Nebraska Daily Accounts Receivable

Description

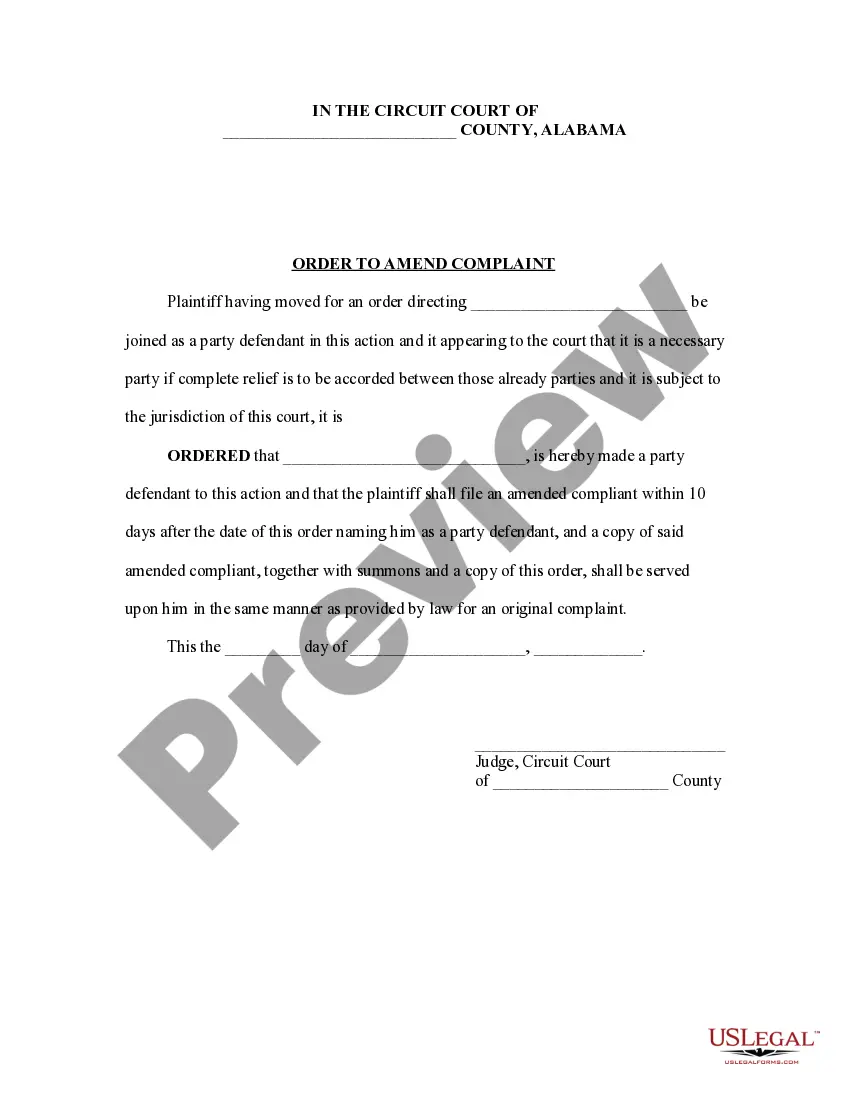

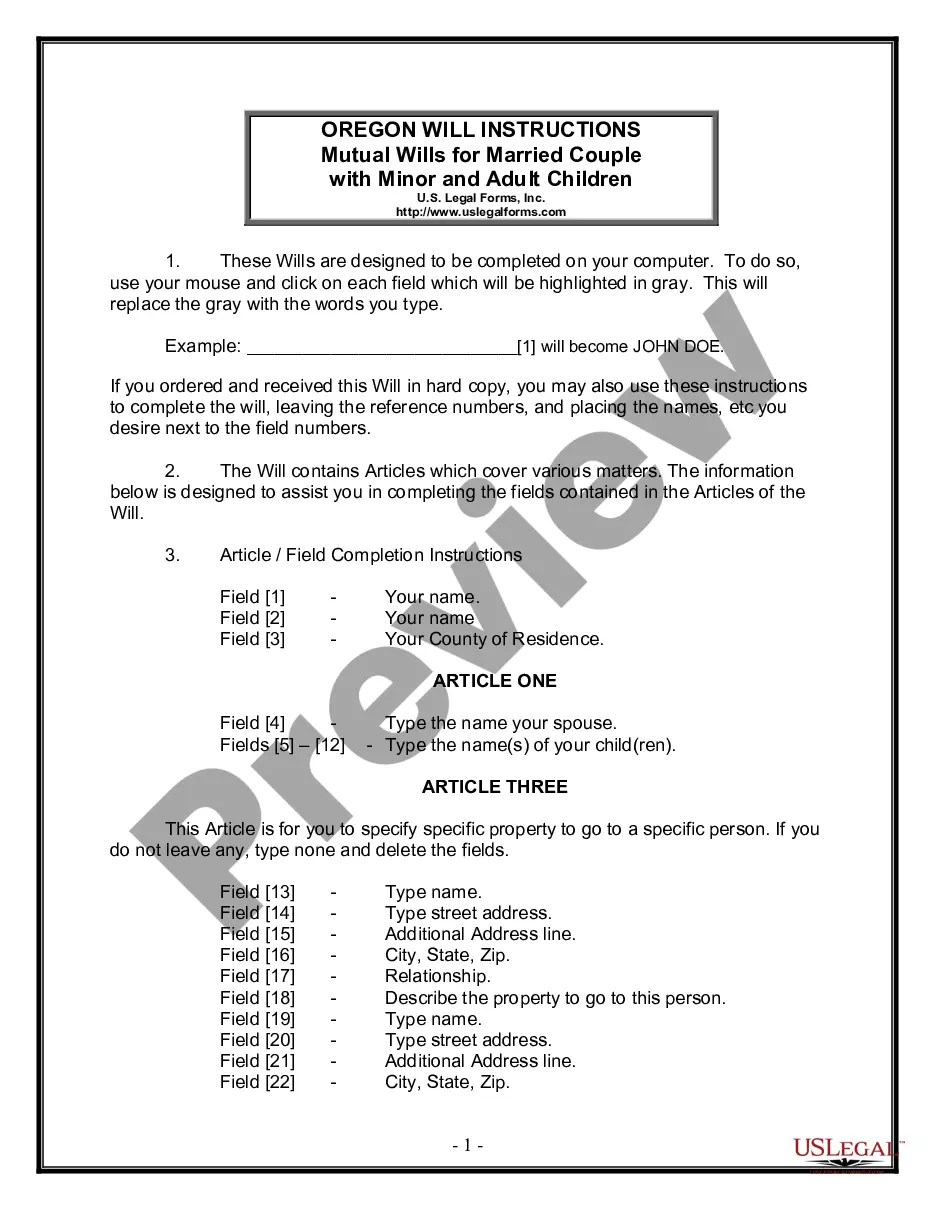

How to fill out Daily Accounts Receivable?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal form templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal use, organized by categories, states, or keywords.

You can locate the latest versions of forms such as the Nebraska Daily Accounts Receivable in just seconds.

If the form does not meet your requirements, utilize the Search area at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Purchase Now button. Then, choose your preferred pricing plan and provide your information to register for the account.

- If you have an existing monthly subscription, Log In to download the Nebraska Daily Accounts Receivable from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously acquired forms from the My documents tab in your account.

- To use US Legal Forms for the first time, follow these straightforward steps.

- Ensure you have selected the right form for your locality/region.

- Click the Review button to check the form's details. Read the description to confirm you have chosen the correct form.

Form popularity

FAQ

The daily tasks of an accounts receivable clerk include managing invoices, processing payments, and following up on overdue accounts. These responsibilities ensure accurate record-keeping and promote timely collections. At US Legal Forms, you can find tools to streamline Nebraska Daily Accounts Receivable processes, allowing your clerks to work more efficiently.

Accounts receivable (AR) is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivables are listed on the balance sheet as a current asset. AR is any amount of money owed by customers for purchases made on credit.

As a general rule, the average business for multiple industries across the country is shooting for a past due receivables percentage in the neighborhood of 10-15%, but depending on your specific circumstances, your ideal number could end up being much higher or lower than that.

If your company allows your clients credit terms of 30 days, and your average collection period is 45 days, that is troublesome. However, if your average collection period is less than 30 days, that is favourable.

Salary Ranges for Accounts Receivable Managers The salaries of Accounts Receivable Managers in the US range from $12,356 to $334,332 , with a median salary of $65,456 . The middle 57% of Accounts Receivable Managers makes between $65,456 and $155,037, with the top 86% making $334,332.

It is an uncomfortable and, often times, frustrating task. Everyone's personalities are different, but some are better suited to credit management teams than others. If you tend to be a hot head, that may be a bad habit to have when you're collecting unpaid invoices often.

Accounts receivable (AR) is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivables are listed on the balance sheet as a current asset. AR is any amount of money owed by customers for purchases made on credit.

On average, an acceptable time line for collecting accounts receivables should not be more than one third longer than your credit period. For example, you may allow your customers to pay you within 30 days, yet, on average, you are only able to collect after 40 days.

Where do I find accounts receivable? You can find your accounts receivable balance under the 'current assets' section on your balance sheet or general ledger. Accounts receivable are classified as an asset because they provide value to your company. (In this case, in the form of a future cash payment.)

An acceptable performance indicator would be to have no more than 15 to 20 percent total accounts receivable in the greater than 90 days category. Yet, the MGMA reports that better-performing practices show much lower percentages, typically in the range of 5 percent to 8 percent, depending on the specialty.