New Hampshire Transfer under the Uniform Transfers to Minors Act - Multistate Form

Description

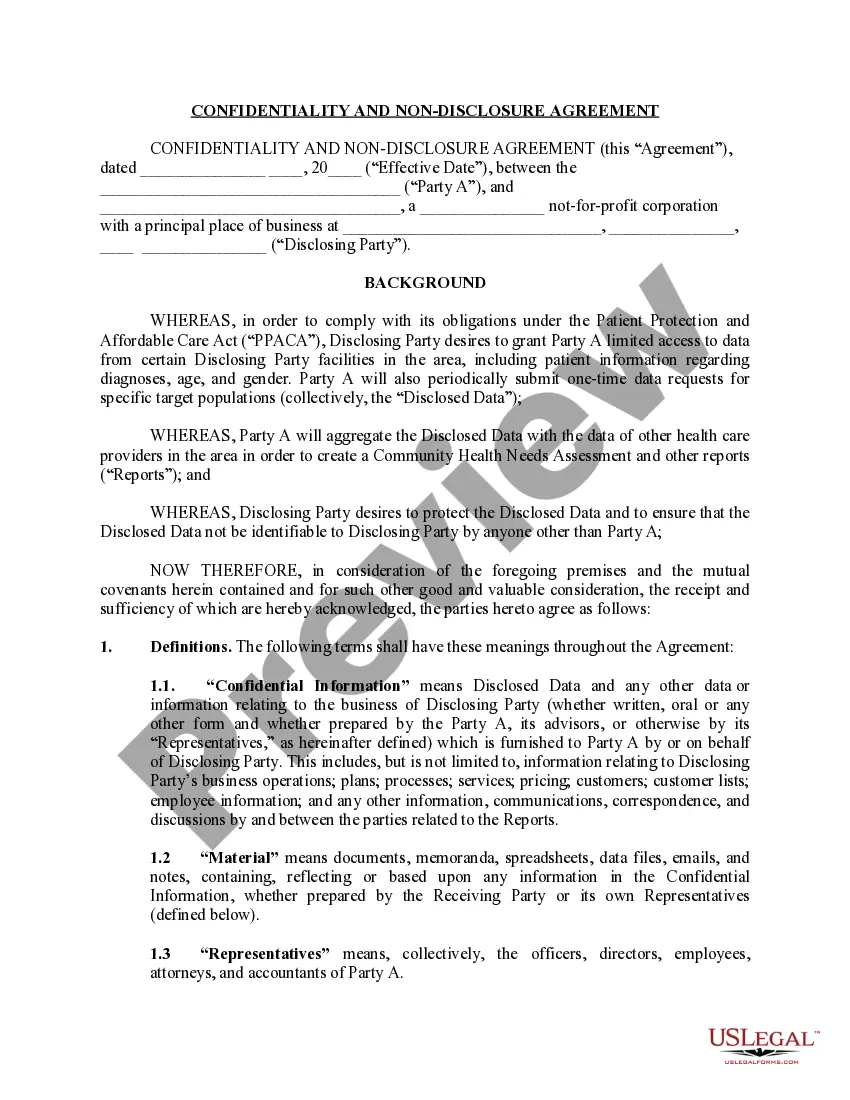

How to fill out Transfer Under The Uniform Transfers To Minors Act - Multistate Form?

Are you currently in a place in which you require paperwork for possibly organization or personal purposes just about every time? There are a variety of authorized papers themes available on the net, but discovering kinds you can trust isn`t straightforward. US Legal Forms offers a huge number of type themes, just like the New Hampshire Transfer under the Uniform Transfers to Minors Act - Multistate Form, which can be composed to fulfill federal and state requirements.

Should you be already informed about US Legal Forms internet site and possess your account, basically log in. Afterward, you are able to download the New Hampshire Transfer under the Uniform Transfers to Minors Act - Multistate Form design.

Unless you come with an account and need to begin to use US Legal Forms, abide by these steps:

- Get the type you require and ensure it is for that correct city/area.

- Take advantage of the Preview switch to examine the form.

- See the information to ensure that you have selected the correct type.

- When the type isn`t what you`re seeking, utilize the Research discipline to obtain the type that meets your needs and requirements.

- Once you find the correct type, just click Purchase now.

- Opt for the rates strategy you need, fill in the required details to create your bank account, and buy the transaction making use of your PayPal or bank card.

- Pick a practical file format and download your backup.

Locate every one of the papers themes you have bought in the My Forms food list. You may get a further backup of New Hampshire Transfer under the Uniform Transfers to Minors Act - Multistate Form anytime, if needed. Just click on the essential type to download or print the papers design.

Use US Legal Forms, probably the most considerable collection of authorized varieties, to save lots of some time and steer clear of blunders. The services offers professionally manufactured authorized papers themes which can be used for a variety of purposes. Generate your account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

The Uniform Gift to Minors Act (UGMA) was created to provide a means by which title to property could be passed to minors by use of a custodian. The nature of property which could be transferred under the UGMA was limited to securities, cash or other personal property.

Cons Of Uniform Gift to Minors Act & Uniform Transfers to Minors Act Account No tax advantages for contributions. UGMA and UTMA plans offer no tax advantages for ?contributions?. ... No oversight for the use of funds. ... Limited tax advantages on income.

Transferring a UTMA account to a child is simple. You can do so with most financial or investment institutions. You can also consult a tax or business lawyer to help you set up the legal structure, although most financial institutions can do this for you.

Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.

The Uniform Transfers to Minors Act (UTMA) allows an adult to transfer assets to a minor by opening a custodial account for them. This type of account is managed by an adult ? the custodian ? who holds onto the assets until the minor reaches a certain age, usually 18 or 21.

Can You Withdraw Money From an UTMA Account? It's possible to withdraw money from an UTMA account. However, there's one essential rule you've got to bear in mind ? all withdrawals from a custodial account must be for the direct benefit of the beneficiary.

The UTMA allows you to transfer money to a custodian, who may be a parent or guardian, and who manages the money on behalf of the minor. The custodian has broad powers to invest or use the money for the minor's benefit.