Nebraska Business Deductibility Checklist

Description

How to fill out Business Deductibility Checklist?

Have you found yourself in a scenario where documentation is required for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Nebraska Business Deductibility Checklist, which are designed to comply with state and federal regulations.

Once you locate the correct form, click on Buy now.

Choose the pricing plan you want, provide the necessary details to create your account, and complete your purchase using your PayPal or credit card.

- If you are familiar with the US Legal Forms site and have an account, just Log In.

- Then, you can download the Nebraska Business Deductibility Checklist template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

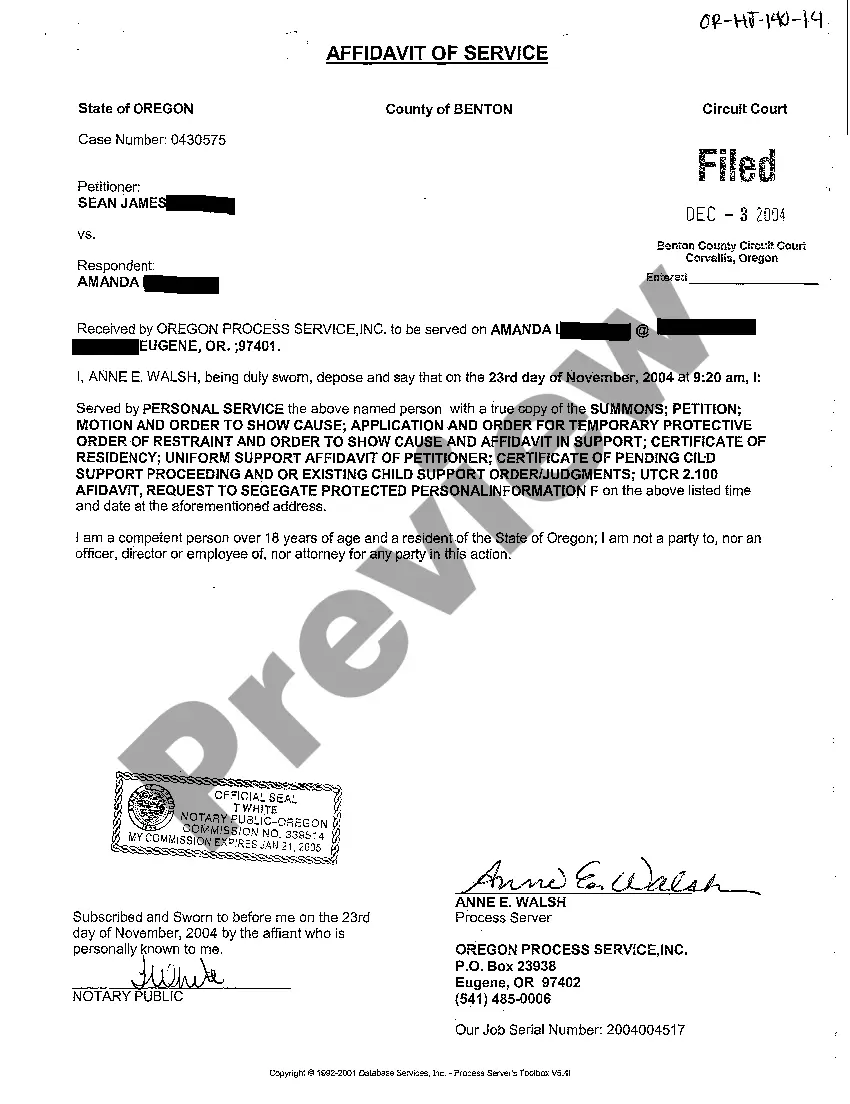

- Use the Preview option to review the document.

- Check the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Nebraska's standard deduction is a specified amount that taxpayers can deduct from their income to lower their taxable income. The amount can change yearly, so it is crucial to stay updated through official resources. The Nebraska Business Deductibility Checklist is a valuable tool that provides current details about standard deductions, helping you manage your finances more effectively.

Filling out a W-4N in Nebraska requires you to provide your personal information, including your filing status and number of allowances. Accurately completing this form is crucial, as it influences your tax withholding from paychecks throughout the year. Utilizing the Nebraska Business Deductibility Checklist can assist you in determining the right allowances for your situation, ensuring you withhold the correct amount for tax purposes.