This office lease form describes the language to be used by a landlord seeking to charge the tenant for operating and maintaining the garage without offsetting the expense with income.

Nebraska Language Charging for Operating and Maintenance of a Garage Without Offsetting the Expense with Income

Description

How to fill out Language Charging For Operating And Maintenance Of A Garage Without Offsetting The Expense With Income?

You can spend hours on-line trying to find the lawful document design that fits the state and federal needs you will need. US Legal Forms supplies a large number of lawful types that are evaluated by experts. It is possible to download or printing the Nebraska Language Charging for Operating and Maintenance of a Garage Without Offsetting the Expense with Income from our assistance.

If you already possess a US Legal Forms account, you can log in and click on the Down load switch. Next, you can complete, edit, printing, or sign the Nebraska Language Charging for Operating and Maintenance of a Garage Without Offsetting the Expense with Income. Each and every lawful document design you purchase is yours permanently. To acquire an additional duplicate associated with a obtained type, visit the My Forms tab and click on the corresponding switch.

If you are using the US Legal Forms web site initially, follow the basic guidelines below:

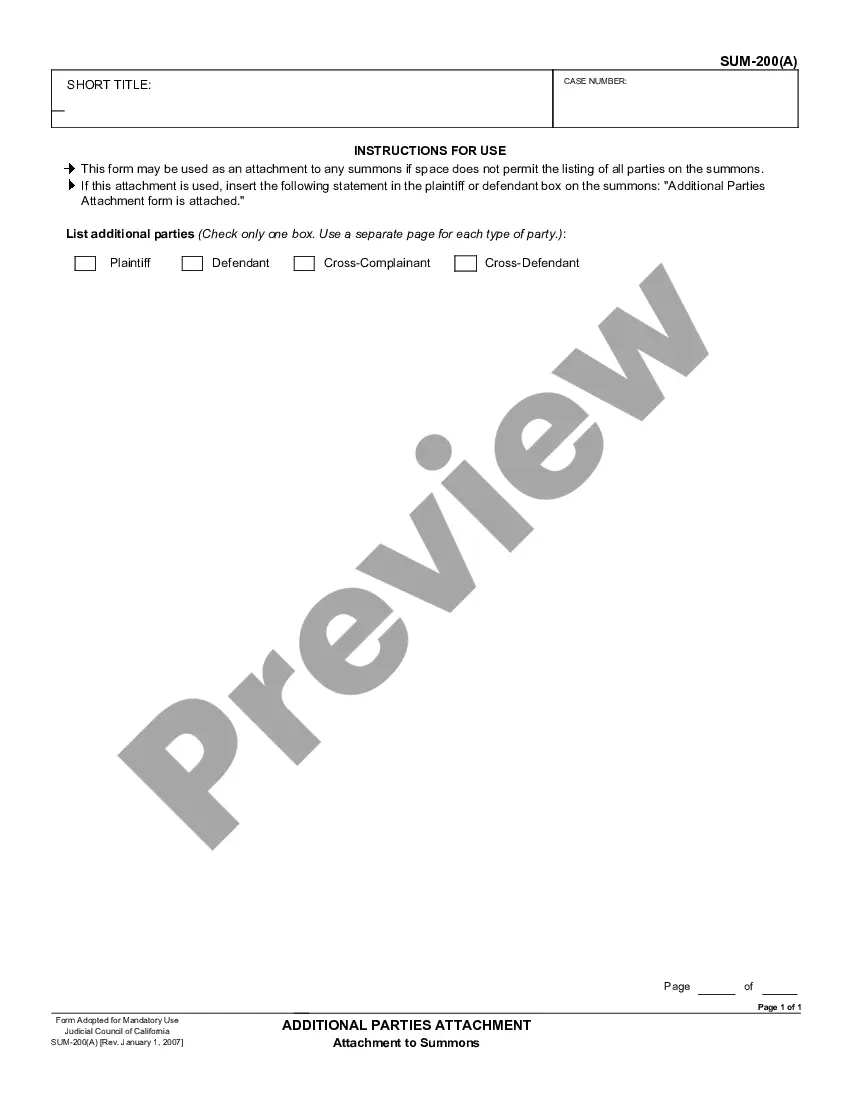

- Initial, be sure that you have selected the proper document design for your area/town of your choice. Browse the type information to ensure you have picked out the correct type. If available, use the Review switch to look through the document design as well.

- In order to find an additional version from the type, use the Research discipline to discover the design that suits you and needs.

- After you have located the design you need, click Buy now to proceed.

- Select the costs plan you need, type your credentials, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You should use your bank card or PayPal account to fund the lawful type.

- Select the format from the document and download it to the gadget.

- Make changes to the document if required. You can complete, edit and sign and printing Nebraska Language Charging for Operating and Maintenance of a Garage Without Offsetting the Expense with Income.

Down load and printing a large number of document templates while using US Legal Forms website, that offers the biggest selection of lawful types. Use expert and status-particular templates to handle your organization or personal requires.

Form popularity

FAQ

An expense is the cost of operations that a company incurs to generate revenue. Unlike assets and liabilities, expenses are related to revenue, and both are listed on a company's income statement. In short, expenses are used to calculate net income.

While expenses and liabilities may seem as though they're interchangeable terms, they aren't. Expenses are what your company pays on a monthly basis to fund operations. Liabilities, on the other hand, are the obligations and debts owed to other parties.

Examples of current liabilities include accounts payables, short-term debt, accrued expenses, and dividends payable.

Liabilities are accounts that carry a balance to be paid down by regular installments. Monthly accrued expenses (utilities, cable, cell phone, insurance payments, rent, food, and other general living expenses) are excluded. Common liabilities, however, do include balances for: Credit cards.

Expense accounts are categories of costs incurred by a company during its operations. Examples include 'Repairs,' 'Advertising,' and 'Rent. ' 'Accrued' is not an expense account but a term used in accounting to describe something that has been incurred but not yet paid for.

Expenses are not liabilities. Expenses are continuing payments for services or things of no financial value. Buying a business cell phone is an expense. Liabilities are loans used to purchase assets (items of financial value), like equipment, ing to The Balance.

The short answer is yes: depreciation is an operating expense. Depreciation is an accounting method that allocates the loss in value of fixed assets over time. And since these fixed assets are essential for day-to-day business operations, depreciation is considered an operating expense.

When expenses are accrued, this means that an accrued liabilities account is increased, while the amount of the expense reduces the retained earnings account. Thus, the liability portion of the balance sheet increases, while the equity portion declines.