New Hampshire Shareholder and Corporation agreement to issue additional stock to a third party to raise capital

Description

How to fill out Shareholder And Corporation Agreement To Issue Additional Stock To A Third Party To Raise Capital?

If you need to obtain, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site's user-friendly and convenient search feature to find the documents you require.

A variety of templates for business and personal purposes are categorized by groups and jurisdictions, or by keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to sign up for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the New Hampshire Shareholder and Corporation agreement to issue more stock to a third party in order to generate capital with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and hit the Download button to acquire the New Hampshire Shareholder and Corporation agreement to issue additional stock to a third party for capital raising.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

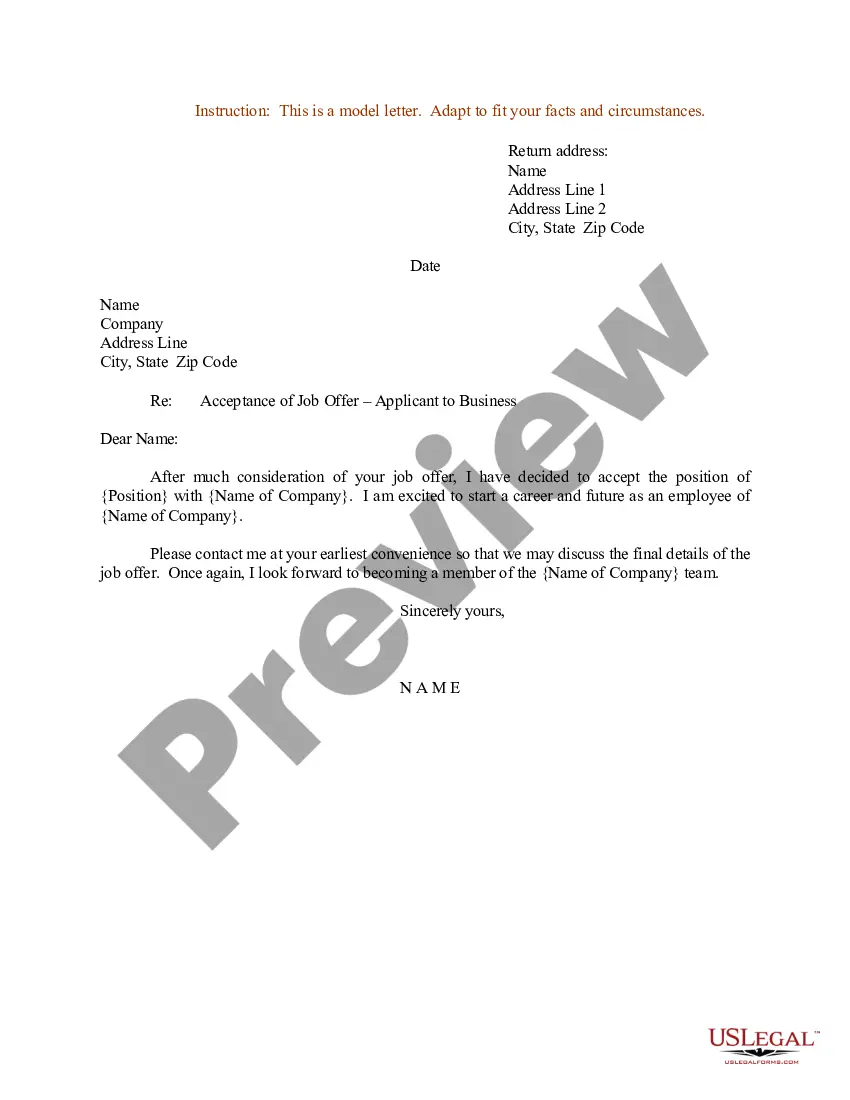

- Step 2. Use the Review option to view the content of the form. Don't forget to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to discover other variants of the legal form template.

Form popularity

FAQ

A merger typically occurs when one company purchases another company by buying a certain amount of its stock in exchange for its own stock. An acquisition is slightly different and often does not involve a change in management.

Regarding the number of shares, public companies usually authorize a very large number of potential shares that can be issued, so they have the necessary flexibility needed to issue shares according to their needs.

Let's go through it. A share issue involves dividing the company's ownership into shares and distributing them to new investors, employees or existing shareholders. Whether you own a public or a private company, you can issue any number of shares, provided you issue a share certificate to each new shareholder.

The number of authorized shares per company is assessed at the company's creation and can only be increased or decreased through a vote by the shareholders. If at the time of incorporation the documents state that 100 shares are authorized, then only 100 shares can be issued.

If the company wants to issue more shares than the authorised limit, the authorised share capital must be removed by a resolution filed with the Registrar of Companies before the new shares can be issued.

Issuing of extra shares will require a resolution to be passed by a general meeting of the company shareholders. The only way of avoiding diluting the company further by issuing shares to new investors is by existing shareholders taking up the extra shares on top of their own.

Shareholder approval will only be required for issuances to a related party, and will not be required for issuances to 1) a subsidiary, affiliate, or other closely related person of a related party, or 2) any company or entity in which a related party has a substantial direct or indirect interest.

Key Takeaways. Cross holding happens when a publicly-traded company owns a stake in another publicly-traded company. The biggest issue with cross-holding is that the value of equity for each company is double-counted, leading to a wrong valuation.

Updated November 4, 2020: Can a private company issue stock? Private companies can issue stock and have shareholders, but they do not trade on public exchanges and aren't held to the Securities and Exchange Commission's (SEC) filing requirements for public companies.

Any private agreement between the shareholders are not binding either on the company or on the shareholders. Further, share transfer can only be restricted by the Articles of Association. The right to transfer shares of a private limited company cannot be an total prohibition or ban on share transferability.