Nebraska Memorandum of Trust Agreement

Description

How to fill out Memorandum Of Trust Agreement?

Finding the right legitimate papers design could be a battle. Needless to say, there are tons of templates available online, but how will you discover the legitimate type you will need? Use the US Legal Forms site. The services offers a huge number of templates, for example the Nebraska Memorandum of Trust Agreement, which can be used for business and personal needs. Every one of the forms are checked by professionals and meet up with state and federal requirements.

When you are already listed, log in to the bank account and click on the Down load button to obtain the Nebraska Memorandum of Trust Agreement. Make use of bank account to look through the legitimate forms you might have acquired formerly. Visit the My Forms tab of your respective bank account and get yet another duplicate from the papers you will need.

When you are a whole new consumer of US Legal Forms, listed here are basic directions that you should adhere to:

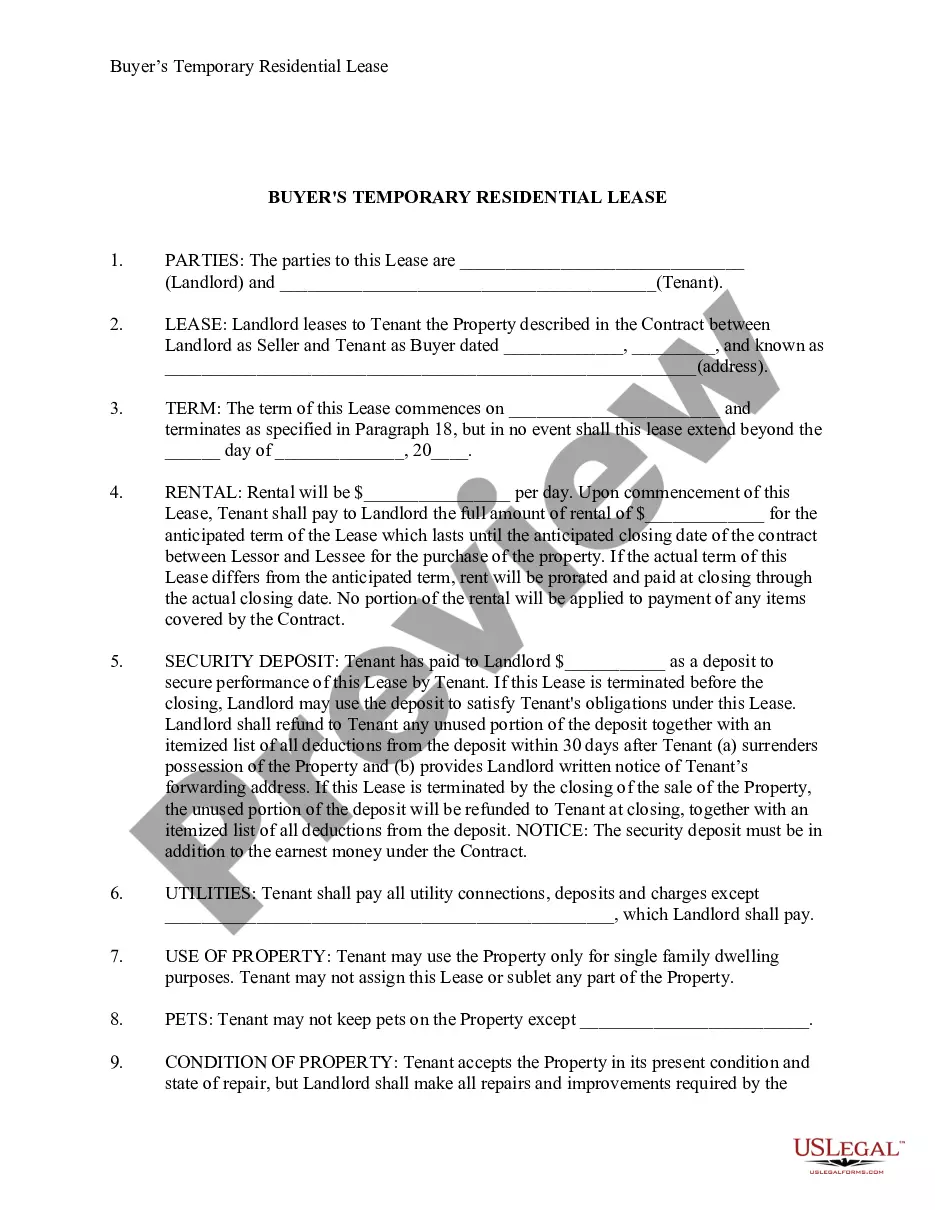

- First, make certain you have chosen the correct type for your personal area/county. You can check out the shape using the Preview button and study the shape outline to guarantee this is basically the right one for you.

- In the event the type is not going to meet up with your needs, make use of the Seach area to obtain the proper type.

- Once you are certain the shape is suitable, select the Acquire now button to obtain the type.

- Pick the pricing prepare you need and enter the needed information. Design your bank account and purchase the transaction making use of your PayPal bank account or credit card.

- Pick the file structure and acquire the legitimate papers design to the system.

- Complete, change and print and sign the received Nebraska Memorandum of Trust Agreement.

US Legal Forms will be the most significant collection of legitimate forms that you can find a variety of papers templates. Use the company to acquire expertly-created paperwork that adhere to express requirements.

Form popularity

FAQ

To complete the transfer, the deed must be recorded in the office of the Register of Deeds of the county where the property is located. All deeds also require a Form 521 - Real Estate Transfer Statement.

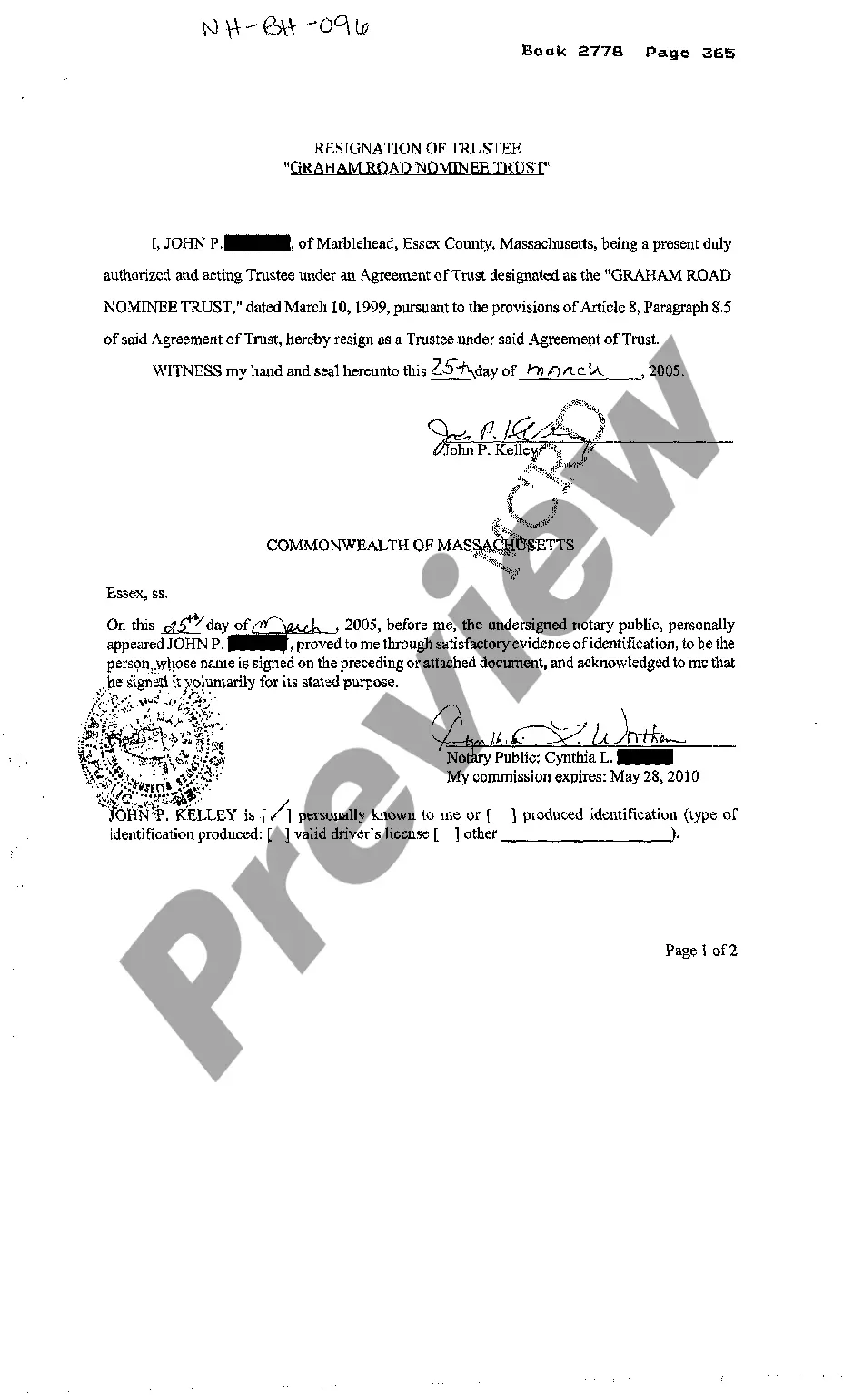

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

To make a living trust in Nebraska, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

How to Write a Nebraska Quitclaim Deed Preparers name and address. Name and mailing address of the party to whom the recorded deed should be sent. County where the real property is located. The consideration paid to the grantor (dollar amount should be written in words and numbers) Grantors name and address.

Creating a living trust in Nebraska is a two-step process. First you create and sign the trust document in front of a notary public. You complete the trust by transferring ownership of assets into it. This last step is essential.

Sign: Sign the trust agreement in front of a notary public. Transfer assets: Move assets into your trust by retitling them. You can do this yourself, but it's recommended that you do it with the help of a professional to make sure it's done correctly.

26. Summary of Living Trust Benefits Avoids probate at death, including multiple probates if you own property in other states. Prevents court control of assets at incapacity. Brings all of your assets together under one plan. Provides maximum privacy. Quicker distribution of assets to beneficiaries.

In Nebraska, the cost of setting up a basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts may cost even more.