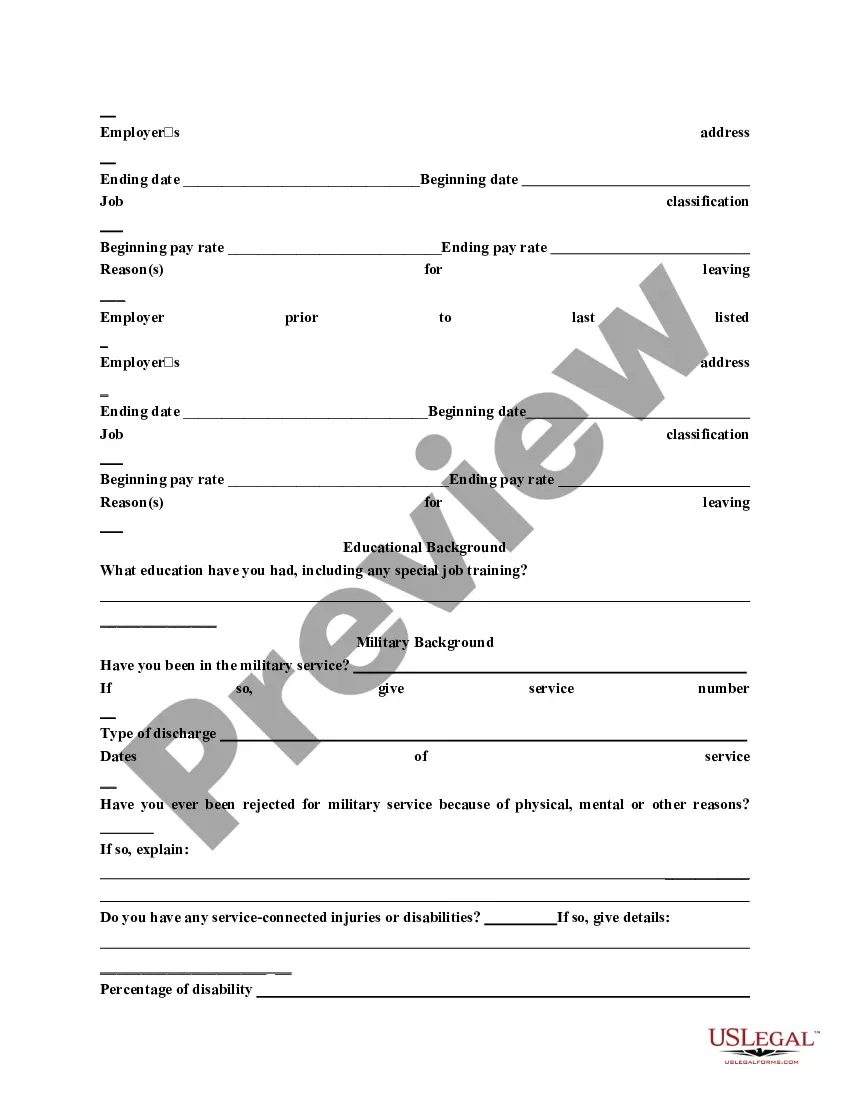

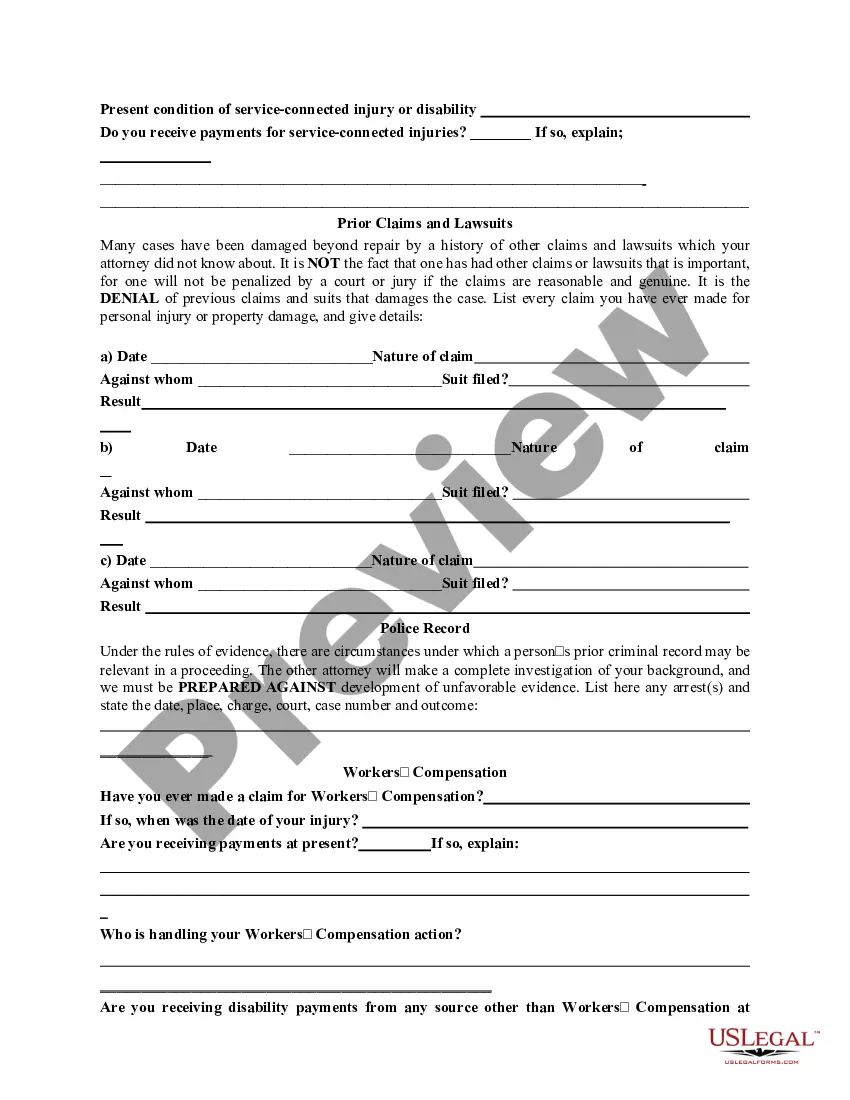

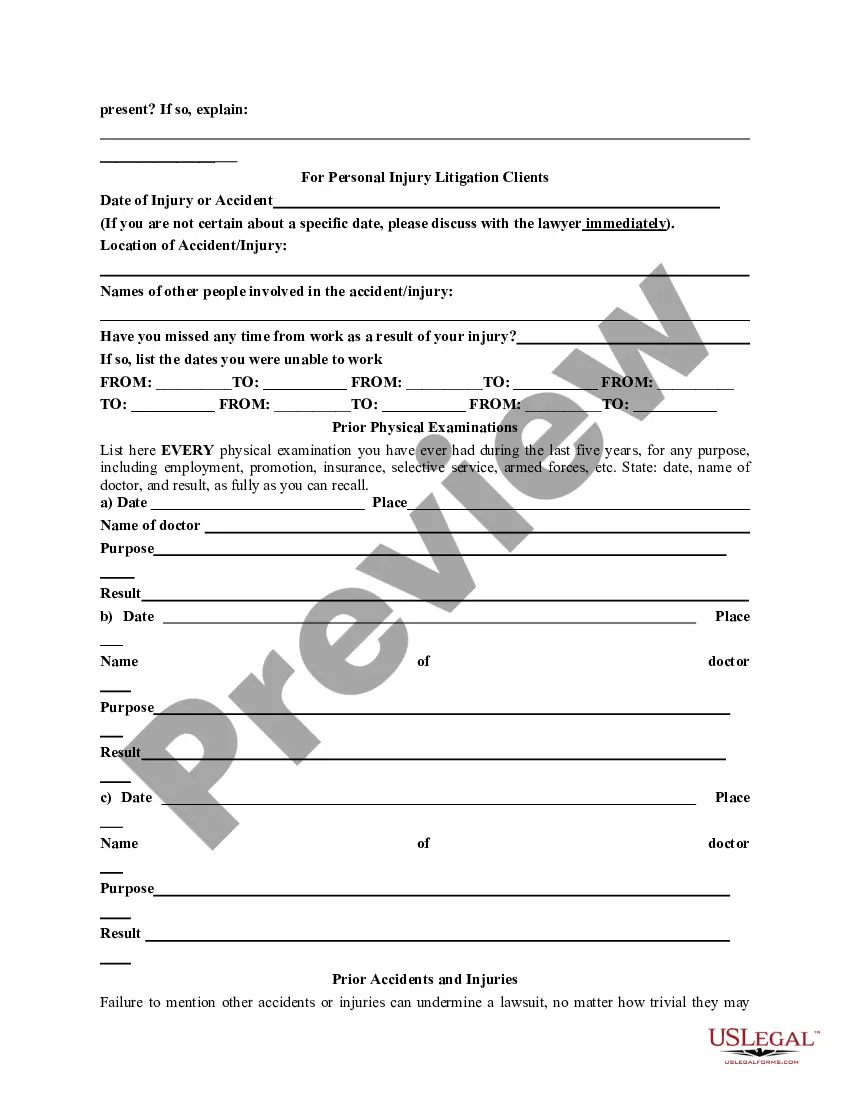

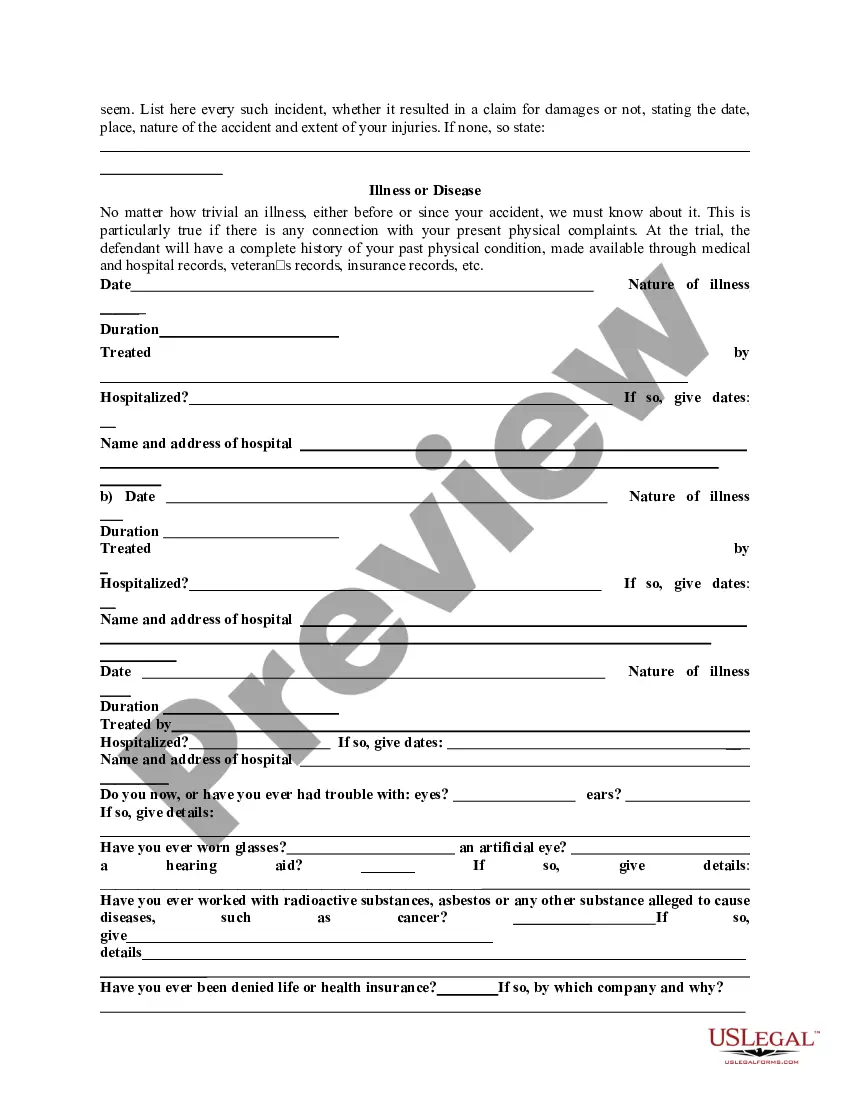

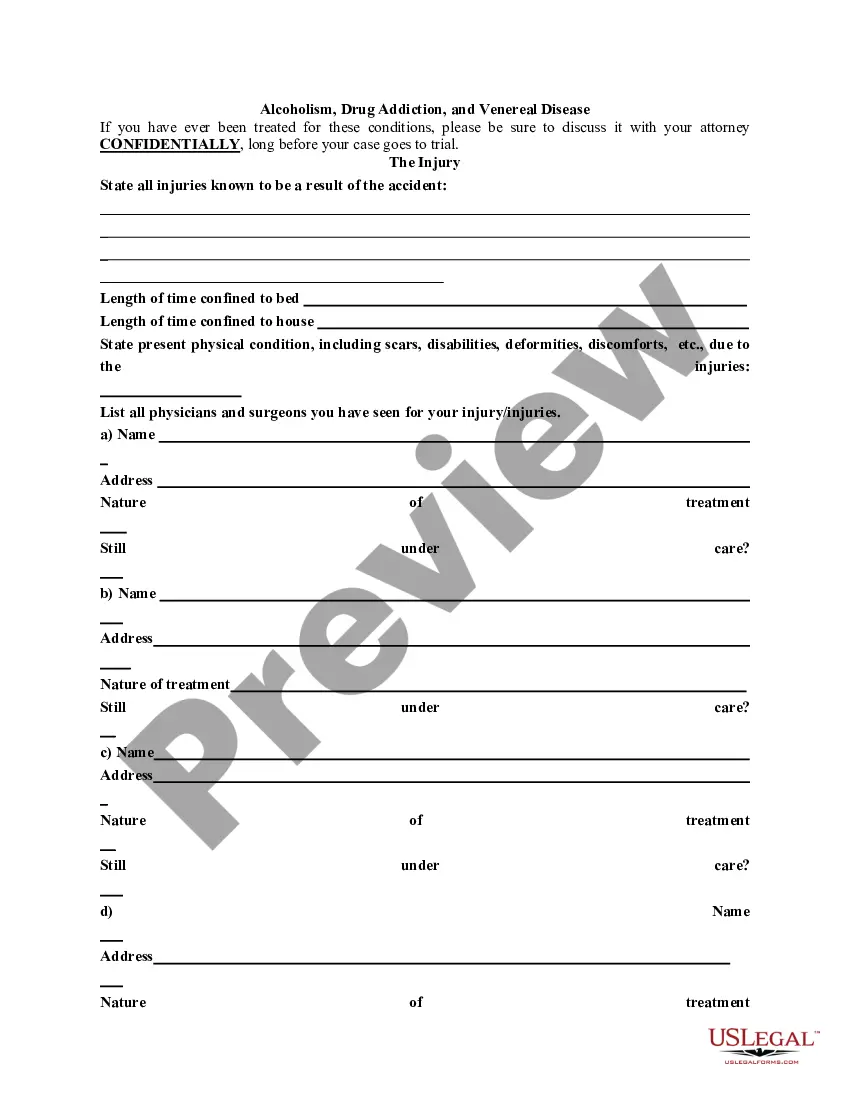

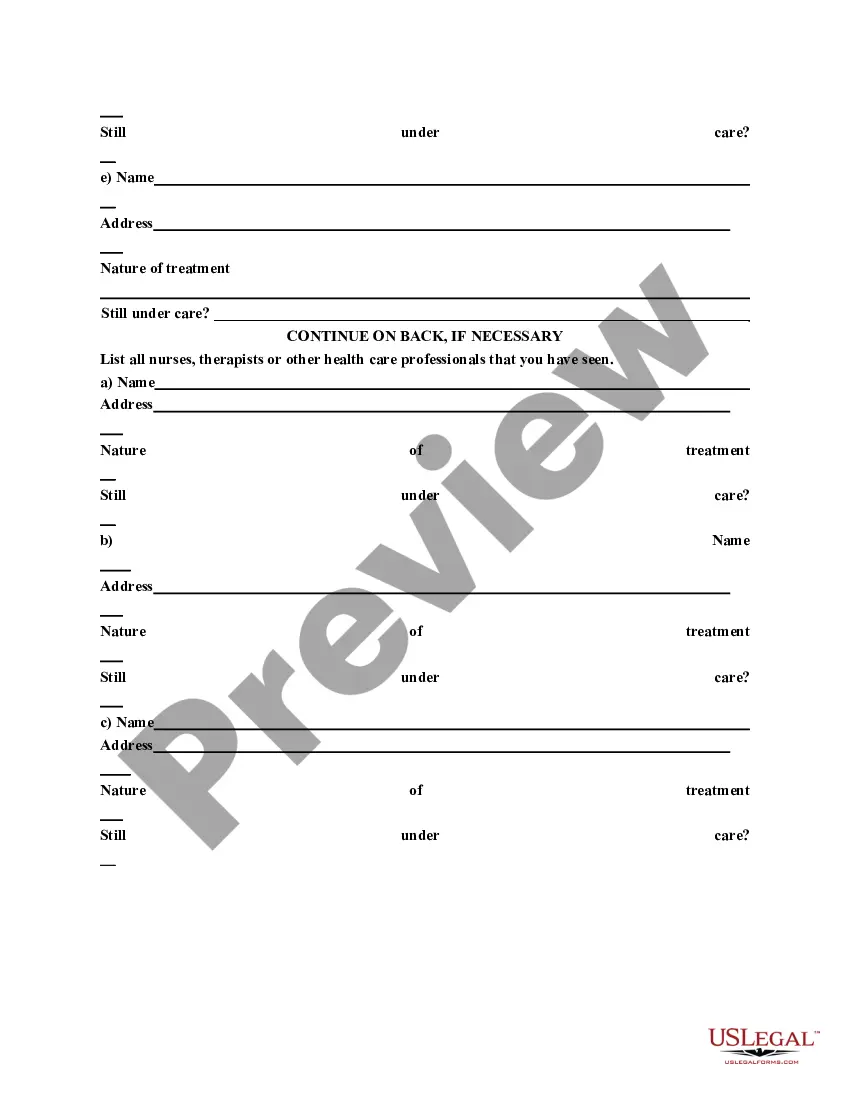

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

New Hampshire General Information Questionnaire

Description

How to fill out General Information Questionnaire?

If you wish to complete, download, or print legal document web templates, utilize US Legal Forms, the foremost selection of legal forms that can be found online.

Take advantage of the site’s straightforward and convenient search feature to locate the documents you require. A range of templates for business and personal purposes are organized by categories and states, or keywords.

Employ US Legal Forms to find the New Hampshire General Information Questionnaire in just a few clicks.

Every legal document template you purchase is yours for an extended period. You will have access to every form you downloaded within your account. Visit the My documents section and select a form to print or download again.

Complete and download, and print the New Hampshire General Information Questionnaire with US Legal Forms. There are millions of professional and state-specific forms you can use for your personal or business needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Obtain button to access the New Hampshire General Information Questionnaire.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

- Step 2. Utilize the Preview option to review the form's content. Don’t forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Get now button. Select the pricing plan you prefer and enter your information to register for the account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the New Hampshire General Information Questionnaire.

Form popularity

FAQ

New Hampshire's business profits tax (BPT) is a flat-rate tax on a business's taxable income (taxable income being determined essentially by federal income tax rules, with a few adjustments). The state budget passed in June 2021 scheduled a BPT decrease from 7.7% to 7.6% starting in 2022. Now, it's down to 7.5%.

Every business organization with gross business income from all business activities of more than $50,000 must file a BPT return.

While New Hampshire businesses do not collect sales tax from residents for items sold in person or online, they sometimes must collect sales tax for items going to other states. However, it is dependent on the laws of each state, as well as the businesses' activity within those states.

NH has two corporate taxes: the Business Profits Tax (BPT) and the Business Enterprise Tax (BET). The BPT rate is 8.5% of income for corporations with gross receipts over $50K. The BET rate is 0.75% on the enterprise value tax base (total compensation paid out, including dividends and interest).

Any business organization, organized for gain or profit carrying on business activity within the State is subject to this tax.

New Hampshire is a state that doesn't have a personal income tax. However, currently, the state has a 5% tax on dividends and interest. However, due to legislation, the tax on dividends and interest is being phased out. The rate will be 4% for 2023, 3% for 2024, 2% for 2025, and 1% for 2026.

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

There is no state income tax in New Hampshire, so your Social Security, benefits, pension, and retirement distributions are safe. However, New Hampshire currently taxes interest and dividend income at 4%. This tax will gradually decrease until it is eliminated in 2027.