Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor

Description

How to fill out Cable Disconnect Service Contract - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

Utilizing the site, you can obtain numerous forms for business and personal needs, organized by categories, states, or keywords. You can access the latest versions of documents such as the Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor within moments.

If you already have a membership, Log In and retrieve the Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor from the US Legal Forms collection. The Acquire button will appear on each document you view. You have access to all previously obtained forms from the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the obtained Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor. Every template you have added to your account does not have an expiration date and belongs to you permanently. Therefore, if you wish to download or print an additional version, simply navigate to the My documents section and click on the document you need. Access the Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor with US Legal Forms, the most extensive library of legal document templates. Utilize a vast array of professional and state-specific templates that satisfy your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

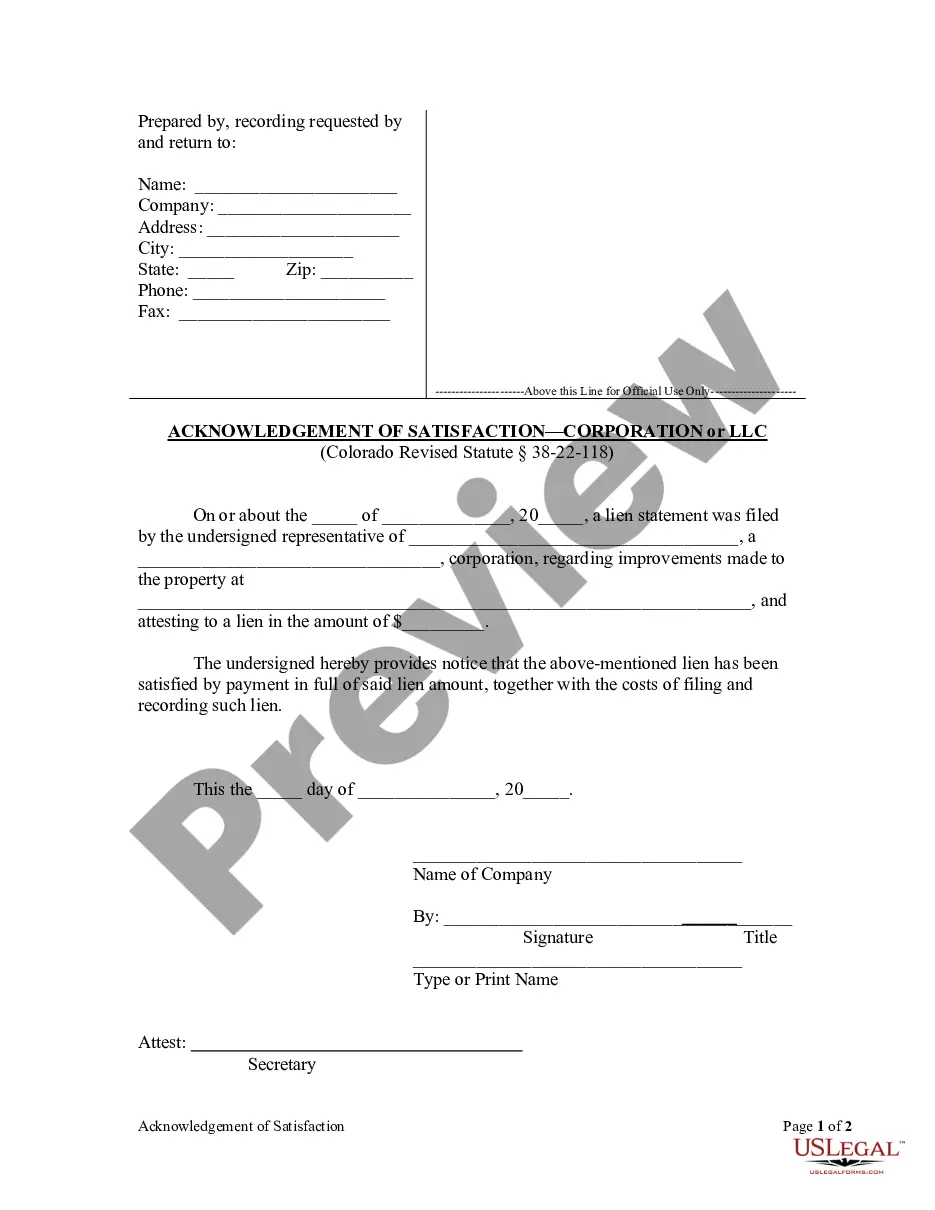

- Ensure you have selected the correct form for your city/county. Click the Preview button to review the form's content.

- Consult the form summary to confirm that you have selected the appropriate document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find a suitable one.

- If you are satisfied with the form, validate your selection by clicking the Purchase now button.

- Then, choose the pricing plan you want and provide your information to register for an account.

Form popularity

FAQ

As a self-employed independent contractor under a Nebraska Cable Disconnect Service Contract, you have specific rights that protect your work and income. You maintain the right to determine how you complete your tasks, as long as you meet the agreed-upon deadlines and deliverables. Additionally, you should receive fair compensation for your services and an understanding of the terms of your contract. Understanding these rights ensures you can operate confidently and effectively in your role.

Writing an independent contractor agreement involves outlining key components in a clear manner. Start with the contract title, date, and the parties' names, followed by a description of the services to be provided. Don't forget to include payment terms, project timelines, and termination clauses. By utilizing a Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor template from uslegalforms, you can ensure a comprehensive and enforceable agreement.

Filling out an independent contractor form requires gathering essential information before you begin. You'll need to provide your tax ID, contact details, and specifics about the services you will provide. Ensure you detail the payment structure and deadlines accurately. Using a Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor from uslegalforms can help streamline this process and ensure compliance with state regulations.

To fill out an independent contractor agreement, start by clearly defining both parties involved. Include your details as the self-employed individual and the client’s information. Next, specify the nature of the work and compensation terms. By using a Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor template from uslegalforms, you can simplify this process, ensuring nothing important gets overlooked.

Yes, you can absolutely have a contract if you're self-employed. In fact, a Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor is crucial for outlining your work terms and protecting your rights. A well-crafted contract helps establish clarity around payment, responsibilities, and deadlines. This document serves as a solid foundation for your professional relationships.

An independent service contract is an agreement between a service provider and a client. It outlines the responsibilities of both parties, including the scope of work and payment terms. In the context of the Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor, this type of contract ensures that service providers understand their obligations and rights. By using such contracts, you can protect yourself and establish clear expectations for your work.

Terminating a 1099 contract is not illegal, but it should be done in accordance with the terms of the contract. Ensure you follow any notice requirements stipulated in the agreement. Actively communicating with the contractor regarding your decision is crucial to avoid potential disputes. Using a clearly defined Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor protects both parties and clarifies termination procedures.

While it's not legally required to give two weeks' notice as an independent contractor, it is often viewed as a professional courtesy. Providing advance notice helps maintain positive work relationships and may lead to future opportunities. Always check your contract for specific notice requirements. Utilizing a Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor sets clear expectations for both parties regarding notice and termination.

In Nebraska, certain types of contractors need a license, depending on the nature of their work. Be sure to check the specific regulations applicable to your trade or industry. If licensure is required, it is essential to obtain the appropriate credentials to operate legally. Utilize resources from platforms like uslegalforms to acquire a Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor, ensuring you meet all legal requirements.

The new federal rule on independent contractors focuses on the classification of workers to ensure proper benefits and protections. This rule outlines criteria that distinguish employees from independent contractors, which affects how you manage your workforce. Understanding these changes is essential for compliance and playing an active role in workplace relationships. Keeping informed with resources like the Nebraska Cable Disconnect Service Contract - Self-Employed Independent Contractor can help you navigate these updates.