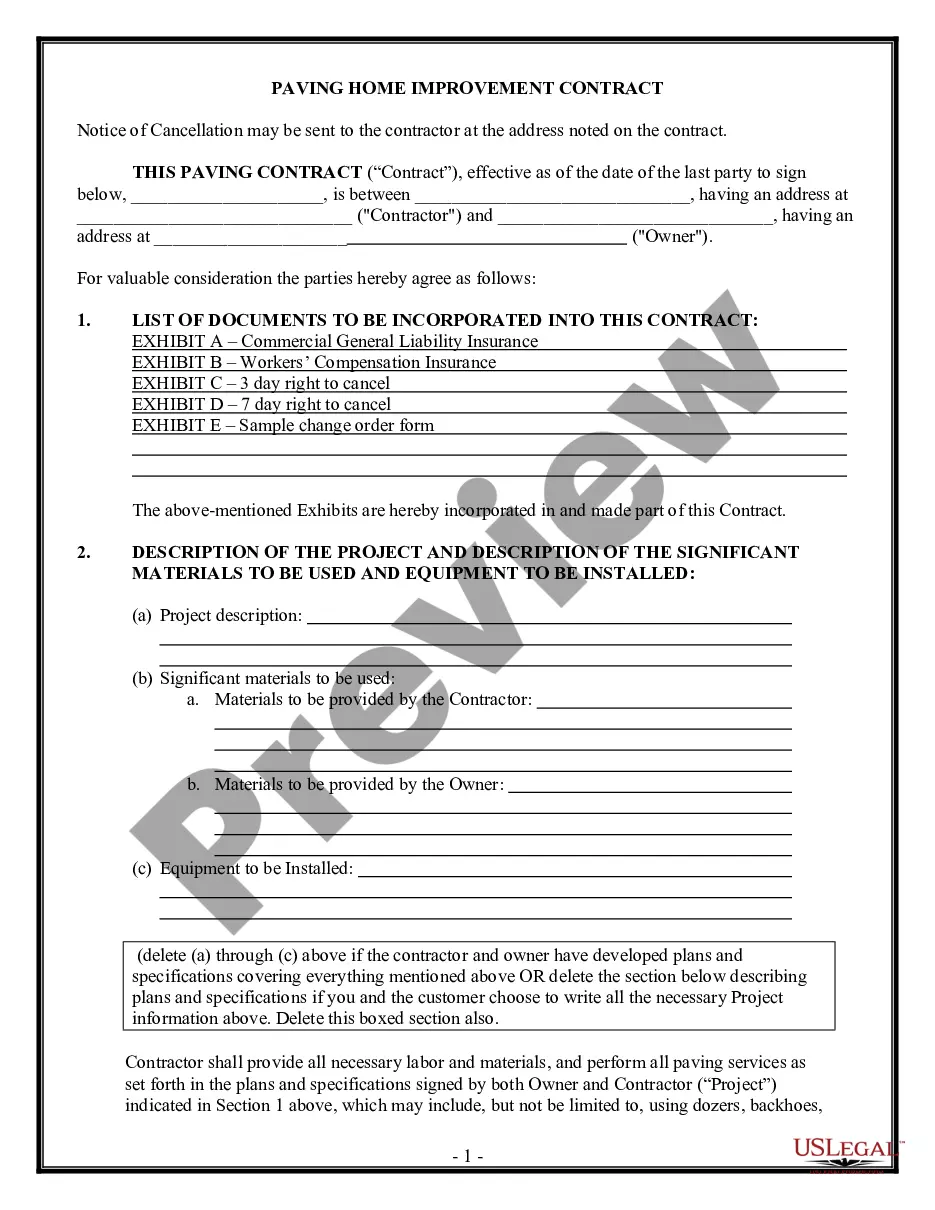

New Hampshire Sample Letter to Include Article Relating to Tax Sales

Description

How to fill out Sample Letter To Include Article Relating To Tax Sales?

You can invest hrs on the web attempting to find the lawful document design that fits the state and federal requirements you require. US Legal Forms supplies a large number of lawful types which are evaluated by specialists. You can actually acquire or printing the New Hampshire Sample Letter to Include Article Relating to Tax Sales from my support.

If you have a US Legal Forms accounts, you can log in and click the Down load switch. Next, you can complete, change, printing, or signal the New Hampshire Sample Letter to Include Article Relating to Tax Sales. Every lawful document design you acquire is the one you have permanently. To get an additional duplicate of the obtained kind, visit the My Forms tab and click the related switch.

Should you use the US Legal Forms site for the first time, adhere to the basic directions listed below:

- First, make certain you have chosen the right document design for your state/metropolis of your choice. Look at the kind explanation to make sure you have picked the right kind. If accessible, take advantage of the Review switch to search with the document design at the same time.

- If you would like discover an additional variation from the kind, take advantage of the Search discipline to find the design that meets your needs and requirements.

- Upon having identified the design you need, simply click Purchase now to move forward.

- Select the pricing prepare you need, enter your qualifications, and register for a merchant account on US Legal Forms.

- Complete the purchase. You may use your charge card or PayPal accounts to purchase the lawful kind.

- Select the file format from the document and acquire it to your device.

- Make adjustments to your document if required. You can complete, change and signal and printing New Hampshire Sample Letter to Include Article Relating to Tax Sales.

Down load and printing a large number of document layouts using the US Legal Forms Internet site, which provides the largest selection of lawful types. Use expert and state-certain layouts to take on your small business or specific demands.

Form popularity

FAQ

At the sale, the home is sold for the percentage of the common and undivided interest that a bidder is willing to offer for the amount of the unpaid tax, interest, and costs due thereon. (N.H. Rev. Stat.

New Hampshire has no income or sales tax, and therefore relies very heavily on property taxes. If both state and local revenues are taken into account, property taxes make up 64.7% of money raised by the government. That's the highest reliance on property taxes in the U.S.

Applicant must be 65 years old before April 1 of the tax year for which the application is being made. You must have resided in New Hampshire for at least three (3) years and owned your home individually or jointly prior to April 1st of the tax year for which you are applying.

Which NH towns have the lowest property taxes? Windsor ($3.39) New Castle ($4.48) Moultonborough ($4.78) Bartlett ($4.97) Tuftonboro ($6.44)

Located in western New Hampshire, Sullivan County has the highest property tax rates in the state. The county's average effective property tax rate is 2.78%. In Claremont, which is the largest city in the county, the total rate is 40.98 mills.

Does New Hampshire have a sales tax? No, there is no general sales tax on goods purchased in New Hampshire.

New Hampshire also has a 7.50 percent corporate income tax rate. New Hampshire does not have a state sales tax and does not levy local sales taxes. New Hampshire's tax system ranks 6th overall on our 2023 State Business Tax Climate Index.