New Hampshire Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

Are you currently in a scenario where you occasionally require documents for a business or individual almost every time.

There are numerous legal document templates accessible on the web, but finding trustworthy ones is not easy.

US Legal Forms offers thousands of form templates, such as the New Hampshire Revocable Trust for Asset Protection, designed to meet federal and state regulations.

Once you find the correct form, click Get now.

Choose the pricing plan you desire, complete the required information to create your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Hampshire Revocable Trust for Asset Protection template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to your correct city/region.

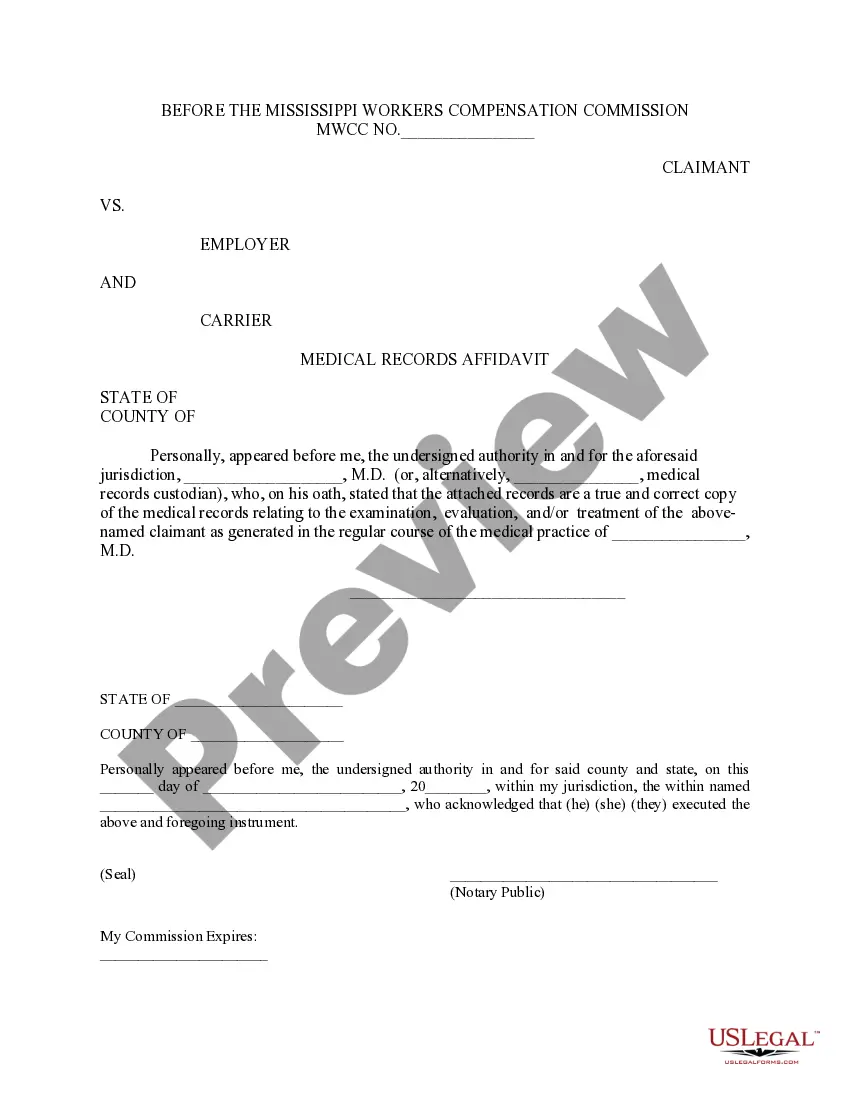

- Use the Preview button to examine the form.

- Read the details to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search area to locate the form that suits your needs.

Form popularity

FAQ

The main difference between a revocable trust and an irrevocable trust in New Hampshire lies in control and flexibility. With a revocable trust, you can modify or terminate the trust at any time, while an irrevocable trust cannot be altered once established. This fundamental distinction affects the asset protection features of each trust type, making it crucial to understand your needs before choosing a New Hampshire Revocable Trust for Asset Protection.

While a New Hampshire Revocable Trust for Asset Protection provides some level of asset protection, it is important to understand its limitations. Creditors can still reach assets in a revocable trust during your lifetime, as you maintain control over the trust. However, this type of trust can offer advantages in managing your affairs and facilitating the transfer of assets after your passing.

You should avoid placing assets like retirement accounts, health savings accounts, and certain life insurance policies in a revocable trust. Typically, these assets have specific beneficiary designations that are more beneficial in the long run. Additionally, maintaining ownership of certain properties or assets outside the trust can sometimes offer better benefits regarding taxes or creditor protection.

A revocable trust protects assets primarily by keeping them out of probate court, which can be time-consuming and costly. While a New Hampshire Revocable Trust for Asset Protection doesn't provide complete immunity from creditors, it does streamline the transfer of your assets upon your passing. This means your heirs can inherit more efficiently, potentially avoiding delays or additional expenses.

The best trust for asset protection depends on your individual needs and circumstances. Many people find that a New Hampshire Revocable Trust for Asset Protection serves them well, as it allows for flexibility while also providing a basic level of protection. However, it's essential to evaluate your financial situation and discuss your options with a legal expert to ensure that your trust aligns with your specific goals.

To start a trust designed for asset protection, first determine your overall estate planning goals. Then, consult with legal professionals who specialize in trusts, especially those familiar with a New Hampshire Revocable Trust for Asset Protection. Platforms like US Legal Forms can provide essential documentation and guidance to help you establish your trust effectively.

One potential downfall of having a trust is the misconception that it provides absolute protection from all legal claims. While a New Hampshire Revocable Trust for Asset Protection can safeguard assets from certain risks, it does not shield assets from tax liabilities or bankruptcy in all cases. Regular reviews and adjustments are necessary to maintain its effectiveness.

If your parents want to ensure a smooth transfer of their assets and provide ongoing protection, a New Hampshire Revocable Trust for Asset Protection may be a wise choice. This type of trust can help avoid probate and keep their affairs private. However, it is essential for them to discuss their specific needs and family circumstances with an estate planning attorney.

One major disadvantage of a trust is the potential costs involved in setting it up, which can include legal fees and ongoing maintenance expenses. Additionally, while a New Hampshire Revocable Trust for Asset Protection offers many benefits, it may not protect assets from creditors during your lifetime. Therefore, careful planning and consideration are crucial before establishing a trust.

The requirements for an asset protection trust can vary, but generally, they include the need for a clear, legal document outlining the terms of the trust. A New Hampshire Revocable Trust for Asset Protection typically necessitates a trust creator, trustees, and designated beneficiaries. Additionally, it's important to ensure that the assets are properly funded into the trust. Consulting with uslegalforms can provide guidance tailored to your specific needs.