Nebraska Window Contractor Agreement - Self-Employed

Description

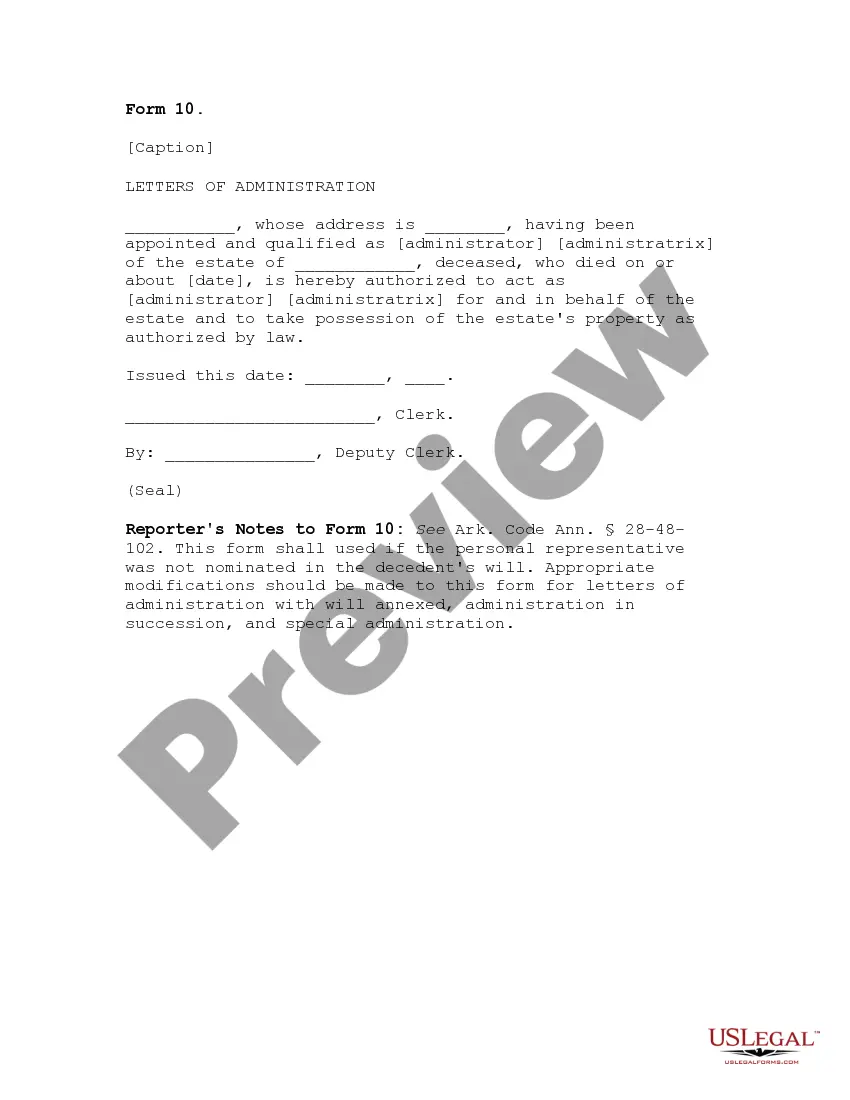

How to fill out Window Contractor Agreement - Self-Employed?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a vast selection of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Nebraska Window Contractor Agreement - Self-Employed in just minutes.

If you already hold a monthly subscription, Log In and retrieve the Nebraska Window Contractor Agreement - Self-Employed from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all previously obtained forms within the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to help you get started: Ensure you have selected the correct form for your city/state. Click the Review button to examine the form's content. Review the form details to confirm that you have chosen the correct document. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose your preferred pricing plan and provide your credentials to register for an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Download the format and obtain the form on your device. Make modifications. Complete, revise, print, and sign the acquired Nebraska Window Contractor Agreement - Self-Employed. Each template you add to your account has no expiration date and belongs to you indefinitely. Therefore, to obtain or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the Nebraska Window Contractor Agreement - Self-Employed with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that satisfy your business or personal requirements.

Form popularity

FAQ

When writing an independent contractor agreement, begin with a clear title and date of the agreement. Outline the scope of services, payment structure, and duration of the contract in straightforward language. Ensure you include necessary clauses about liability and dispute resolution. A well-structured Nebraska Window Contractor Agreement - Self-Employed will help protect your rights and interests effectively.

To fill out an independent contractor agreement, start by entering the names and contact details of both parties. Next, specify the work to be performed, deadlines, and payment details. Don’t forget to include sections that cover confidentiality and termination. Using a template from uslegalforms for a Nebraska Window Contractor Agreement - Self-Employed can simplify this process for you.

Filling out an independent contractor form requires you to provide your personal details, such as your name, address, and Social Security number. Additionally, clearly outline the scope of work, payment terms, and any other relevant information. Make sure your Nebraska Window Contractor Agreement - Self-Employed accurately reflects the intentions of both parties to promote transparency.

Typically, the hiring party drafts the independent contractor agreement, but both parties should review and agree on its terms. You can also utilize templates available on platforms like uslegalforms, which offer guidance specific to the Nebraska Window Contractor Agreement - Self-Employed. This collaboration ensures that both parties understand their rights and responsibilities.

To set up as a self-employed contractor, first, choose a business structure that suits your needs, such as a sole proprietorship or LLC. Next, register your business with the state of Nebraska and obtain any necessary permits or licenses. Lastly, you might want to draft a Nebraska Window Contractor Agreement - Self-Employed to outline your services and protect your interests.

Legal requirements for independent contractors vary by state but generally include registering your business and obtaining necessary licenses. You must also accurately report your earnings for tax purposes. Keeping distinct business records is essential for legal compliance. To protect your rights and provide clear expectations in your working relationship, consider utilizing a Nebraska Window Contractor Agreement - Self-Employed.

One key requirement to be classified as an independent contractor is the ability to control your own work. This includes deciding how, when, and where you will perform your tasks. By fostering this independence, you align with the criteria set for contractors under the law. To formalize this relationship, it's beneficial to use a Nebraska Window Contractor Agreement - Self-Employed to establish your status and responsibilities clearly.

Independent contractors must adhere to specific regulations and guidelines to maintain their status. These rules often include maintaining a degree of independence in how you execute your work. While you may need to follow certain client specifications, your overall management must remain autonomous. Having a comprehensive Nebraska Window Contractor Agreement - Self-Employed can provide clarity on your roles, responsibilities, and obligations outlined in your work.

Setting up as an independent contractor begins with obtaining the necessary licenses and permits for your field. You will also need to organize your business structure, such as whether you will operate as a sole proprietorship or LLC. A Nebraska Window Contractor Agreement - Self-Employed can help you define the terms and responsibilities of your role. Additionally, consider setting up a separate business bank account and bookkeeping system to manage your finances.

To be classified as an independent contractor, you must have control over how you complete your work. This means setting your own hours, choosing your own tools, and determining the methods you will use. You should also have a clear contract, such as a Nebraska Window Contractor Agreement - Self-Employed, that outlines the scope of your services. Lastly, your work should not be directed by someone else, as this is a core aspect of independent contracting.