Nebraska Paint Removal And Cleaning Services Contract - Self-Employed

Description

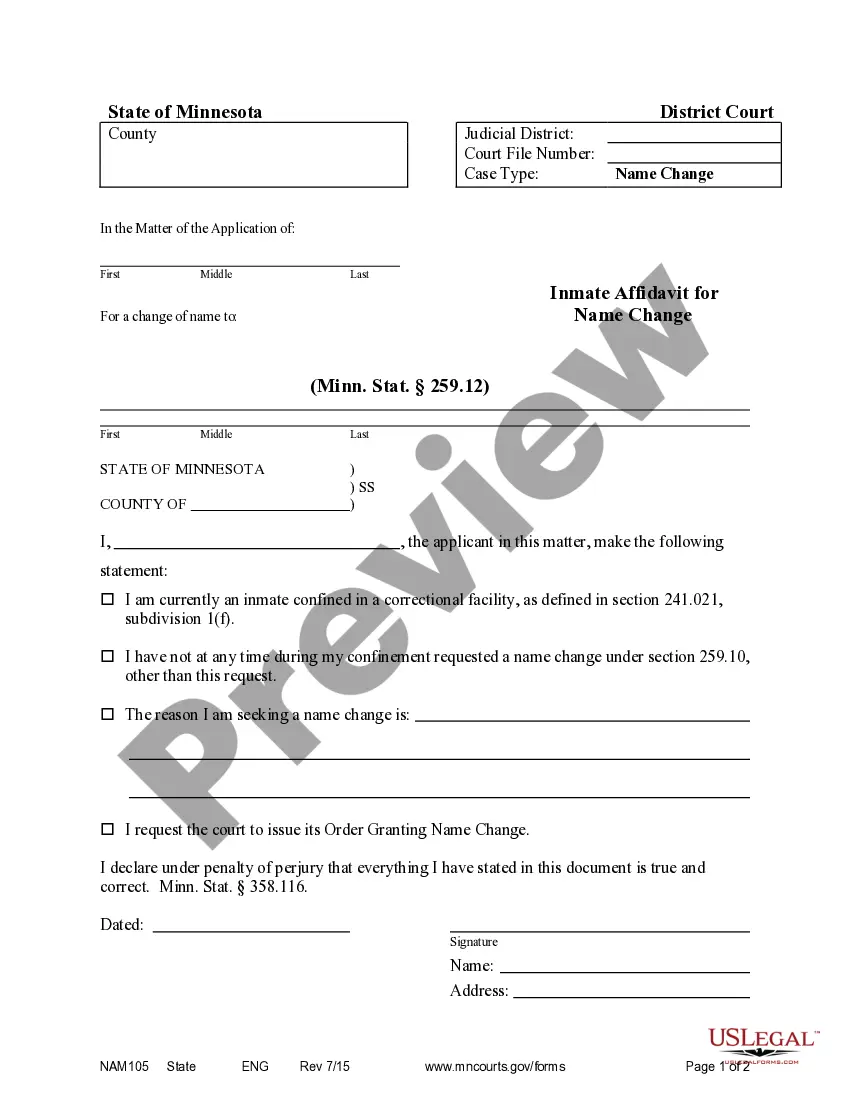

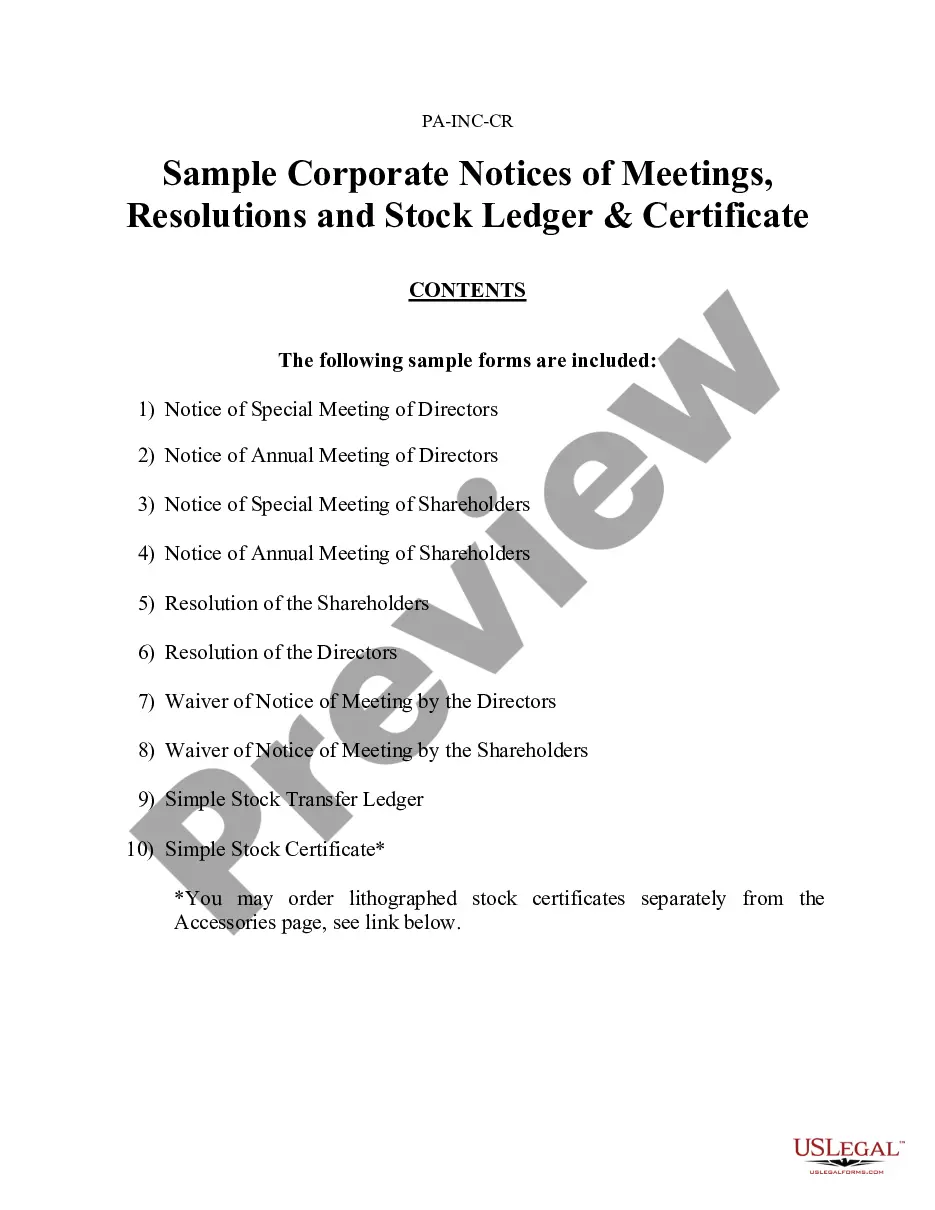

How to fill out Paint Removal And Cleaning Services Contract - Self-Employed?

If you require extensive, download, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's simple and user-friendly search to locate the documents you need.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you desire, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You may use your Visa or MasterCard or PayPal account to complete the transaction.

- Use US Legal Forms to find the Nebraska Paint Removal And Cleaning Services Contract - Self-Employed in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Nebraska Paint Removal And Cleaning Services Contract - Self-Employed.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Review option to examine the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the type, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

To secure a contract for your cleaning business, start by identifying potential clients and understanding their needs. Create a compelling proposal that includes your services and a Nebraska Paint Removal And Cleaning Services Contract - Self-Employed that outlines the terms clearly. Platforms like USLegalForms can assist you in drafting a legally sound contract tailored to your cleaning business.

Getting cleaning contracts often requires persistence and a strategic approach. It may involve bidding on jobs, networking, and establishing a strong online presence. Once you have a well-defined Nebraska Paint Removal And Cleaning Services Contract - Self-Employed, you'll attract more opportunities and reassure clients of your professionalism.

Acquiring cleaning clients can be challenging, but it is entirely achievable with the right strategies. Networking, online marketing, and leveraging local referrals can enhance your visibility. By presenting a professional Nebraska Paint Removal And Cleaning Services Contract - Self-Employed, you can inspire confidence in potential clients, making it easier to secure their business.

Contract law in Nebraska governs the agreements made between parties, ensuring that contracts are enforced legally. Key elements include the mutual consent of both parties, a lawful purpose, and a consideration. When creating your Nebraska Paint Removal And Cleaning Services Contract - Self-Employed, it’s important to adhere to these laws to avoid disputes and ensure a solid business foundation.

The 20 minute rule in cleaning suggests that you should break tasks down into 20-minute segments for effective cleaning sessions. This method helps maintain focus and makes daunting cleaning tasks manageable. Incorporating this rule can be beneficial when fulfilling obligations in a Nebraska Paint Removal And Cleaning Services Contract - Self-Employed, ensuring efficiency and satisfaction.

To qualify as an independent contractor in Nebraska, you need to understand the criteria set by the IRS. This typically involves demonstrating that you control how you perform your work, you supply your own tools, and you offer your services to multiple clients. Additionally, developing a clear Nebraska Paint Removal And Cleaning Services Contract - Self-Employed can help establish your status and protect your work.

An Option 3 contractor in Nebraska is one who operates under a specific tier set by the state for contractors. This designation allows for varying degrees of licensing and regulatory exemptions. If you’re navigating the Nebraska Paint Removal And Cleaning Services Contract - Self-Employed, consider whether this designation applies to your work.

Yes, some cleaning services can be taxable in Nebraska. Typically, the taxation of your services hinges on the specifics of what cleaning is performed. Review your classification under the Nebraska Paint Removal And Cleaning Services Contract - Self-Employed to prepare for potential tax implications.

Service charges may be considered taxable in Nebraska, contingent upon the service type. If your charges are closely related to tangible goods or services, they might incur tax. Ensure that your Nebraska Paint Removal And Cleaning Services Contract - Self-Employed explicitly states your service charges to avoid confusion.

Cleaning fees can be taxable in Nebraska, depending on the nature of the service provided. Residential cleaning services, for example, may be subject to sales tax, while other specialized services might not. Always refer to your Nebraska Paint Removal And Cleaning Services Contract - Self-Employed for clarity on tax obligations.