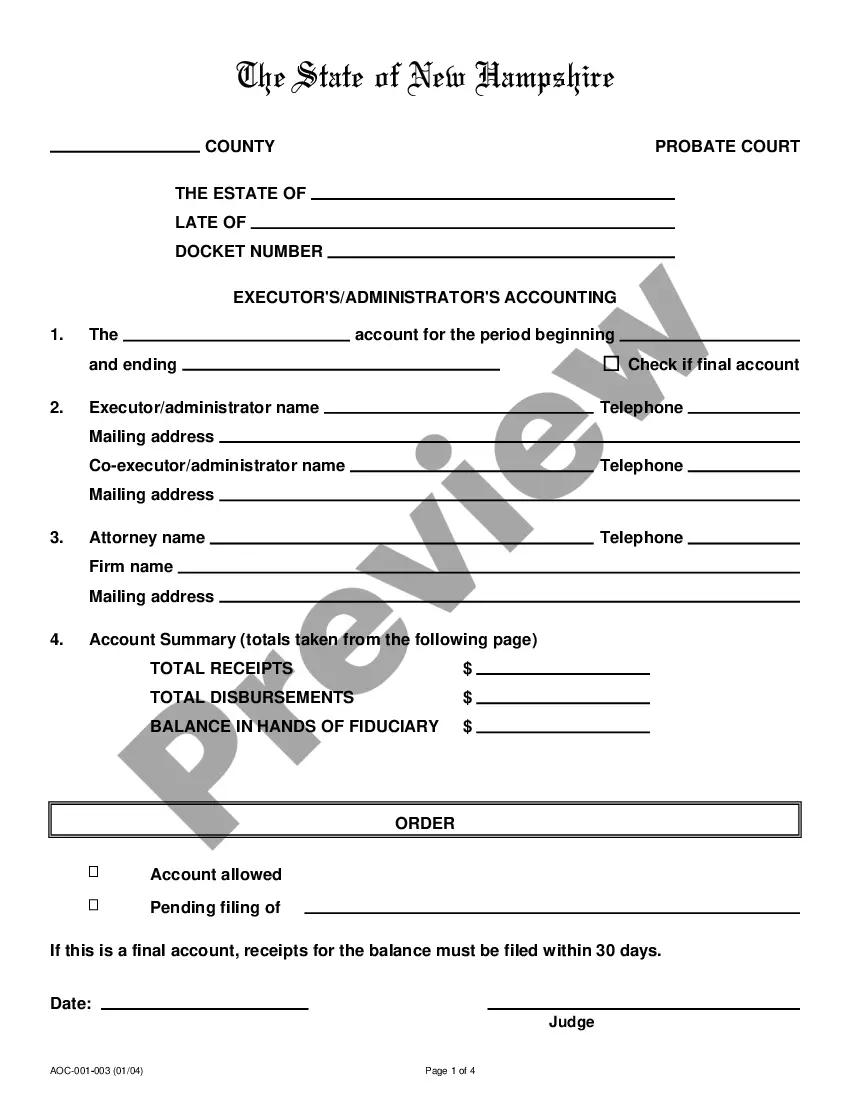

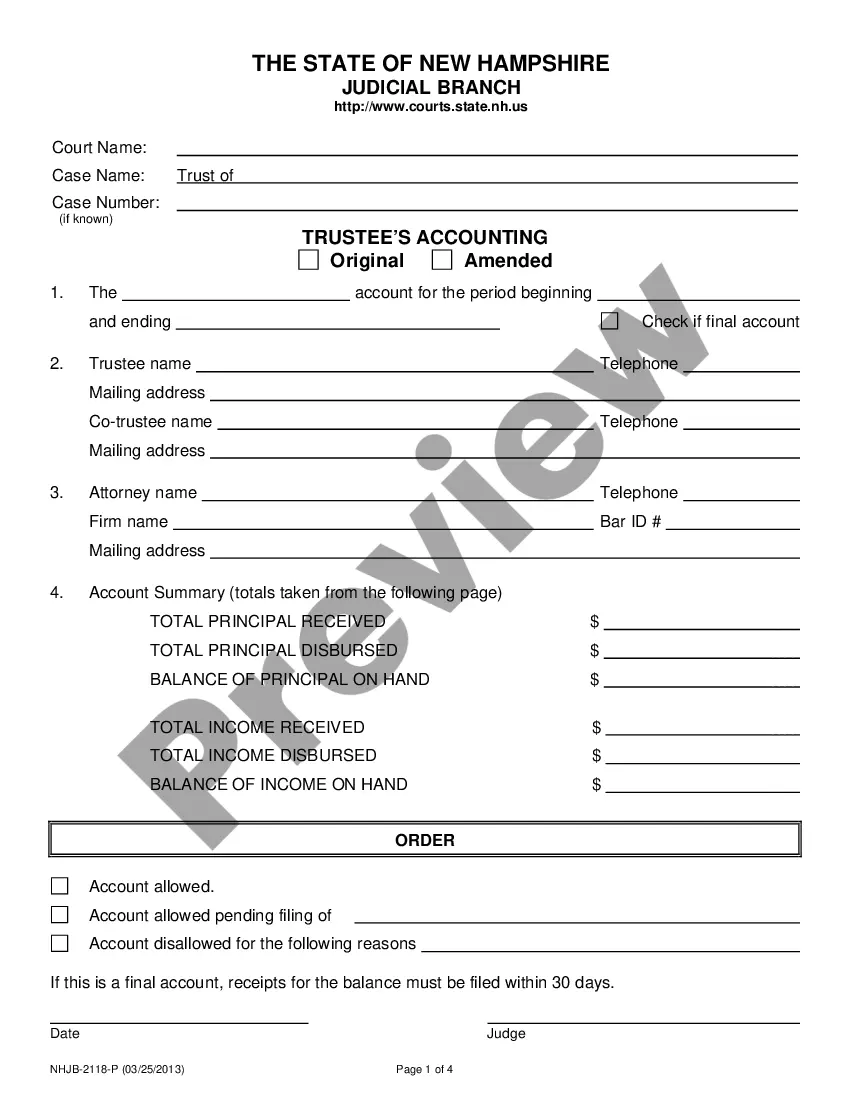

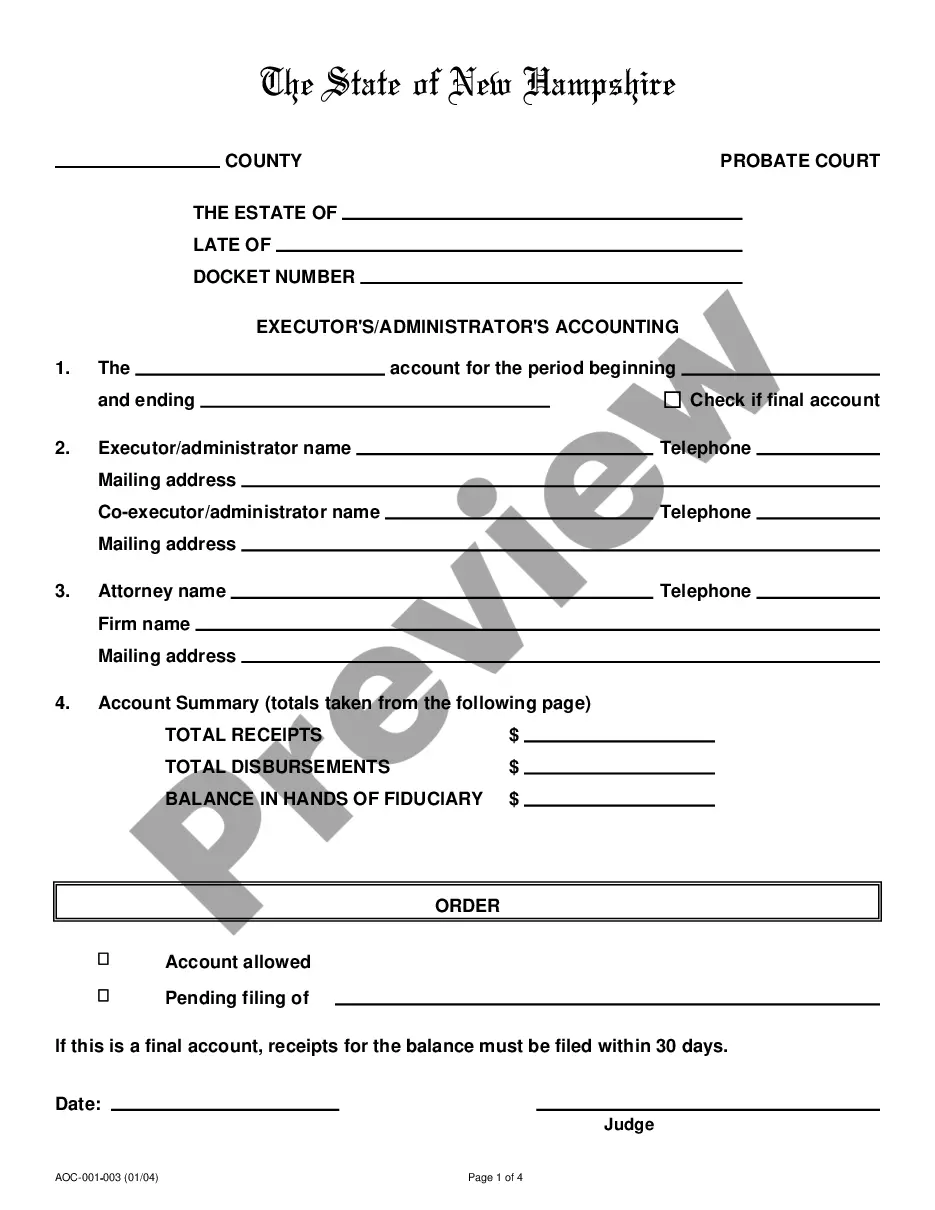

This form, along with the required attachments, is a report of all the transactions that have taken place during the accounting period specified on the form. Basically, it is used to show the court the details of how the assets of an estate have been managed. It will summarize the money the estate had or received , and the money spent out of the estate.

New Hampshire Executor or Administrator Accounting

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Hampshire Executor Or Administrator Accounting?

US Legal Forms is really a unique platform to find any legal or tax template for submitting, including New Hampshire Executor or Administrator Accounting . If you’re sick and tired of wasting time searching for perfect examples and paying money on document preparation/attorney fees, then US Legal Forms is exactly what you’re seeking.

To experience all the service’s advantages, you don't have to download any software but simply choose a subscription plan and register an account. If you have one, just log in and look for an appropriate template, download it, and fill it out. Downloaded files are all stored in the My Forms folder.

If you don't have a subscription but need New Hampshire Executor or Administrator Accounting , have a look at the recommendations below:

- Double-check that the form you’re looking at applies in the state you need it in.

- Preview the form and read its description.

- Simply click Buy Now to access the sign up webpage.

- Choose a pricing plan and keep on registering by providing some information.

- Pick a payment method to complete the sign up.

- Download the document by selecting the preferred format (.docx or .pdf)

Now, submit the document online or print it. If you feel uncertain concerning your New Hampshire Executor or Administrator Accounting sample, speak to a lawyer to review it before you decide to send out or file it. Start without hassles!

Form popularity

FAQ

Yes an estate can have 2 administrators but it is not likely. If a names co-executors the Court may allow this, but if two people want to serve as co-administrators most Courts say "No" to the future conflicts between adminsitrators.

The simple answer, as previously mentioned, is no, a personal representative or executor may not hide assets.

Beneficiaries often must sign off on the inheritance they receive to acknowledge receipt of the distribution. For example, if you inherit a portion of real estate from the decedent, you must sign a deed accepting that real estate.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Beneficiaries are entitled to receive a financial accounting of the trust, including bank statements, regularly. When statements are not received as requested, a beneficiary must submit a written demand to the trustee.The court will review the trust account for any discrepancies or irregular activity.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

It is an administrator's job to gather all of the assets of the estate, pay the debts of the estate, and distribute the assets to the beneficiaries in accordance with the will or the laws of intestate succession. All of this will occur under the supervision of the probate court in the county where the decedent lived.

Each beneficiary is entitled to a trustee's accounting, at least annually, at termination of the trust, and on upon a change of trustee. (California Probate Code 16062). Unfortunately, not all beneficiaries are entitled to automatic accounting, nevertheless, the court may force the trustee to provide an accounting.

The Executor is responsible for wrapping up the deceased person's affairs and distributing the assets to, or for the benefit of, the persons named in the will (beneficiaries). An Administrator is the person in charge of the estate when my someone dies without a Last Will and Testament.