New Hampshire Sample Letter regarding Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate

Description

How to fill out Sample Letter Regarding Discharge Of Debtor And Order Approving Trustee's Report Of No Distribution And Closing Estate?

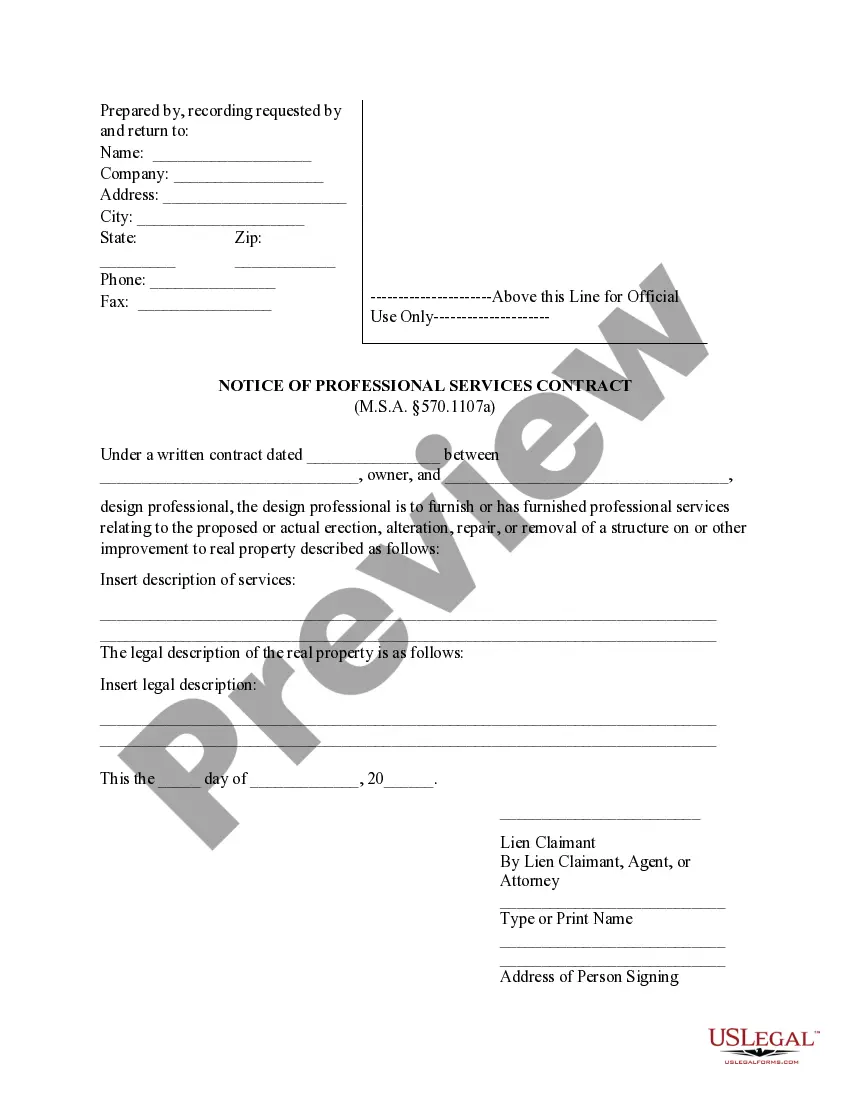

Are you presently within a position the place you need to have files for either organization or specific uses virtually every day? There are a variety of lawful document templates available on the Internet, but finding types you can trust is not effortless. US Legal Forms gives a large number of develop templates, like the New Hampshire Sample Letter regarding Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate, which can be created to meet state and federal needs.

If you are presently knowledgeable about US Legal Forms website and have a free account, just log in. Following that, you are able to obtain the New Hampshire Sample Letter regarding Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate web template.

If you do not offer an profile and would like to begin to use US Legal Forms, follow these steps:

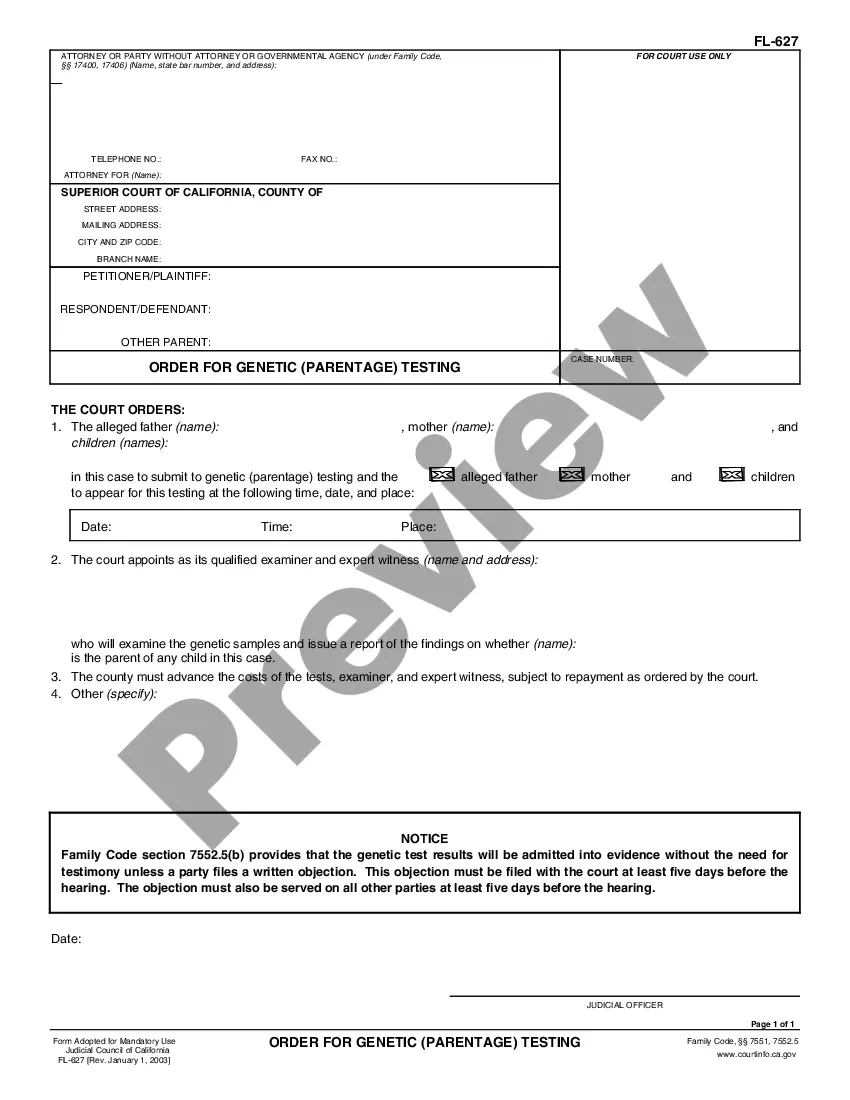

- Find the develop you want and ensure it is for the right town/area.

- Take advantage of the Review button to examine the shape.

- Browse the description to actually have selected the correct develop.

- In case the develop is not what you`re seeking, utilize the Lookup field to obtain the develop that meets your requirements and needs.

- Whenever you get the right develop, click Buy now.

- Pick the pricing prepare you need, complete the necessary info to create your money, and purchase the order using your PayPal or credit card.

- Select a hassle-free document formatting and obtain your copy.

Discover all of the document templates you may have bought in the My Forms menu. You can aquire a further copy of New Hampshire Sample Letter regarding Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate any time, if necessary. Just click on the required develop to obtain or produce the document web template.

Use US Legal Forms, by far the most substantial collection of lawful kinds, to save lots of some time and stay away from blunders. The support gives expertly made lawful document templates which can be used for a variety of uses. Produce a free account on US Legal Forms and begin creating your life a little easier.

Form popularity

FAQ

Debt discharge is the cancellation of a debt due to bankruptcy. When a debt is discharged, the debtor is no longer liable for the debt and the lender is no longer allowed to make attempts to collect the debt. Debt discharge can result in taxable income to the debtor unless certain IRS conditions are met.

If you fail to take any action to resolve the non-dischargeable debt then the creditor will have a right to seek collection against you including filing a lawsuit in court, garnishment of wages, and levying against a bank account.

Once you're discharged, you're no longer legally responsible for any of the debts that were included in your bankruptcy. Some debts, such as criminal fines, child maintenance arrears or TV Licence non-payment, are not discharged in bankruptcy and won't be written off. You'll need to keep paying these.

Whether the trustee can take money you receive after filing your case depends on whether you were entitled to the money at the time your case was filed and how it was listed on your forms, if at all.

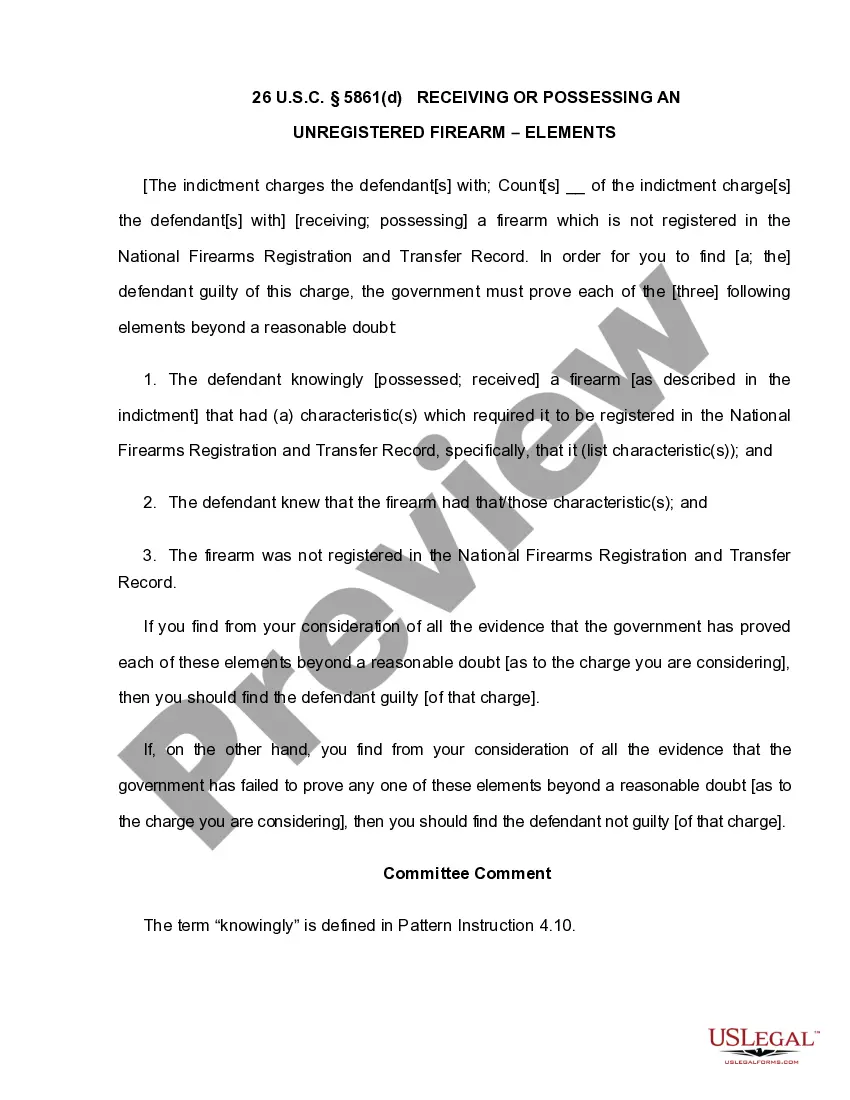

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

Generally, a discharge removes the debtors' personal liability for debts owed before the debtors' bankruptcy case was filed. Also, if this case began under a different chapter of the Bankruptcy Code and was later converted to chapter 7, debts owed before the conversion are discharged.

Types of debt that cannot be discharged in bankruptcy include alimony, child support, and certain unpaid taxes. Other types of debt that cannot be alleviated in bankruptcy include debts for willful and malicious injury to another person or property.

The Trustee's Report of No Distribution, or NDR, lets the court and all interested parties know that no money will be paid to creditors. If a NDR is filed, the court will close the bankruptcy case shortly after the discharge has been entered.