Nebraska Renunciation of Legacy to give Effect to Intent of Testator

Description

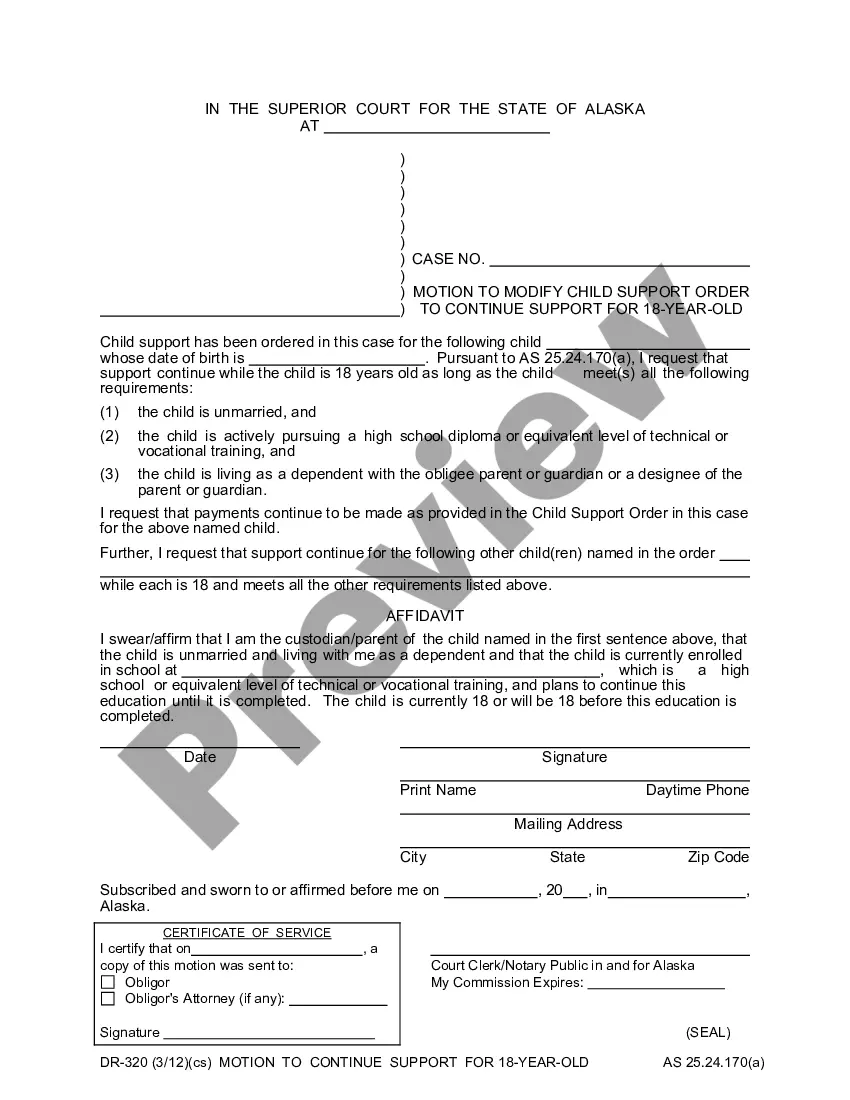

How to fill out Renunciation Of Legacy To Give Effect To Intent Of Testator?

US Legal Forms - one of the greatest libraries of legitimate types in the States - provides a wide array of legitimate record templates it is possible to down load or printing. While using web site, you can find thousands of types for business and personal functions, sorted by categories, states, or search phrases.You will discover the most up-to-date models of types such as the Nebraska Renunciation of Legacy to give Effect to Intent of Testator in seconds.

If you have a monthly subscription, log in and down load Nebraska Renunciation of Legacy to give Effect to Intent of Testator from the US Legal Forms library. The Acquire switch can look on every kind you view. You gain access to all previously saved types from the My Forms tab of your respective profile.

If you want to use US Legal Forms the first time, allow me to share straightforward instructions to get you started off:

- Be sure to have picked out the proper kind for your personal area/county. Go through the Review switch to analyze the form`s content. Browse the kind outline to ensure that you have chosen the right kind.

- When the kind does not fit your needs, make use of the Search discipline on top of the display to discover the one which does.

- If you are pleased with the shape, affirm your option by simply clicking the Buy now switch. Then, opt for the costs plan you favor and provide your credentials to sign up to have an profile.

- Approach the deal. Make use of bank card or PayPal profile to finish the deal.

- Select the format and down load the shape in your system.

- Make modifications. Complete, change and printing and indicator the saved Nebraska Renunciation of Legacy to give Effect to Intent of Testator.

Every template you included in your bank account lacks an expiration particular date and is also your own property eternally. So, if you would like down load or printing an additional duplicate, just check out the My Forms area and click around the kind you need.

Gain access to the Nebraska Renunciation of Legacy to give Effect to Intent of Testator with US Legal Forms, one of the most extensive library of legitimate record templates. Use thousands of professional and express-certain templates that fulfill your organization or personal needs and needs.

Form popularity

FAQ

Stopping, standing, or parking prohibited; exceptions. (ii) At any place where official signs prohibit parking. (2) No person shall move a vehicle not lawfully under his or her control into any such prohibited area or away from a curb such a distance as shall be unlawful.

No action at law or equity may be brought or maintained attacking the validity or enforceability of or to rescind or declare void and uncollectible any written contract entered into pursuant to, in compliance with, or in reliance on, a statute of the State of Nebraska which has been or hereafter is held to be ...

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

60-684. Person charged with traffic infraction; citation; refusal to sign; penalty. Whenever any person is charged with a traffic infraction, such person shall be issued a citation pursuant to the provisions of section 29-424.

A person commits a Class IV felony if he or she (1) forges any certificate of title or manufacturer's or importer's certificate to a vehicle, any assignment of either certificate, or any cancellation of any lien on a vehicle, (2) holds or uses such certificate, assignment, or cancellation knowing the same to have been ...

Lights, red or green, in front of vehicle prohibited; exceptions. Except as provided in sections 60-6,230 to 60-6,233, it shall be unlawful for any person to drive or move any vehicle upon a highway with any red or green light thereon visible from directly in front thereof.

There shall be a rebuttable presumption that any motor vehicle or trailer stored and kept more than thirty days in the state is being operated, parked, or towed on the highways of this state, and such motor vehicle or trailer shall be registered in ance with the act, from the date of title of the motor vehicle or ...

Disclaiming inherited assets is often done to avoid taxes but also so that other individuals can receive the assets. A disclaimer that does not meet basic requirements under federal and state law could cause adverse consequences for the person disclaiming the assets as well as any subsequent beneficiaries.