Nebraska Child Care or Day Care Services Contract - Self-Employed

Description

How to fill out Child Care Or Day Care Services Contract - Self-Employed?

You can spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of legal templates that are reviewed by experts.

You can easily download or print the Nebraska Child Care or Day Care Services Contract - Self-Employed through my help.

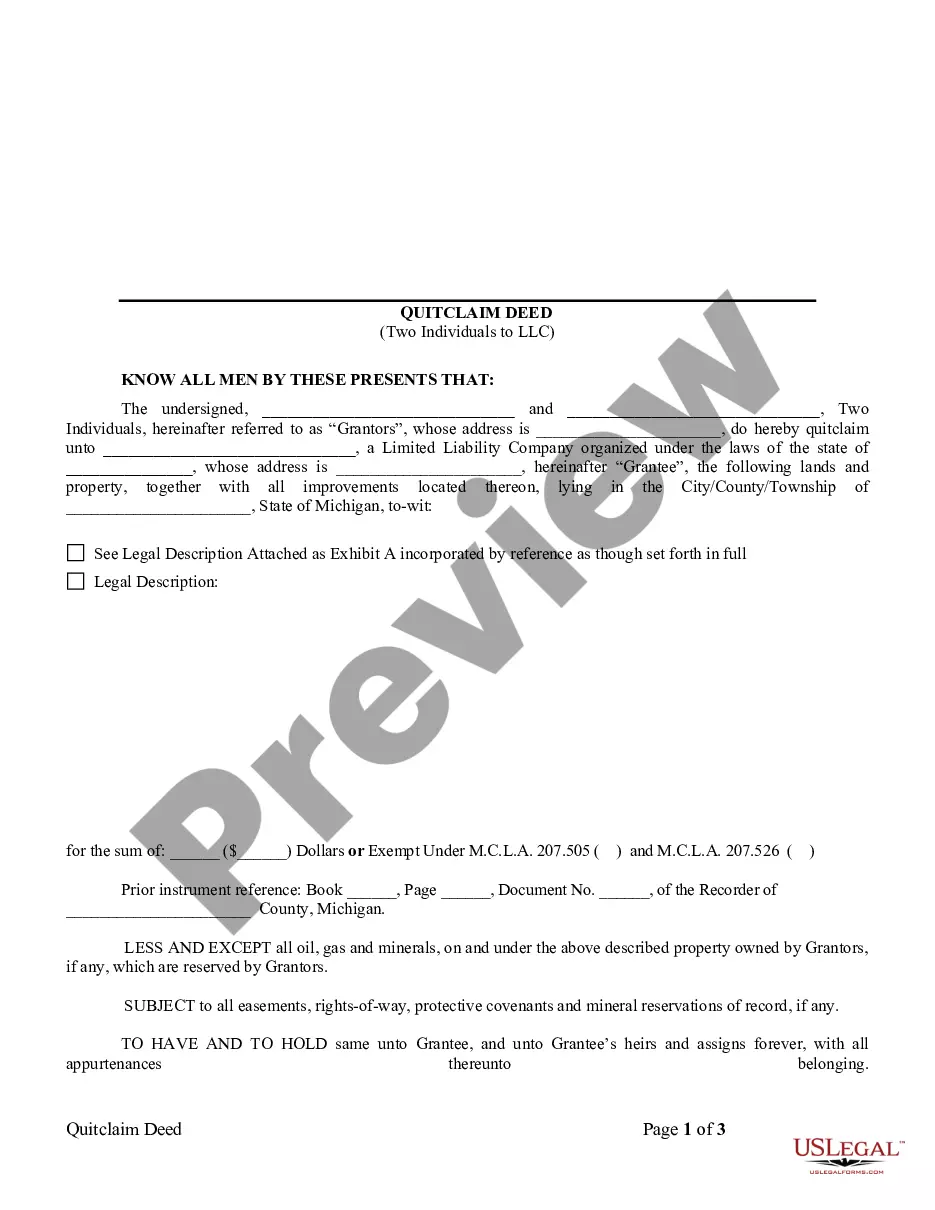

If available, utilize the Preview button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can fill out, modify, print, or sign the Nebraska Child Care or Day Care Services Contract - Self-Employed.

- Every legal document template you purchase is yours forever.

- To obtain another copy of the acquired form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Check the form description to confirm that you have chosen the right template.

Form popularity

FAQ

Yes, self-employed individuals can claim the child tax credit, provided they meet income requirements and other criteria. This credit can provide essential financial relief and encourage working parents. By leveraging a Nebraska Child Care or Day Care Services Contract - Self-Employed, you enhance your eligibility and optimize your financial situation. Consider using USLegalForms to guide you through the intricacies of this process.

The amount you can write off on taxes for child care varies depending on your income and the number of qualifying children. Generally, you can claim up to 35% of your child care costs, up to certain limits. For self-employed individuals, deducting these expenses under a Nebraska Child Care or Day Care Services Contract - Self-Employed can lead to significant tax savings, so keep detailed records of all relevant costs.

exempt organization for child care is typically a nonprofit that provides services without the goal of making a profit. These organizations often receive government funding to support families in need, allowing them to offer lower fees. Understanding the benefits of engaging with these organizations can enhance your experience in finding suitable Nebraska Child Care or Day Care Services Contract SelfEmployed.

Yes, self-employed individuals can write off certain child care expenses on their taxes. This applies when the child care enables you to work or look for work. To maximize your tax benefits, maintain thorough records of your expenses related to Nebraska Child Care or Day Care Services Contract - Self-Employed. Using platforms like USLegalForms can help you navigate these deductions effectively.

The maximum amount you can write off for childcare expenses varies based on your specific situation and the number of children you have. Generally, the limit is up to $3,000 for one child and $6,000 for two or more children. Keep in mind that these figures can change, so always verify your eligibility according to the latest IRS guidelines regarding the Nebraska Child Care or Day Care Services Contract - Self-Employed.

Daycare expenses can qualify as tax write-offs for self-employed individuals in Nebraska. This is part of the Child and Dependent Care Credit. To maximize your deductions, maintain clear records of all daycare-related expenses, making it easier to claim them in conjunction with your Nebraska Child Care or Day Care Services Contract - Self-Employed.

Yes, self-employed individuals can apply for child care subsidies, depending on their income and state guidelines. In Nebraska, programs are available to help offset daycare costs, even if you're self-employed. Check with local agencies to see if you’re eligible for these subsidies, which can significantly reduce your childcare expenses.

Self-employed individuals can write off daycare expenses under certain conditions. If your daycare costs allow you to work or seek employment, you may qualify for tax deductions. This is particularly beneficial if you are managing a Nebraska Child Care or Day Care Services Contract - Self-Employed. Always consult guidance from a tax advisor to ensure you're applying this correctly.

Yes, childcare expenses can be deductible for self-employed individuals under the Nebraska Child Care or Day Care Services Contract - Self-Employed. You can deduct child care costs if they are necessary for you to work or look for work. Make sure to keep detailed records of your expenses, as these will support your deduction claims on your tax return.

In Nebraska, the self-employment tax for individuals who have a Nebraska Child Care or Day Care Services Contract - Self-Employed is generally 15.3%. This covers Social Security and Medicare taxes. Therefore, it's essential to factor this tax into your earnings when you calculate your net income. Consult a tax professional to ensure you're meeting all your obligations accurately.