no income tax model in New Hampshire, concrete changes are still under discussion. It's important to keep an eye on legislative updates regarding tax policies. Utilizing resources like the New Hampshire Investment Letter regarding Intrastate Offering can both inform your decisions and help navigate changes effectively.

Yes, if you earn interest or dividends that exceed the required threshold, you must file a New Hampshire tax return. Even if your earnings are below the limit, filing may still be beneficial. The New Hampshire Investment Letter regarding Intrastate Offering can assist you in understanding your filing responsibilities and optimizing your tax strategy.