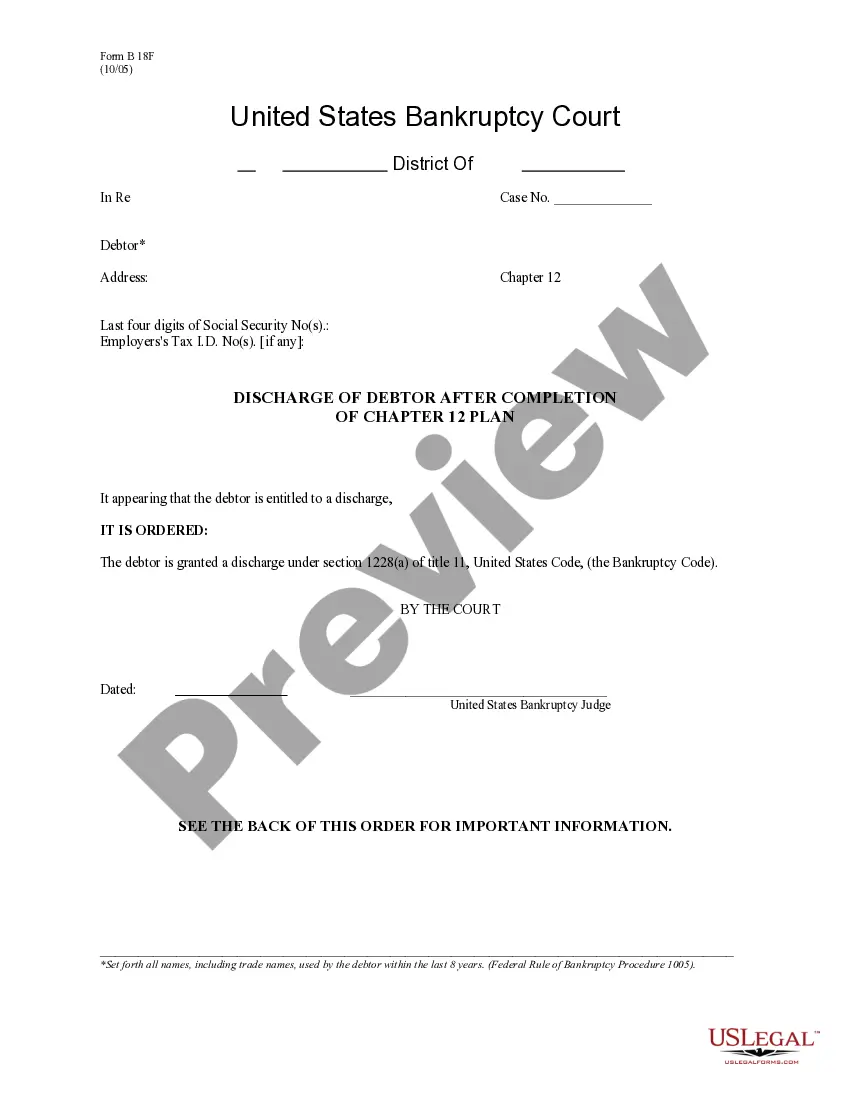

Nebraska Order Discharging Debtor Before Completion of Chapter 12 Plan - updated 2005 Act form

Description

How to fill out Order Discharging Debtor Before Completion Of Chapter 12 Plan - Updated 2005 Act Form?

You may spend time on the web attempting to find the authorized record template that suits the federal and state demands you need. US Legal Forms supplies a large number of authorized varieties which are examined by experts. It is possible to down load or produce the Nebraska Order Discharging Debtor Before Completion of Chapter 12 Plan - updated 2005 Act form from my support.

If you already possess a US Legal Forms profile, you can log in and click the Acquire switch. After that, you can complete, modify, produce, or signal the Nebraska Order Discharging Debtor Before Completion of Chapter 12 Plan - updated 2005 Act form. Each authorized record template you purchase is yours permanently. To have an additional backup of the purchased type, go to the My Forms tab and click the corresponding switch.

If you use the US Legal Forms internet site the first time, keep to the basic guidelines below:

- First, make certain you have chosen the best record template to the area/metropolis of your choice. Look at the type description to make sure you have chosen the right type. If offered, take advantage of the Review switch to look through the record template too.

- If you wish to find an additional edition in the type, take advantage of the Search area to discover the template that meets your requirements and demands.

- After you have identified the template you need, click Buy now to continue.

- Select the prices strategy you need, key in your credentials, and register for your account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal profile to fund the authorized type.

- Select the formatting in the record and down load it to your product.

- Make changes to your record if required. You may complete, modify and signal and produce Nebraska Order Discharging Debtor Before Completion of Chapter 12 Plan - updated 2005 Act form.

Acquire and produce a large number of record themes utilizing the US Legal Forms website, which provides the most important selection of authorized varieties. Use expert and status-particular themes to tackle your company or person requirements.

Form popularity

FAQ

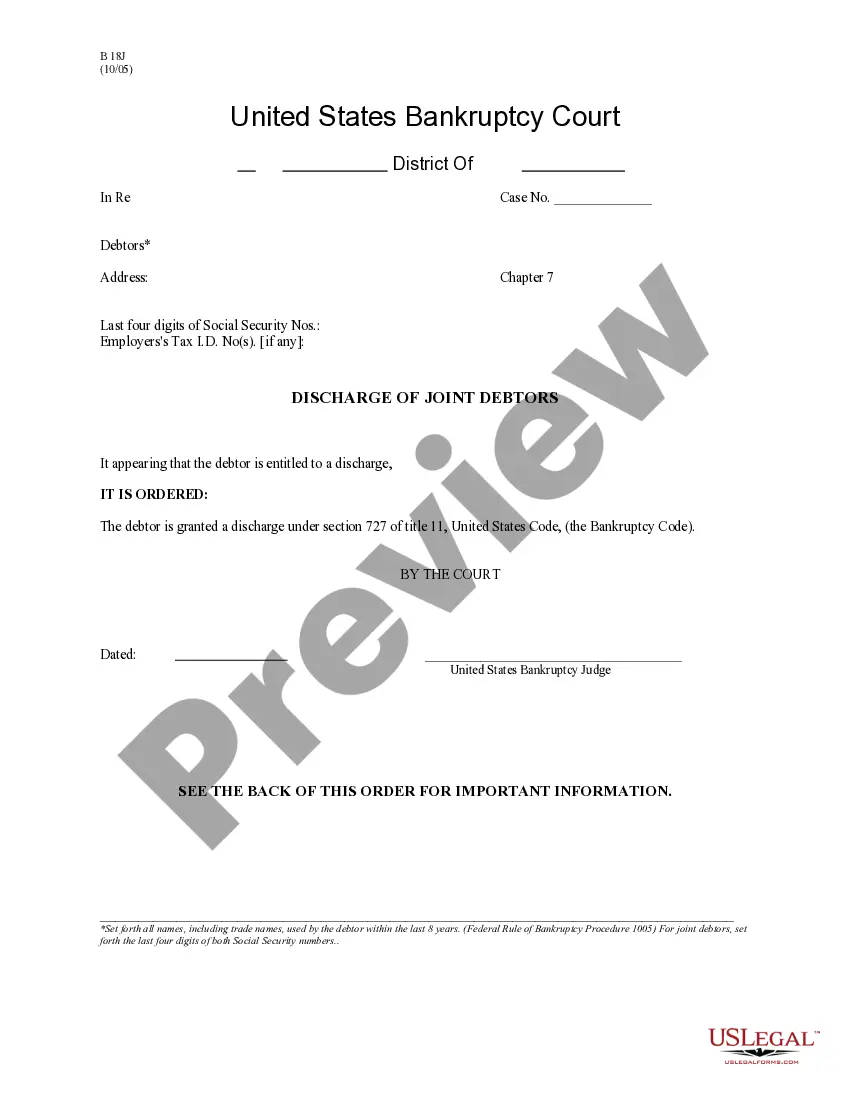

Generally, a discharge removes the debtors' personal liability for debts owed before the debtors' bankruptcy case was filed. Also, if this case began under a different chapter of the Bankruptcy Code and was later converted to chapter 7, debts owed before the conversion are discharged.

The Process of a Debt Discharge The bankruptcy court will look at your plan and decide whether it is fair and in ance with the law. You will also need to work with a trustee who will distribute these payments to the creditors. The trustee will pay creditors ing to priority.

Courts can issue a discharge ruling when the debtor meets the discharge requirements under Chapter 7 or Chapter 11 of federal bankruptcy law, or the ruling is based on a debt canceling. A canceling of debt happens when the lender agrees that the rest of the debt is forgiven.

If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case.

Except as otherwise provided in subdivision (d), a complaint to determine the dischargeability of a debt under §523(c) shall be filed no later than 60 days after the first date set for the meeting of creditors under §341(a).

What is a discharge in bankruptcy? A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

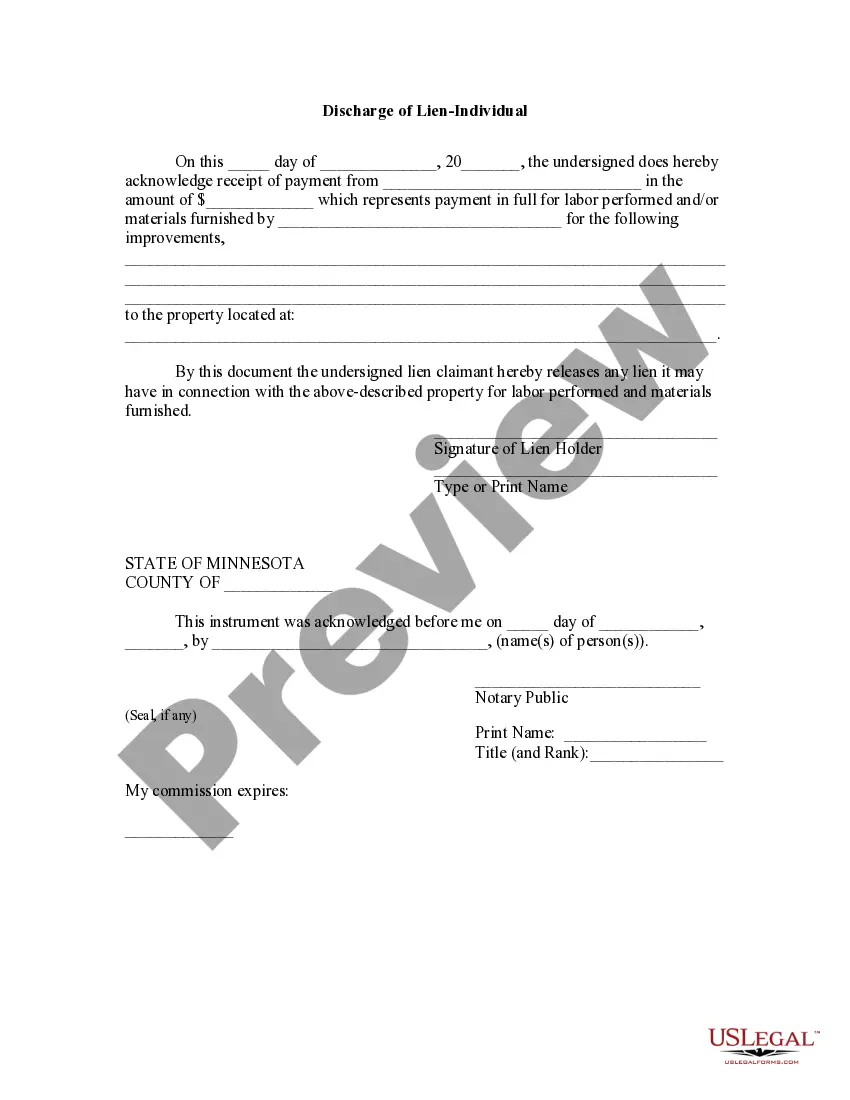

When a debt is discharged, the debtor is no longer liable for the debt and the lender is no longer allowed to make attempts to collect the debt. Debt discharge can result in taxable income to the debtor unless certain IRS conditions are met. A debt discharge occurs when a debtor qualifies through bankruptcy court.

What happens when a creditor files an objection? A creditor's objection does not automatically prevent a discharge of debt. The debtor gets a chance to file an answer to the objection, and the court may hold a hearing to decide the issue. This is called an adversary proceeding, and it works much like any other lawsuit.