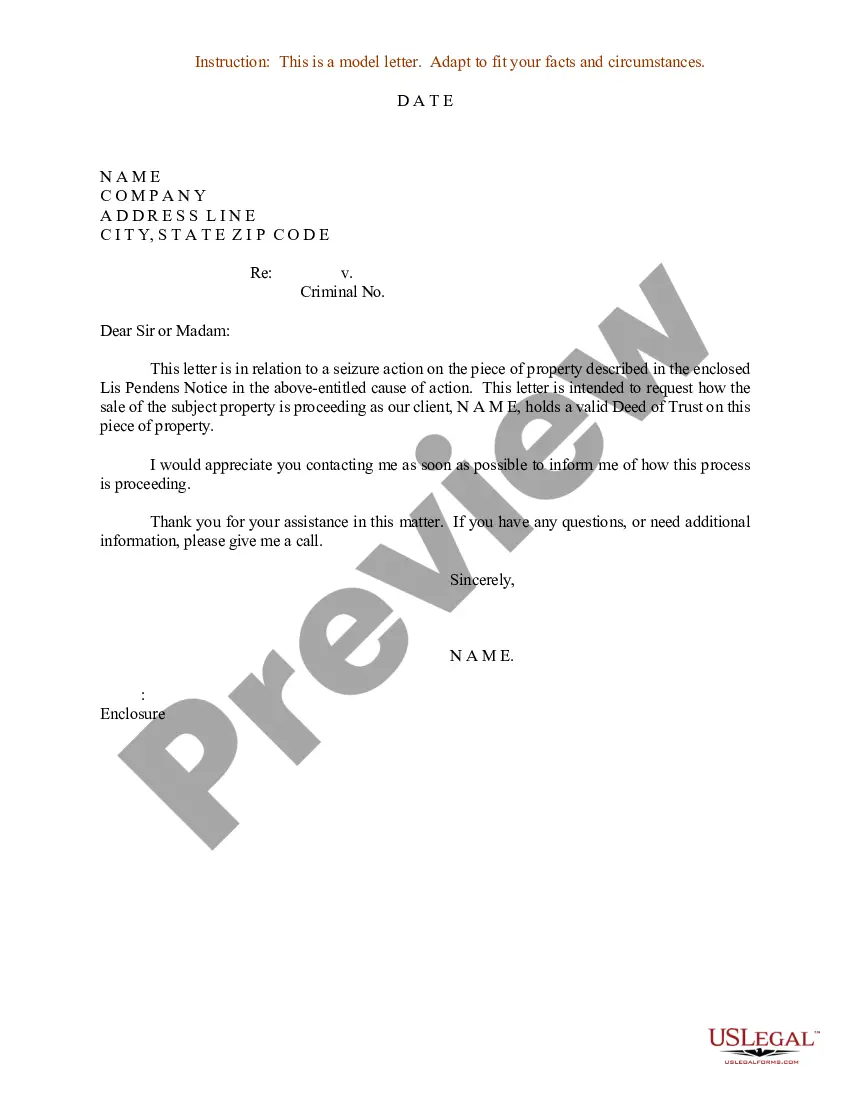

Nebraska Sample Letter for Request of Information Pertaining to Property Sale

Description

How to fill out Sample Letter For Request Of Information Pertaining To Property Sale?

If you want to complete, download, or print authorized papers themes, use US Legal Forms, the biggest collection of authorized varieties, which can be found on-line. Make use of the site`s simple and handy search to discover the documents you want. Numerous themes for business and specific purposes are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to discover the Nebraska Sample Letter for Request of Information Pertaining to Property Sale in just a couple of mouse clicks.

When you are already a US Legal Forms client, log in to your accounts and then click the Download key to find the Nebraska Sample Letter for Request of Information Pertaining to Property Sale. You can also accessibility varieties you earlier delivered electronically from the My Forms tab of your accounts.

If you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the correct metropolis/country.

- Step 2. Take advantage of the Review option to check out the form`s information. Never neglect to read through the outline.

- Step 3. When you are not happy together with the kind, make use of the Search industry on top of the display screen to locate other models from the authorized kind template.

- Step 4. When you have identified the form you want, click on the Purchase now key. Select the pricing program you prefer and add your accreditations to register on an accounts.

- Step 5. Method the transaction. You should use your charge card or PayPal accounts to finish the transaction.

- Step 6. Select the format from the authorized kind and download it on the device.

- Step 7. Total, revise and print or sign the Nebraska Sample Letter for Request of Information Pertaining to Property Sale.

Each authorized papers template you acquire is yours permanently. You might have acces to each and every kind you delivered electronically with your acccount. Select the My Forms area and select a kind to print or download once again.

Compete and download, and print the Nebraska Sample Letter for Request of Information Pertaining to Property Sale with US Legal Forms. There are millions of professional and express-distinct varieties you may use for your business or specific demands.

Form popularity

FAQ

Property taxes are determined by multiplying the property's taxable value by the total consolidated tax rate for the tax district in which the property is located.

Property Taxes are due December 31st with Nebraska State Law allowing taxpayers the opportunity to pay in two (2) installments. The first installment must be paid on or before March 31st to avoid delinquency. The second installment must be paid on or before July 31st to avoid delinquency.

The Nebraska homestead exemption program is a property tax relief program for three categories of homeowners: A. Persons over age 65; B. Qualified disabled individuals; or C.

The Nebraska Public Records Law is a series of laws designed to guarantee that the public has access to public records of government bodies at all levels. Public records include all documents, no matter the form, belonging to any government agency.

This Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in Nebraska. Also, when owners of an existing business change, a Form 20 needs to be filed.

The Nebraska homestead exemption program is a property tax relief program for three categories of homeowners: A. Persons over age 65; B. Qualified disabled individuals; or C.

In Nebraska, a homestead exemption is available to the following groups of persons: ? Persons over the age of 65; ? Qualified disabled individuals; or ? Qualified disabled veterans and their widow(er)s. Some categories are subject to household income limitations and residence valuation requirements.

Form 13, Section B, may be completed and issued by governmental units or organizations that are exempt from paying Nebraska sales and use taxes. See this list in the Nebraska Sales Tax Exemptions Chart. Most nonprofit organizations are not exempt from paying sales and use tax.