New Hampshire Rental Application for Landlords

Description

How to fill out Rental Application For Landlords?

If you need to finish, obtain, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Make use of the site's straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are organized by categories and suggestions, or keywords.

Step 4. After locating the form you need, click the Purchase now button. Choose the payment method you prefer and provide your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the New Hampshire Rental Application for Landlords in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to retrieve the New Hampshire Rental Application for Landlords.

- You can also access forms you previously acquired through the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/region.

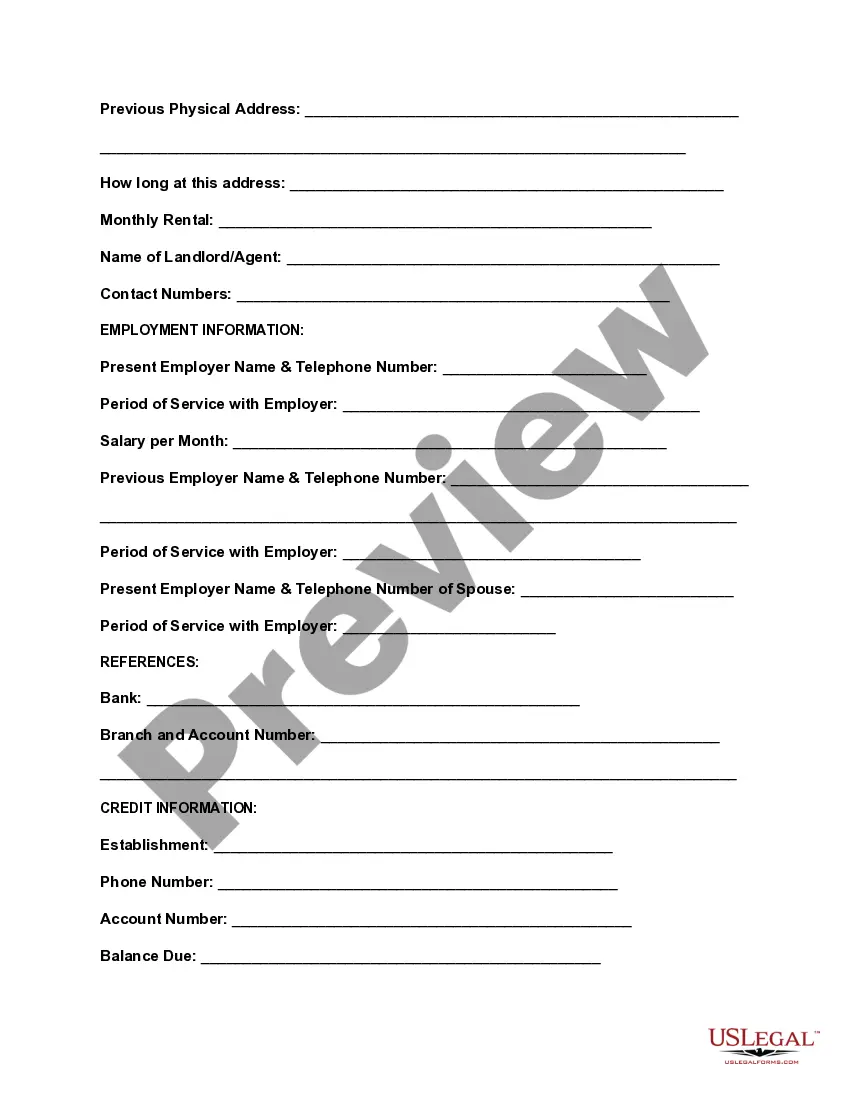

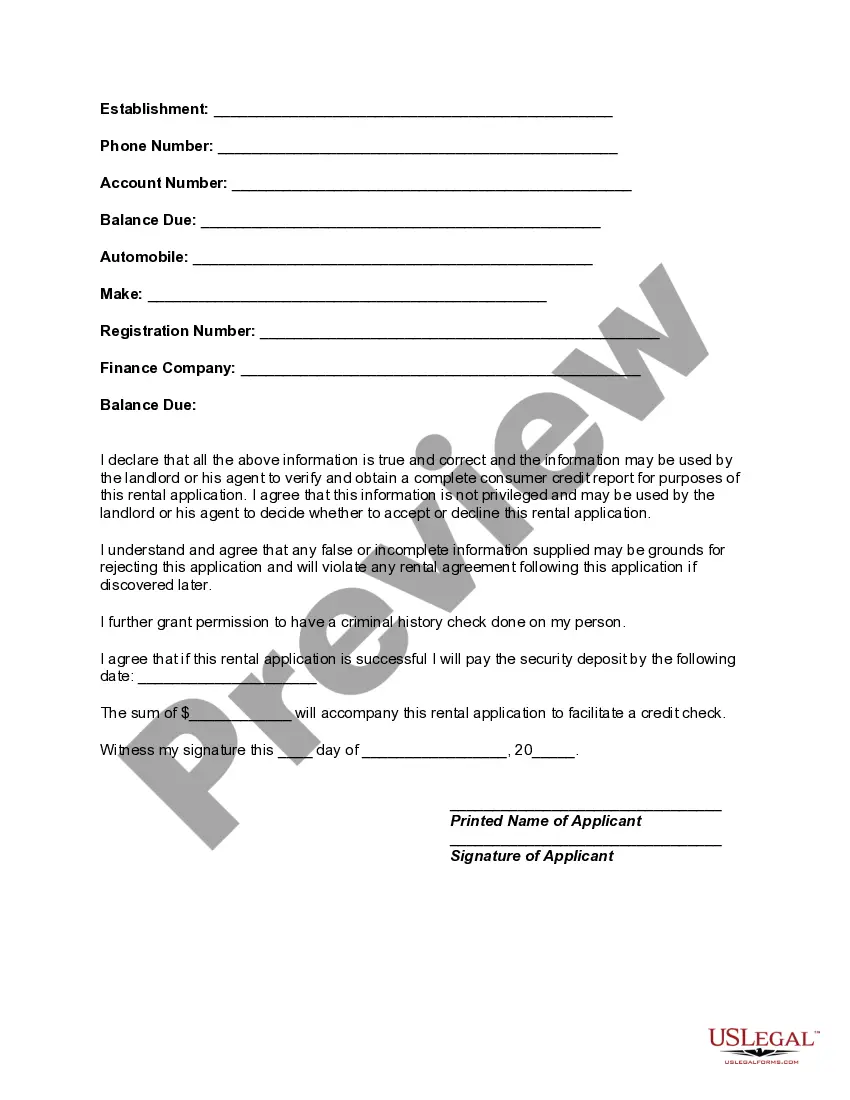

- Step 2. Use the Preview option to review the form's content. Don't forget to read the information carefully.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

While some may find it challenging to get approved for a rental, it primarily depends on the elements of the New Hampshire Rental Application for Landlords they submit. Factors like credit score and rental history play critical roles in the approval process. Being prepared and presenting your financial situation clearly can enhance your prospects. Therefore, it doesn't have to be hard if you approach it systematically.

To comfortably afford $1500 in rent, a general rule is that your monthly income should be at least three times that amount. This means you would need a monthly salary of about $4500 or an annual income of around $54,000. Using the New Hampshire Rental Application for Landlords can streamline this process by clearly showing income and employment details. Ultimately, ensuring your salary aligns with your rental choice can ease your application experience.

Rental applications can get denied for several reasons, including low credit scores or insufficient income. The failure rate often varies by region and situation. With a thorough New Hampshire Rental Application for Landlords that adheres to local laws, landlords can minimize biases and make informed decisions. Thus, applicants should be aware of their financials before applying.

Getting approved for a rental hinges on various factors such as credit score, income, and rental history. While the New Hampshire Rental Application for Landlords gathers critical information, it’s important to ensure all documentation is accurate and complete. Many applicants may not realize that providing a co-signer or extra documentation can strengthen their chances. Thus, it's not necessarily hard, but preparation makes a difference.

When using a New Hampshire Rental Application for Landlords, a common guideline is to require a credit score of at least 620. This score indicates a reasonable level of creditworthiness, helping you assess a tenant's reliability. However, factors such as rental history and income should also be considered. Ultimately, it's about finding tenants who will meet their obligations consistently.

In New Hampshire, there isn’t a specified maximum percentage for rent increases, which means landlords can set their own rates within reason. Fairness and communication are essential in maintaining a good relationship with tenants. A New Hampshire Rental Application for Landlords is an excellent resource for documenting rental agreements clearly, thus helping to manage expectations regarding rent increases.

While there's no maximum limit for rent increases in New Hampshire, landlords should consider local market conditions and fair housing regulations. It’s advisable for landlords to establish reasonable increases that reflect property improvements or market trends. Implementing a New Hampshire Rental Application for Landlords can help justify these increases and provide a structured approach.

Yes, many consider New Hampshire to be a landlord-friendly state due to its relatively minimal regulations regarding rental properties. Landlords have considerable autonomy in managing their properties and setting rental terms. For landlords navigating the rental landscape, a New Hampshire Rental Application for Landlords can provide clarity and ensure legal compliance.

In New Hampshire, there’s no statewide cap on rent increases, allowing landlords to adjust rent as they see fit, provided they give proper notice to tenants. Typically, a 30-day notice is required for lease agreements, making it crucial for landlords to maintain clear communication. Utilizing a New Hampshire Rental Application for Landlords streamlines this process, ensuring everyone is on the same page.

In New Hampshire, landlords have the authority to raise rent, but there is no specific limit set by law. Instead, the increase often depends on the rental agreement and the market rate for similar properties in the area. To ensure compliance with local laws, it's beneficial for landlords to use a New Hampshire Rental Application for Landlords, which can help clarify terms and conditions.