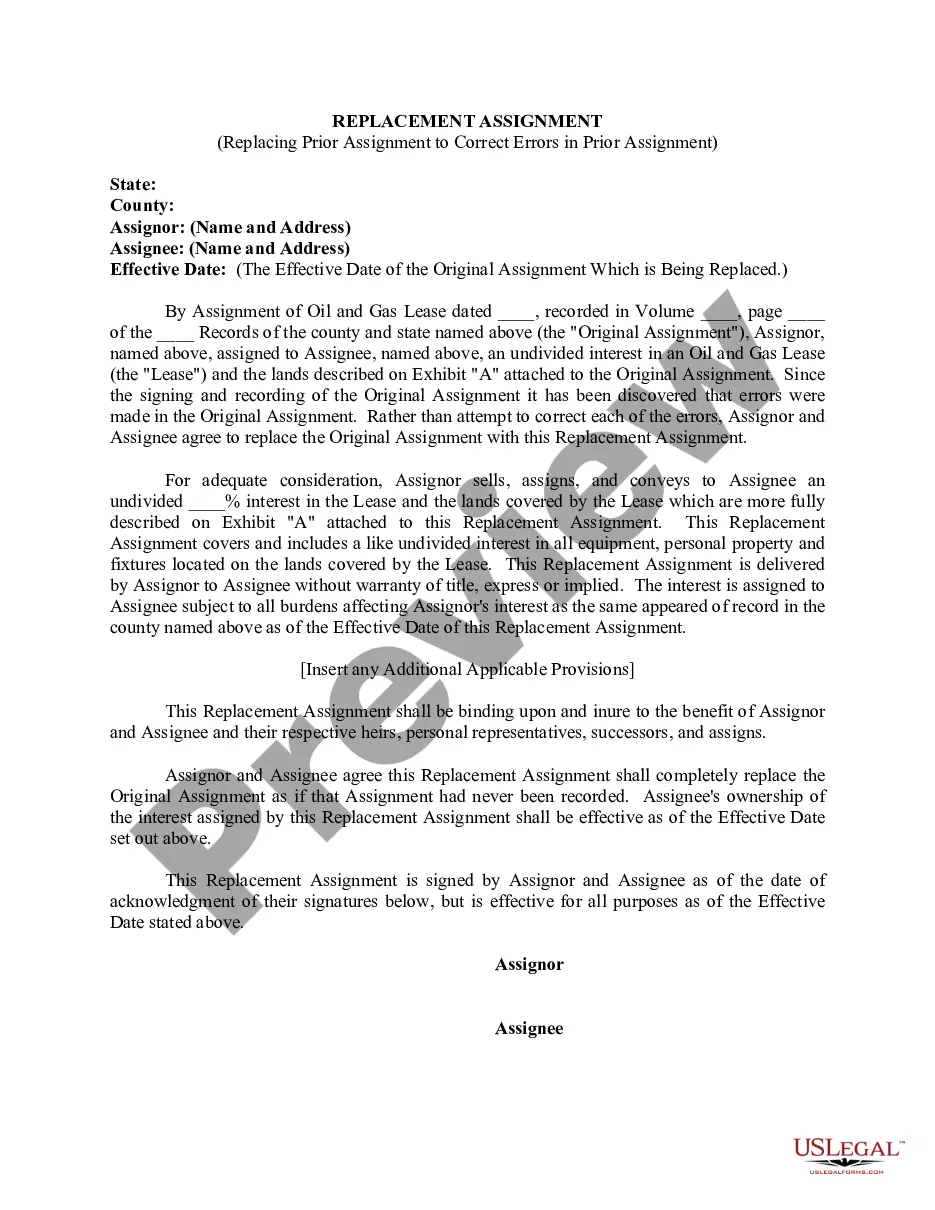

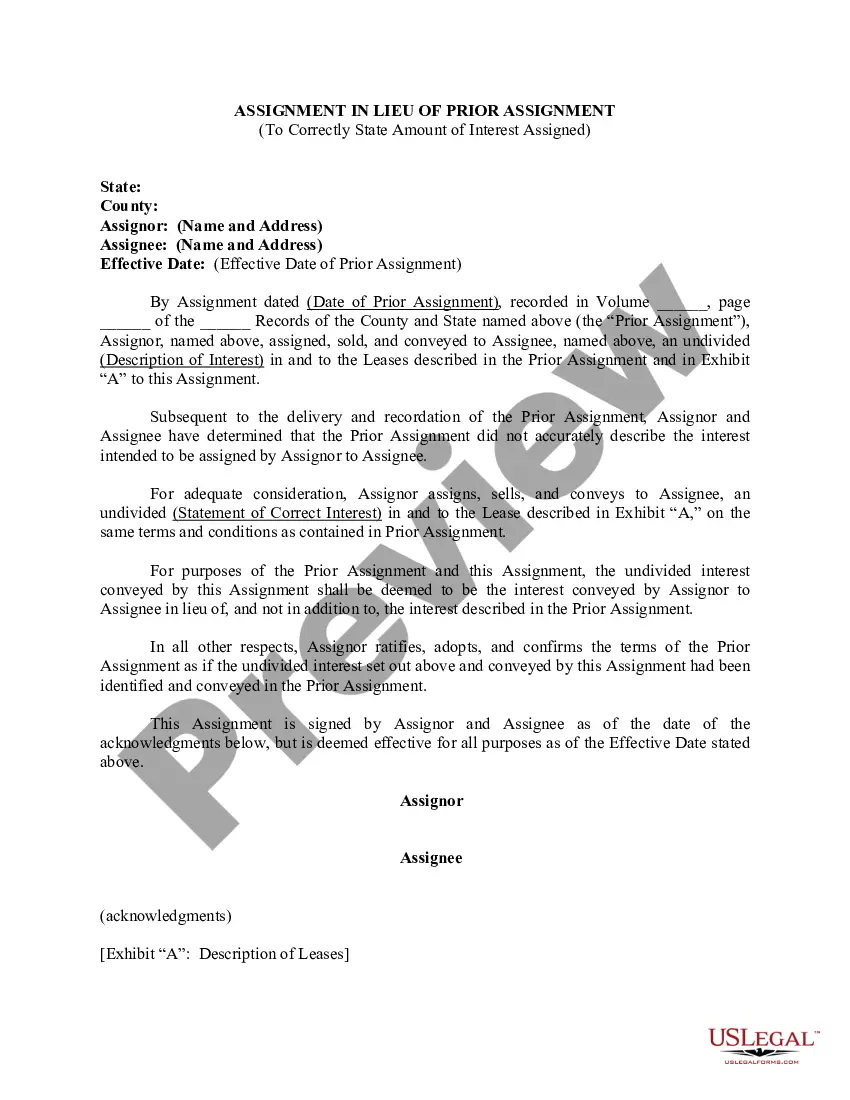

Nebraska Assignment in Lieu of Prior Assignment to Correctly State Amount of Interest Assigned

Description

How to fill out Assignment In Lieu Of Prior Assignment To Correctly State Amount Of Interest Assigned?

Are you inside a position that you need to have documents for both organization or person purposes nearly every time? There are a variety of legitimate file themes available online, but getting kinds you can rely isn`t easy. US Legal Forms offers a large number of form themes, like the Nebraska Assignment in Lieu of Prior Assignment to Correctly State Amount of Interest Assigned, that happen to be composed to satisfy federal and state requirements.

In case you are presently informed about US Legal Forms internet site and get a merchant account, merely log in. Following that, you are able to obtain the Nebraska Assignment in Lieu of Prior Assignment to Correctly State Amount of Interest Assigned template.

Unless you have an profile and would like to start using US Legal Forms, adopt these measures:

- Get the form you require and ensure it is for that proper area/area.

- Use the Preview button to check the shape.

- Browse the outline to actually have chosen the right form.

- If the form isn`t what you are trying to find, utilize the Look for field to get the form that fits your needs and requirements.

- If you obtain the proper form, click on Buy now.

- Opt for the costs prepare you want, complete the desired info to create your money, and pay for the order making use of your PayPal or credit card.

- Pick a convenient data file file format and obtain your backup.

Find all the file themes you possess bought in the My Forms food selection. You can get a additional backup of Nebraska Assignment in Lieu of Prior Assignment to Correctly State Amount of Interest Assigned any time, if required. Just select the needed form to obtain or printing the file template.

Use US Legal Forms, by far the most considerable selection of legitimate varieties, to conserve efforts and steer clear of blunders. The support offers professionally manufactured legitimate file themes that you can use for a range of purposes. Produce a merchant account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

Spouse Income - Military Spouses Residency Relief Act (MSRRA) The MSRRA allows military spouses who reside with their service member spouse stationed in a nonresident state on military orders to keep their resident state for tax purposes.

?And then through the process, after a period of time, if those taxes still haven't been paid, then they can claim the property.? In Nebraska, whoever pays your unpaid property tax bill can file a deed to the home if you don't pay within three years and nine months.

Nebraska allows a subtraction from income for Tier I and Tier II Benefits as well as Railroad Benefits. You will be taxed on any other retirement income received.

Nebraska ended state taxes on military retirement income in 2022, when Ricketts was governor.

Military retirement pay based on age or length of service is considered taxable income for Federal income taxes. However, military disability retirement pay and Veterans' benefits, including service-connected disability pension payments, may be partially or fully excluded from taxable income.

Military retirement benefits are excluded from Nebraska taxable income for tax years beginning on or after January 1, 2022.

That's because Nebraska law institutes a waiting period, called a ?redemption? period (3 years). During this time, the owner is legally able to pay off the debt and reclaim the property. The Certificate of Purchase merely acts as evidence of the investor's interest in the property during the redemption period.

Nine states tax military retirement benefits, but only partially. These states include Colorado, Delaware, Idaho, Kentucky, Maryland, New Mexico, Oregon, South Carolina, and West Virginia. The District of Columbia also taxes military benefits partially.