Nebraska Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan

Description

How to fill out Approval Of Grant Of Security Interest In All Of Assets To Secure Obligations Pursuant To Terms Of Informal Creditor Workout Plan?

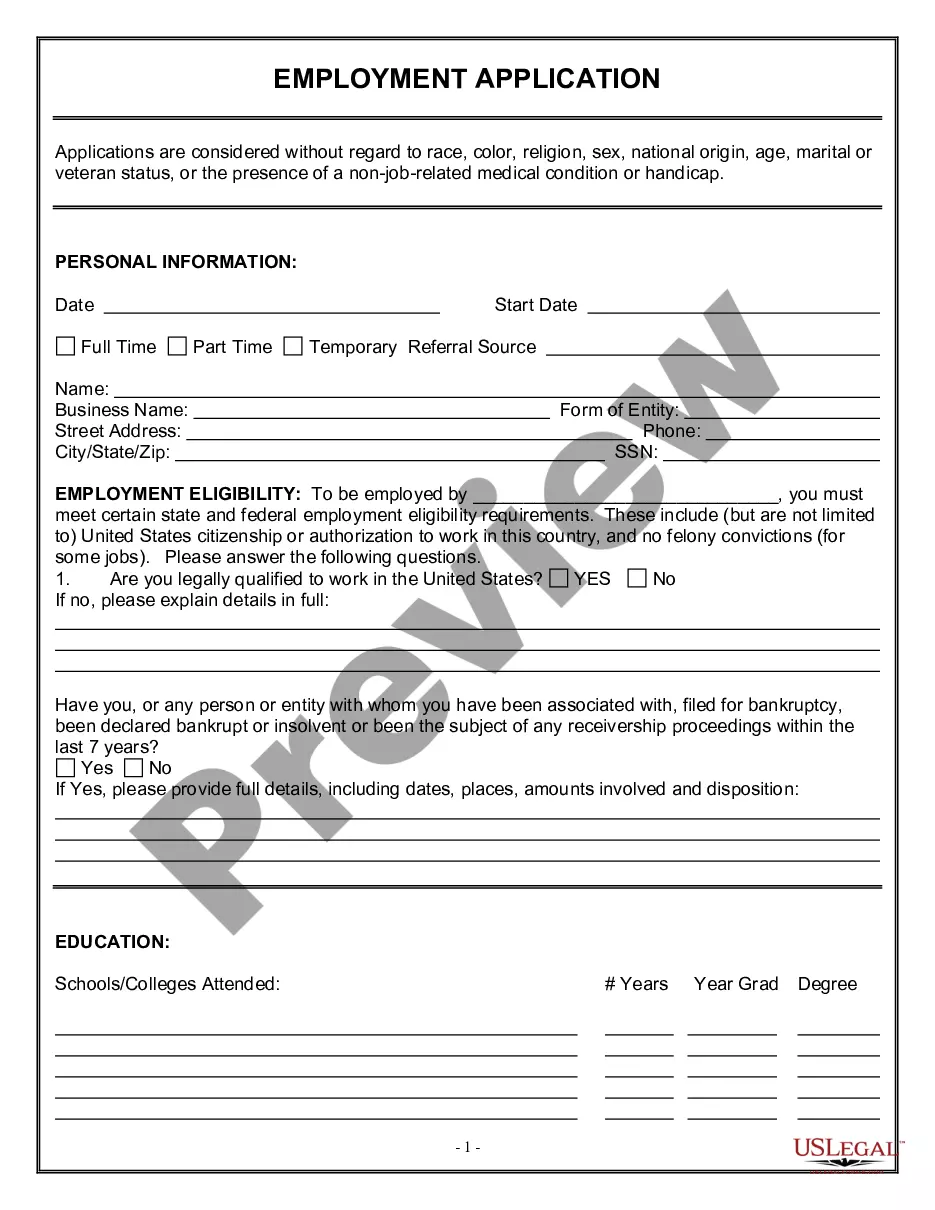

If you need to comprehensive, obtain, or printing lawful document layouts, use US Legal Forms, the biggest variety of lawful types, that can be found online. Use the site`s basic and handy look for to find the documents you want. Numerous layouts for business and person reasons are sorted by types and says, or keywords. Use US Legal Forms to find the Nebraska Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan in a handful of clicks.

When you are currently a US Legal Forms client, log in for your account and click on the Obtain option to obtain the Nebraska Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan. You can even entry types you previously downloaded inside the My Forms tab of your own account.

If you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form to the proper town/nation.

- Step 2. Take advantage of the Review solution to check out the form`s content. Never forget to learn the information.

- Step 3. When you are not happy with all the type, use the Search discipline near the top of the monitor to locate other variations from the lawful type web template.

- Step 4. Upon having discovered the form you want, click on the Acquire now option. Opt for the prices program you choose and put your credentials to register for an account.

- Step 5. Method the transaction. You can utilize your credit card or PayPal account to finish the transaction.

- Step 6. Select the file format from the lawful type and obtain it in your product.

- Step 7. Full, edit and printing or signal the Nebraska Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan.

Every lawful document web template you buy is yours for a long time. You may have acces to each type you downloaded inside your acccount. Go through the My Forms segment and decide on a type to printing or obtain again.

Remain competitive and obtain, and printing the Nebraska Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan with US Legal Forms. There are thousands of professional and status-distinct types you may use for your personal business or person needs.

Form popularity

FAQ

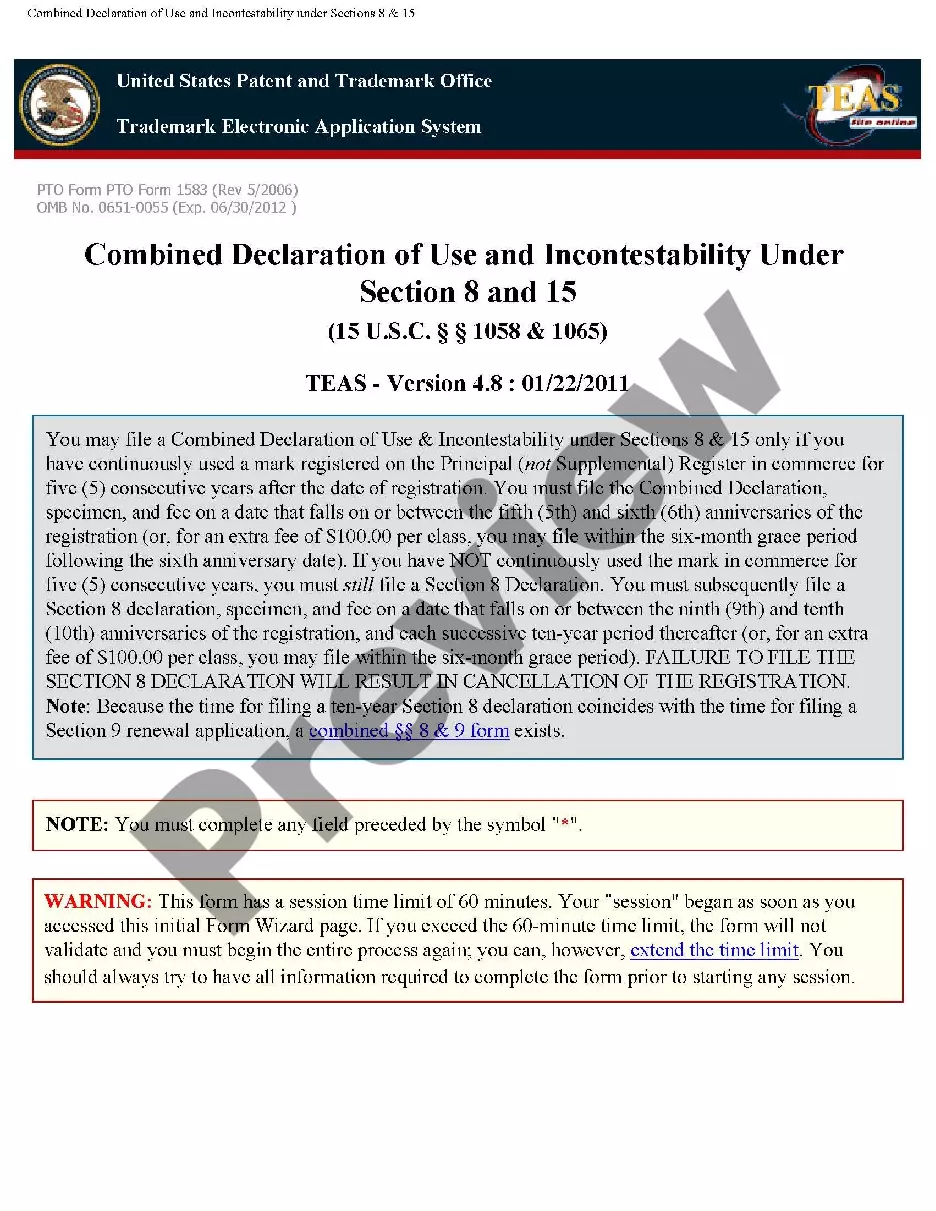

Secured Transaction Law: An Overview A security interest arises when, in exchange for a loan, a borrower agrees in a security agreement that the lender (the secured party) may take specified collateral owned by the borrower if he or she should default on the loan.

Security Interest: An interest in personal property or fixtures -- i.e., improvements to real property -- which secures payment or performance of an obligation. Security Agreement: An agreement creating or memorializing a security interest granted by a debtor to a secured party.

Attachment gives a creditor an enforceable security interest in collateral. To be valid, a financing statement does not need to contain a description of the collateral.

One of the most common examples of a security interest is a mortgage: a person borrows money from the bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan.

In general: (1) the creditor must give value, (2) the debtor must have rights in the collateral, and (3) there must be a security agreement or other action indicating an intent to convey a security interest. Once the security interest has ?attached,? it is effective between the debtor and the creditor.

Interest in someone else's property, created by contract or by law. A mortgage is one type of security interest created by contract. A garnishment is one type of security interest created by law. See Collateral and Secured transaction.

A security interest is retained in or taken by the seller of the collateral to secure part or all of its price. A security interest is taken by a person who, by making advances or incurring an obligation, gives something of value that enables the debtor to acquire the rights in the collateral or to use it.

A security interest is not enforceable unless it has attached. Attachment of a security interest generally requires a written security agreement, description of collateral, secured party's giving value, and the debtor having rights in collateral.