Nebraska Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust

Description

How to fill out Agreement And Plan Of Merger For Conversion Of Corporation Into Maryland Real Estate Investment Trust?

If you need to total, download, or print lawful file templates, use US Legal Forms, the most important variety of lawful kinds, that can be found online. Take advantage of the site`s simple and easy practical search to discover the paperwork you want. A variety of templates for enterprise and specific functions are sorted by types and says, or key phrases. Use US Legal Forms to discover the Nebraska Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust in a number of click throughs.

In case you are presently a US Legal Forms customer, log in to your account and then click the Download button to find the Nebraska Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust. You may also accessibility kinds you in the past downloaded in the My Forms tab of your respective account.

If you use US Legal Forms the first time, follow the instructions beneath:

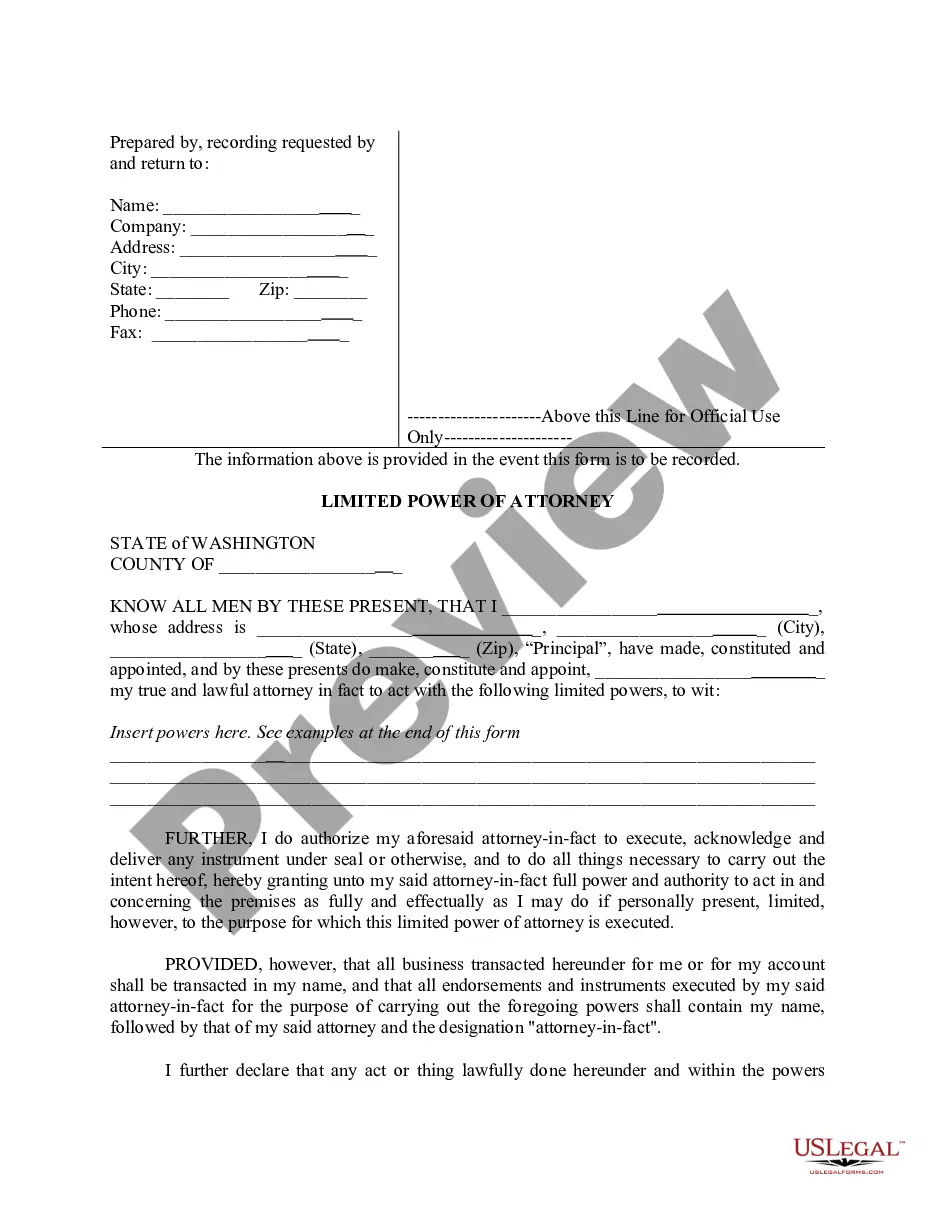

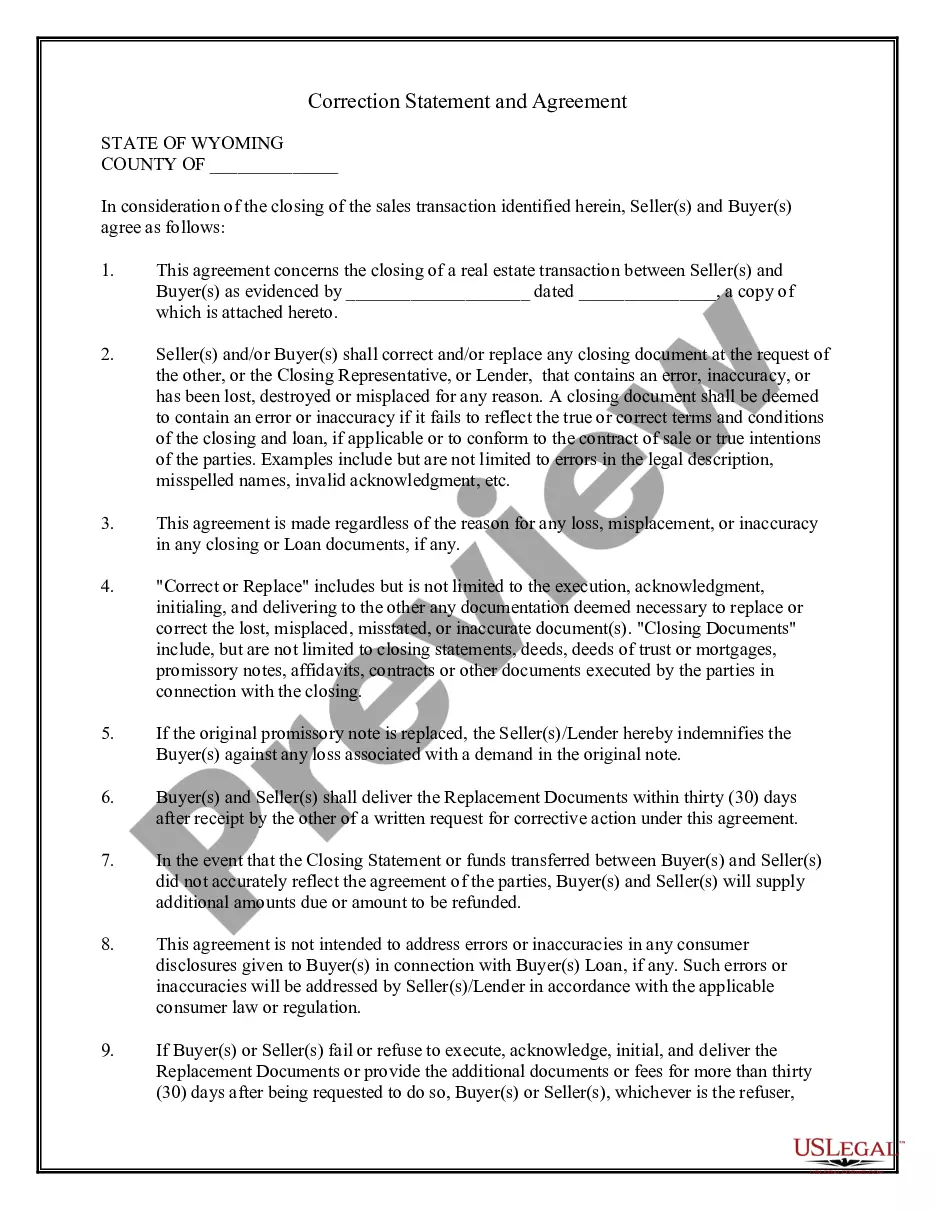

- Step 1. Make sure you have chosen the form for the correct metropolis/nation.

- Step 2. Use the Preview solution to look over the form`s information. Don`t forget to read the outline.

- Step 3. In case you are unsatisfied using the develop, make use of the Search area on top of the display to locate other types in the lawful develop template.

- Step 4. After you have located the form you want, go through the Get now button. Opt for the prices program you prefer and add your references to register for an account.

- Step 5. Method the purchase. You should use your bank card or PayPal account to perform the purchase.

- Step 6. Pick the file format in the lawful develop and download it on your system.

- Step 7. Full, edit and print or signal the Nebraska Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust.

Every single lawful file template you get is yours forever. You might have acces to each develop you downloaded inside your acccount. Click on the My Forms portion and decide on a develop to print or download once more.

Be competitive and download, and print the Nebraska Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust with US Legal Forms. There are many expert and condition-distinct kinds you can use for the enterprise or specific needs.