A New Hampshire Personal Monthly Budget Worksheet is a comprehensive tool designed to help individuals in the state of New Hampshire manage their finances effectively. It assists in tracking income, expenses, and savings on a monthly basis, providing a clear overview of one's financial situation. This worksheet is particularly tailored to meet the needs and requirements specific to residents of New Hampshire. The primary purpose of the New Hampshire Personal Monthly Budget Worksheet is to help individuals set achievable financial goals, stay organized, and make informed decisions about their spending habits. By using this worksheet, individuals can carefully plan and allocate their income towards various categories such as housing, transportation, utilities, groceries, healthcare, entertainment, and more. Some key features of the New Hampshire Personal Monthly Budget Worksheet include: 1. Income Tracking: The worksheet allows users to record and track their various sources of income, including wages, salaries, side gigs, investments, and rental income. 2. Expense Tracking: It provides categorized sections to record and monitor various monthly expenses, such as rent/mortgage payments, insurance, transportation costs, utilities, groceries, dining out, healthcare expenses, and debt payments (if applicable). 3. Savings and Investments: This worksheet includes sections to track savings goals, emergency funds, retirement contributions, and any other investment plans. It emphasizes the importance of setting aside money for the future. 4. Flexible Format: The worksheet offers a flexible format that can be easily customized according to individual preferences. It allows users to add or remove expense categories and tailor it to their specific financial situation. 5. Expenditure Analysis: This worksheet provides a feature to analyze expenditure patterns, enabling individuals to identify areas where they may be overspending and make appropriate adjustments to their budgets. 6. Goal Setting: The worksheet encourages users to set short-term and long-term financial goals, such as saving for a down payment on a house, planning for a vacation, paying off debt, or establishing an emergency fund. 7. Regular Assessments: By using this worksheet monthly, individuals can assess their financial progress, make necessary changes to their budget, and ensure they are on track to meet their financial goals. It is important to note that while a general New Hampshire Personal Monthly Budget Worksheet is applicable to most individuals, there might be specific templates available for different circumstances or financial situations within the state. For example, there could be specialized budget worksheets for students, families, self-employed individuals, or retirees residing in New Hampshire. These specialized templates may include additional sections or categories that cater to the unique financial needs of these specific groups.

New Hampshire Personal Monthly Budget Worksheet

Description

How to fill out New Hampshire Personal Monthly Budget Worksheet?

If you require comprehensive, obtain, or print authentic document templates, utilize US Legal Forms, the premier selection of official forms that are accessible online.

Take advantage of the site's user-friendly and efficient search feature to find the documents you need.

Various templates for professional and personal use are categorized by sectors and states, or keywords.

Every legal document template you purchase is yours permanently.

You will have access to every form you downloaded in your account. Visit the My documents section and select a form to print or download again.

- Use US Legal Forms to access the New Hampshire Personal Monthly Budget Worksheet with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the New Hampshire Personal Monthly Budget Worksheet.

- You can also find forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, please follow these directions.

- Step 1. Ensure you have selected the form for your specific city/state.

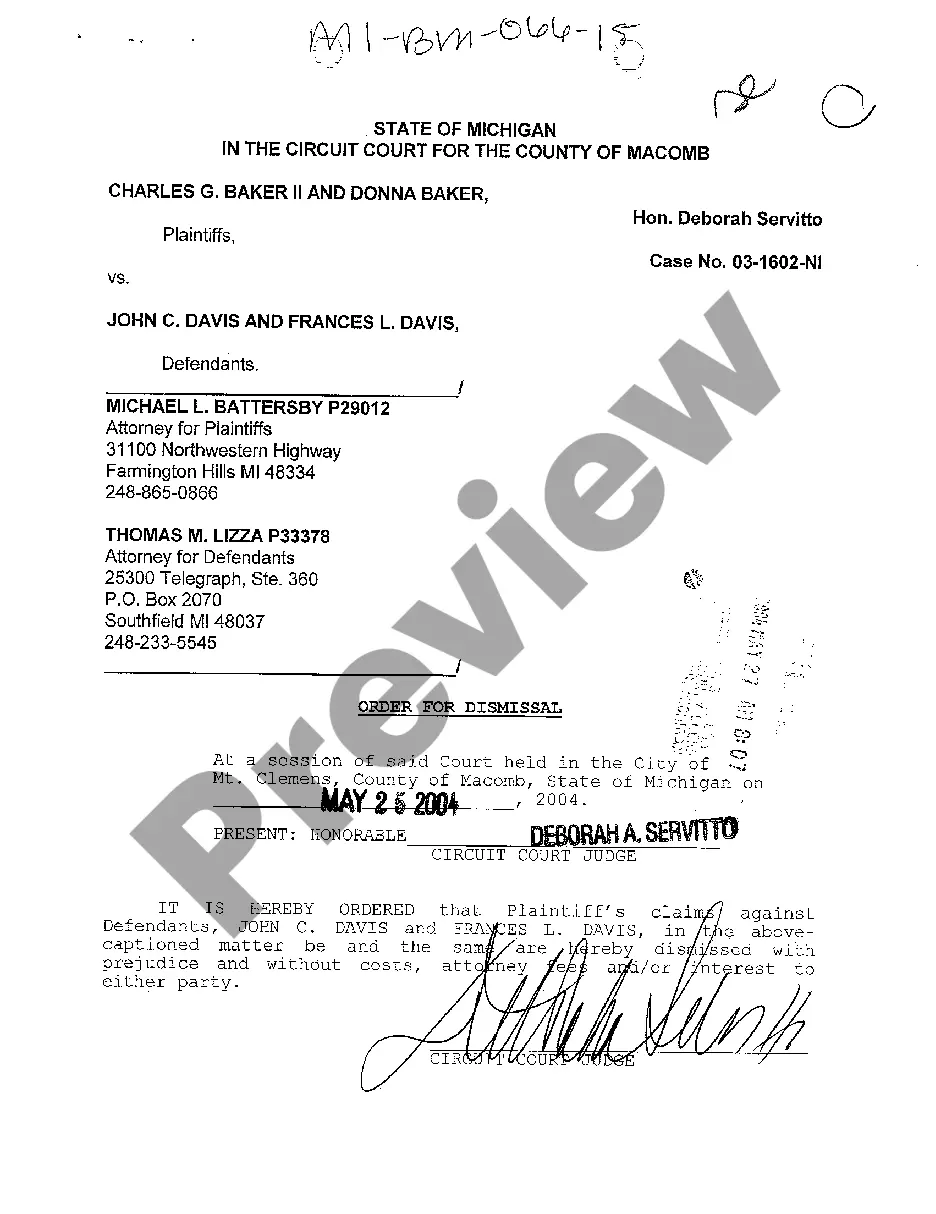

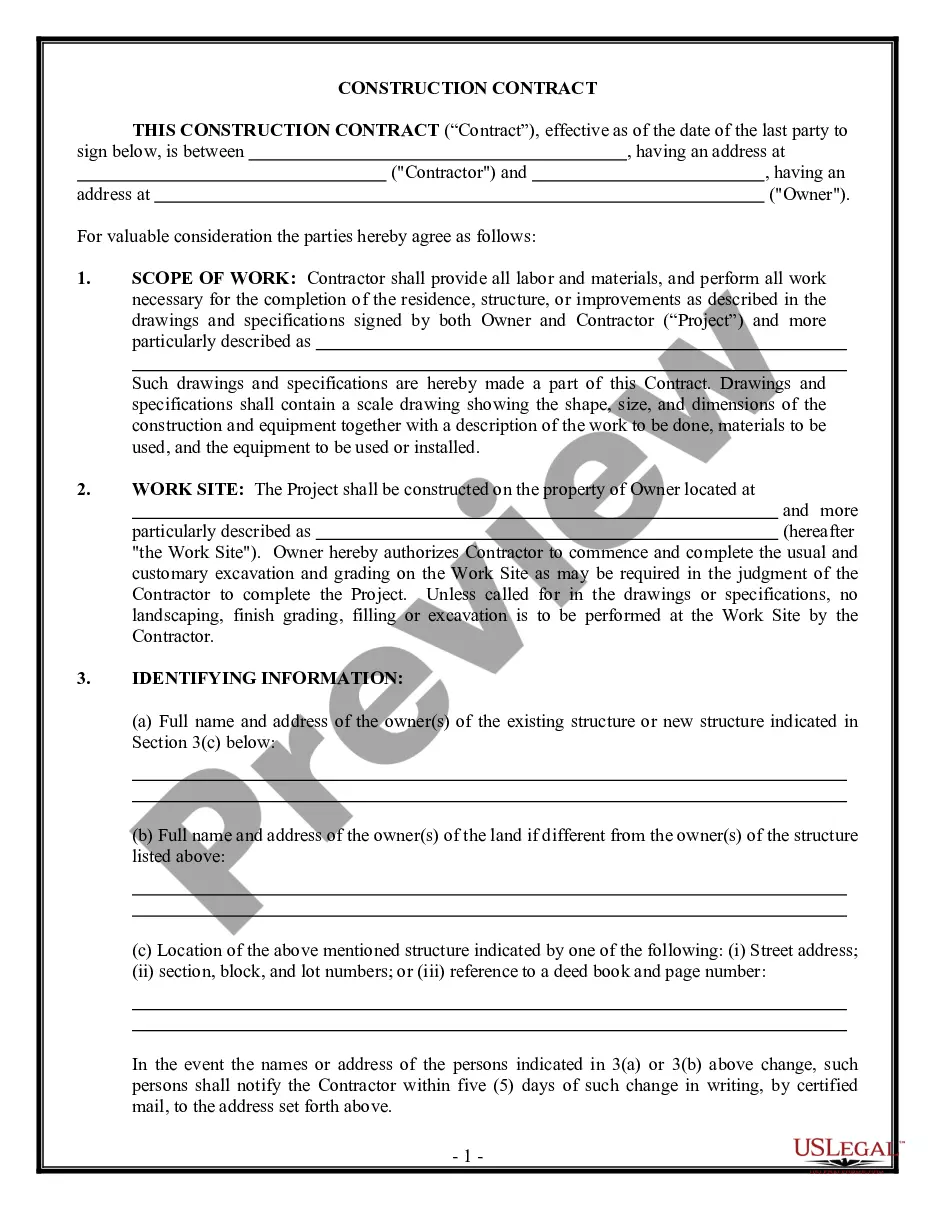

- Step 2. Use the Preview feature to review the content of the form. Remember to check the description.

- Step 3. If you are not happy with the form, utilize the Search feature at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Choose your desired pricing plan and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Hampshire Personal Monthly Budget Worksheet.

Form popularity

FAQ

A monthly budget, especially a well-crafted New Hampshire Personal Monthly Budget Worksheet, guides you in achieving your financial goals. It empowers you to allocate funds wisely, reducing the likelihood of overspending. Furthermore, it creates a roadmap for savings, allowing for better financial security. As a result, you gain confidence and control over your financial future.

Absolutely, a New Hampshire Personal Monthly Budget Worksheet significantly aids your financial management efforts. It serves as a practical tool that allows you to visualize your expenses and make informed choices. By regularly reviewing it, you can quickly spot trends or issues in your spending. This proactive approach helps you stay on top of your finances.

A New Hampshire Personal Monthly Budget Worksheet provides clarity about your overall financial picture. It lists your income, expenses, and savings goals, giving you insight into your spending habits. This visibility allows you to identify areas where you can cut back or save more effectively. Ultimately, it empowers you to make informed decisions about your finances.

To calculate your monthly budget, start by determining your total income for the month. Next, add up all your expenses, ensuring you account for both fixed and variable costs. By using the New Hampshire Personal Monthly Budget Worksheet, you can easily track your calculations and adjustments, providing an organized method for maintaining your financial health.

Writing a monthly budget example involves clearly listing your income sources followed by a detailed breakdown of expenses. You can categorize these expenses into fixed and variable costs for better organization. The New Hampshire Personal Monthly Budget Worksheet provides a straightforward format to help you create a succinct and effective budget example.

To create a monthly budget, start by assessing your total income and expenses. Break your expenses into necessary categories, such as housing, food, and transportation. Consider using the New Hampshire Personal Monthly Budget Worksheet to simplify this process, allowing you to balance your income with your expenses for a more secure financial future.

Excel is a powerful tool for personal budgeting due to its flexibility and customizable functions. You can create your own templates or use existing ones to manage your budget effectively. Additionally, the New Hampshire Personal Monthly Budget Worksheet can be easily converted into Excel format, giving you even more control over your finances.

To fill out a monthly budget sheet, start by listing your total monthly income at the top. Next, outline your fixed and variable expenses, ensuring you categorize them appropriately. Using the New Hampshire Personal Monthly Budget Worksheet can simplify this process, helping you allocate funds efficiently and see where you can save.

A budget sheet should be clear and organized, making it easy for you to track income and expenses. It typically includes sections for listing fixed costs, variable expenses, and savings goals. With the New Hampshire Personal Monthly Budget Worksheet, you can easily visualize your financial situation and adjust it as needed for better control.

Interesting Questions

More info

Is CCM Free To Use? Are Credit Cards Safe To Buy With? Can You Get Covered During The Holidays? Do You Have to Register in Person? How Do Credit Card Charges Affect Credit Scores? Do You Have to Provide Personal Information After You Make A Credit Card Purchase? How Would You Start A Credit Line With CCM? How Do I Buy A Credit Card For Someone I Don't Know? How Do I Buy Another Credit Card for My Husband? How Do I Get a Debit Card With My CCM Member? Is It Easy To Get A Credit Card When You Do Not Know An Address? Is It Safe to Pay with CCC Debit Cards on Your Mobile Phone? Is It Safe to Buy Credit Cards Online When You Have Poor Credit History? Is It Safe Use Credit Cards With Only One Name? Is It Safe to Use Credit Cards on Your Cell Phone When You Are Not Using Your Primary Credit Card? Is It Safe To Use Credit Cards With Expired Cards When You Are Paying with a Debit Card? Is It Safe to Use a Credit Card With Another Account from the Same Bank?