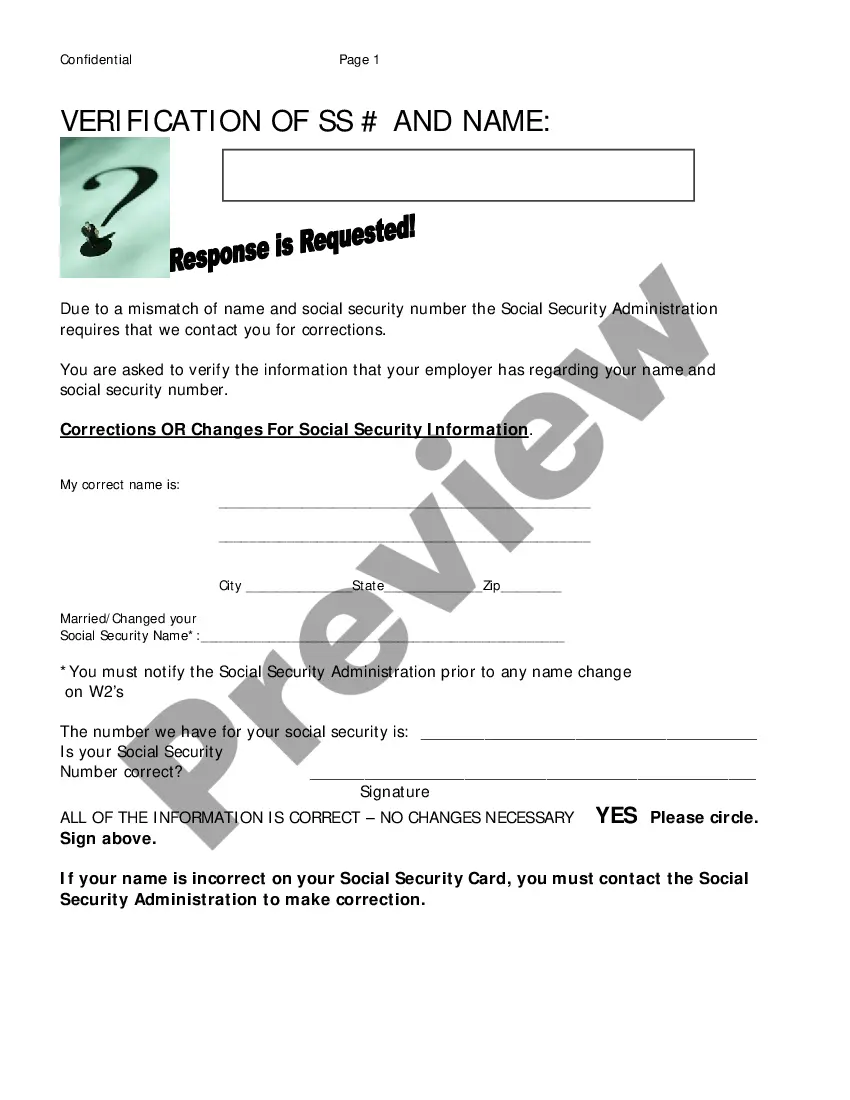

Nebraska Mismatched Social Security Number and Name Form

Description

How to fill out Mismatched Social Security Number And Name Form?

Have you been in the place that you will need files for either enterprise or person reasons virtually every time? There are tons of lawful document templates accessible on the Internet, but discovering versions you can depend on is not effortless. US Legal Forms gives 1000s of kind templates, just like the Nebraska Mismatched Social Security Number and Name Form, which can be published to meet state and federal needs.

When you are previously knowledgeable about US Legal Forms internet site and get an account, basically log in. After that, you may download the Nebraska Mismatched Social Security Number and Name Form design.

Should you not provide an bank account and wish to begin using US Legal Forms, adopt these measures:

- Discover the kind you require and make sure it is to the right city/state.

- Utilize the Review button to review the form.

- Browse the description to ensure that you have selected the appropriate kind.

- In the event the kind is not what you are searching for, make use of the Lookup field to find the kind that suits you and needs.

- If you discover the right kind, just click Acquire now.

- Pick the costs plan you would like, complete the required information and facts to make your bank account, and pay money for the order using your PayPal or Visa or Mastercard.

- Pick a hassle-free file structure and download your duplicate.

Locate all the document templates you have purchased in the My Forms menus. You can aquire a more duplicate of Nebraska Mismatched Social Security Number and Name Form whenever, if needed. Just select the essential kind to download or produce the document design.

Use US Legal Forms, probably the most extensive variety of lawful forms, to conserve efforts and prevent blunders. The service gives appropriately created lawful document templates that can be used for a selection of reasons. Make an account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

Nebraska's special capital gains exclusion was adopted in 1987 as part of the Employment and Investment Growth Act. This allows individual taxpayers to make a one-time election to exclude Nebraska income capital gains from the sale of the stock of a qualified corporation.

Paper returns must be mailed to the Nebraska Department of Revenue, PO Box 98923, Lincoln, NE 68509?8923. Retain a copy of this return for your records. Preidentified Return.

Nebraska Change of Address Request for Individual Income Tax Only, Form 22A, should be used for individual income tax name and address changes. When and Where to File. Mail to the Nebraska Department of Revenue, PO Box 98903, Lincoln, NE 68509-8903, or fax to 402-471-5927, prior to the change.

The Nebraska Department of Revenue announced Tuesday that the real property tax credit for tax year 2023 will amount to $220.76 for the owner of a $200,000 home, and $264.90 for the owner of $200,000 worth of farmland.

The Lincoln office is open from a.m. until p.m., Monday through Friday. For assistance at other times of the day, or to make an appointment, call 800?742?7474 (NE and IA) or 402?471?5729.

You can complete the current or previous tax year Nebraska State Income Tax Amendment with Form 1040XN and mail it in to file it. You can not submit it electronically. For a federal amendment the IRS requires a different Form - Form 1040X -to amend an IRS return (do not use Form 1040 for an IRS Amendment).