Nebraska Deferred Compensation Investment Account Plan

Description

How to fill out Deferred Compensation Investment Account Plan?

If you want to comprehensive, download, or printing legal record templates, use US Legal Forms, the biggest variety of legal kinds, which can be found on the web. Make use of the site`s basic and convenient lookup to obtain the paperwork you require. Various templates for enterprise and specific uses are sorted by categories and claims, or keywords and phrases. Use US Legal Forms to obtain the Nebraska Deferred Compensation Investment Account Plan in just a couple of mouse clicks.

If you are previously a US Legal Forms consumer, log in in your account and click the Obtain option to have the Nebraska Deferred Compensation Investment Account Plan. Also you can access kinds you in the past delivered electronically from the My Forms tab of your respective account.

Should you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape to the right metropolis/region.

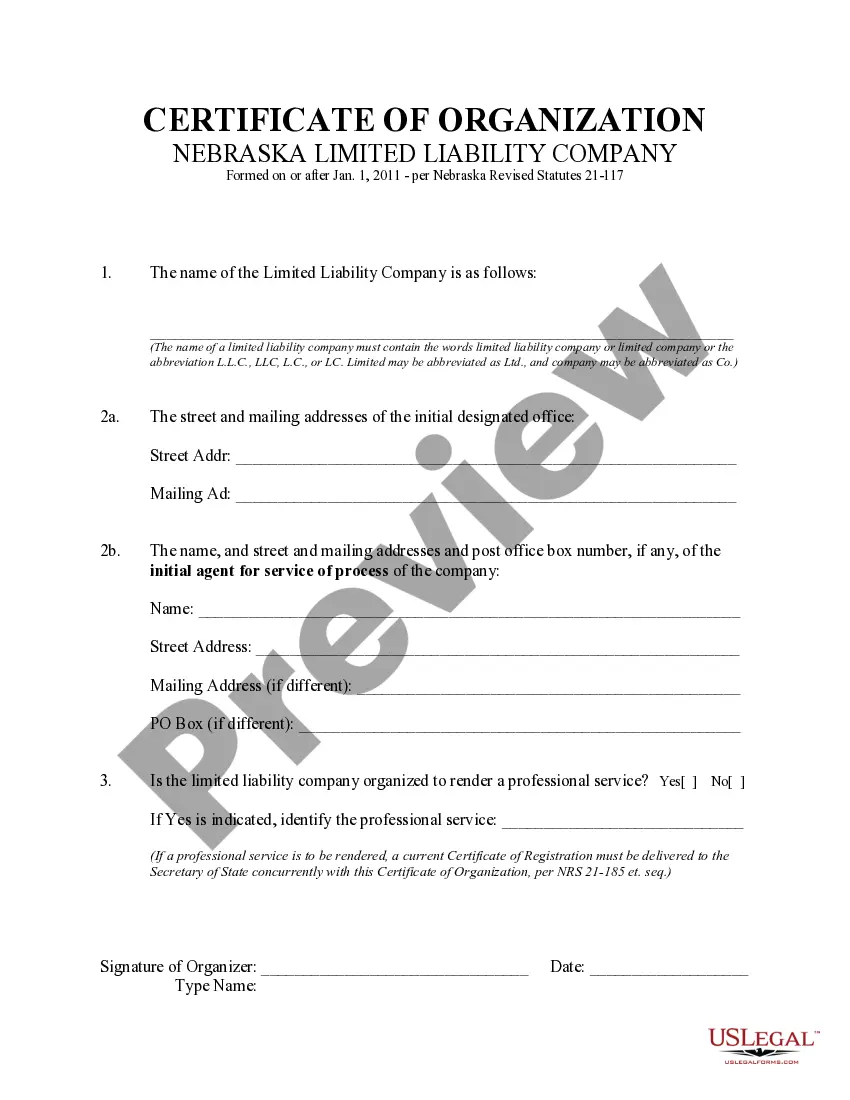

- Step 2. Use the Preview option to look over the form`s information. Don`t overlook to read the description.

- Step 3. If you are not happy using the type, use the Look for industry on top of the display screen to discover other versions in the legal type template.

- Step 4. When you have located the shape you require, go through the Acquire now option. Select the prices strategy you like and put your references to sign up for an account.

- Step 5. Procedure the purchase. You can use your credit card or PayPal account to accomplish the purchase.

- Step 6. Choose the structure in the legal type and download it on your own device.

- Step 7. Complete, edit and printing or signal the Nebraska Deferred Compensation Investment Account Plan.

Each legal record template you get is yours eternally. You might have acces to every single type you delivered electronically with your acccount. Go through the My Forms area and decide on a type to printing or download yet again.

Contend and download, and printing the Nebraska Deferred Compensation Investment Account Plan with US Legal Forms. There are many expert and condition-particular kinds you may use to your enterprise or specific requirements.

Form popularity

FAQ

Investing your deferred compensation Your plan might offer you several options for the benchmark?often, major stock and bond indexes, the 10-year US Treasury note, the company's stock price, or the mutual fund choices in the company 401(k) plan.

The State of Nebraska Deferred Compensation Plan (DCP) is designed to provide employees a supplementary retirement income. As with other retirement plans, there are restrictions on withdrawals from a DCP.

Deferred compensation plans can be a powerful tool for early retirement goals. Deferring income to retirement might help avoid high state income taxes (ex: California, New York, etc) if you're planning to move to a low-tax state.

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds. Unlike a check, direct deposit typically doesn't include a hold on the funds from your account.

Key Differences Deferred compensation plans tend to offer better investment options than most 401(k) plans, but are at a disadvantage regarding liquidity. Typically, deferred compensation funds cannot be accessed, for any reason, before the specified distribution date.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

Like the better-known 401(k) plan in the private sector, the 457 plan allows employees to deposit a portion of their pre-tax earnings in an account, reducing their income taxes for the year while postponing the taxes due until the money is withdrawn after they retire.

In general, deferred compensation plans allow the participant to defer income today and withdraw it at some point in the future (usually upon retirement) when taxable income is likely to be lower. Like 401(k) plans, participants must elect how to invest their contributions.