Nebraska Response to Notice of Title Defect by Seller to Buyer in Response to Notice

Description

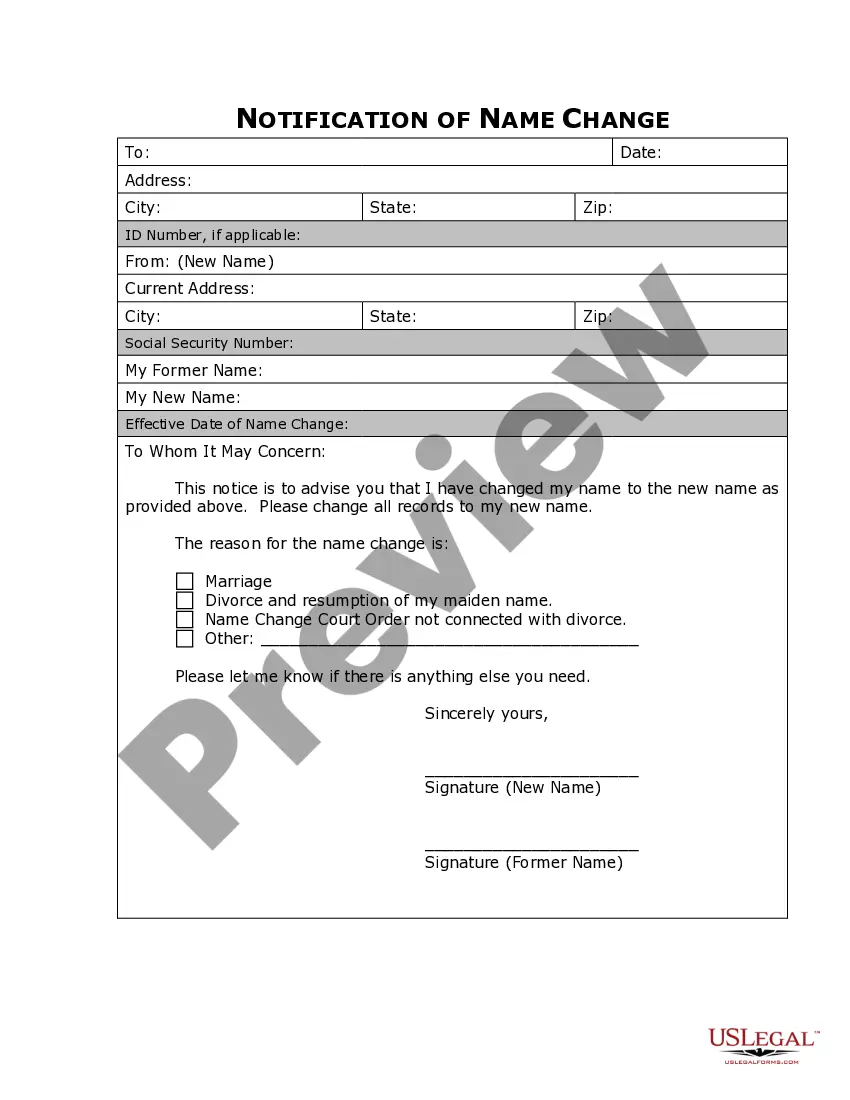

How to fill out Response To Notice Of Title Defect By Seller To Buyer In Response To Notice?

You may spend hrs online attempting to find the legitimate file design that meets the state and federal needs you will need. US Legal Forms gives a huge number of legitimate forms that happen to be analyzed by professionals. You can easily down load or produce the Nebraska Response to Notice of Title Defect by Seller to Buyer in Response to Notice from our service.

If you have a US Legal Forms account, it is possible to log in and click the Acquire key. After that, it is possible to full, edit, produce, or sign the Nebraska Response to Notice of Title Defect by Seller to Buyer in Response to Notice. Every legitimate file design you acquire is your own for a long time. To acquire another copy for any obtained form, visit the My Forms tab and click the related key.

Should you use the US Legal Forms website initially, adhere to the easy guidelines beneath:

- Very first, make certain you have chosen the best file design for the area/metropolis of your liking. Look at the form information to make sure you have selected the appropriate form. If accessible, take advantage of the Preview key to appear with the file design as well.

- If you want to discover another edition in the form, take advantage of the Search industry to obtain the design that meets your needs and needs.

- Upon having located the design you want, click on Purchase now to continue.

- Choose the costs prepare you want, key in your qualifications, and sign up for an account on US Legal Forms.

- Total the financial transaction. You can utilize your charge card or PayPal account to fund the legitimate form.

- Choose the format in the file and down load it to the product.

- Make adjustments to the file if possible. You may full, edit and sign and produce Nebraska Response to Notice of Title Defect by Seller to Buyer in Response to Notice.

Acquire and produce a huge number of file themes while using US Legal Forms Internet site, which provides the biggest variety of legitimate forms. Use expert and condition-distinct themes to deal with your small business or personal needs.

Form popularity

FAQ

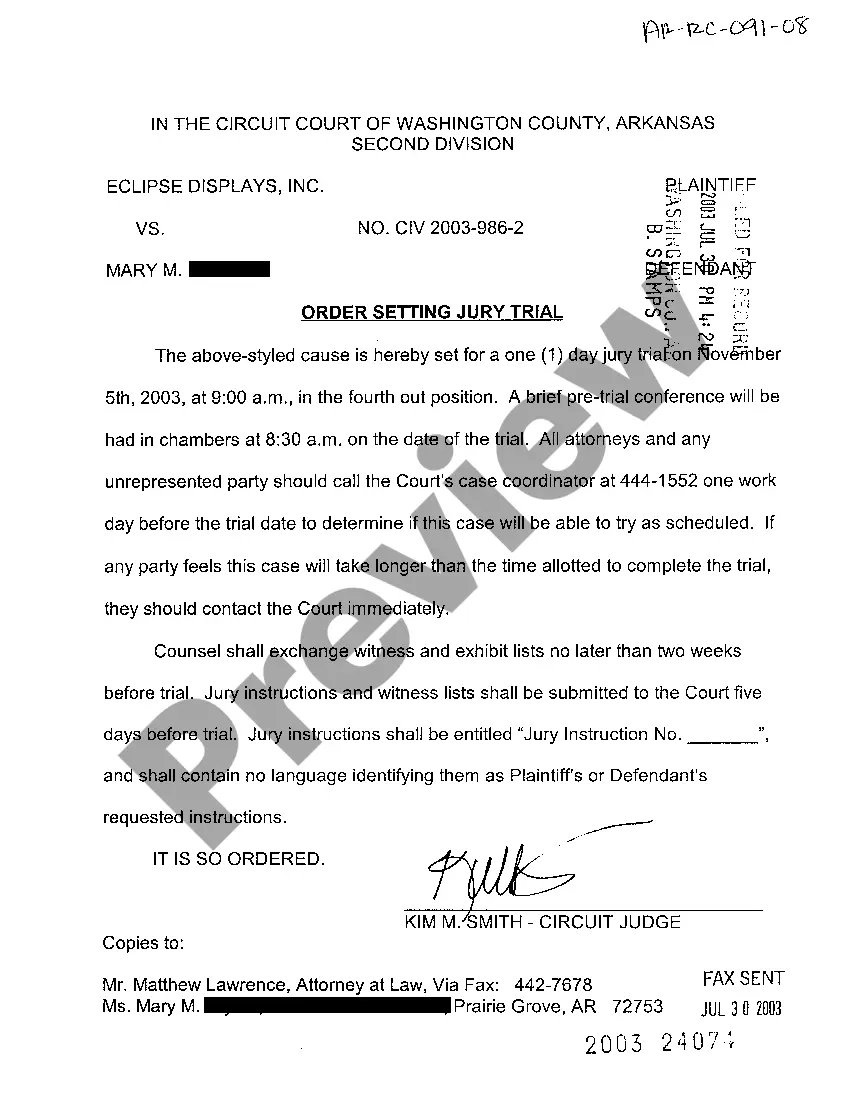

The title and the property cannot be legally transferred until the title defect is resolved. The titleholder must take care of all and any issues. For example, if there are tax liens on the property, the homeowner must pay off outstanding taxes before going through with the sale.

A quitclaim deed is often used to cure a defect (a "cloud on the title") in the recorded history of a real estate title.

Title insurance protects home buyers against covered title defects, such as a previous owner's debt, liens, and other claims of ownership.

What is a corrective deed? A corrective deed is an instrument filed in the public record in addition to the incorrect deed. It's known as a confirmatory instrument since it perfects an existing title by removing any defects, but it doesn't pass title on its own.

Make Sure You Have Title Insurance There are two types of title insurance: lender's and owner's. Lender's title insurance is required by your mortgage company and assures them the title is cleared for sale. An owner's title insurance policy is what protects you after you buy the property.

Generally, a standard policy of title insurance will protect the insured against losses arising from such title defects as: Forged documents such as deeds, releases of dower, mortgages; Undisclosed heirs; Mistaken legal interpretation of wills; Misfiled documents, unauthorized acknowledgments; Confusion arising from ...

Title insurance guarantees you or your lender against losses from any defects in title that may exist in the public records at the time you purchase that property, and certain other risks described in the title insurance policy.

The defect or impairment on the title can be in the form of a lien, mortgage, judgment, or other type of encumbrance. Because other parties can lay claim to the property or asset, the title cannot be legally transferred to someone else. Defective titles are also called bad titles.