Nebraska Acoustical Contractor Agreement - Self-Employed

Description

How to fill out Acoustical Contractor Agreement - Self-Employed?

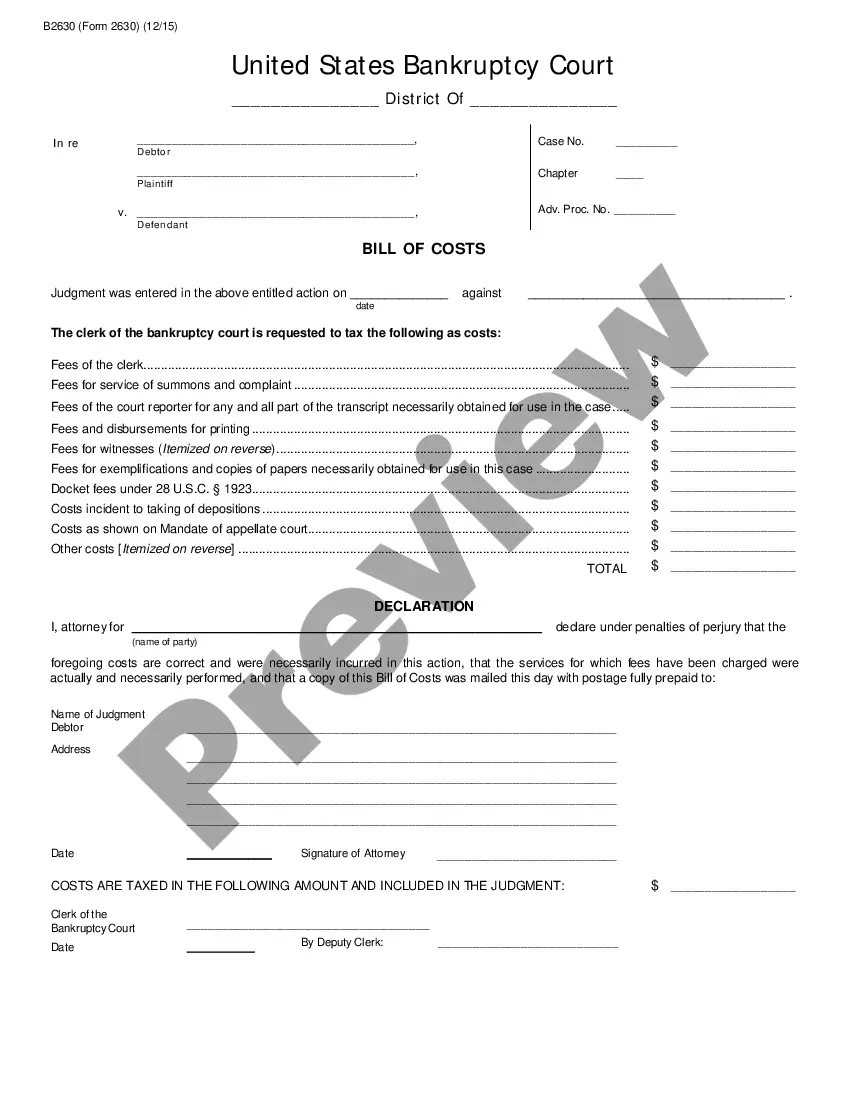

You can dedicate hours online trying to locate the valid document template that meets the state and federal criteria you need. US Legal Forms offers a vast array of valid forms that have been reviewed by professionals.

It is easy to obtain or print the Nebraska Acoustical Contractor Agreement - Self-Employed from the platform. If you already have a US Legal Forms account, you can Log In and click the Download button. Then, you can complete, modify, print, or sign the Nebraska Acoustical Contractor Agreement - Self-Employed. Every legal document template you purchase is yours indefinitely. To obtain another copy of the downloaded form, go to the My documents section and click the corresponding button.

If you are using the US Legal Forms site for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the region/area of your choice. Review the form description to confirm you have chosen the appropriate document. If available, use the Review button to examine the document template as well. If you want to find another version of the form, use the Search field to locate the template that fits your needs and specifications. Once you have found the template you want, click Get now to proceed. Choose the pricing plan you prefer, enter your credentials, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make modifications to the document if necessary. You can complete, alter, sign, and print the Nebraska Acoustical Contractor Agreement - Self-Employed. Download and print a multitude of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

Form popularity

FAQ

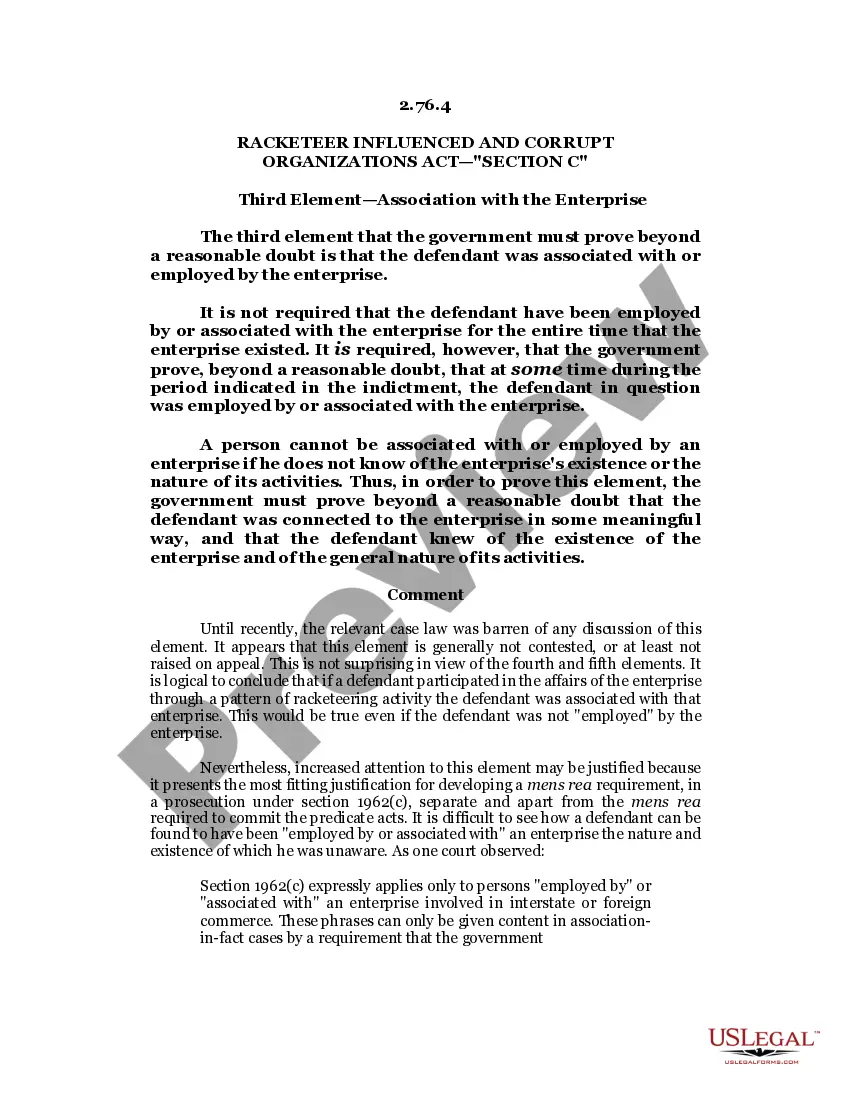

A person is considered self-employed if they run their own business and do not operate under the control of an employer. This includes independent contractors who provide services based on a contract, such as a Nebraska Acoustical Contractor Agreement - Self-Employed. To establish self-employment, you must regularly engage in business activities aimed at generating income.

The terms 'self-employed' and 'independent contractor' can often be used interchangeably, but they may carry different implications. Saying you are self-employed emphasizes your entrepreneurial spirit, while independent contractor highlights the contractual nature of your work. In the context of a Nebraska Acoustical Contractor Agreement - Self-Employed, either term can accurately describe your working status.

Indeed, independent contractors are regarded as self-employed individuals. They offer services under a contract and enjoy the flexibility that comes with self-employment. If you are navigating a Nebraska Acoustical Contractor Agreement - Self-Employed, it’s important to understand your rights and obligations as a self-employed contractor.

Yes, an independent contractor is typically classified as self-employed. This means they operate their own business without a traditional employer-employee relationship. When you enter into a Nebraska Acoustical Contractor Agreement - Self-Employed, you take on the role of a business owner responsible for your work and income.

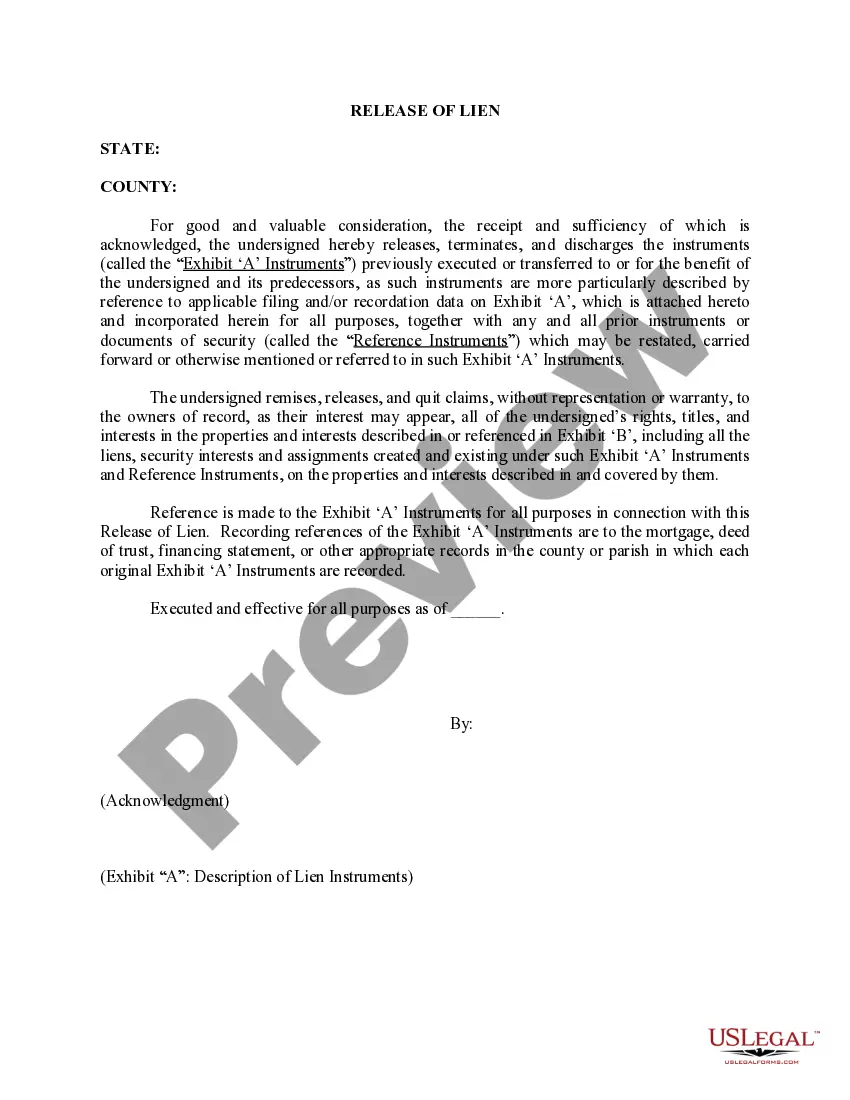

To write an effective independent contractor agreement, start by defining the scope of work, payment terms, and deadlines. Clearly outline the responsibilities of both parties, including any specific provisions related to a Nebraska Acoustical Contractor Agreement - Self-Employed. Utilizing platforms like uslegalforms can provide templates and guidance to ensure your contract covers all essential aspects.

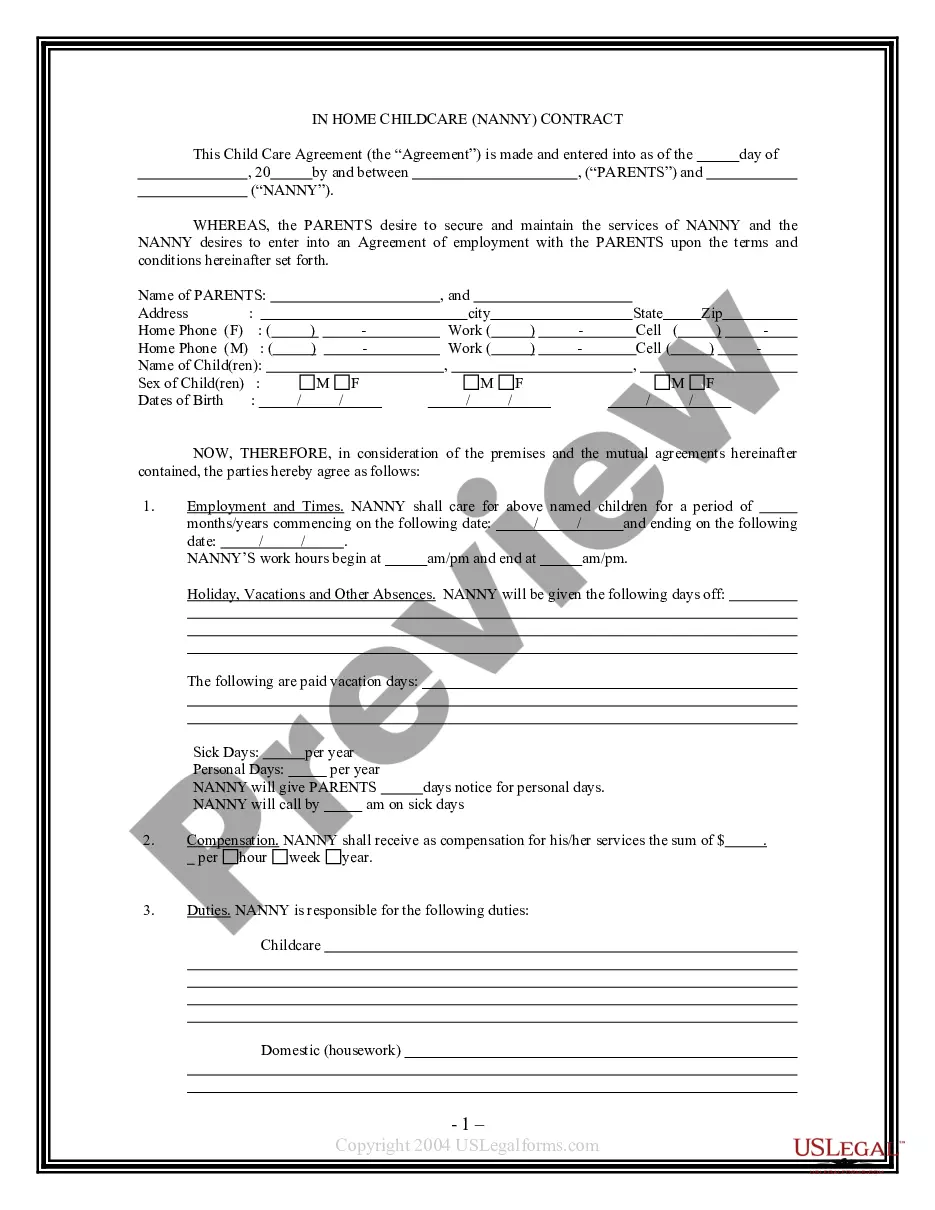

Yes, receiving a 1099 form indicates that you are working as an independent contractor and are considered self-employed. This means you are responsible for managing your own taxes and business expenses. When working under a Nebraska Acoustical Contractor Agreement - Self-Employed, you should ensure you keep thorough records of your earnings and expenses for tax purposes.

Writing a self-employment contract involves outlining the agreement clearly and concisely. Begin with a header that identifies both parties and states the agreement's purpose. Subsequently, detail the scope of work, payment terms, and responsibilities, making sure it aligns with the Nebraska Acoustical Contractor Agreement - Self-Employed standards for legal compliance.

To write a contract for a 1099 employee, focus on clearly defining the relationship and work expectations. Specify the services offered, payment structures, and project duration. Referring to the Nebraska Acoustical Contractor Agreement - Self-Employed can provide a useful guideline, ensuring that all necessary terms and conditions are included.

Yes, you can write your own legally binding contract as long as it meets certain criteria. Ensure that both parties agree on the terms and include essential elements like service descriptions and payment details. For a strong foundation, consider adopting the Nebraska Acoustical Contractor Agreement - Self-Employed format to ensure compliance with applicable laws.

Writing a self-employed contract requires clarity and precision. Start by identifying both parties, including their contact information. Incorporate specific details about the services provided, compensation, and deadlines. This approach will help create a comprehensive Nebraska Acoustical Contractor Agreement - Self-Employed that serves both parties effectively.