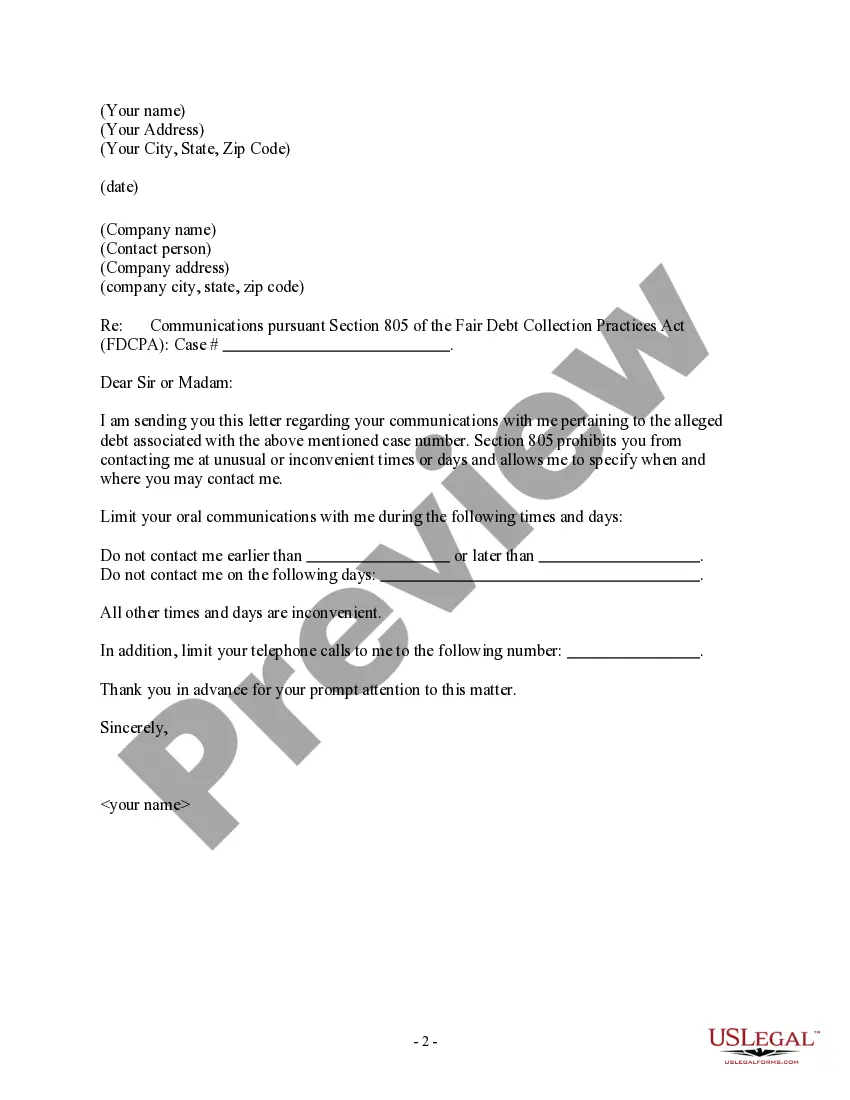

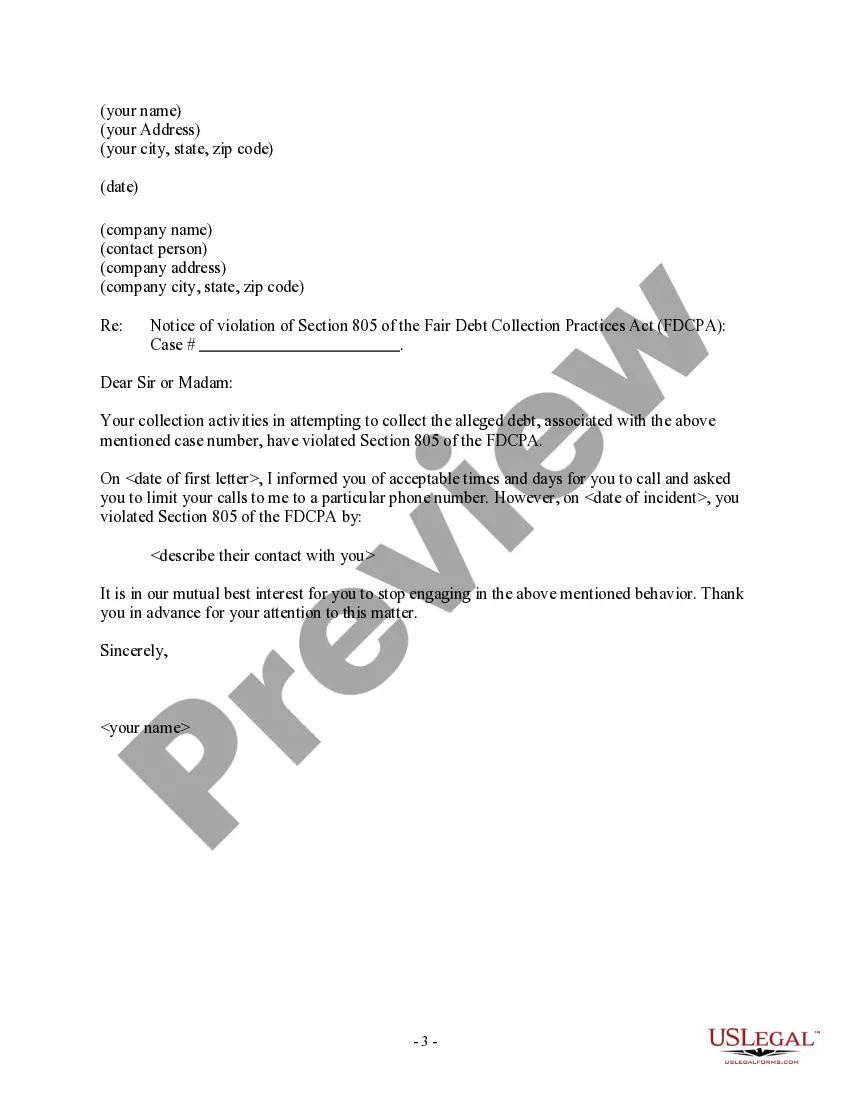

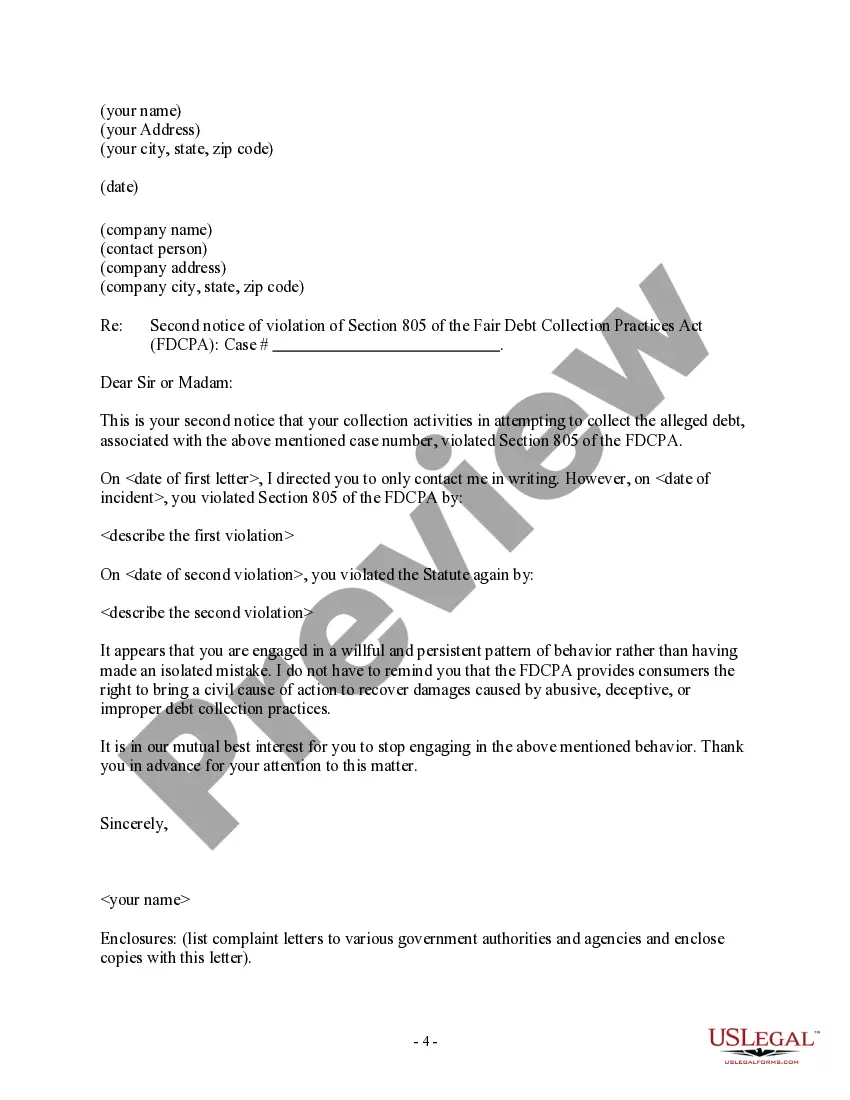

Nebraska Letter to Debt Collector - Only call me on the following days and times

Description

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

You might invest numerous hours online attempting to locate the official document template that satisfies the state and federal requirements you have.

US Legal Forms offers an extensive selection of official forms that are reviewed by specialists.

You can easily obtain or create the Nebraska Letter to Debt Collector - Only reach me on the specified days and times from the support.

First, ensure that you have selected the appropriate document template for the county/town of your choice.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can fill out, modify, create, or sign the Nebraska Letter to Debt Collector - Only reach me on the specified days and times.

- Every official document template you acquire is yours permanently.

- To get another copy of any purchased form, visit the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Old (Time-Barred) Debts In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

Debt collection agencies are not bailiffs; They have no extra-legal authority. Debt collectors are either acting on behalf of your creditor or working for a company that has taken on the debt. They don't have any special legal powers and can't do anything different than the original creditor.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

When it comes to consumer debt in the state of Nebraska, the statute of limitations 5 years from the last payment made. This means that a creditor or debt collector may not sue you for debt after five years have passed. If the agreement was verbal, then that number is reduced to 4 years in the state of Nebraska.

Plan and modify arrangements with them and the creditor. Organise a settlement offer with you that may make it easier to pay off the debt. Sell your debt to another company who will have the same arrangements and powers as the original creditor. Obtain an order from a court to repossess some of your property.

Limitations on debt collection by state The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

What debt collectors can doask for payment.offer to settle or make a payment plan.ask why you haven't met an agreed payment plan.review a payment plan after an agreed period.advise what will happen if you don't pay.repossess goods you owe money on, as long as they've been through the correct process.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Debt collectors have no special legal powers. You may feel under pressure to pay more than you can afford, but don't feel threatened. Find out more about the difference between debt collectors and bailiffs. Debt collectors may work for your creditor, or they may work for a separate debt collection agency.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.