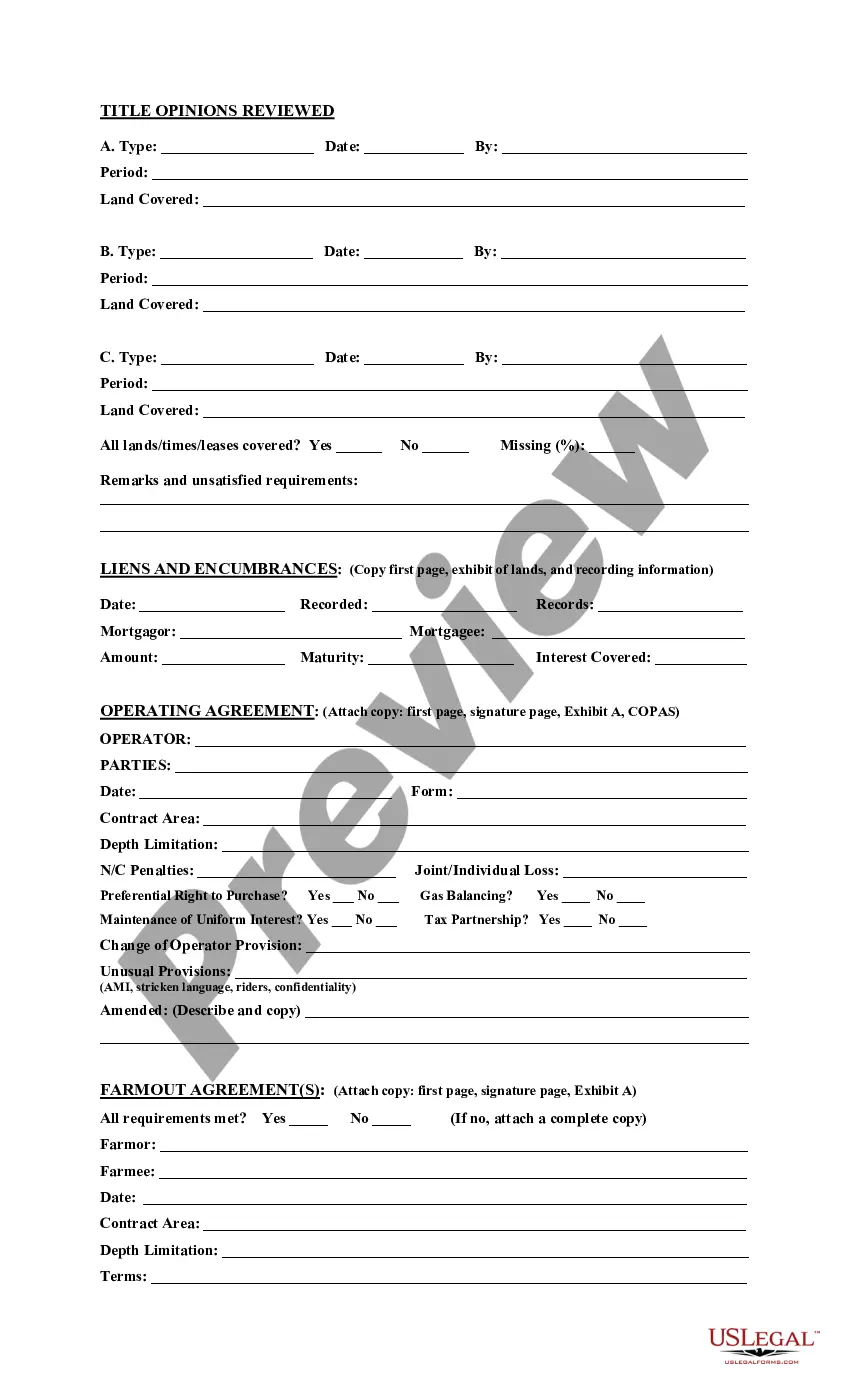

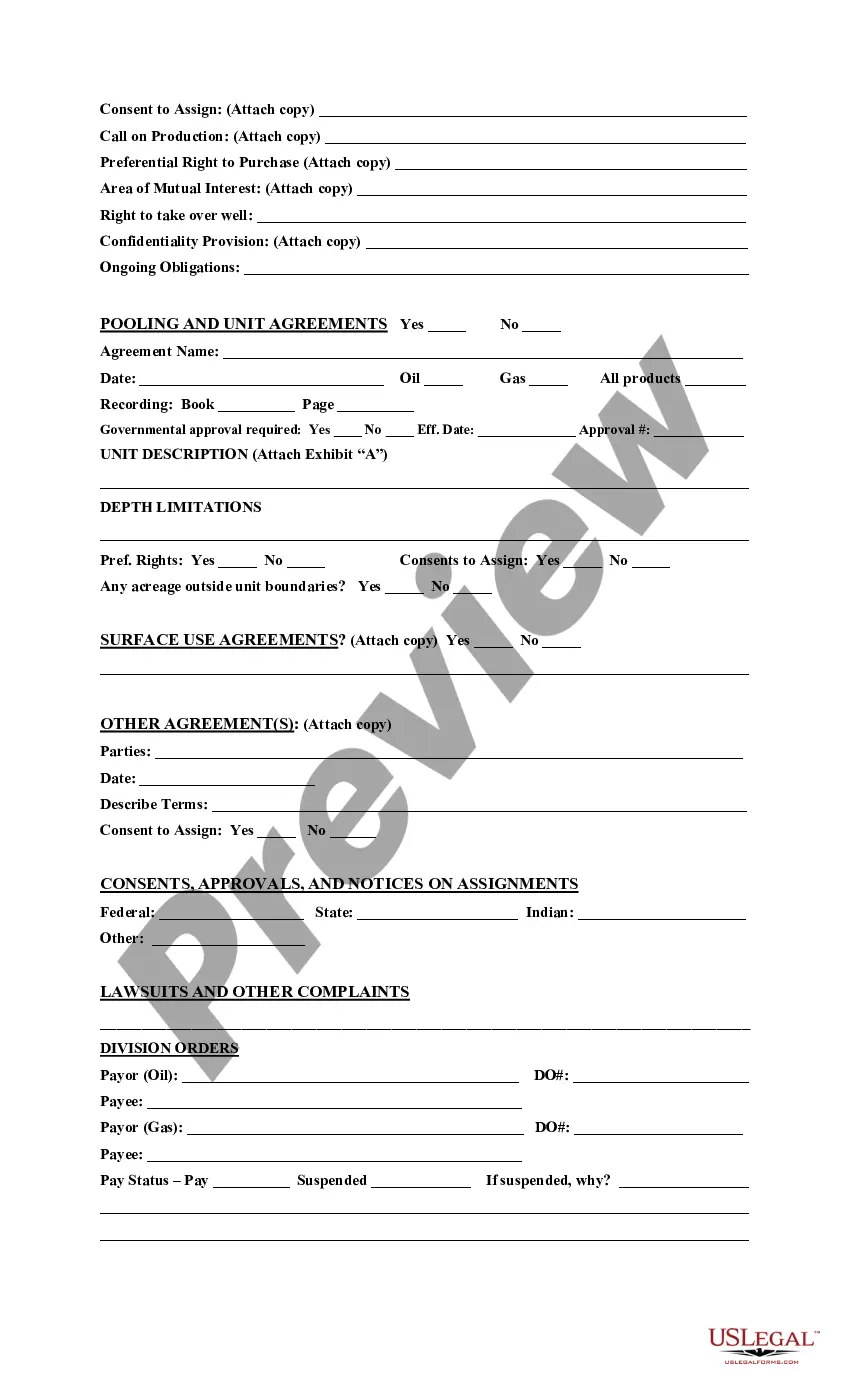

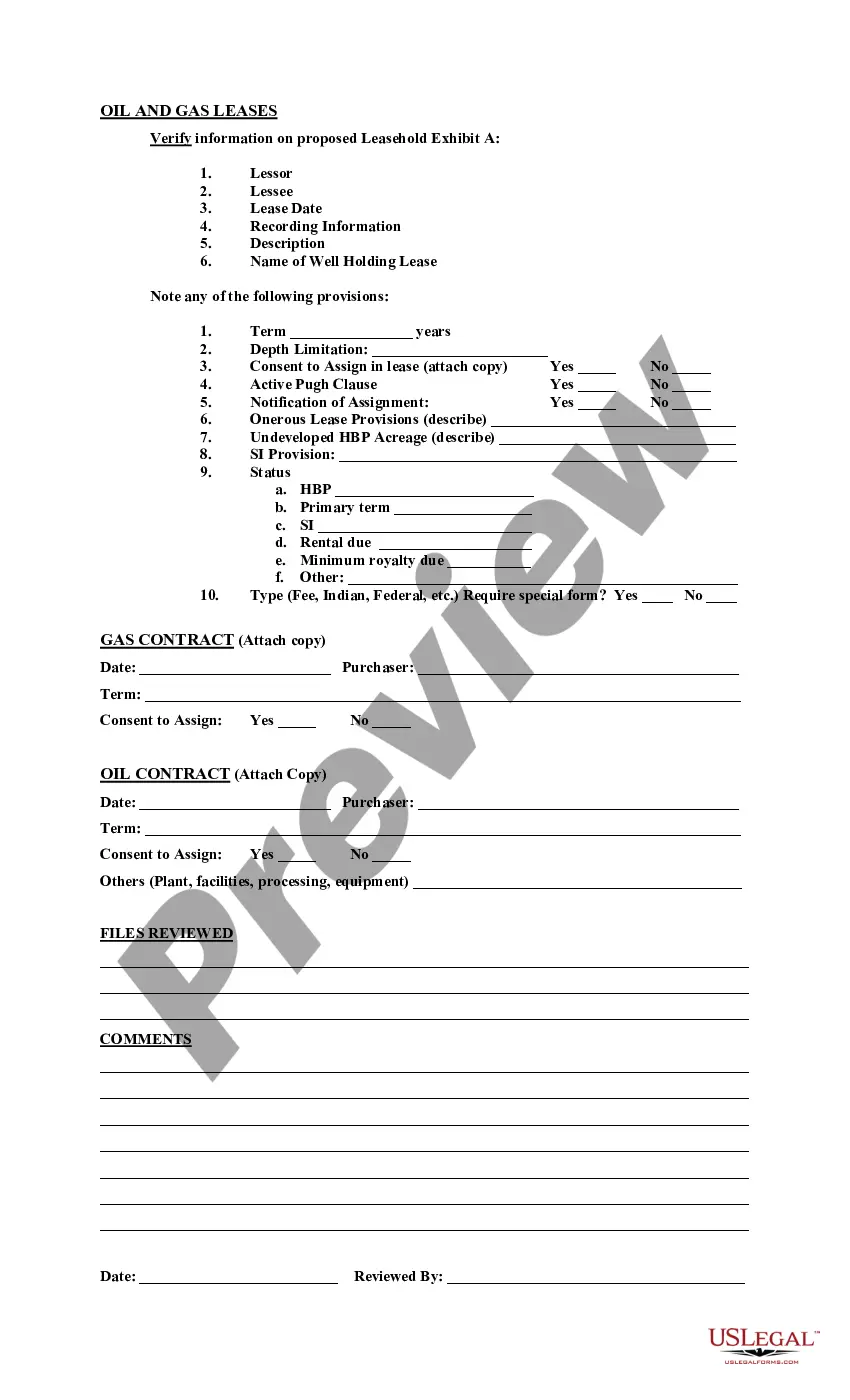

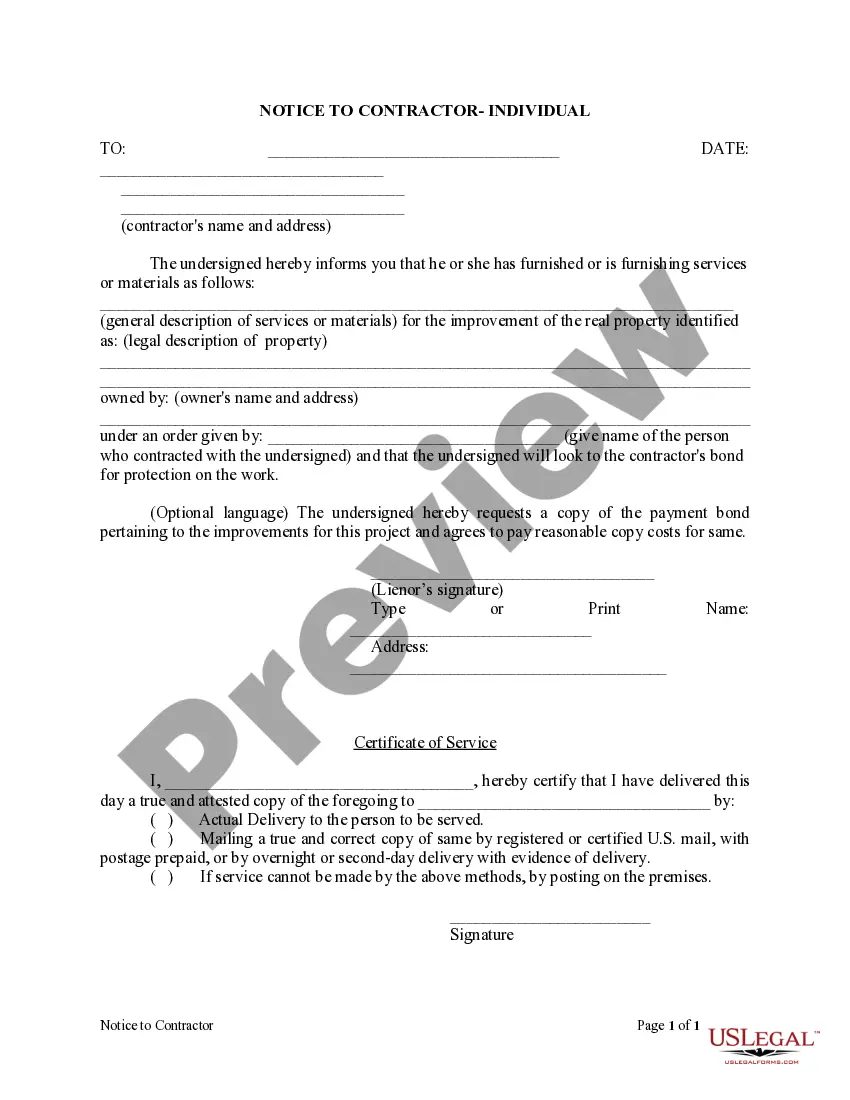

Nebraska Acquisition Due Diligence Report

Description

How to fill out Acquisition Due Diligence Report?

US Legal Forms - one of several biggest libraries of legitimate types in the USA - delivers a wide array of legitimate record templates you may acquire or print. While using website, you can get a large number of types for enterprise and specific reasons, categorized by categories, states, or keywords.You can find the most recent types of types like the Nebraska Acquisition Due Diligence Report in seconds.

If you have a registration, log in and acquire Nebraska Acquisition Due Diligence Report in the US Legal Forms library. The Obtain button will appear on each form you see. You have accessibility to all in the past downloaded types inside the My Forms tab of your respective bank account.

If you would like use US Legal Forms for the first time, allow me to share basic guidelines to help you get began:

- Ensure you have picked out the proper form to your town/region. Click the Preview button to check the form`s articles. Read the form description to actually have selected the proper form.

- In the event the form doesn`t fit your requirements, take advantage of the Search discipline on top of the screen to find the one that does.

- In case you are content with the form, confirm your option by clicking on the Purchase now button. Then, opt for the costs plan you want and give your references to sign up on an bank account.

- Method the transaction. Make use of your bank card or PayPal bank account to complete the transaction.

- Choose the structure and acquire the form on your gadget.

- Make alterations. Complete, change and print and signal the downloaded Nebraska Acquisition Due Diligence Report.

Each design you included in your money lacks an expiration date and it is your own property for a long time. So, if you want to acquire or print one more version, just visit the My Forms area and click on the form you want.

Gain access to the Nebraska Acquisition Due Diligence Report with US Legal Forms, the most considerable library of legitimate record templates. Use a large number of skilled and condition-specific templates that meet your business or specific requires and requirements.

Form popularity

FAQ

Legal due diligence is the process of collecting and assessing all of the legal documents and information relating to the target company. It gives both the buyer and seller the chance to scrutinize any legal risks, such as lawsuits or intellectual property details, before closing the deal.

Corporate mergers and acquisitions can vary considerably in the time they take to be completed. This length of time may span from six months to several years. There are a number of individual steps that need to be completed successfully by two public companies before they are legally combined into a single entity.

Due diligence needs to be conducted before any contracts are signed to ensure you have a full picture of what you are purchasing. The process can take a week to several months, depending on the scale and complexity of the purchase and how long it takes to obtain and review the information about the business.

A typical due diligence period runs between 30-90 days, however, some more complex transactions can have due diligence periods that greatly exceed that time frame. During that window there are often required time frames for specific contingency items dictated by state law or negotiated between the parties.

Timeline and Costs for the Due Diligence Process A typical due diligence process typically takes between 4 and 20 weeks, with an imperfectly positive correlation between due diligence time and transaction size. In terms of costs, the best way to reduce costs is to invest in a virtual data room.

Who Creates a Due Diligence Report? There can often be many groups involved in preparing the due diligence document. Companies may carry out the analysis internally with their corporate development team, or they may hire external advisers like investment bankers or the Due Diligence Team at an accounting firm.

There are quantitative and qualitative aspects to diligence, and it can take anywhere from 6-12 weeks depending on the size and complexity of the business. While all processes are different, it certainly takes substantial time to gather information and respond to requests, all while you continue to run a business.

A due diligence report is key to finalizing an investment, merger, acquisition, or legal agreement. The due diligence report offers a comprehensive exploration and explanation of a property, a company's financial records, or a company's overall standing in the marketplace.