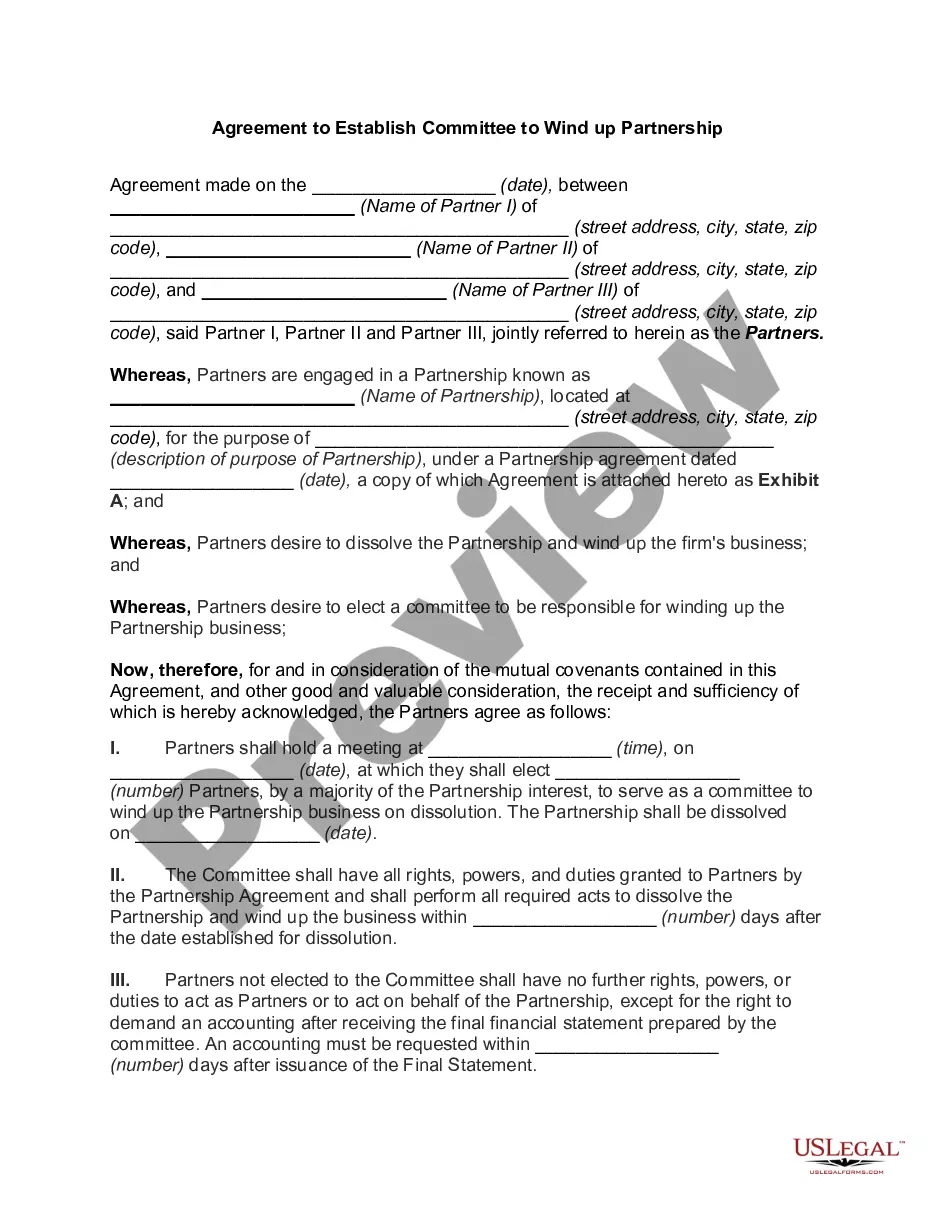

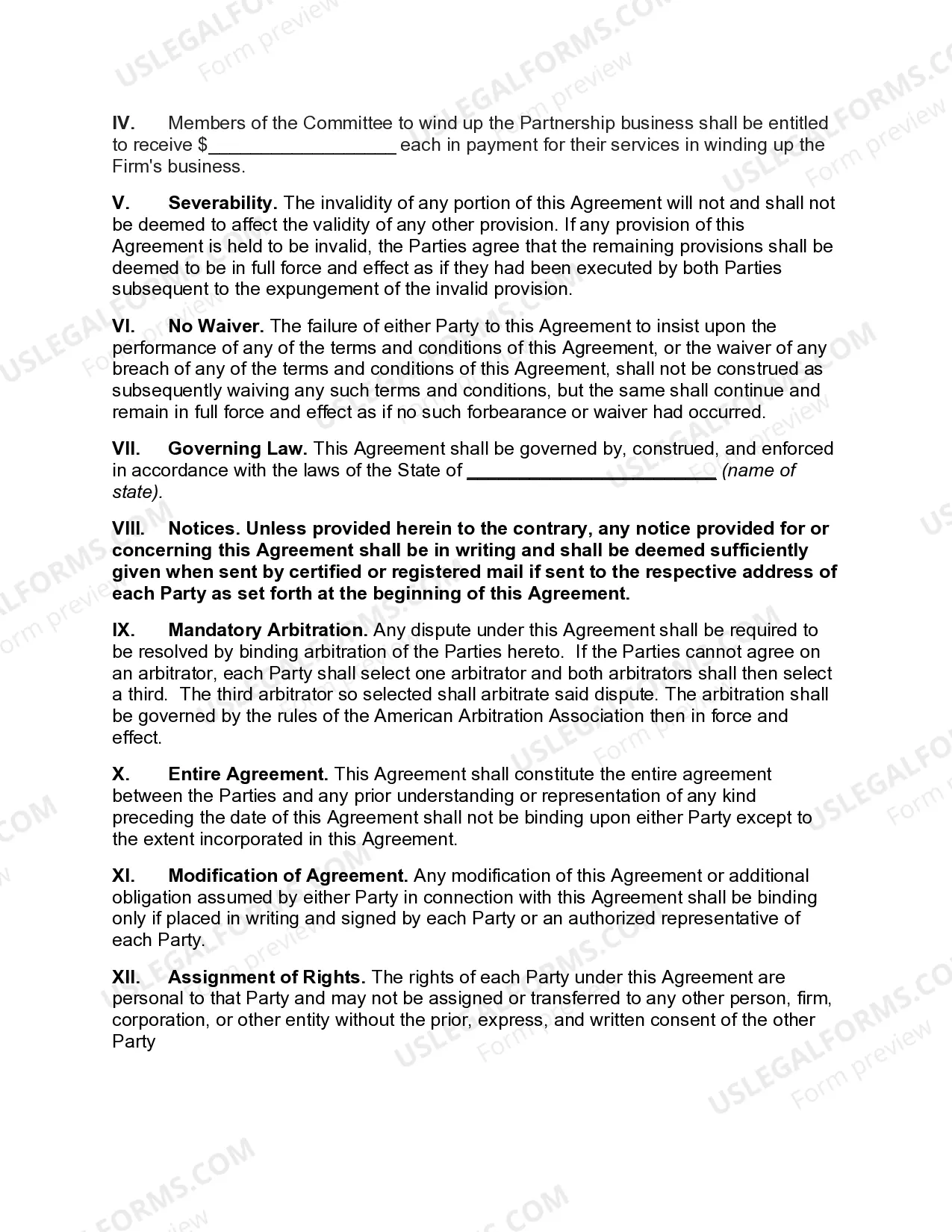

Nebraska Agreement to Establish Committee to Wind up Partnership

Description

How to fill out Agreement To Establish Committee To Wind Up Partnership?

US Legal Forms - one of many greatest libraries of legal varieties in America - provides an array of legal record themes you can acquire or printing. While using site, you can find thousands of varieties for organization and individual purposes, categorized by classes, states, or search phrases.You can find the latest models of varieties such as the Nebraska Agreement to Establish Committee to Wind up Partnership in seconds.

If you already have a monthly subscription, log in and acquire Nebraska Agreement to Establish Committee to Wind up Partnership through the US Legal Forms local library. The Download option will show up on each and every kind you look at. You have accessibility to all formerly saved varieties from the My Forms tab of the bank account.

If you want to use US Legal Forms the first time, allow me to share simple guidelines to get you started out:

- Make sure you have picked the best kind for the city/state. Click the Preview option to analyze the form`s content. See the kind outline to ensure that you have selected the appropriate kind.

- When the kind does not suit your demands, take advantage of the Lookup field on top of the display to get the one that does.

- In case you are satisfied with the form, verify your selection by clicking the Purchase now option. Then, pick the costs program you favor and provide your credentials to sign up on an bank account.

- Process the purchase. Use your charge card or PayPal bank account to perform the purchase.

- Find the format and acquire the form on your device.

- Make changes. Load, revise and printing and signal the saved Nebraska Agreement to Establish Committee to Wind up Partnership.

Each template you put into your money does not have an expiration time and is the one you have eternally. So, if you want to acquire or printing an additional copy, just proceed to the My Forms section and click on the kind you require.

Gain access to the Nebraska Agreement to Establish Committee to Wind up Partnership with US Legal Forms, probably the most comprehensive local library of legal record themes. Use thousands of professional and condition-distinct themes that fulfill your business or individual requires and demands.

Form popularity

FAQ

Step 1: Register the business name (Department of Trade Industry). Step 2: Have the partnership agreement (Articles of Partnership) notarized and registered with the SEC. Step 3: Obtain a Tax Identification Number for the partnership from the BIR. Step 4: Obtain pertinent municipal licenses from the local government.

To dissolve an LLC in Nebraska, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Nebraska LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

If you decide to create a partnership in Nebraska, there are a few steps to go through in order to properly establish the business.Step 1: Select a name for your partnership.Step 2: Register business name.Step 3: File organizational documents with the Secretary of State.More items...?

The cost of registration can be up to $200, depending on the state or territory. Other than this, a partnership can be remarkably inexpensive to set up. A partnership is not a separate legal entity, so while the partnership requires its own ABN and must lodge its own tax return, the partnership itself is not taxed.

To determine whether a partnership exists, the three essential elements are 1) sharing of profit or losses, 2) joint ownership of the business, and 3) an equal right to be involved in the management of the business. Joint ownership of property does not in and of itself create a partnership, as intentions are key.

Here are the basic steps to forming a partnership:Choose a business name.Register a fictitious business name.Draft and sign a partnership agreement.Comply with tax and regulatory requirements.Obtain Insurance.

There are three necessary elements for there to be a partnership between two or more persons:carrying on a business;in common; and.with a view to profit.23-Mar-2018

A partnership must have two or more owners who share in the profits and losses of a business. Partnerships can form automatically without the submission of formation documents. All partnerships should have a written partnership agreement that spells out the rules and regulations of the business.

To dissolve an LLC in Nebraska, you are required to submit a complete Article of Dissolution to the Secretary of State. Before submitting the Article of Dissolution, one must follow the operating agreement. If you have a Nebraska LLC (domestic or foreign) you must have an operating agreement.

A partnership agreement must contain the name and address of each partner and his contribution to the business. Contributions may consist of cash, property and services. The agreement must detail how the partners intend to allocate the company's profits and losses.