New Hampshire Affidavit of Lost Promissory Note

Description

How to fill out Affidavit Of Lost Promissory Note?

Are you in a situation where you require documents for either organizational or personal tasks frequently.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of template options, such as the New Hampshire Affidavit of Lost Promissory Note, that are designed to fulfill state and federal regulations.

Once you find the correct document, click on Get now.

Choose the pricing plan you need, fill out the necessary information to create your account, and pay for the transaction using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Hampshire Affidavit of Lost Promissory Note template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is for the correct city/county.

- Use the Preview button to review the form.

- Check the details to confirm you have chosen the right document.

- If the document isn’t what you want, utilize the Search field to find a form that suits your requirements.

Form popularity

FAQ

You can get a copy of your Master Promissory Notes by going to studentloans.gov and entering your FSA ID. Click on Completed Master Promissory Notes under the menu bar heading that says My Loan Documents. The completed Master Promissory Notes will appear, and you can download them directly.

Circumstances for Release of a Promissory NoteThe debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

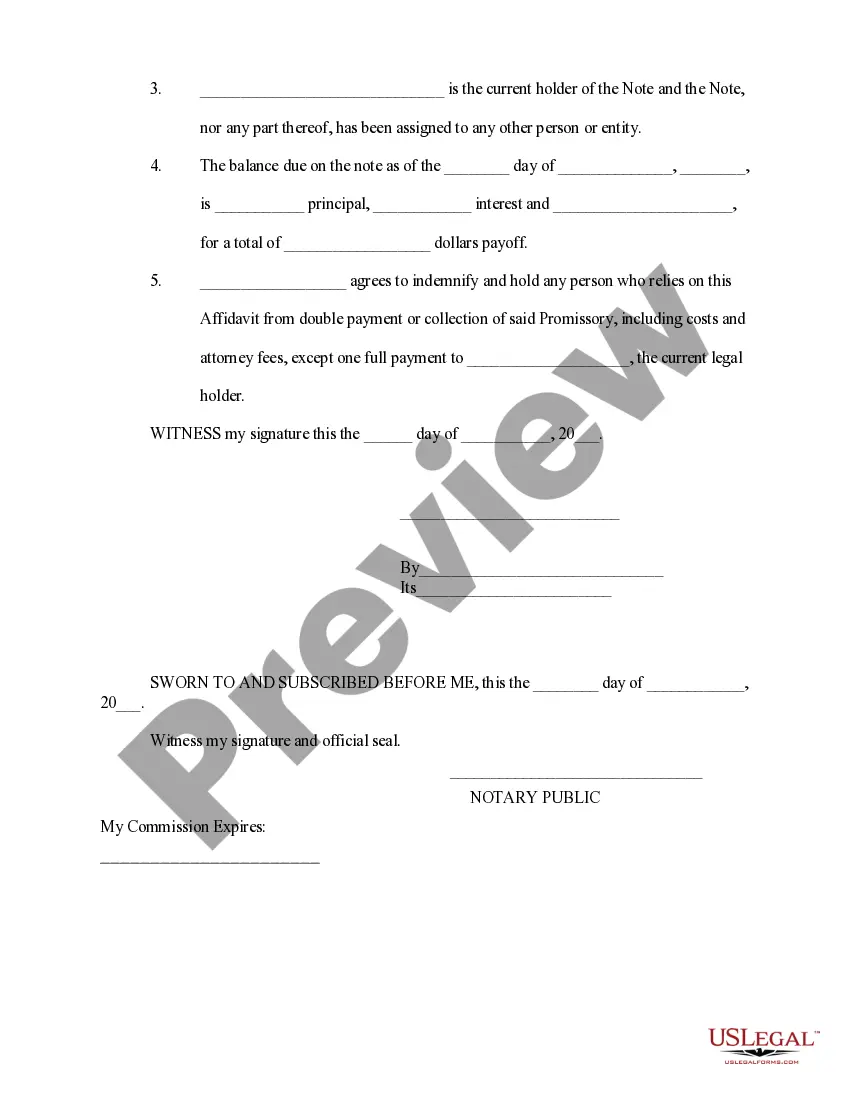

A lost note affidavit is a sworn statement made by the lender that it has lost the original note. The affidavit also contains factual representations from the lender about the status of the note and the loan.

Losing the original note or a copyThe original copy of a valid promissory note is usually held by the lender, but the borrower should also keep a copy of the signed document. If the borrower does not repay the loan, the lender can pursue appropriate legal action.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

4. Search the county recorder's records. Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied.

The buyer of the note becomes what is called a holder because they hold your note as the owner of it. A holder has a special right to collect from you right away if you don't pay. But only the holder of an original promissory note can collect from you. A promissory note can change many hands as it is bought and sold.