Nebraska Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd.

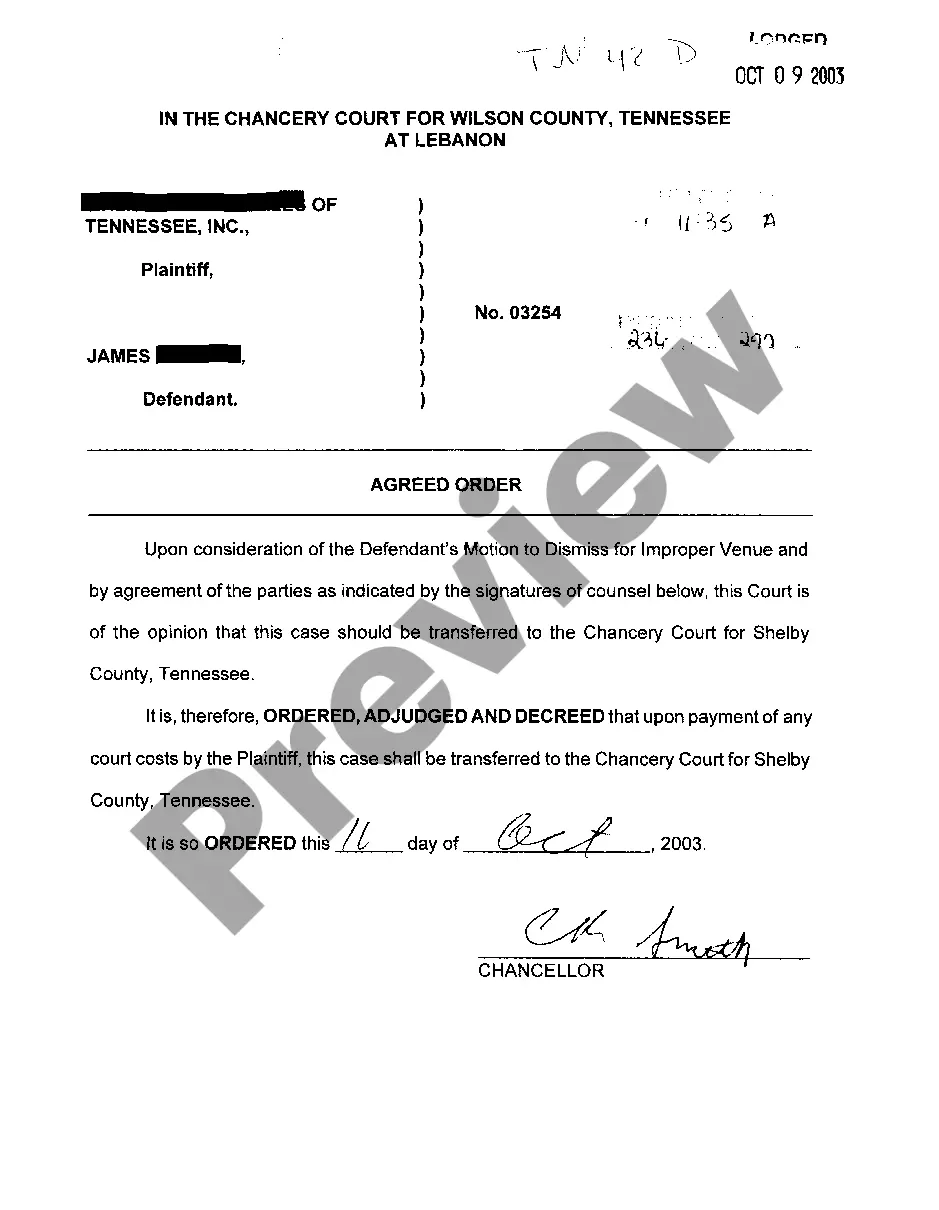

Description

How to fill out Form Of Security Agreement Between Everest And Jennings International, Ltd., Everest And Jennings, Inc., And BIL, Ltd.?

If you wish to total, down load, or produce lawful file layouts, use US Legal Forms, the largest collection of lawful types, which can be found on the web. Utilize the site`s basic and handy look for to get the papers you want. Different layouts for enterprise and specific functions are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to get the Nebraska Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd. within a few mouse clicks.

In case you are already a US Legal Forms client, log in to your profile and click on the Download key to have the Nebraska Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd.. You can even accessibility types you earlier delivered electronically inside the My Forms tab of your profile.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for that right town/nation.

- Step 2. Make use of the Preview choice to examine the form`s content material. Do not forget about to read through the explanation.

- Step 3. In case you are not happy with the develop, use the Search field at the top of the display to get other models of your lawful develop design.

- Step 4. Once you have discovered the shape you want, select the Buy now key. Select the rates program you choose and include your credentials to sign up to have an profile.

- Step 5. Approach the deal. You should use your charge card or PayPal profile to perform the deal.

- Step 6. Pick the format of your lawful develop and down load it on your system.

- Step 7. Total, change and produce or indicator the Nebraska Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd..

Every lawful file design you purchase is yours permanently. You might have acces to each and every develop you delivered electronically in your acccount. Click the My Forms section and select a develop to produce or down load again.

Remain competitive and down load, and produce the Nebraska Form of Security Agreement between Everest and Jennings International, Ltd., Everest and Jennings, Inc., and BIL, Ltd. with US Legal Forms. There are many specialist and express-distinct types you can utilize for your personal enterprise or specific requirements.