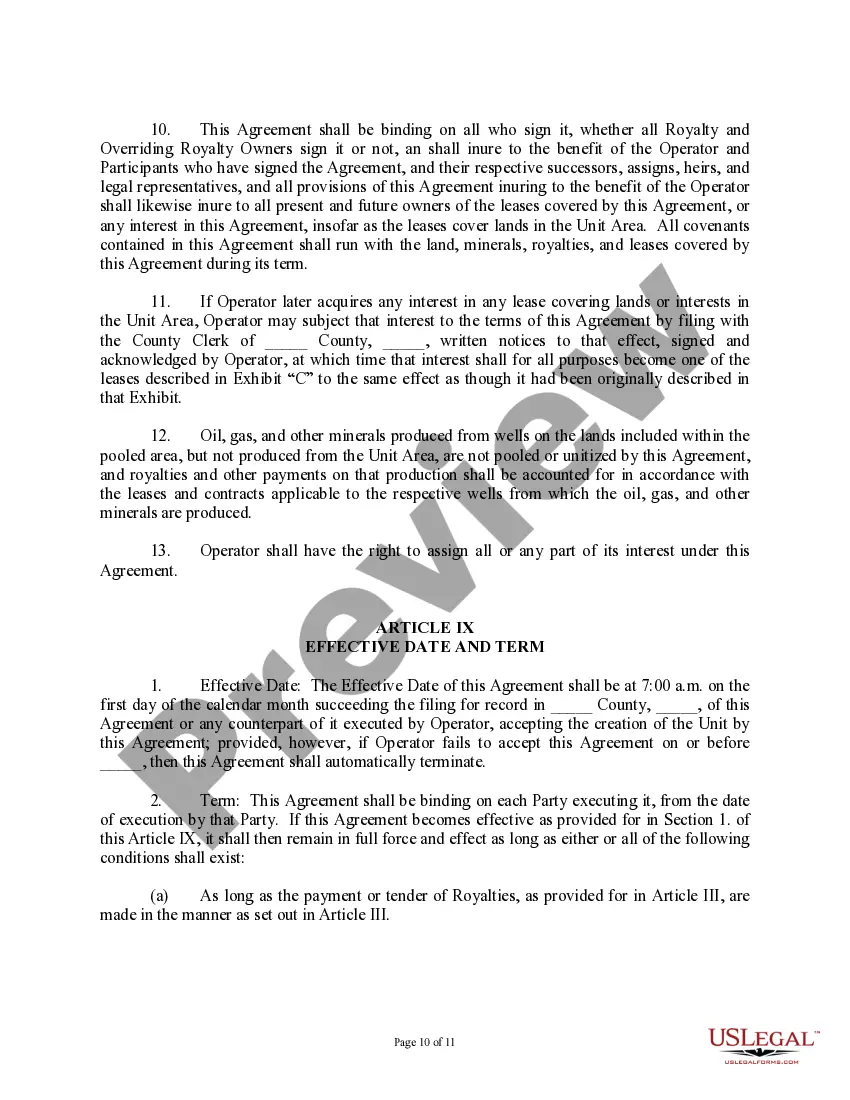

Nebraska Production and Storage Unit Agreement

Description

How to fill out Production And Storage Unit Agreement?

Discovering the right lawful papers format could be a have a problem. Needless to say, there are plenty of templates accessible on the Internet, but how will you obtain the lawful type you will need? Make use of the US Legal Forms web site. The assistance offers thousands of templates, for example the Nebraska Production and Storage Unit Agreement, which you can use for organization and private demands. All the forms are examined by specialists and fulfill federal and state demands.

If you are previously listed, log in for your accounts and click on the Obtain switch to get the Nebraska Production and Storage Unit Agreement. Use your accounts to check through the lawful forms you may have acquired previously. Visit the My Forms tab of the accounts and obtain an additional duplicate of the papers you will need.

If you are a whole new end user of US Legal Forms, listed here are easy guidelines for you to stick to:

- Initial, make sure you have chosen the appropriate type for your city/state. It is possible to examine the form making use of the Preview switch and browse the form outline to ensure it will be the right one for you.

- In the event the type fails to fulfill your needs, make use of the Seach area to find the proper type.

- Once you are certain that the form is suitable, click the Acquire now switch to get the type.

- Select the prices prepare you need and enter the essential details. Design your accounts and purchase your order using your PayPal accounts or Visa or Mastercard.

- Choose the document file format and down load the lawful papers format for your product.

- Full, edit and print out and indication the received Nebraska Production and Storage Unit Agreement.

US Legal Forms is the greatest collection of lawful forms for which you can discover various papers templates. Make use of the service to down load professionally-created documents that stick to status demands.

Form popularity

FAQ

All depreciable tangible personal property, used in a trade or business, with a life of more than one year is subject to net book personal property tax in Nebraska. Personal property must be reported annually to the county assessor and is based on the depreciated life of an asset.

Personal property is all property other than real property and franchises. Recovery Period. The recovery period is the federal Modified Accelerated Cost Recovery System (MACRS) recovery period over which the Nebraska adjusted basis of property will be depreciated for property tax purposes.

Nebraska Property Tax Rates The state of Nebraska is prohibited by law from levying property taxes.

A Nebraska month-to-month lease agreement is a real estate contract that allows a person to be able to occupy and lease property on a continuous basis which restarts every thirty (30) days upon the payment of rent.

Sales Tax¹ Nebraska sales tax is imposed upon the gross receipts from: all sales, leases, rentals, installation, application, and repair of tangible personal property; ? every person providing or installing utility services; retailers of intellectual or entertainment property; the sale of admissions, bundled ...

It is the Nebraska adjusted basis of the tangible personal property multiplied by the appropriate depreciation factor for the recovery period and year. The property tax is imposed on the net book value of tangible personal property.

The Personal Property Tax Relief Act allows for an exemption of the first $10,000 of value of taxable tangible personal property in each tax district in which a Personal Property Return is filed.